Elon Musk Gets Approval for Bitcoin on X, Grayscale to Make $5.7 Billion From Win in Court

Today's episode is a deep dive into the regulatory landscape and its impact on the crypto market. First up, we're exploring why the SEC has been so resistant to approving a Spot ETF for Bitcoin. What's holding them back?

We'll also discuss how GBTC stands to benefit from converting to an ETF and why this is a game-changer. Did you know GBTC is holding over 600k BTC and was the single largest driver of the 2021 bull run inflows? We'll break down these staggering numbers and what the closing GBTC discount means for investors.

Bloomberg analysts are optimistic, suggesting a 75% approval chance for a Spot ETF. But it's been over a decade since the Winklevoss twins filed for the first BTC ETF—what's changed?

In other news, 'X' has secured a license to store, transfer, and exchange BTC and other digital assets for users through SocialFi. Could this be a sign of things to come? And speaking of the future, we'll discuss whether March 2024 could kickstart a run to $100k+ for BTC.

Bitcoin is making front-page news everywhere, signaling that the floodgates may soon open. But it's not all smooth sailing—the SEC has charged Impact Theory, setting a precedent for NFTs as unregistered securities.

Want to Help Us Double the Userbase of Hive?

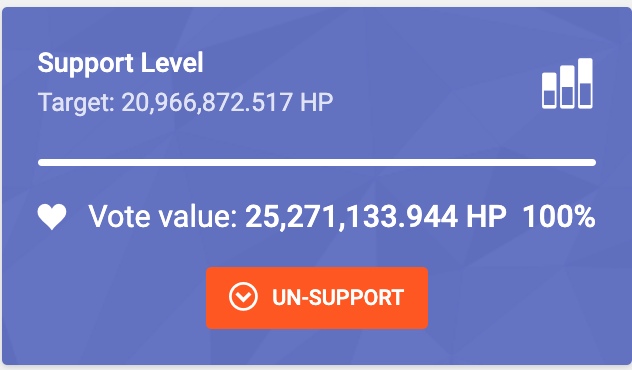

Our DHF Proposal is currently 100% funded which means that it is over the return proposal. This being said, we still want to campaign to keep getting votes to signal support from the community. We have so much in store for the proposal and our aim is to get over 30M HIVE POWER in backing votes. We're at 25.2M currently. The funding begins on September 1st and so do all of our marketing funnels. Vote now to help us grow Hive, together!

- Vote the Proposal on PeakD ▶️ https://peakd.com/me/proposals/269

- Vote the Proposal on Ecency ▶️ https://ecency.com/me/proposals/269

- Vote the Proposal on Hivesigner ▶️ https://hivesigner.com/sign/update-proposal-votes?proposal_ids=%5B269%5D&approve=true

Posted Using LeoFinance Alpha

When did Elon become so ugly? 😂

!LOLZ

lolztoken.com

He kept looking at me kinda sideways.

Credit: reddit

@khaleelkazi, I sent you an $LOLZ on behalf of fantagira

(1/2)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

yay, everyone loves regulations..

This really interesting lol😂