A Request for Taskmaster:

@taskmaster4450 does a pretty decent job of reminding us all that the banking sector is an extremely complicated entity that is constantly misrepresented and oversimplified to comically childish levels. Especially now when the banking sector is having problems: all the reply guys jump in and act like experts on the topic even though they don't even have basic cursory knowledge of how it works. This becomes particularly frustrating when noobs keep spewing the same old tired narrative over and over again without having any idea what they're talking about.

It's important to understand that the economy is a complex living entity.

Just like the world is filled with pretentious doctors that could give a dozen diagnoses based on a single set of symptoms, so too is the world filled with oodles of know-it-all economists who could give a dozen reasons for why the economy is sick at any given time.

Nothing within this ecosystem is simple, and the rabble coming in to give their two cents on the matter is like a pleb thinking they have the answer because they did a single search on WebMD. Certainly it is possible for the novice to come up with the right answer but the odds are certainly not tilted in their favor. It takes a lot of work to figure this stuff out.

Main Theme: Money Printing

Taskmaster's beef with a lot of people who talk economics revolves around the concept of where money comes from. Whenever the dollar loses purchasing power everyone just assumes it's because the money supply has expanded. However, this seems to have not been the case for the last twenty years.

Everyone points to the M2 money supply as the ultimate metric to show that printer go brrr, but this is simultaneously a metric that includes financial instruments that are completely locked within the retail banking sector.

We must remember that the Federal Reserve at its core is a bank for banks. They do not interact with the public: they interact with other banks. When the FED prints financial instruments and uses them to do things like buy securities (QE) from banks: those financial instruments are absolutely not liquid USD. They are locked within the banking sector.

These financial instruments can be leveraged indirectly to issue more loans and actually create real USD and expand the money supply, but this action is not guaranteed (even though this is exactly what we want to happen). In fact we constantly see evidence that when the FED engages in QE this doesn't really help the risk:reward landscape in the banking sector. Retail banks are not required to act the way the FED wants them to act just because the FED believes they've incentivized a certain behavior.

Banknote Hypocrisy

All the "printer go brrr" memes involve banknotes (cash). It's true... the FED (Treasury) can print banknotes directly. And yet the same people who make these printer go brrr memes don't actually use cash. In fact these same printer go brrr people think there is a globalist conspiracy to eliminate cash from the ecosystem entirely.

It is fully hypocritical to hold both of these ideologies within a single mind. Either the FED is printing a ton a cash and flooding the economy with physical cash (which everyone knows isn't happening), or the only real way to expand the money supply in any meaningful way is for retail banks to issue loans to their constituents.

My request to @taskmaster:

A lot of the focus here goes into why people are wrong and why they have no idea what the fuck they are talking about when they start flapping their jaws about the banking sector. I would like to see some focus on the flip side: how are people correct about the banking sector? Certainly the main theme cannot be incorrect.

