BANK RUN: Silicon Valley Bank + USDC/DAI

THIS IS NOT A DRILL

Banks are not a safe place to store one's money. Everyone outside USA realizes this a little better than our more tame citizens. Bank runs have been going on across the globe in response to the FED raising rates and "fractional reserve banking" practices.

I put "fractional reserve banking" in quotes there because these days a bank can get away with having zero reserves. Used to be they were required to keep at least keep something like 20% liquid, but that number has dwindled ever since COVID began in 2020. Some of these banks are operating on 1% reserves; just enough to cover small withdrawals and to resume normal day to day operations.

The bond market is fucked

A lot of these banks love to throw their reserves into bonds because that's just "free money". Bonds are considered to be a very safe investment. Unfortunately now with the inverted bond curve we can see that many many bond investors are being forced to sell their unmatured bags at a loss, making the yields even more juicy for anyone willing to enter now and provide liquidity to the floundering market. This will not end well. Banks will continue to go insolvent as they are forced to sell their "safe investments" back into liquidity at a loss just like we saw with Silvergate.

At this point in time I'm absolutely floored that people still don't believe we are in the middle of a recession right now this second. We so obviously are... but everyone is waiting for the other shoe to drop and for something massive to collapse before we call it a "real recession". It's a real recession right the hell now... just because it can and will get worse doesn't mean we aren't in a recession today.

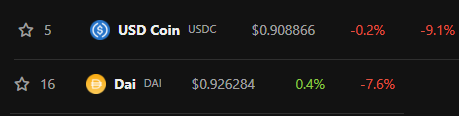

I've had so many conversations back in the day about how USDT FUD is ridiculous and how alternative regulated stable coins are not better. Oh... would you look at that. USDT hasn't broken its peg but both USDC and DAI did. DAI proving how worthless it is, just like I claimed years ago when they allowed USDC to collateralize it and I exited ETH entirely.

The interesting thing here is that it's probably still worth printing DAI and dumping it when it's at the $1 peg because the worst that can happen is that DAI crashes to zero and you owe nothing back on the loan... assuming the protocol will allow you to unlock your stake when you buy back the DAI for pennies on the dollar. I'm not sure why or how that wouldn't be the case but it's something to consider for sure.

Money Funnel:

A lot of people are out there trying to say if USDC crashes to zero then BTC will also crash to local lows. I'm not so sure. Wasn't the entire point of Bitcoin to provide a safe haven for bank collapse? Now we are on the brink of bank collapse and everyone is losing their shit. Cowards: all of them.

If USDC crashes to zero and the crypto sector loses faith in stable coins pegged to dollars in the legacy financial system... where is that money going to go? If users are selling Bitcoin into cash then where is that money going to go? Into a bank? Into another stable coin? Make it make sense. There is no safe place to park your money except within the Bitcoin network at this juncture.

Given this kind of systemic failure there is only one place for the money to go: and that's right back into Bitcoin. We are on the verge of The Great Decoupling with Bitcoin. There's no place to run except right back into granddaddy BTC's arms. Hardware wallet or better recommended.

Significant resilience across the board.

We're monitoring...

Don't play games with the US economy.

GOP is going to risk a financial default over their demands.

(Quite unreasonable demands)

Nobody is going to be holding the US financial system hostage by saying if they don't get their way they're going to default the US government and have an unprecedented financial catastrophe.

lol?

Sounds like a prophecy more than a consolation.

Gotta love hove CNBC leverages a bank run into left-right partisan politics; blaming republicans for the failures of the current administration. Love it. Not that I have any respect for republicans but I've got to call it like I see it. To be fair CNBC is not wrong, and GOP main brand is to simply obstruct democrats without the ability to actually get anything done within the party. But is now really the time to bring this up?

The FED is going to keep increasing rates, and the chance of this bank-run contagion spreading is going to increase exponentially. I've been talking about this exact moment for multiple years now. Bail-ins are firmly on the table. Banks are going to steal client funds and call it "an investment". I guarantee it. It's only a matter of time... and given these red flags time is short.

This is not a bullish or a bearish situation.

This is a lose/lose situation no matter how one slices it on the short term. Even if I knew BTC was going to collapse to $10k I wouldn't sell any or short it because selling it or shorting it runs the risk of losing everything. Where would I store that value? On an exchange? In a bank? lol pass. No thanks.

