CUB Multi-Token Bridge Protocol Update | TX Reliability and 30% Yield Increases for bHBD & bHIVE

CUB's Multi-Token Bridge protocol has taken the spotlight as of late. ICYMI, we launched bHIVE and bHBD derivatives on the BNB Smart Chain (BSC). These derivatives trade 1:1 with native HIVE and HBD.

Users can now seamlessly transfer HIVE & HBD to BSC and utilize it to provide liquidity or trade for other assets on BSC. In this post, we'll explore some of the changes that we made to the MTB Protocol for reliability, security and added yield.

Before we jump into that, the Hive Hardfork 26 was launched recently. This added a lot of much needed changes to HBD that make it far more attractive and scalable as an algorithmic-stablecoin. Obviously, we at LeoFinance are extremely excited about these updates.

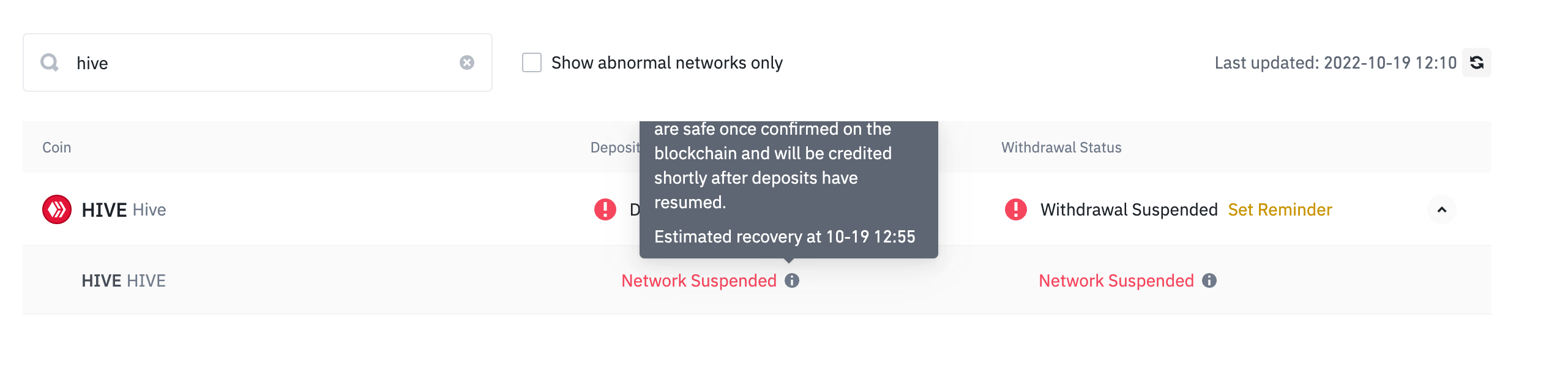

Additionally, Binance - the largest exchange with HIVE-based trading - has been offline for deposits and withdrawals since the Hardfork. This is likely to resume soon but it has shown the growing need to decentralized HIVE & HBD trading. We need HIVE & HBD derivatives on more DEXes. There will always be a need for CEXes as an offramp/onramp but DEXes are necessary to become truly antifragile.

bHIVE & bHBD are derivatives of their native equivalent - HIVE and HBD - these allow people to seamlessy wrap and unwrap HIVE & HBD to/from BNB Smart Chain which ultimately provides yet another source of liquidity and decentralized access to HIVE & HBD trading.

Hive is one of the most decentralized blockchains in the world. It's about time we decentralize trading and open ourselves up to more opportunities to expand into non-CEX-controlled territories. bHBD & bHIVE are controlled by the CUB DAO which utilizes wrap/unwrap fees to buy and burn the CUB token - the CUB token is then used to pay yield to all bHBD and bHIVE Liquidity Providers who facilitate liquidity and trading.

Reliability, Scalability and DEX Access

bHBD and bHIVE have seen a lot of updates since they went live on BSC. Namely, we rebuilt some of the protocols that run the backend contracts for bHBD and bHIVE wrapping.

If you've utilized any of the LeoBridges in the past, then you've likely experienced a "Stuck TX". Nobody ever loses funds in a stuck TX situation, but it is annoying because you have to open a Discord Tech Support Ticket and get a LeoTeam Tech Support member to process & refund manually.

Since the launch of bHBD and bHIVE, the CUB DAO has processed thousands of transactions - often over 100 per day on busy trading days - and there have been less than 3 failed wrap/unwraps... 3!

These 3 were right at the beginning and we quickly found the issues and fixed them. Since then, there have been 0 failed wrap/unwrap transactions for bHBD and bHIVE.

Reliability and scalability have become a focus for us - not just on the bridges but across the entire LeoVerse application stack.

