Learn Not To Ascribe Too Much Meaning To Short-Term Price Action In Crypto - Focus On Fundamentals Instead

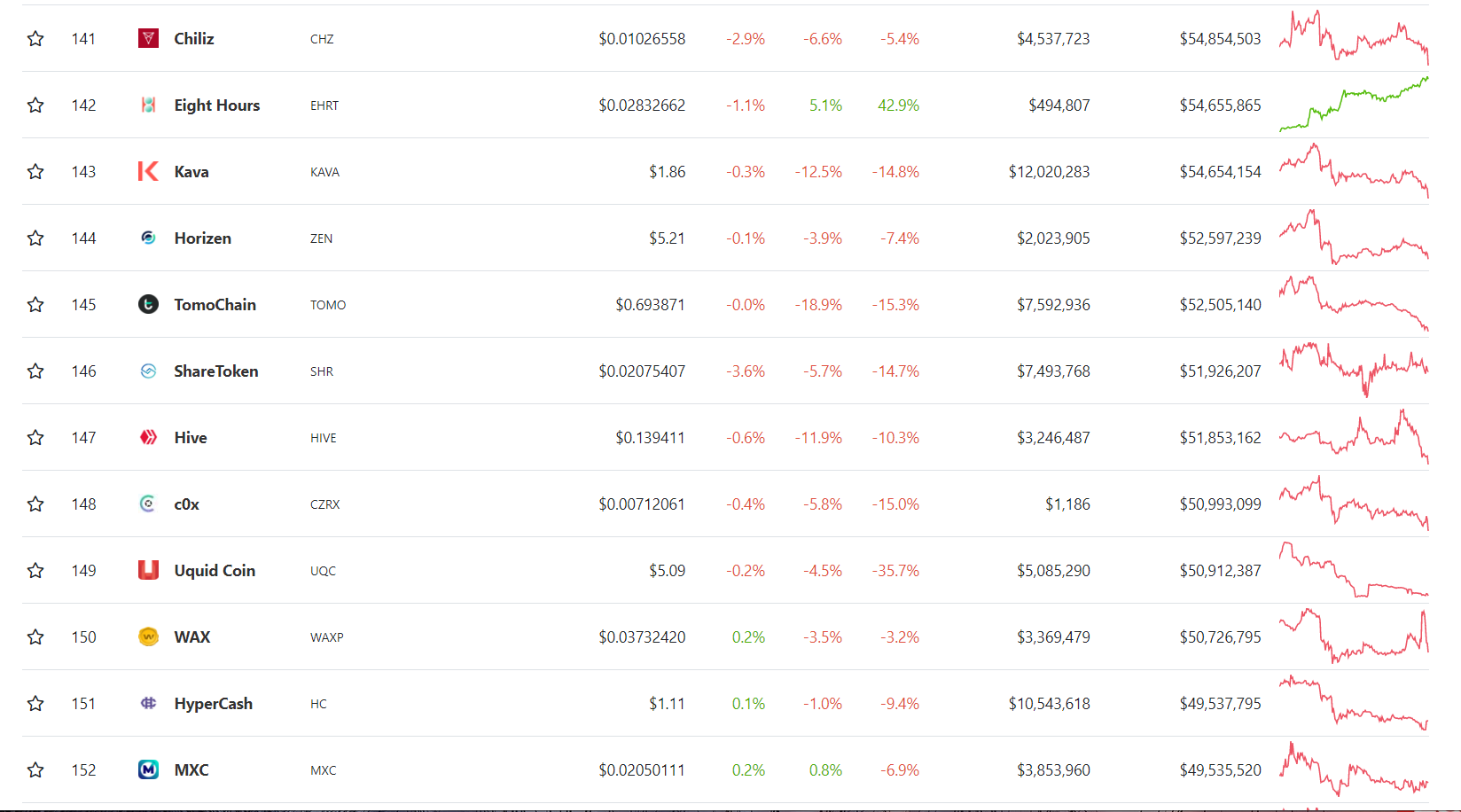

Hive has gone under 14 cents. I've seen people start asking questions and frantically putting forward hypotheses that this or that must be causing the dip. All that is very bad for your state control. You have to accept that on markets as speculative as crypto, you cannot possibly predict every short-term price action. It seems that there is a market-wide correction in altcoins. There's blood everywhere. DeFi protocols are bleeding. The UniSwap governance token (UNI) is down by 11.8% in the last 24 hours. SushiSwap (SUSHI) is crashing even harder. The largest cap coins are holding the steadiest right now as you can expect. But they'll also pump the least, relatively speaking, when they pump.

