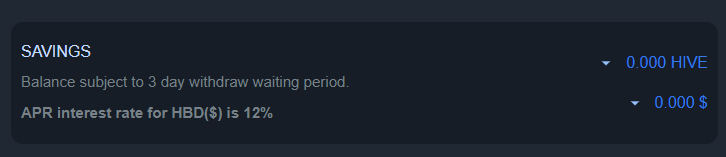

HBD's 12% a year interest rate is a relatively safe way to put your money to work for you

When HBD interest rate went to 10% I already thought it was a game-changer. Now at 12% a year, more than ever, Hive positions itself as a safe, stable, reliable, efficient, and very rewarding DeFi platform.

Our social-network side of this blockchain speaks louder than the financial side, but with an APR of 12% it became impossible to ignore! People that want to save money in USD and want to generate a yield from it need to seriously consider Hive.

Other blockchains have issues, the main one being the transaction fees, but those aside also leave the volatility as an issue! The APR on other DeFi platforms may offer 12% APR one year, but then fall down to 2% APR the next day! It is unpredictable. You can get a predictable APR on centralized platforms, but then you would risk trusting a third party with your money.

On Hive you have the best of both worlds:

- A stable a predictable APR

- Decentralized platform

- A USD coin with theoretically illimited liquidity/backing (by HIVE)

The time has come, when DeFi investors literally can not ignore Hive, at least not if they want to get the best relative profits aligned with decentralization.

I bet some people will say that 12% is not much. Maybe it is not if you are used to the riskier DeFi investments, but I think it's definitely a safe heaven for your money.

Go to your bank and ask them to give you 12% on your stable.. ehem I mean fiat money.

So if you have some risky investments, it's a good idea to back it up with some safe stable coins and earn some solid interests on it.

Be a smart investor!

!PIZZA

!gif smart investment

Via Tenor

12% is insane! Of course, the witnesses can reduce that "at any time" (theoretically) but for a long time we have been seeing the APR growing and giving stable returns to DeFi investors on Hive. Ignoring this blockchain as a DeFi space is missing out on stability, high yield and security. Just the fact that Hive has no fees is a deal to me, because I have some DeFi investments on Ethereum, but they are all locked up behind prohibitive hundred dollars transaction fees, so I can't even touch those investments, they are practically a loss and a money I can't count with, differently from HBD which is liquid in just 3 days for free.

Wow, exactly the same happened to me. I got into DeFi on the ETH chain when gas was cheap. Then gas went crazy and I will not pay half of my liquidity to get my money out. So it's locked up like you said. I bet we are not alone and many small investors are stucked now. Let's hope ETH 2.0 will come soon and solve this problem.

I am afraid that the altcoin pump was because of people locked, and once unlocked people can sell out. I for myself am going all-in on Hive once ETH2.0 comes and reduces gas fees. Because I plan to sell everything on ETH I expect others to do the same and create some downwards pressure. It will be like a banks race to the bottom (I am pessimistic because of my bad experiences due to fees)

Understandable. I'm not sure yet if I will leave ETH completely but I'm will definitely go deeper into Hive. What I've seen so far is amazing and I'm just a newbie here. Joined hive this October.

It's definitely attractive! I wish it didn't do this at a time where I withdrew all my HBD in savings in order to fund my Splinterlands purchases hahaha. I'll hopefully get my HBD back up there! Had 350 at one point. One of the main things with this stuff though, is you earn it but it's important to also spend it when you can otherwise you could miss some opportunities elsewhere!

Let's see how it all shakes out over the coming months!

I withdrew mine from my savings too and I think I bought some HIVE back then. Definitely do not regret. But now it is tempting to do the opposite: sell HIVE to buy HBD and put it into those 12% a year savings

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more