Miners selling more Bitcoin than they are mining?

What are the miners telling us?

Looking at the recent figures, it looks like bitcoin miners are selling more bitcoin than they are mining each day.

Something we haven't seen much of over the past several months.

Back in January of this year, miners were mining much more bitcoin than they were selling. They were hoarding bitcoin so to speak.

Fast forward to the recent drop and subsequent recovery, and they were selling more than they were mining...

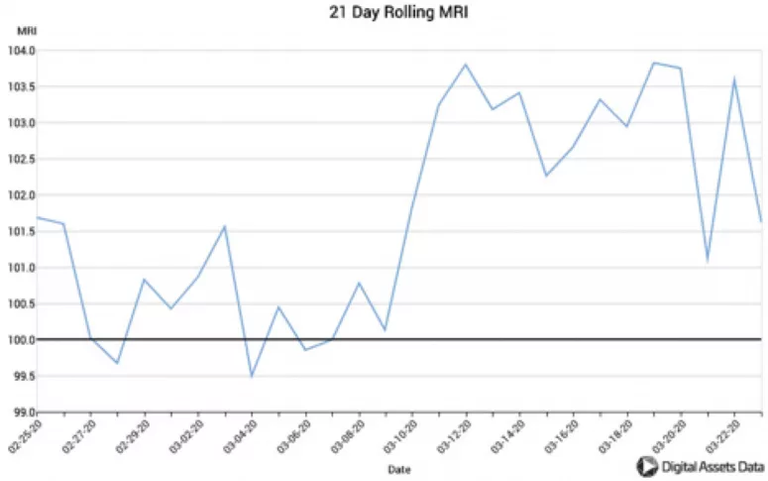

Check it out:

(Source: https://www.coindesk.com/miners-are-selling-more-bitcoin-than-they-are-mining)

A 21 day miner's rolling inventory (MRI) number greater than 100 means they are selling more than they are mining.

Why is that?

There are two schools of thought here.

On the one hand, people might assume that miners try to hold onto coins when they think the price is low in hopes of selling them later on at a higher price.

This seems to be a logical conclusion, especially with the halving right around the corner.

However, miners behaving the way they are might actually be the opposite of what most people tend to intuitively think...

Miners are sellers, always.

They have bills to pay in fiat and their revenue is in bitcoin, which means they gotta sell at all times.

That being said, they also know that the higher the bitcoin price the more money they ultimately make from their mining business.

For that reason, historically, miners have actually been rather responsible sellers.

Meaning that they actually tended to hoard when markets are weak and sell when markets are strong, thus having the least impact on prices.

If that is the case, looking at the above data one might assume that if miners are hoarding bitcoin, it may be because prices are likely to fall, and if they are net sellers it is because the market is strong and able to absorb their selling.

Which would mean they are fairly certain the market will be able to absorb their selling at current prices. That, or they are trying to get as many sold as they can before the bottom falls out again. :)

Anyways, just some thoughts on the recent miner activity.

Stay informed my friends.

-Doc

When people want to sell, there will be more competition as people don't want to sell at lower rate than the current minimum is... That makes people who had previously set sell orders lower than minimum cancel their orders and put them at higher rate. The result is that when there is more people selling, the prices go up as long as people keep buying the lowest orders. When the buying stops, sellers stop cancelling their orders.

1000$ bitcoin in a fast selloff has increased in probability a lot in the last 2 months.

If it happens, it will only be short-lived and increase quickly again, but can you imagine the fear that this will cause and the weak hands puking their BTC on the market when that happens?

No one said mining will be cheap a lot of these bigger operations are also leveraged and have debt and staff to pay so they need to sell regardless of the price which is good for the ecoystem, more BTC in more hands is the end goal, I say let them sell and let us all get a piece of this magical money