Aftershock FUD: $10k regulation travel rule

The coordinated attack on Bitcoin continues.

Further, as with cash transactions, businesses that receive cryptoassets with a fair market value of more than $10,000 would also be reported on.

Not that this is a surprise or anything, but the constant never ending FUD and regulations being thrown out during such a small window of time of pretty suspect imo.

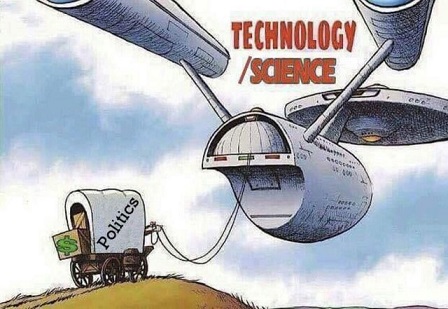

At the end of the day more regulations on the centralized tendrils of decentralized assets (crypto exchanges) just push more people away from using the exchanges in the first place. These regulators think they can control this situation... they obviously can not: that's the entire point of crypto.

Devs are going to continue to churn out code a thousand times faster than anyone could hope to contain. Every regulation that comes down, no matter how reasonable or justifiable, is simply going to heavily incentivize the decentralized option that CANT be regulated. In this case this means decentralized exchanges.

From there it means products/services being sold directly for crypto. Why transfer $20k to your bank account when you can just buy whatever you want with Litecoin or whatever? Privacy tech will also be on the rise because legacy law does not mesh with crypto and it becomes literally impossible to obey the law.

Most importantly, a strong link to cash is being forged.

Most people think we are headed toward a cashless society... not me. The physical nature of money is literally going to be the ONLY thing fiat has going for it in the next ten years. I think it's quite obvious that peer-to-peer links between cash and crypto will be forged, and anyone will be able to swap cash for crypto & crypto for cash in person.

The Craigslist of crypto awaits, it just hasn't been built yet. Of course it will be banned by the app stores but by that time I expect there to be decentrazlied avenues around that as well.

Chainalysis Data Shows Hedge Funds Bought the Bitcoin Dip

Wow I'm shocked that the establishment would actively buy Bitcoin after purposefully attacking it with everything it has for the past week. Shocked I tell ya.

Vitalik says that BTC might be left behind due to its vast energy usage

Et Tu, Vitalik?

I would not want to be recorded for all time being on the obvious wrong side of history. Even Vitalik wants to jump on this ridiculous Green Propaganda that Bitcoin wastes energy? Again, turning energy into currency is not a waste: it's a free market. It's a feature, not a bug. It's a miracle invented by an anonymous entity. Doesn't get any crazier than that.

At the end of the day POW has extreme advantages over every other kind of consensus algorithm. It creates checks and balances between the block producers, the devs and the community. It offers increased security. It's a totally unique solution that isn't going anywhere: especially not because China burns coal for energy. That's a China problem, try again, propaganda machine.

Again, Bitcoin promotes sustainable energy in a big way.

Spinning any other narrative is parroting propaganda.

DUTCH CENTRAL BANK FORCED TO BACKPEDAL ON BITCOIN ADDRESS VERIFICATION PROCEDURES AFTER COURT RULING

This is a fun one.

The judge’s opinion in the case was generally favorable towards Bitonic’s complaints, and, on April 7, she gave the DCB six weeks to review its policy. Wednesday evening, the DNB formally acknowledged the legitimacy of Bitonic’s complaints and revoked its mandate for stringent address verification requirements as part of the registration regime.

Yeah, so you know all those regulatory fears about requiring exchanges to KYC self-hosted wallets? Look no further than the Netherlands to see how it's all bullshit. Exchanges will fight these changes tooth and nail and prove how worthless they really are.

Okay, so you KYCed a single layer of self-hosted wallets. How is that helpful? lol. Immediately transfer the money to another wallet that isn't KYCed. Oops, your regulations just failed, idiots. Did they not realize that BTC can be transferred to a non-KYC wallet? Like... seriously. KYC on a single layer of self-hosted wallets doesn't give them any more control over the situation than KYC on the original exchange account. Bitcoin has more wallets than atoms in the universe.

Conclusion

2021 is so bullish. They are literally throwing everything they have at Bitcoin right now while they still can. Hell, I'd prefer if Bitcoin crashed all the way down to the doubling curve at $20k. That way I could feel safe going long and leveraging debt just to increase gains by the end of the year.

On a very real level there have been far too many coincidences for all these events to be totally random and independent. Bitcoin is under attack. I mean, it's always under attack 24/7 but right now even moreso due to these recent events. They want people to panic and sell their stack, and they are winning.