HBD

Once again the Hive network comes out of all of this smelling like roses. HBD doesn't even have any exchange listings right now... which has always been a huge detriment but puts us in a really good position right now. We are largely disconnected from all of this, and HBD will maintain the $1 peg all the way down to a 7 cent Hive price or less. Truly, HBD might be one of the safest and best deals within the entire cryptoverse and hardly anyone knows about it. Mindblowing.

Conclusion

Usually when the legacy system experiences systemic issues Bitcoin will enter the bear market along with everything else. Risk-on assets are risk on. However, we have yet to see what happens when the banks themselves are the problem and capital is running away from them as fast as possible. This is the entire reason Bitcoin was created in the first place... just look at the genesis block. Bitcoin was always meant to be the long-term risk-off solution

There is only a very small chance that a contagion like this can be contained. This is especially true with Powell continuing his hawkish crusade against "inflation". As rates continue to rise and faith in the banking sector diminishes, it's almost guaranteed that there will be some kind of chain-reaction domino-effect. All we can do in hunker down on crypto assets and weather the storm. There is no safe place to hide in a scenario like this, especially in the short term. But we do know that crypto is the long term solution. Stay the course. Keep stacking.

Posted Using LeoFinance Beta

This is just the beginning. If Bitcoin fails the only thing left will be gold and silver.

Nah. There's guns and ammo, industrial tools and supplies, rice... The list of durable goods that will retain value regardless of what happens in financial markets is endless.

land

https://www.century21global.com/property/urbanizacion-monte-cristo-casa-nro-7-caracas-miranda-1071-venezuela-C21125794002-USD

Just sayin'

what the fuck

once 130€ for whole house with garden in city?

In Venezuela.

Not accurate tho. That house must be in a state of abandonment or something like that.

But there are houses about 1k-5k

Hmm so powering down all my earned stake I can buy a house in a failed state in a civil war area?

I meant you can find houses in a good state around 1k-5k usd. There are ppl leaving the country and they usually sell their houses at those prices

I cannot strongly enough recommend due diligence regarding title potential to foreign persons in Venezuela, and particulars regarding such properties priced at these levels specifically. My spidey sense is all atingle.

Something's not right.

If you search for real property in Venezuela on the Century21.com site, you will find more than a dozen examples of homes offered for sale at prices below $1000 USD. While I have not further researched the title availed, and it seems certain to me that some fraud or other reason for pricing real property so low is involved, that's what is claimed by Century21.com.

hmm - Id prefer something away from cities in maybe georgia or albania..

We all have our preferences. Back when I was a kid, I read about the tepuis, I think they're called. Buttes that rise up hundreds of meters out of the jungle with sheer walls that have kept people off them for millenia. At the top there are ecosystems unknown to man, and that is largely true to this day, even though we have helicopters.

One of my dreams was to study the unique ecosystems on these lost worlds. I was always thrilled by jungles, the hot, steamy verdant, bustling masses of creatures, and places like Venezuela, Brazil, Indonesia, New Guinea, Borneo, and basically all of SE Asia, Central Africa, and S. America were on my dream list of places to explore and study life. I was raised in Alaska, on islands freshly exposed from the retreat of the glaciers, and while verdant and temperate, a wide variety of species just hadn't had time to find their way there.

Then I grew up and went to Texas. I discovered Palmetto Bugs, and Red Ants. I went to Houston, a massive city built on a swamp. At night it was ~45 degrees and 130% humidity. The air was overstuffed with water vapor, and I was the coolest thing in the environment at 37 degrees. Instead of being cooled by my sweat, water actually condensed out of the air onto my overheated body. It was life threatening, and I was from Alaska. Then I didn't ever want to go to a jungle for any reason.

I still look and remember my childhood dream.

that probably also plays into why I'd prefer Georgia/ maybe Armenia/ Albania over South-America/ Venezuela

also besides South America's climate, economics (georgia, armenia are no socialistic shitholes like south america), just the long way..

it is the "other side of the earth" to me - to georgia or albania I could theoretically ride with my oldtimer motorbike (If I ever get it back, same with my driving license - and my pain allows me to)

you could still study these ecosystems ! wouldnt be the best idea to live in them (untouched ecosystems) anyways :P

but yeah I see you - I'm also more of a cold boy, a viking..

would also tend north normally - but one of my companions wont allow that (he can't manage the cold anymore - even though cold is healing)

have you heard of the big caves in china with giant mammoth trees underground?

