The Art of Timing: Know When to Trade and When to Hold

Most of the time mistake we do is not knowing when to trade and when to Hold. So, base on this psychology we can perfectly time a trade. Well, let's have a deep dive into this discussion.

The Art of Timing in Trading

Firstly, we make a plan for a trade and then comes execution where it all depends on how we time it.

This is quite challenging but knowing some of these Things will increase probability of perfectly timing.

1. keep an eye on News and Events

Market Always react when there's a News and events. So, monitoring them will give more clear understanding of decision making.

Major events like FOMC or other news like bankruptcy or insolvent like FTX, LUNA kind of news bring a huge impact while coins developing something, rebranding or coming with new technology like Ai also bring positive or negative change in market price.

So. Fundamentals analysis is always an important aspect of trading.

2. Technical Analysis

Secondly, technical analysis always gives a better idea where to enter in trade.

Using indicators and basics things like where liquidity lies, strong buying demand, resistance gives much better indications keeping fundamentals Analysis in mind.

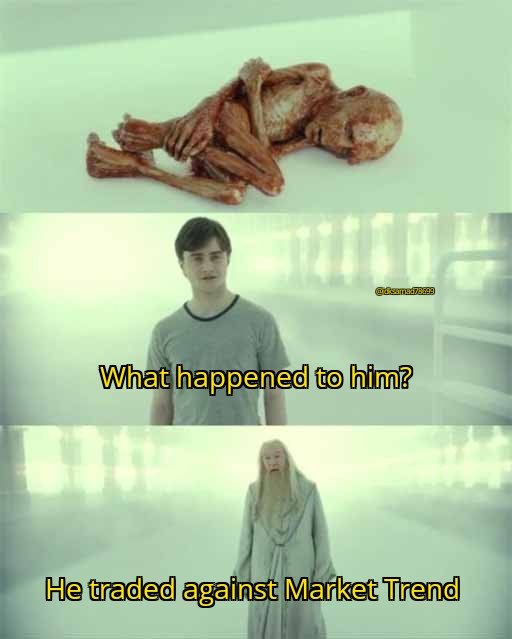

3. Trend of Market

One should know the trend whether it's downtrend or uptrend. I used to make a huge mistake in my first bear market which was "Long Positions" one after another in downtrend.

And learnt going against market trend is absolutely worst thing you can do with portfolio.

So, make sure to clearly know trend of market before jumping into a trade.

4. keep the Patience until results

With risks it comes reward and not taking a risk is bigger risk itself I believe.

Once you timed a trade and position is open now it takes patience simply not letting emotions take control over your trade and let it execute till there's a result in profit or loss.

I used to Panic myself and exit trade right after few minutes which lead me to loses big time.

When to Trade and When to Hold

This past bear market on Hive taught me this lesson of when to trade and when to hold.the market trend was downtrend in 2022 which is why I made sure to make a plan of holding hive and goal to accumulate more.

There was high uncertainty and low volatility in market which is why it was suitable time to hold instead of trading.

Now, when there's high volatility and a bit more certainty that bull run is coming and accumulation is ongoing on with pretty much volume is what gives indication about it's time to trade and HoDL at same time.

When not to Trade

As we can market is already taking a correction is because of people were overexposed and confidently in long positions, Greed index was high and that is when exactly one should step back and wait for the right time to get in.

Wrapping up...

In the end, these are some of my thoughts and views about timely making decisions and investments which is going to bring a positive impact in my point of view.

Rest, I'll look forward to hear your perspective about this in comments.

Posted Using LeoFinance Beta

https://twitter.com/1350003331549290497/status/1623813112896933890

The rewards earned on this comment will go directly to the people( @idksamad78699 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I make use of all these techniques, but I learnt more about your points. Especially when to trade and when to hold. That's the major step of loss and gain.

You have dropped some valid points here bro, thank you for sharing your knowledge.

Glad to hear this... Indeed, loss and gain depends on theze things!

Thank you for your kind words bro. Much appreciate and !LUV

@actordontee, @idksamad78699(1/1) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

You welcome

Hmmmm, what a great insight, thanks for sharing bro

Thank you for your kind words. Much !LUV

!PIZZA

Yay! 🤗

Your content has been boosted with Ecency Points, by @idksamad78699.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

And I don't have good timing 😂.. Buy early, sell early.. Regret later 😂..

Hehehehe, buy high, sell low - iykyk. 😂

😂😂

Time in the market > Timing the market

True!

!PIZZA

Lol, exactly what I said hehe

I gifted $PIZZA slices here:

idksamad78699 tipped desiredlady (x1)

@idksamad78699(3/5) tipped @mypathtofire (x1)

idksamad78699 tipped spiritsurge (x1)

Join us in Discord!

Those are some great points to consider when deciding to trade markets or buy and hold. I have been looking at moving averages and ranges too. Those memes are great. !MEME

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Credit: memehive

Earn Crypto for your Memes @ HiveMe.me!

Man, really Glad you see it like this way.... I'm also doing same. Hehe, preparations for bull run. Thanks for your kind words and picking my post. Really appreciate and much !LUV

!PIZZA

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

The best strategy i learned is to not try to time the market.