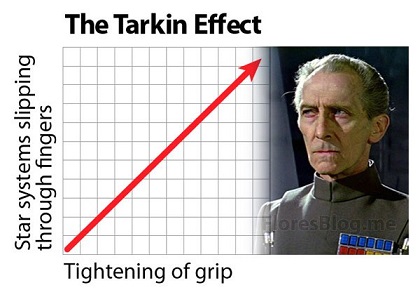

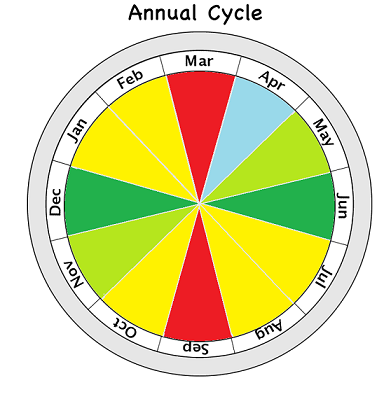

Take a look at my handy-dandy chart. Feb/March/April aren't good months. Where is Bitcoin right now? Right where it was in January during the last good month we had. Market was bubbled... market came down to Earth. 2021 isn't over.

Posted Using LeoFinance Beta

markets are always stupid. Special if a lot of retards come in.

They think tomorrow is everything gone. It's not how it works :)

And the US once again becomes the sleeping giant.

Too much energy is used in Bitcoin?

The US comes to the rescue. All of the overweight and obese people will wake up from their food induced coma's and surge for better health and finances at the same time. How? Some genius is gonna build some bikes and treadmills that create energy instead of using it, and everyone will be paid in mined bitcoin to work out.

HAHAHAHAHHAHAHAAH

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

So weird...

Posted Using LeoFinance Beta

Many have difficulty with where to go and not to make a mistake already. I, for example, a long time to choose, and I managed to find here https://tripbirdie.com/santorini-greece-all-inclusive-resorts/ information about one of the ideal resorts. I, for example, very pleased with this information and now there are no more difficulties. I hope that I can help you with this as well. Good luck.

Posted Using LeoFinance Beta

Many have difficulty with where to go and not to make a mistake already. I, for example, a long time to choose, and I managed to find here https://tripbirdie.com/santorini-greece-all-inclusive-resorts/ information about one of the ideal resorts. I, for example, very pleased with this information and now there are no more difficulties. I hope that I can help you with this as well. Good luck.

Posted Using LeoFinance Beta

Now if these same entities would put this much effort in solving poverty we’d all be rich. Their counter productivity is now bursting out at the seams.

Posted Using LeoFinance Beta

But if we're all rich, doesn't that make us all poor, until someone with less comes along?

no, animals plants fungus and crystals on neuralink under humans. lol planetary fuedalism with humans as royalty

It'll be interesting watching those humans go to war with water after taking a tsunami personally.

That graphic with the Enterprise and the one with the guy at the gate are awesome. I have seen the gate one before, but never the Enterprise one. I look forward to the day when I can have my fiat obligations out of the way and then I can just do as much as I can with crypto. Being able to keep it all on decentralized areas is going to be awesome. I've still got one or two transfers to fiat I need to do before that...

Posted Using LeoFinance Beta

Can’t wait til the day we no longer need the legacy system for anything. But for now got to pay fiat to survive…

Posted Using LeoFinance Beta

Yes we do! Gotta feed the pig for now!

I get the impression in my legacy media feeds that they are still trying to kick BTC while its down. More propaganda. Elon should be buying DOge or LTC hand over fist if he was so concerned with energy.

Posted Using LeoFinance Beta

I mean if it worked 4 years ago why not do it again. Same exact headlines and same exact FUD like seriously! Rally for sure end of this year for now it's stacking and staking!

I mean we have already been through this that they can't ban bitcoin, again now that the price is up they threaten SEC regulations and attacking people lol it's honestly so ridiculous and sadly so many people listen to it.

Posted Using LeoFinance Beta

I think that all weak hands have bailed by now... So they can keep throwing punches, diamond hands can see right trough this FUD and if anything they become even more bullish and enlarge their bags.

I agree with you, 2021 still has a lot to show. The people who bought the dip won't be willing to let go of their BTC for anything less than 90K

Posted Using LeoFinance Beta

Whatever the government does as regards trying to stop thee progress of crypto won't work. They should know this and know peace. I mean crypto is the future. The hedgefunds can see that and they are currently making profits.

Posted Using LeoFinance Beta

Imagine a day you wake up and they ban the exchanges.

It's actually just a law passing...Look in history, its not so hard for the establishment to create law.

Posted Using LeoFinance Beta

Oh no, what would we do without the centralized exchanges?