I read as a child the lurid pulp fantasies of Edgar Rice Burroughs, and similar authors that conjured vivid hallucinations of cavernous worlds subterranean. Mere reality cannot compete LOL.

The ability of living things to habituate to environments on Earth is astounding. Microbial species live kilometers deep in suboceanic rock, feeding on the sparse resources that percolate therein. While microbes in active ecosystems can reproduce every ~20 minutes, deep in the lithosphere they can only reproduce once in a century.

Archaia is yet remnant in such places.

Sure, but how can Bitcoin "fail"?

What is the definition of "failure" in this case?

Even crashing to $1000 a token is not failure.

Failure only occurs if mining and hashrate lead to double-spending.

The systemic risks of Bitcoin are totally separate from the banking sector.

The chance that they both fail at the same time is practically zero.

$1,000 Bitcoin would be a failure. I didn’t say they’d happen at the same time. But if bigger banks fail and people need money they might sell off Bitcoin to get some crashing the market by flooding it.

I suffered a 99% loss from peak on Steem starting in 2017.

That was not a failure.

This community is stronger than ever.

Your declaration of "failure" is clearly wrong.

If $1000 BTC is a failure, then is $2000?

What about $3000? $4000?

Please tell me which number is failure and what number is not.

Draw the line for me; I'll wait right here.

Good luck with that.

Spot price of Bitcoin going down is only a "failure" for distressed sellers.

It's the ultimate buying opportunity for people with balanced positions.

Distressed selling is the ultimate expression of individual greed on a collective level.

The solution is to just stop being greedy.

Easier said than done.

Anyone who can't hold for 1 or 2 years of bear market is doing it wrong.

I agree that people selling are the ones making it fail. If it gets down to single digits meaning anything under 10K I’m gonna buy as hard as I can. But that will still be considered a failure by the markets. My opinion means nothing to it being labeled a failure or not I’m nobody in the large scheme of things. I’ll buy all day if it drops hard like that.

Fair enough

Ur not a true crypto Degen unless u held a 99% loss down into an eventual profit ;)

It is known

2017, good times. That was the first time BTC reached 20k right? I started on Steem after the peak on December. All the cryptos went to shit most of 2018 XD)

How does btc fail?

When the hashrate declines to zero.

And quietly hive and hbd gain strength and liquidity. When government’s start to notice hive and hbd it will be far too late.

It will be doing too much good in too many countries already. Borehole anyone?

I’m wondering how many people on hive are inspired by the borehole project and will start similar projects. I think we’ll see an explosion like you can only have in a decentralized system 😁

I mean, isn't it exactly the time to bring up GOP obstruction? The Debt Ceiling Increase has already been obstructed... and so now Yellen is using all her accounting tricks to give the US a couple of more months, but the US Government has already spent that money, they've got until June to pay up and if the Debt Ceiling isn't increased by then - global chaos.

How is this relevant to the SVB insolvency?

These are two totally disconnected events and bringing them up together like they are one and the same shows an obvious bias and agenda that can't be trusted by definition. The debt ceiling exists for a reason, does it not? Will we kick the can down the road like we always do? Probably.

It's related because the SVB insolvency is a good example (but obviously much smaller scale) of what might happen to every industry that the US Federal Government owes money to. SVB really just affects tech companies and related industries, the US Federal Government has invoices outstanding is almost every industry.

"See what's happening here... multiply this by a thousand in 4 months", etc.

Of course the debt ceiling exists for a reason - but if you want the budget to come in under the ceiling then you have to reject the bills going through the senate. Obstructing the debt ceiling is essentially just refusing to pay your credit card bill after you've already used all the stuff you bought.

I do agree though, I don't think the GOP obstructionists will hold firm, they'll cave when their donors get upset.

We go through the same stupid bullshit dance every single time the debt ceiling gets hit.

Politicians are leveraging their power to try to get what they want.

This is business as usual.

The result will be the same as it's always been, and there's no reason to pretend otherwise.

All part of the great big festering neon distraction that is politics.

I hope so, and I think you're probably 70% right, but this particular time there are more people involved who actually do want to end the Fed because they'll profit from that chaos.