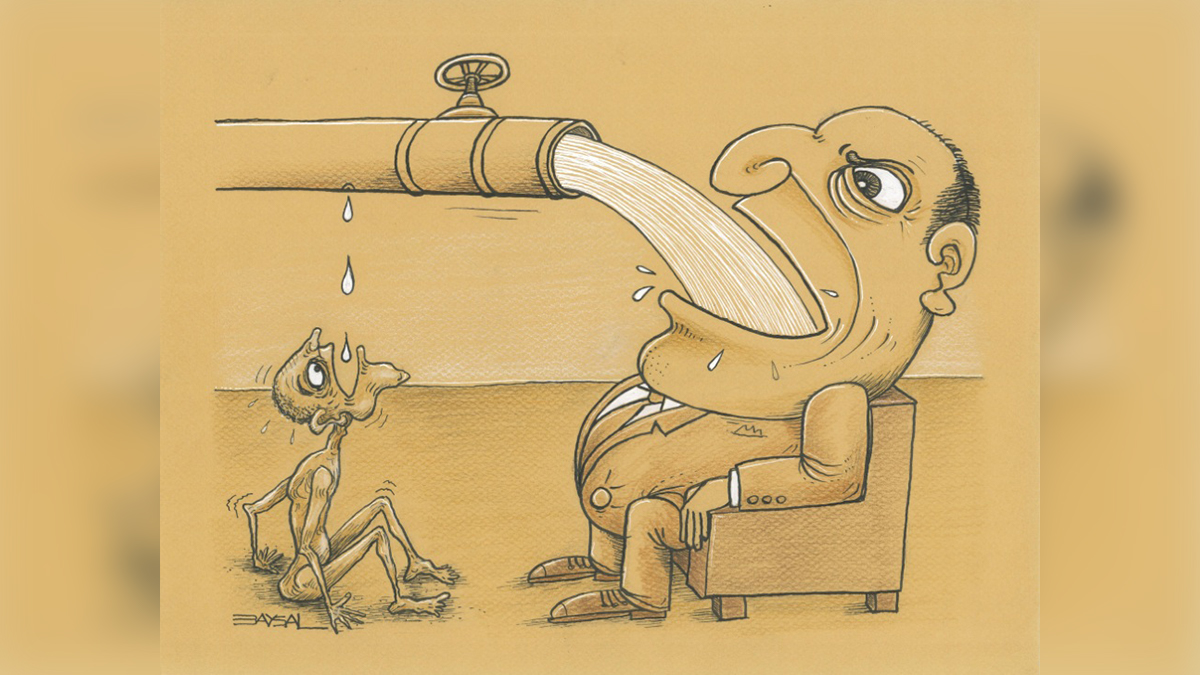

This main theme of central banking of course is that they are bleeding us dry like vampires and siphoning value from our lifeforce into their own. If this isn't accomplished through the process of money-printing and the expansion of the money supply, then another narrative must be provided so that people can understand what is actually going on.

We can't just tell people they have no idea what they're talking about and then not provide them with the actual reason for why everything is totally fucked. I've been waiting for the other shoe to drop for over a year, but it never seems to come. Taskmaster just keeps harping on this idea that the way people think it works is not how it actually works. Okay sure but we all know the banks are profiteers, and it's not being explained how they are raking in the lion's share of all the profits. This narrative-vacuum creates a situation in which the people hearing this information simply aren't going to believe it because it's an incomplete story. In one ear and out the other so to speak.

Here's my humble guess:

Given what I now know about the banking sector, most value must be being extracted through interest rates. This fits Taskmaster's narrative of how printer is actually not going brrr; in fact there is a worldwide dollar shortage that has been compounded by rising FED rates.

We know that money is debt and that all this debt is owed back to the banks with interest. Funny story: this interest doesn't exist. The money owed back to the banks is more than the total amount of money in circulation. As time passes these interest rates suck liquidity out of the economy. Thinking about money like a river: the water level is getting low; the ecosystem is becoming stagnant and decrepit without much needed velocity to keep pumping lifeblood into the ecosystem.

This is the situation we are in right now.

Moments like this are avoided during economic prosperity because economic expansion implies that the banks are giving out new loans to people and expanding the money supply. With this expanded money supply there's enough money floating around for everyone to pay back their debts. When the river runs dry we run into these problems. The result is the dollar shortage we are seeing today in addition to inflation, which should be totally baffling to the printer go brrr people. But somehow isn't. Call it cognitive dissonance.

Debt default

The economy grades on a curve, and there is always someone at the bottom of the meatgrinder no matter how financially responsible everyone is. During times of economic contraction defaults are high because money within the system is low. Again, more money is owed back to the banks than exists. The only way to navigate this situation mathematically is that a lot of that debt simply won't get paid back. Whatever collateral existed to secure that loan now belongs to the bank (like a house).

Centralization is bad for the economy.

The reason why the economy is in such trouble right now is because the gap between the rich an the poor is absurd and it only gets worse every year. Of course correlation does not equal causation, and this gap between the upper and lower class is clearly a symptom of the actual disease rather than the disease itself.

Collateral required

In order for a bank to issue a loan: they must have a reasonable expectation that they will be paid back. They are in the business of making money after all. If they issue ten equivalent loans at a 10% interest rate, they need nine out of ten borrowers to pay them back just to break even. Like many business ventures this is a game of very thin margins and high competition.

So what happens when the collateral is people?

Credit scores are collateral. People are collateral. The Bible calls this usury and it is generally frowned upon. After all those who cannot pay become debt-slaves.

However as someone who never paid back $10k worth of credit card debt I can tell you that there are many laws in place today that greatly soften the blow of punishment for not paying up. These banks are not loan sharks: they aren't going to break your legs over it. In fact I personally suffered zero drawback from not paying my debt. Six years later my credit score is higher than it's ever been.

Collateral is diminishing.

Technology creates economic deflation. If people start 3D printing houses then all the houses currently in existence go down in value. Inflation of houses creates deflation of value. Technology creates this inflation of product and deflation of value. If AI can start doing the jobs of 50% of the population this will in turn lower the collateral value of people themselves. This has already been happening for decades with the advent of technology, and more specifically mass production and automation.