With these updates, we're also able to manually (if one occurs, which hasn't happened in several weeks) refund failed wraps/unwraps in under 12 hours from when a support ticket is opened. This is really incredible. Unprecedented level of support and speed in the exchange space (i.e. open a tech support ticket at binance for a bad TX and it will often take 3 to 90 days to get it resolved).

DEX Access has never been more important for HIVE and HBD. We covered this in the early part of this article but it doesn't hurt to reiterate. We believe in an interoperable, blockchain-agnostic future for cryptocurrency trading.

bHBD and bHIVE are one piece to that broader idea. We believe the future is in many listings. Many exchanges. Many derivatives. We aim to be a key player in bringing decentralized liquidity to the Hive blockchain ecosystem.

Yield Increases for bHBD & bHIVE

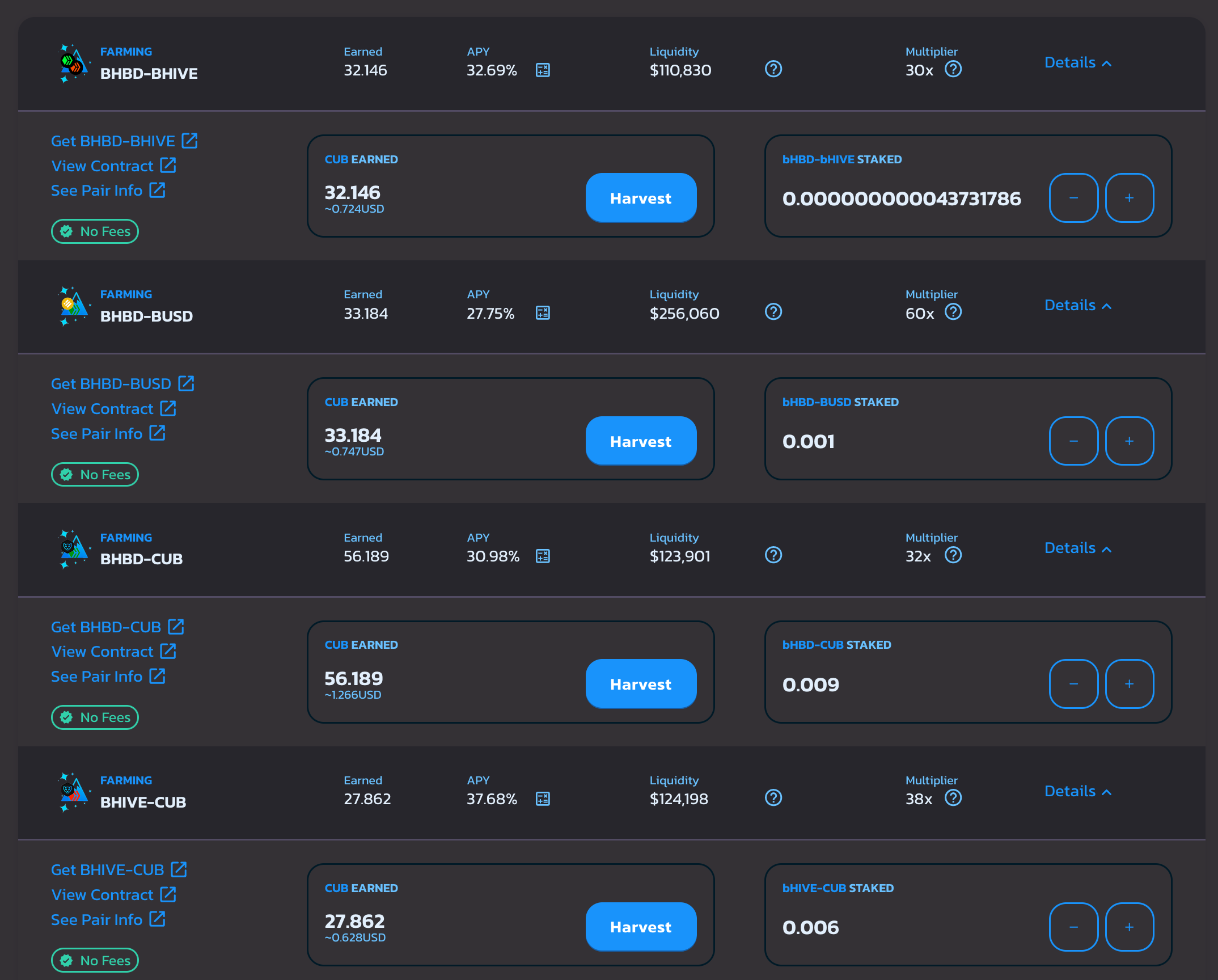

We've continued to manage the yield for bHBD and bHIVE. We're keeping yields well above 30% APY for wrapping HIVE/HBD to bHIVE/bHBD and providing liquidity to any of the 4 pairs available on https://cubdefi.com/farms

- bHBD-bHIVE

- bHBD-BUSD

- bHBD-CUB

- bHIVE-CUB

The sustainability of yield on CUB has never been so high. We've seen massive success with the Multi-Token Bridge and the revenue that we're capable of creating.