Posted Using LeoFinance Beta

They finally wiped out the long-leveraged people and flipped it short. My thoughts are one more big scare and then start wiping out all the shorts on the way back up. We had the liquidation crash. Next will be the short squeeze and then the reins come off for a while in my opinion.

Posted Using LeoFinance Beta

It feels like people will never learn.

Posted Using LeoFinance Beta

It's incredible how they are clinging to the energy consumption argument. You know what else sucks up a crazy amount of energy? Vegas. Are they going to try and shut that down too?

Posted Using LeoFinance Beta

It's honestly fully predictable.

Clearly it was even more ridiculous to say Bitcoin was for drug dealers and terrorists,

and they clung to that narrative for almost ten years.

This whole energy argument is way more believable, so they are pushing it even harder.

I think I saw all the headlines besides Vitalik talking about energy. But yea I do think it is dumb when banks launder more money than crypto, banks/tech companies waste more energy than crypto, and all we get is more talk about regulations. I think the regulations were fully expected since they want the control and money generated from the crypto system but I don't think they can fully control it.

Posted Using LeoFinance Beta

I've been advocating for years that one of crypto's most needed — but unbuilt — use cases is a giant peer-to-peer marketplace; a sort of Craigslist-meets-eBay dApp where goods and services can be traded without the need to exit to fiat, at all.

As for the banned thing, maybe it's also time someone created a decentralized dApp store/aggregator venue where you can go to look for everything, and connect to everything.

There are a few fundamental concepts of the the centralized model we should not throw away too hastily... one of them being the benefit of "economies of scale" and offering the convenience of being able to get most of what we need from a single venue/experience. Perhaps the one weakness of decentralization is the risk of everything slowing/becoming awkward to use due to excessive fragmentation. I think the cryptosphere needs to look more towards structures like Farmer's Markets to help make use more convenient for more people.

=^..^=

Exactly. It has more or less compelled mines to look at renewable and clean energy solutions which are increasingly in use. Then again, when you challenge the established order of things, be prepared for all kinds of propaganda

Excellent use of the proofofbrain tag. You just made more on this post.

Posted Using LeoFinance Beta

Hodl your bags they are trying hard to take it from you, using the same lines and Fud only new traders with less experience will get burn

They trying to bring btc down to my $20k price prediction

Posted Using LeoFinance Beta

confident that BTC will rise once again. Maybe Elon also realised that he needs to shut the hell up for a brief period of time, say 3 months or so. I think if he does that, BTC will rise up to 100k for sure. DIAMOND HANDS!

Amazing

I agree this is a coordinated attack on Bitcoin to shake out the retail investors now and allow others to buy it up cheap, as well as other cryptocurrencies.

Posted Using LeoFinance Beta

you got good points, i believe is a concentrated attack, maybe for the big corporation to get a bag of bitcoins, and some governments too. we will see.

I think you are right.

The more they try to control digital assets the more people they will drive away from cefi centralised exchanges.

By doing this they are in fact forcing a more privacy based Defi Decentralised exchange minded crypto community.

This will help to strengthen the community against possible future attacks and governmental overeach.

Posted Using LeoFinance Beta

Hard for me to wrap my head around this attack, so just kind of rambling here, but...

Aren't the regulators / central banks and the billionaires kind of at odds with each other?

Or, actually, the regulators are probably in the middle, being pushed by both sides to create FUD.

So is it billionaires taking advantage of FUD from regulators to make gains, or is it regulators taking advantage of a window of opportunity (created by billionaire FUD) to try to stop and/or slow down crypto?

On a side note, Elon tweeted today:

Could he be talking about crypto here? As in, it's not just the technology but also importantly people's belief in the technology that makes crypto so powerful? He is known to talk in code on occasion.

Posted Using LeoFinance Beta

The real quote is:

He's just making a joke by not distinguishing them correctly on purpose.

More of a perception is reality type thing.

If you don't know how something works then it's magic.

Yeah, that was my point, convoluted as it was.

Posted Using LeoFinance Beta

no hes talking about searl effect generators

.gif)

antigravity

lolol

THE MORE YOU TIGHTEN your grip the more blockchains SLIP through your fingers

what? that makes 0 sense lol

lol what the hell does that even mean bloomberg?

I know right they are such fuckups.

Thought the same thing didn't mention it though.

I guess (value) == (market_cap) these days.

It's pretty easy tbh. The only time you try to "fight" an entity is because the entity has the ability to hurt you.

In this case, the entity is Bitcoin and the "fighters" are the agents if FUD.

Posted Using LeoFinance Beta

I love the meme on the government banning bitcoin... classic..

Posted Using LeoFinance Beta