None of these things bode well for a centralized economy in which the distribution of wealth is constantly being syphoned away from the lower and middle class. Within this context we can see that interest rates and debt might not be the problem at all (although it's not helping) but rather technology consolidating more and more wealth into the hands of the elite.

National Debt

I'll do a post on national debt some other day but this is a topic I'd also like Taskmaster to cover because I feel like there is a ton of nuance here that I still don't understand.

Conclusion

Everyone seems to think that the dollar is down and out. It's losing world-reserve status and printer has gone brrr long enough. Taskmaster seems to believe this is extremely wishful thinking based on a complete lack of knowledge of how the economy actually functions. I tend to agree with him.

That being said I would like to see less focus on debunking printer go brrr and more focus on how the banks are choking the economy like leeches. If we tell people the FED doesn't print money they will simply dismiss that information without a replacement narrative to show how they are siphoning value into their pockets and the pockets of the cronies around them.

Or perhaps the banks are not the problem at all, and the real problem stems from technology and the fetid centralization of wealth it creates. If this is the case we are all certainly in the right place, as crypto (and especially Hive) are all about getting a better distribution.

Posted Using LeoFinance Beta

https://leofinance.io/threads/@rmsadkri/re-taskmaster4450le-hno2z15w

The rewards earned on this comment will go directly to the people ( rmsadkri ) sharing the post on LeoThreads,LikeTu,dBuzz.

https://peakd.com/@edicted/currency-tidal-wave-part-3-the-age-of-exponents

Nominally, the Federal Reserve and the Treasury are separate entities. But with the former Fed chair now running Treasury, the line between the two sure seems blurry.

And it doesn’t help that the head of Treasury seems to speak crazy talk like all bank deposits would be insured !LOL

lolztoken.com

He told me to stop going to those places.

Credit: benthomaswwd

@preparedwombat, I sent you an $LOLZ on behalf of @mawit07

(2/8)

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

Incorrect. Since all banks are investment banks now, and all investment banks, also have deposits. Most value is currently and for a while is being extracted from commissions of various derivative products. And I am not talking about complex products like CDO, or MBS. Something extremely simple like Interest-rate-swaps.

There is an exciting and entertaining book on this topic from an world expert on this topic. It is written several years back but still relevant. I recommend you read it:

https://www.amazon.com/Traders-Guns-Money-Unknowns-Derivatives/dp/0273776762

Looks interesting...

But also the spirit of this post is that we shouldn't do things like tell people they are wrong and be like "no, it's this other thing" without explaining it.

If it's so simple then why don't I know any more about it than I did 10 seconds ago?

Like: it's so simple but if you wanna understand it you should probably go ahead and read this 440 page book. lol. Legit exactly what I was talking about in the OP. None of these topics are simple but it doesn't stop people from trying to oversimplify them regardless.

Certainly it looks worth the read though I'll check it out.

learning is a strange thing @edicted, seek and thou shall find.

There are many simple things you DO NOT know :)

There are many simple things I do not know.

Doesn't make either of us better or worse. I can only show you the door, you have to walk though it. I have done my part.

It is not about right or wrong, it is about knowledge.

Cheers!

Hey hey hey

You can lead a horse to water, buddy!

You know my knee jerk reaction to your comment was something like:

But on second thought.

It's actually like the perfect comment on a lot of different metrics.

Good jobs. Unironically.

Have you seen the movie, Smallfoot? :)

There is a nice song there.

maybe better vid here

Here is the lyrics by Common. Give it a listen, free and easy.

Um where are you takin' me?

So many questions

I think it's about time I give you some answers

What is this?

You see, Migo

There was a time when Yetis lived beneath the clouds

We were alive and we were thriving till we came across a crowd

Of Smallfoot, that's right, we used to live down there

But there were actions we could not forgive down there

And though they used a different nomenclature

Man, or human, they showed us human nature

A dangerous species that we approached with wonder

They attacked with spears and their smokin' sticks of thunder

They called us Sasquatch, they called us abominable

They chased us, pursed us, their persistence indomitable

We had no choice but to run and hide

Otherwise, we surmised we were facin' genocide

So we climbed this mountain just to stay alive

You see we knew that up here Smallfoot cannot survive

So it was here the first law was written in stone

It was named and proclaimed as a truth to be known

Our world is an island, it floats on a sea of endless clouds

That's how we would be

And then we wrote more laws, more rules to obey

For the sake of us all it was the only way

To protect us from all of the human ravages

Heaped upon us by those human savages

Now you know, now you know, now you know

Now you know, now you know

And new rules apply

Now you know, now you know, now you know

So it's best just to let it lie

Now you know, now you know, now you know

Now you know, now you know

And you can't deny

Now you know, now you know, now you know

That it's best just to let it lie

But my Smallfoot, he's not like that

They're all like that

Tell me, when you found him

Did he greet you with open arms?

