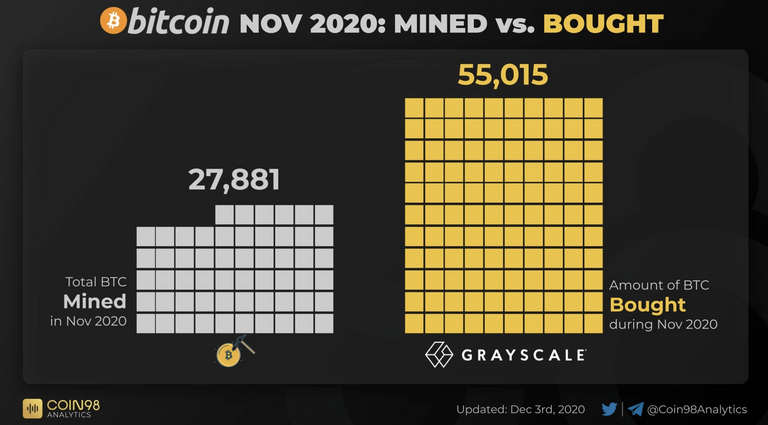

Grayscale alone bought more than 2x the amount of Bitcoin created during the month of November

Grayscale bought over 55k Bitcoin in the month of November

We know Grayscale has been buying a lot of bitcoin, but did you know that in the last month they bought more than 2x the number of bitcoin that was mined during that time?

New supply isn't the whole story when it comes to sellers, but traditionally miners are the largest net sellers on a daily basis.

When you have one entity sucking up all that and then some, it becomes that much easier for prices to go higher.

Check this out:

(Source: https://twitter.com/Bitcoin/status/1334987721924726786/photo/1)

There was a total of 27,881 BTC minded during November while Grayscale added 55,015 BTC.

Keep in mind that this is just one institution, when you factor in what Square and PayPal are doing as well, it becomes very clear that we are running out supply very quickly.

More on the dwindling supply sitting on exchanges can be seen here:

For more details on what Grayscale has been doing lately, see below...

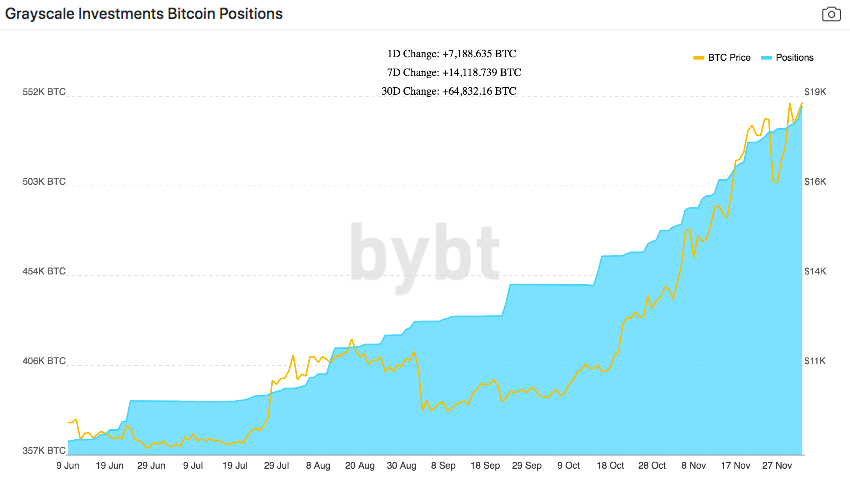

Grayscale added almost 7,200 BTC in the last 24 hours

Pretty soon, Grayscale is going to own all the bitcoin.

They already are one of the largest holders in the world and they just keep getting bigger.

In the last 24 hours alone, they added almost 7,200 bitcoin.

Check it out:

(Source: https://twitter.com/Bloqport/status/1334816442970148865/photo/1)

This 7,200 was in addition to the 14k they added in the last 7 days and the 65k they added in the last 30 days.

Long story short, that's a lot of bitcoin Grayscale is sucking up!

For some further context...

Sometimes seeing numbers just by themselves doesn't really tell you the whole story.

You need some context to further understand exactly what these numbers mean.

For example, the 7.2k taken in by Grayscale in the last 24 hours may sound like a lot to you or it may sound like a little depending on your perspective.

Well, here's a newsflash for you...

The 7.2k taken in by Grayscale is roughly 8x the total BTC mined during that same period...

(Source: https://twitter.com/caprioleio/status/1334800981536681986)

How's that for some context? :)

Just one firm took in more than 8x the new supply over the last 24 hours.

When you see numbers like this one on a sustained basis it gets pretty difficult to see how bitcoin is going any direction but higher.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

That is the FIAT we need! The more FIAT pumped in, the more awareness, the more liquidity taken of the market, the more scarcity, which will only help the value grow.

People buy into Grayscale only because it is easy to due the taxes. It goes on the same field with stocks, not the separate filling for crypto. Also for most people, buying into BTC is still a big struggle.