😬 yikes

https://twitter.com/863912546/status/1634632171406204928

https://twitter.com/27706436/status/1634686623785930754

The rewards earned on this comment will go directly to the people( @celi130, @seckorama ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Reading into SVB bank its ironic how they were taken over. They were buying long term treasury bonds with depositors' cash and holding losses as yields soared. When too many customers wanted withdraw SVB did not have enough available cash. To think SVB was using customers' cash to be invested in venture capital and that the bank was taking aggressive risks is not true. Such a bank failure is much worse because the bank was investing if likely one of the lease riskiest investments in the world, US long term treasuries. I have a bad feeling many banks are in the same position and if too many customers pull out the whole system maybe be in for a shock. I won't be surprise if Central Banks act in the coming days !LOL !PIZZA

This is a very astute assessment.

lolztoken.com

It’s all fun and games until someone loses an I.

Credit: reddit

@edicted, I sent you an $LOLZ on behalf of @mawit07

(1/8)

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(1/5) tipped @edicted (x1)

Join us in Discord!

https://leofinance.io/threads/@celi130/re-leothreads-kmrm8sia

The rewards earned on this comment will go directly to the people ( celi130 ) sharing the post on LeoThreads,LikeTu,dBuzz.

I can see your point about the stability of USDT compared to alternative regulated stable coins like USDC and DAI. It's interesting to consider the potential outcomes if a stable coin were to crash to zero and the impact it would have on the crypto sector. It's true that Bitcoin was originally created as a safe haven for bank collapse, and it may still serve that purpose in the face of a systemic failure. It's possible that in such a scenario, investors would turn to Bitcoin as a more secure option for their money.

I always found the USDT FUD as something to laugh at. USDT is one of the cockroaches of the crypto space. The only way for USDT to die is for the feds to come in and shut it down. Otherwise, it survives whatever you throw at it.

Thank you for holding virtualgrowth token. You have been included in today's post.

Posted Using LeoFinance Beta

The timing is very #sus, they knew their f+cked and chose to pin a point of failure of their liking. Let them rott in the sun until a more reasonable entity takes them over.

As I see it, they broke the news on a Friday. They have no clear impact that caused it. They knew it is coming and the now-left corpse is already deprived of all nutrients. It's a warehouse in California that only stores technology and since they know that their not able to pay the next rent, employees, and management have ransacked it over some time and then declared complete failure on a convenient afternoon. Sure the GOP will not refinance that and sure they will find a way to blame Trump and Hitler.

I don't know anything about anything, but interesting article non the less. I don't know about money, cause I don't have any, but I got so much air, does anyone want to buy? I'm laughing all the way to the ... bank?

Lol, air. Worthless. I pity the fool who can't breathe money.

I was patiently waiting for the HBD shout out. It is probably the best kept secret these days and frankly speaking, I'm not even sure I want the World to hear about it.

We keep it "healthy" in our private little corner on Hive, away from the corrupt meddling of the wider society. I suspect this is the reason why it has been so stable and unblemished, for the most part.

Posted Using LeoFinance Beta

I think that one of the major casualties of this USDC/SVB debacle is going to be Ethereum. And, consequently, all Ethereum-based tokens. They might not all perish, but most are likely to take a heavy beating in days and weeks to come.

Posted Using LeoFinance Beta

I saw a fascinating interview with a former Fed economist Chris Whalen who said the Fed's interest rate rises are the prime reason for the collapse of Silicon Valley Bank. Banks across the US bought large quantities of US treasuries and mortgage backed securities back when interest rates were at zero and they received a tiny amount of interest in return from those bonds. Now that the Fed has increased rates to over 4% the value of those bonds has gone down significantly. So many banks are sitting on large unrealized losses from the bonds they bought back when rates/yields were low.

Whalen emphasized that the Fed needs to cut rates next week to prevent a contagion spreading throughput the US banking system. The Fed faces a real dilemma: keep increasing rates to 'fight inflation' and face the prospect of more bank collapses or cut rates in a high inflation environment to save the banks.

Either way, keeping all of your money in the bank is fraught with dangers.

Your article says nothing about gold and silver as safe havens in this situation. More and more central banks are buying gold with Russia moving in the direction of a gold backed currency for trade settlements. What is your view of gold and silver in this situation?