They don't care about us

They don't care about anything but themselves

Which is why we must do the same if we care about our future

Wait, we're below the clouds

Or so it would seem

But look closer

Those aren't clouds, it's steam

The stones are working

The stones?

Every job and every task is pointless as it seems

All of it ensures that this important machine

Keeps turning and turning and spinnin' around

So those below don't look up and those above don't look down

And they'll look 'cause even if they hear of these atrocities

The only thing stronger than fear is curiosity

Now you know, now you know, now you know

Wait so, so none of those stones are true, they're all lies

Good lies to protect our world

But they need to know the truth

Oh do they?

You feel emboldened by your noble quest to find the truth

I chalk it up to the naive innocence of youth

So let me share a secret that you'll learn as you grow older

What's true or not true is in the eye of the beholder

So do you wanna prevent our own annihilation? (Yes!)

Then our only goal should be to control the flow of information

Unless you wanna see the Smallfoot conquer and pillage

Then protect the lie and you protect the village

Lives are at stake Migo

Your friends, your father, Meechee

She's curious and you know what they say

Curiosity killed the yak

So what do you want me to do?

Tell everyone you were lying about the Smallfoot

But they've already seen it, they're not gonna believe me

You'd be surprised at what they'll believe

You think knowledge is power Migo?

Now you know, now you know, now you know

Now you know, now you know

Question is

Now you know, now you know, now you know

What are you gonna do with that power?

I have not seen it and I could interpret this comment in a dozen different ways.

Just like the dozen economists and doctors mentioned in the OP.

good!

"now you know" :)

A friend once recommended this movie and I kept postponing to watch it until I forgot about it.

Hmm just listening to this song got me really interested to finally watch the movie probably this coming weekend.

I think now it's even more relevant with all that has been happening around us from COVID to financial crisis, all the policies and regulations around low-carbon economy politics.

It seem like most of us are just Migo with the government and banks being the Smallfoot- *"They don't care about us. They don't care about anything but themselves".

Now you know, now you know, now you know!

So it's best just to let it lie.🎶🎶

Lol this part of the song is now stuck in my head I even added it to my Spotify playlist. Awesome thanks for sharing🤔😅

Hurry up and get it right! You people are my only source of knowledge and I need to know how to think!

Well that just goes without saying.

Value is a point in time. Market cap in itself is flawed, there is never the liquidity to cash out the market cap yet the value could be used as collateral to create “debt” money.

You and @taskmaster4450 are super great at explaining all these financial topics. I only listen to daily news and definitely always hearing conflicting reasons as to why things happen the way they do. Much appreciate you guys insights and learning as I read both your insights.

On the topic of money printing I agree it’s not helping the majority but the money is being created. In this money system there are two kinds of money. There is base money where it’s only interchanged between banks and broad money where it’s used by everyday people in the real economy.

The issue lies in the money printing is going into base money which banks control. Broad money works in the real economy but central banks are not allow to give it directly to people. Government need to push fiscal policies to get broad money into the real economy. This happened during the pandemic.

During lockdown government made fiscal policies that push cash to people such as tax credits and loan moratorium. The results of this now is what we see now, real inflation. Supply of goods and services never increased due to shutdown but people had cash to spend. Savings rates in the USA were at highs during pandemic but now with everything opening everyone is spending what they saved which pushes prices higher and higher prices.

The Fed has to main objectives. Control prices of assets and minimize unemployment. With real inflation seeming out of control the Fed is raising rates but not raise too high to increase unemployment. They are trapped in that if inflation can’t be contained they will continue to tighten money supply with monetary policies like raising rates and selling assets on their balance sheet.

While globally there is a shortage of dollar due to their own greed by inflating their own asset prices. Outside USA other central banks created their own US dollars for holding up asset prices. These US dollars are known as Eurodollars. Fed had stated they don’t care what how many Eurodollar ther is and it’s other countries problem to keep of track if and when issues arise. Issues are arising where people are withdrawing US dollars to pay for loans or buy assets. Foreign banks are in trouble because they don’t have enough US dollars for people to withdraw because it’s mostly Euro dollars. So foreign countries holding a lot of US treasuries are selling to get dollars. The Fed don’t want other countries to lose value on the US treasury sales since rates have been rising so Fed made up new policies to buy foreign owned US treasuries at face value. This will starve a domino effect of deflation for now since there are trillions of US treasury outside of the US.