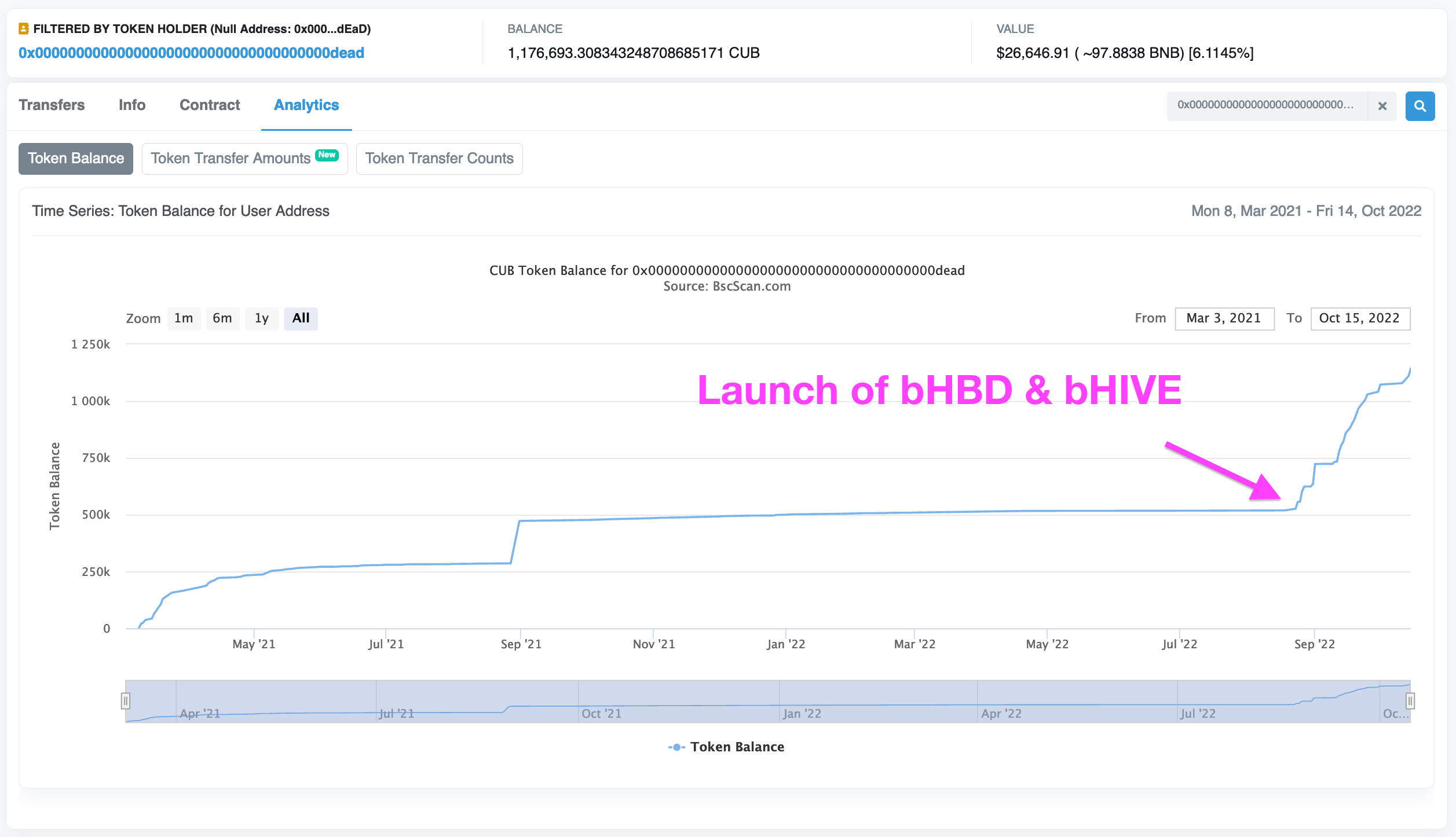

Since the launch of bHBD & bHIVE, we've been able to buy and burn over 1M CUB. This is truly amazing and just the beginning of what is possible with these derivatives. 100% of the wrapping/unwrapping, arbitrage and staking revenue that the CUB DAO earns from these contracts is utilized to buy/burn CUB on a daily basis. Yesterday, we burned 33k CUB and today will likely be a similar number.