We have a bright future, the more people like this will invest, the better.

Posted Using LeoFinance Beta

Yep, plus it can be bought in an IRA. I had a couple people ask me about buying bitcoin recently, I just told em to pick up some GBTC in their brokerage account as their eyes glazed over when I told them the process of funding and then buying bitcoin off of a crypto exchange.

Biggest hurdle for crypto is the hard process of acquiring and moving it. If this is solved, moooooon!!!

Posted Using LeoFinance Beta

Well as @jrcornel said, it allows for IRA money.

There are a lot who have little cash, but have a great deal in retirement accounts. This opens up larger buys.

Whereas one might only be able to put a couple hundred dollars in BTC, the same person could dump tens of thousands into GBTC through an IRA.

Posted Using LeoFinance Beta

Exactly.

Another way to phrase that: Grayscale bought more than a week's worth if mined Bitcoin in the last 24 hours.

Of course, we can't overlook Microstrategy adding more to its stake.

And to be honest, they are small entities. We are not even talking about the major Wall Street players like Fidelity.

Funds like that have trillions under management.

Posted Using LeoFinance Beta

Correct. It gets exciting real quick when you think about where things could end up going...

The question is when do some of these entities (or others) start looking at different coins.

While everyone is focused upon BTC, there is a lot of development taking place on other chains.

Posted Using LeoFinance Beta

From what I have read and seen, there are a ton of institutions looking at bitcoin now, with a small percentage of those also looking at ethereum. Beyond that, there isn't much looking at anything else besides some crypto hedge funds and vc funds from the ico days. It's basically the big 2 and then everything else...

Makes sense. Until other things stand out, there is little to attract the bigger entities.

Plus they are not going to get into anything too risky so having the track record is also important to them.

Posted Using LeoFinance Beta

Fiat money seems to be waking up. And that can only be good. Initially. 💰 💲 💱

Yeah, but Satoshi may print more Bitcoin in the next quantitative easing.

With it being worth $20k a pop, he may wish that he could! ;)

Really impressive these numbers. What if 5 other companies like Grayscale were interested in Bitcoin? Availability on the market would run out very quickly and the price would skyrocket!

Posted Using LeoFinance Beta

Well, there is already Square and PayPal soaking up similar numbers... the supply of bitcoin sitting on exchanges is shrinking by the day.

Microstrategy has started buying new Bitcoins, over 2500 in the past hours 🚀

Posted Using LeoFinance Beta

They're buying all the air we need to breathe and then selling it back to us for a premium... This is how Uncle Scrooge made his fortune in the cartoons...

One advantage of these large companies buying up all the available bitcoin is that people can see other equally profitable cryptomontages such as WLeo and Hive.

So it's time to promote them to show the world what a great advantage our cryptomoney is.

Posted Using LeoFinance Beta

hah at that rate we will see cashapp square and greyscale alone buying up all the new supply and only block.one and their northern data will mine any NEW BTC, loaded onto eos as PBTC from @bitfinex and @eosfinex https://ptokens.io

Posted Using LeoFinance Beta

It seems Greyscale wants to own BTC. This quite amazing what amount of this mega coin that just one entity #Hodls. I am positive LEO will soon become as mega as BTC so that Greyscale will buy much like this.

This action of Grey reminds me of a man that discovered a fortune in a deserted land and went and sold all he had and sunk in all his fiat to acquire the land. Thumbs up Greyscale.

Posted Using LeoFinance Beta

I'm not sure Grayscale's holdings matter. They are securitized and then can be bought and sold.

Posted Using LeoFinance Beta

Of course they matter, the only thing that is up for debate is whether they represent new purchases in the crypto market or whether it is already purchased bitcoin taking advantage of the premium. Institutions have been exchanging bitcoin for shares of GBTC to collect the premium in the shares. If you are going to hold bitcoin anyways, why not have grayscale custody it for you and collect a nice premium for your troubles.

Yes, exactly. Whether BTC is for sale through coinbase or through GBTC, they are still for sale. If the coins are going into trading activity or into cold storage is what will affect the price over the long term.

Posted Using LeoFinance Beta

The bitcoin in the fund are locked in cold storage...

The bitcoin in the fund are locked in cold storage...

Hypothecated cold storage

Posted Using LeoFinance Beta

The bitcoin is bought and stored in cold storage, shares are then issued in correlation with those bitcoin investments with a 6 month lockup period. The shares then trade on a secondary market where investors can buy and sell them.

I added grey scale to my 401k so I can get some BTC exposure there. It’s great to be able to get some crypto exposure in my traditional investment accounts.

Posted Using LeoFinance Beta

Crazy, would probably have been absolutely unimaginable 3 years ago. But for me it shows where the journey is going. Whether it is good in the end that companies buy in over 100% of the monthly mining rewards and mutate into gigantic stakeholders is another story.

Posted Using LeoFinance Beta