In the last piece regarding government debt it is a shift that is continuing on a daily basis with the end result likely hyperinflation in the US economy. Back in 2008 the financial crisis was bubble popping on public debt. Now it’s debt on commercial entities. For examples overpriced commercial real estate and high company evaluations free falling. It will end up being debt on government once economy slows and too many people lose their jobs. The government will end up voting for a economic bailout. The debt can’t be sold at reasonable prices because foreign countries are selling US treasuries to fend of what they printed in Euro dollars. This is what people call the everything bubble popping.

The everything bubble popping is a slow and steady process but end result is a lot of US dollars in the form of bailouts and foreigners unwilling to hold US dollars. It’s going to take decades if not a century to play out but at the end there is too much US dollars chasing fewer and fewer goods and services. Hyperinflation or stagflation where prices go up but income stagnant.

This is just my interpretation from all the Econ stuff i read. Apologies in advance for any misinformation. !LOL

Again appreciate the post as it’s really interesting stuff being discussed.

lolztoken.com

At the end of the night he took her back to her place.

Credit: reddit

@edicted, I sent you an $LOLZ on behalf of @mawit07

(1/8)

This is remarkably lucid.

Thanks!

The Everything Bubble Popping!

First time I've seen that one

What a phrase

We have a supply side problem causing the inflation.

Then there is also partly self-fulfilling prophecy: people demand higher pay, cause cost for the employers to go up, cause price of goods and services to go up.

Also as interest rate go up, cost of borrowing go up (companies will pass the cost to consumers if they can, while individuals have lower disposable income)

Always push and pull.

Sustainability of USD is another issue: without war and conflicts how is US going to “pay back” much of the $32 trillion without arms sale?

Or intellectual property sale when China is catching up?

The ability for the US to repatriate and bring it back to balance is diminishing by the day.

The amount of goods and services and protection that can be used to “collateralize” the $32 trillion is going from monopoly to duopoly. Not looking good.

I wonder if you follow balajis on Twitter or have seen any of his backings to the $1m Bitcoin bet

Posted Using LeoFinance Beta

I mean I loosely followed it on the day it happened.

he’s been coming out with facts backed with evidence. In quote, because, I mean, I didn’t understand. My brain circuit fry(ew) at first glance.

Posted Using LeoFinance Beta

I could not resist

This is your birthright.

https://twitter.com/1472693700933345286/status/1640539110409486338

https://twitter.com/1415155663131402240/status/1640669458527318022

The rewards earned on this comment will go directly to the people( @kalibudz23, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

No. It is the disease, and the faltering economy is the symptom.

Taskmaster has pointed out that commercial banks don't conjure loan principal, but instead the deposits they lend out, making depositors automatically the losers in the event loans aren't repaid in full (which we call a bail-in ((they keep 100% of the interest payments (which interest, less what is paid to depositors and other overhead, is the only income they record (however, handing your money to a bank means it's the bank's money. You have exchanged it for their promise to repay it to you (a liability on their books). It becomes their money in actual fact, allowing them to declare a financial loss (of money you gave them) in the event they default on their promise to pay you, in a surprise plot twist))) the number of parentheses here reveals how this fraud is concealed (the sleight of hand is that your deposit is not income they declare, and neither is loan principal when the borrower pays it to them, because those are accounted as an increase or decrease in their liability to you, the depositor, and is the asset the bank lends out and profits from, which means if the loan goes bad, you're the one who's out money, which the bank declares it's loss))).

The money created when it is lent is destroyed when loans are repaid and the bank is fully collateralized, which is why we're facing a lack of dollars today. New credit is not conjuring new dollars into the economy. As even well collateralized banks like SVB and Signature are seized, banks are dissuaded from new lending that reduces their collateralization and increases their susceptibility to seizure (in theory. In fact, fractional reserve lending means no banks can pay all depositors on demand, and are all susceptible. SVB and Signature were targeted and collapsed deliberately, and these things are planned). Interest rates aren't the sole determining factor in how much money is borrowed either, and are another limitation on the confidence of borrowers in their ability to profit by borrowing money due to inflation (or worse, deflation), war, government mandates that prevent creation of goods and services, blowing up pipelines, crashing planes into chicken coops, and etc.