Relax. It's not good for your mental state to react too strongly to market events like this. Crypto is a long game where you try and find the most advantageous entry point and identify the top. You'll do best if you follow macro trends if you trade at all. The short-term fluctuations will only mess with your head if you allow them to.

If this correction lasts much longer, look forward to HIVE at 10 cents. That was the bottom last April before the violent pump to 90+ cents from which HIVE has been correcting the whole time. I have no idea whether it will go that far down or if it will go even further down but anyone can read the charts and see for themselves where HIVE bottomed out last spring. 10 cents was incidentally also where STEEM bottomed out last December.

I believe it's best to set sights on the distant future (> 5 years from now). What matters for Hive is what is being built. I'm particularly impressed by two projects: 3speak and LeoFinance. What I like about LeoFinance is that it's run by people who grok the economic side of things and who are getting stuff done. 3speak is working on a decentralized media storage system complete with the ability to offer any content creator their own instance of 3speak.online and to create a token for themselves. The plan is to build a robust infrastructure for a non-canceling online publishing culture with the tokenomics to enable every interested party including the audience to seamlessly participate in it.

Some serious shit is being worked on by a bunch of fanatically obsessed people with bags bursting with money. :) Do not lose your shit over some insignificant short-term market movements.

Posted Using LeoFinance Beta

oh well, could use this opportunity to get to 3k hivepower. if bitcoin could follow the trend, i don't mind. something like 6k happens and i will definitely buy some and wait for another 12k...the cycle continues

I agree. Although I do think that a deep correction that sent Bitcoin languishing around 5k to 7k for any length of time would make me suspicious of the validity of the stock-to-flow model.

Posted Using LeoFinance Beta

Great post and agree completely. The short term price fluctuations really mean little. We need to understand that, on Hive, development is the most important.

We are seeing some serious stuff being built which is going to pay dividends down the road. The projects you mentioned hit it on the head. We also can throw in some of the games which are very interesting.

Over the next couple years, the pricing we are seeing will be nothing compared to what takes place.

Posted Using LeoFinance Beta

I consider it likely that there will be a post-halvening bubble in Bitcoin and the rest of the space.

What interests me at this point is identifying the next successful projects on Hive. The folks on Mancave have been making noise. I haven't had time to look into that. Are there other projects that have taken the code developed by your wrapped LEO developer and begun to work on tapping into the liquidity on UniSwap for their project?

Posted Using LeoFinance Beta

If it means anything it's a good buying opportunity and cost averaging.

I suppose this would also apply to Leo, if you think in the long term it would only be necessary to stack more tokens, thanks for the article I never saw words on speculation topics

Posted Using LeoFinance Beta

In theory, it's true but not in the real world. Look what happened with steem.

The same can happen to hive.

I was focused long term and hold 100K coins through $8 steem to sell later at 15 cents. Was smarter and focused short term and sold hive at $1 though.

Posted Using LeoFinance Beta

Not in my theory.

In every PoS or DPoS coin those who hold the staked coins control the inflation and those who hold the liquid coins control the price. On HIVE and STEEM, the price volatility dwarfs the inflation by a huge factor, which is why it is completely useless to squabble over whether the inflation rate should be 8, 6, 4 or 2 percent. Notice that the vesting fund (the total number of staked coins) in HIVE is only about 170 million out of a total supply of about 360 million.

I'm well aware of all of STEEM's price history as well as that of HIVE's after the its inception.

I believe it is likely.

Whether or not that was a smart action depends on whether there was any reason to expect the gigantic pump in the late stages of the general crypto bubble top of late 2017/early 2018. If the past history of altcoins never suggested such a thing, your blaming yourself for not cashing out then because you had everything powered up is pure 20/20 hindsight and nothing but counterproductive. On the other hand, if you could've found out that altcoins mooned during the 2013/2014 top, then your not selling was a result of your lack of research.

Did you buy back at a much lower price to grow your stake or did you just spend the money? I think $8 to $12 per coin is entirely possible if Bitcoin goes to six figures per coin at the next bull market top. Even a long-term floor at a level higher than $1 is possible if the Web 3.0 paradigm becomes dominant and Web 2.0 comes crashing down in the future.

Good points.

Hive to satoshi interests me a lot more than Hive to USD. Right now in terms of sat it is ATL at 10 cents it would be under 1000 sat making it a serious bargain. May have to pull out me old hard wallet and make a move soon.

HIVE to satoshi is a lot more stable measure than HIVE to USD but that too is quite volatile. If the past bull market top is any guide, HIVE should be a late popper.