If you want to dive deeper into how the MTB is earning revenue and buy/burning CUB to create sustainable yield for the bHBD and bHIVE pools, then we recommend reading the latest Monthly DAO Report.

Help Us Decentralize HIVE & HBD Trading

As we've reiterated throughout this post, we believe in a future of many listings and derivatives for HIVE & HBD.

bHIVE and bHBD are extremely important to this future. They are one more notch in the ladder of antifragility for the Hive blockchain.

If you want to help us contribute to this future, then consider wrapping some HIVE & HBD to BSC and providing liquidity in any of the 4 available bHBD/bHIVE LPs! There are some awesome tutorials out there if you google it or you can view a video tutorial via the CUB Docs: https://docs.cubdefi.com/tutorials/how-to-wrap-hbd.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

I'm doing my bit and staking some more every few days. #diamondpaws

However, your post sounds like you haven't reached enough liquidity and MTB revenue to make it all viable. I mean it's like a cry for help.

Do you want my advice?

Since I have your attention, please check the report of @cube4stake

https://leofinance.io/@cube4stake/getting-hive-listed-on-stakecube-piggy-bank-report-2

Posted Using LeoFinance Beta

Well it can’t be done alone. For Cub to facilitate a material % of Hive and HBD trading, we need the community to come together and provide liquidity.

@lbi-token is it’s own project. Not sure what they do with rewards but I’d assume something beneficial to their stakeholders.

Glad to hear you’re staking, so am I and I hope others find their diamond paws and contribute to bHBD, bHIVE liquidity

Posted Using LeoFinance Beta

Growth takes time but the current metrics show that CUB is on the right path. And with the tokenomics strengthening, if the market turns around, we'll see this token prove itself once again.

Posted Using LeoFinance Beta

Forget the money the bridge generates CUB for a second.

This is the most important thing for HIVE itself!

You're doing god's work, team!

Posted Using LeoFinance Beta

Thank you ser!

We'll keep buidling 🦁

Posted Using LeoFinance Beta

Love to see it!

Posted Using LeoFinance Beta

🦁

Posted Using LeoFinance Beta

Cub as been the saving grace for many because binance deposit and withdraw is down, we must all support this because it will all help us all.

Posted Using LeoFinance Beta

💪🏽💪🏽

Posted Using LeoFinance Beta

CUB projects made Hive cross-chain. Besides, Hive & HBD, as cryptocurrencies, has found another place for themselves in different blockchains. I adore this!

Thanks for Bridge update, glad to be an investor!

Posted Using LeoFinance Beta

We’ve got a lot of work to do to deepen liquidity but we just crossed $610k bHIVE/bHBD TVL so we are well on our way!

Posted Using LeoFinance Beta

Added in a little more. Every bit helps

Posted Using LeoFinance Beta

Every bit makes a huge difference. We need to achieve escape velocity liquidity. From there, liquidity simply begets more liquidity and the pools will continue to deepen as more CUB gets burned, price cranks higher and APY increases as a result

Liquidity black hole theory coming soon!

Posted Using LeoFinance Beta

This however have been showing progress and Cub still have more positive side to showcase.

The future of bhive and bhbd depends on everyone and the support we give to it will make it future very bright

💪🏽

Posted Using LeoFinance Beta

https://twitter.com/1149806884335050752/status/1582785605565845505

https://twitter.com/1366686073250865153/status/1583003686187700224

The rewards earned on this comment will go directly to the people( @elyelma ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @leofinance! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 22000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

PIZZA Holders sent $PIZZA tips in this post's comments:

@torran(9/10) tipped @leofinance (x1)

Please vote for pizza.witness!

Hmmm. My "Stuck TX" took 15 days (not hours ...) to be refunded (this past Saturday), with all of the attendant lost opportunity costs ... Again (my 3rd one? I've lost count) ...

Oh wait! You're making this claim about Cub. I wonder when this same claim will be made about PolyCub (where mine got "stuck") ...

Posted Using LeoFinance Beta

Yes, as mentioned - these updates extended to bHBD and bHIVE first. Bridge updates have been deployed to pHBD already and subsequently pHIVE and pLEO.

In the meantime, tech support has been cleared up after significant volume from the Hive hard fork and any assets operating with the new bridge update have under 12 hour response time

Posted Using LeoFinance Beta

It would be nice to have known this, all the time I was waiting for my "Stuck TX" to be addressed. Had our roles been reversed? I cannot imagine you would not have had a similar expectation ...

My question is, if at some point the farms of bHBD/BUSD, bHBD/bHive will be part of the Kingdoms section.

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444