I was acquainted with a lender that would lend out funds overnight for 1%. They had no interest in lending $50k. They were only interested in deals >$1m. Similarly infestors in BlackRock can't profit from my ex watching kids after school until their parents can come pick them up after work. They can't profit from 50M of my exes doing that either, despite that would be an appreciable chunk of the economy, thus licensing is used to limit that form of economic activity to licensed entities BlackRock can own. BlackRock only wants companies it owns the majority of to be imprisoning children. Every license to warehouse kids isn't there to protect kids from under-edumacated prison guards, but to limit economic activity the infestor class cannot own. This licensing scheme has been gradually increasing for a long time, as more and more economic activity is restricted by licensing, and fewer and fewer economic opportunities exist outside the control of the infestor class. The flaw in licensing is that bad parents can use fiat to pay my skeezy unlicensed ex to warehouse their insufferable brats, extralegally, and such small fry aren't worth the trouble to squash any more than they're worth the trouble to finance.

However, there is a plan to underwrite all economic activity with SDRs, and this requires that only temporary debts in the form of CBDCs are transactable, separating the functions of money into stores of value and means of transaction, so that Megacorp can prevent economic activity they don't profit from. They can't do this if we are happily transacting with the forms of money extant, such as fiat, BTC, and Hive. Now that Megacorp (BlackRock, StateStreet, and Vanguard, because each of these is substantially infested in the others and own a majority stake in ~90% of stock corporations in the world) is the majority owner of almost all entities creating economic activity, it's owners can arrange to transfer their equity to SDRs at their whim and complete the acquisition of all actual wealth by destroying stores of value they don't own, which we observe allegedly ongoing. Megacorp will be able to underwrite CBDCs with whatever features they want, since their SDRs are collateralizing them, and plebs UBI'd CBDCs collateralized by overlords' SDRs. Plebs will no longer have assets, all of which will have been tokenized in SDRs owned by substantial stakeholders in Megacorp, so their access to CBDCs will be charity, and they will have no say in what, when, where, why, or who they can be spent for, however those CBDCs are limited per their social credit scores, skin color, gender, and etc.

That's the problem with the economy today: Megacorp owns a majority stake in ~90% of the stock corporations in the world, and is executing a plan to exclude the non-infestor class from participating in economic activity that Megacorp doesn't profit from, widening the divide to infinity.

"You will own nothing, and you will grovel before your generous overlords whom grant you life at their whim and sole option, and be very, very happy you aren't gulaged into bug food."

My answer to this is that money is not wealth. Money can be used to buy wealth, but wealth exists whether money is involved or not. I exchange my services for goodwill. I have for years foregone wages and cash payments that would encumber me with tax liabilities, and my bills get paid. A landlady, for example, can consider rent paid for a month for painting a sign. She didn't pay wages for the painting. She did forego income, however, and reduced her tax liability. This can become far more complex and impossible for others to track, such as by doing work for a farmer who delivers produce to a mechanic that fixes my truck. No one can ever establish I paid that mechanic diddly squat, nor that the farmer ever paid me jack-all, and everyone involved reduces their tax liability. Despite no money being involved, economic activity occurs, and wealth in the form of goods and services is the result. I can hoard goodwill to any level I want, and money printers can't reduce it's value to me. It can't be taxed, stolen, inflated, deflated, or probated. In fact, if you've been defrauded, you gain goodwill from sympathetic people today. They might even set up a GoFundMe for you.

Because goodwill is based on trust, dishonest actors cannot participate in economic activity transacted in goodwill. This is not a bug, it's a feature. Because untrustworthy actors can transact in money, the world is facing every single problem you can name, from the plandemic to the war in the Ukraine. It is the love of money that is the root of all evil, not the love of wealth.

Personally, I recommend only undertaking economic activity with good people anyway.

Thanks!

Edit: https://www.imf.org/en/About/Factsheets/Sheets/2023/special-drawing-rights-sdr

Posted Using LeoFinance Beta

I tend to disagree with him in this. It’s a fact the dollar is getting ditched by major Middle East partners and India. Even moving to only dollar use in all trading to multi currency trade including dollar for certain nation still is a huge change that shouldn’t be overlooked how big a shift it is. I have little doubt this will only continue. With India ,China, Saudi Arabia trading in multiple currencies it’s a huge huge huge shift. What am I apparently missing?

Honestly I have no idea but MSM has started broadcasting the message pretty hard which makes me skeptical no matter what.