Breaking Down The Simple Formula Supporting Bitcoin's Future Growth

Bitcoin's Sound Money Principle Is Supported By Another Sound Principle

Bitcoin's Sound Money Principle Is Supported By Another Sound Principle

Back in 2017, we saw many people move into the Crypto space that had never traded a conventional stock or share before. The bull run of 2017 was largely driven by the retail market and even worse, a retail market that had close to zero investing or trading experience whatsoever. Even now, there are many people hodling BTC that have no understanding of moving averages, chart patterns and other market indicators. For many, this is fine as they understand the sound money principles of Bitcoin and plan to hodl their BTC into the future.

The sound money principles of Bitcoin evolve largely around the halving, mining adjustments and block times. People who understand these dynamics, or even trust others who do understand them are happy to hodl their BTC into the future. Hard money is very appealing in our current global economic climate and that is very unlikely to change anytime soon. Many people believe that the value of Bitcoin simply comes down to how much the next person is willing to pay for it. Some BTC hodlers are probably also subscribers to this narrative without even realizing it. Many reason that because the demand for Bitcoin is high, the price will increase. This is very true to a point but what really provides fuel to this narrative is the limited supply, which cannot be changed.

This is all very well and true, as well as imperative for the Bitcoin price to appreciate over time. A growing demand, or even constant demand that is met by a shrinking supply will ultimately push the price higher. People that don't understand this dynamic are unable to see how an asset that is already at $40K can actually appreciate further. Even by removing this fundamental principle that drives the price of Bitcoin higher, there is another principle that not only indicates how BTC can move higher but how it can actually move significantly higher.

Think Of A Balloon

As I draw your attention to a balloon, you may be reasoning that I am about to discuss bubbles and bubble territory. Well, not really, I am looking at the idea of adjustment and space. Currently BTC has a market cap of approximately $700 billion with an average trading price of 38K. A movement in price will subsequently bring a movement in market cap. You may of heard it said in the past, that new money was required to move into the Bitcoin space in order to see a significant rise in the value. This is true because market cap and price are connected at the hip. They move in tandem, just as a balloon adjusts with the amount of air that it receives.

Money moving into BTC can be compared to air being injected into a balloon. In the same way, the balloon is similar to the market cap, as it adjusts to receive the new air. This is the most significant case for BTC increasing in value in years to come.

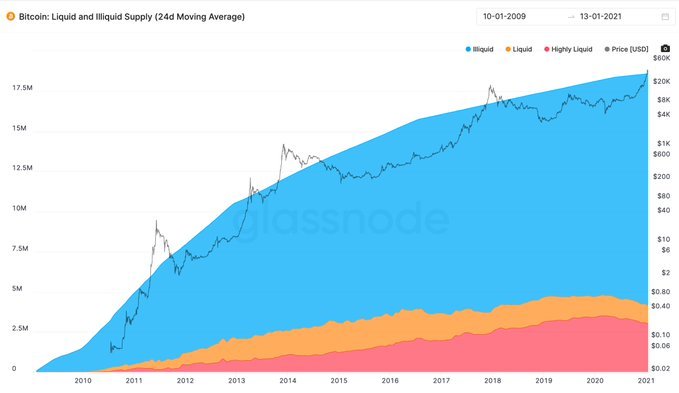

The comparison has been made to gold, as well as a store of value and hedge against inflation. As institutions climb on board, they encourage the broader market. If gold alone is a $10 Trillion market, how much capital will begin to flow into BTC once RA's, potential ETF's and other corporations and investment firms begin to see the case for Bitcoin? One of the most scariest or bullish cases is that there is only 4.1 million BTC of the current supply that are liquid.

This places an even stronger case for the scarcity of Bitcoin, both currently and into the future. This means that currently there is only 20% of all BTC that can ever be produced actively being traded. This number will decrease in time and most likely with a very significant initial spike.

The events of 2020 legitimized Bitcoin in a way that cannot just be undone or ignored. The argument for BTC becoming a multi trillion dollar market is actually rather modest in light of the potential capital that is on its way to Bitcoin. The market cap has to adjust in order to meet and receive this capital. It goes without saying, BTC has greater days just over the horizon.

Posted Using LeoFinance Beta

!WINE

Cheers, @zelensky You Successfully Shared 0.100 WINE With @sapphirecrypto.

You Earned 0.100 WINE As Curation Reward.

You Utilized 3/3 Successful Calls.

WINE Current Market Price : 1.000 HIVE