LeoFinance Stats | April 2020

Welcome to the monthly edition of LeoFinance stats. This is a monthly report for April 2020.

After the Hardfork on the Steem blockchain creating Hive, ergo rebranding from Steemleo to LeoFinance. The posting activity moved to Hive quickly after that, but some more time was needed for the tokens to be moved as well, since they depend on the engine platform. In April this happened as well and LeoFinance is now completely operating on the Hive blockchain.

If you want to know a bit more about the LeoFinance platform and dig into the numbers, this is the place to be.

The following topics will be covered:

- Issued LEO Tokens

- Top LEO Earners

- Rewards to SP delegators trough the leo.bounties program

- Daily stats on tokens staking

- Share of tokens staked

- Top Users that staked

- Number of Steemleo users

- Posts and comments activities on the platform

- Posting from Steemleo.com inteface

- Price Chart

Note that this was a transitional month for the LEO token, and there is a possibility some of the numbers to not be totally correct.

Issued LEO Tokens

Let’s take a look into token distribution, inflation and how it is distributed.

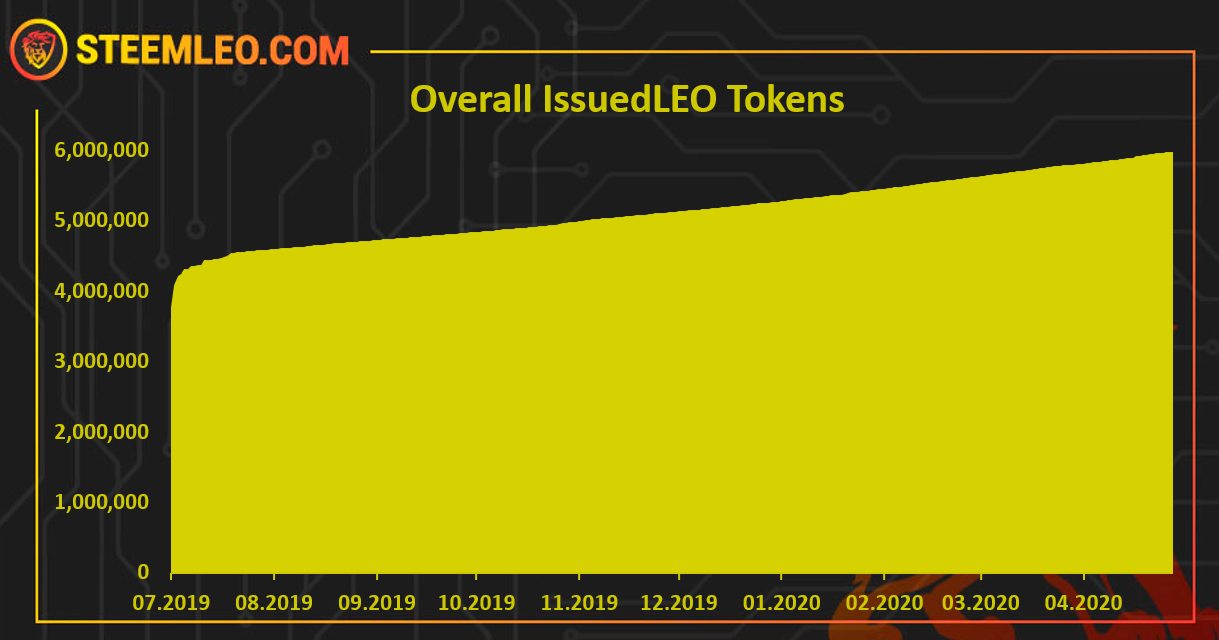

Below is a chart that represents the cumulative issued LEO token.

A total of 5.98 M issued LEO tokens.

We can notice that the LEO token doesn’t have a large inflation compared the base supply and its slowly increasing its supply. Note that burnings are not taken into consideration in this chart. That will be presented below.

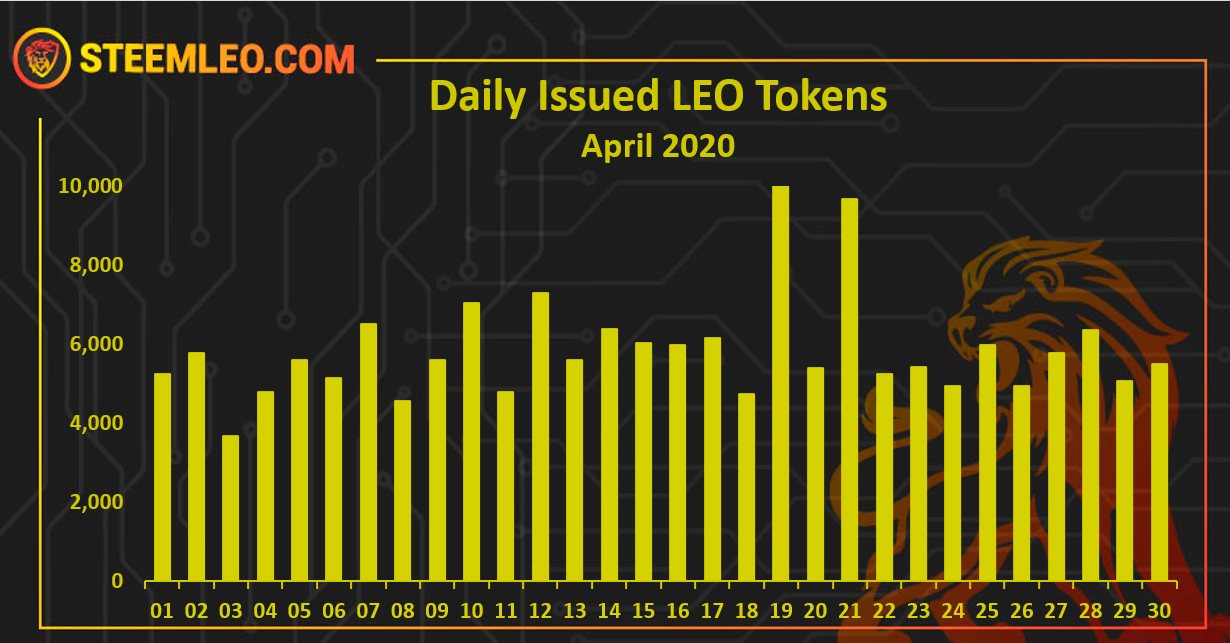

Next the issued LEO tokens from last month. Here is the chart.

On average 6k LEO tokens were issue daily in the last month with a total of 185k tokens issued.

Let’s see how these tokens were distributed.

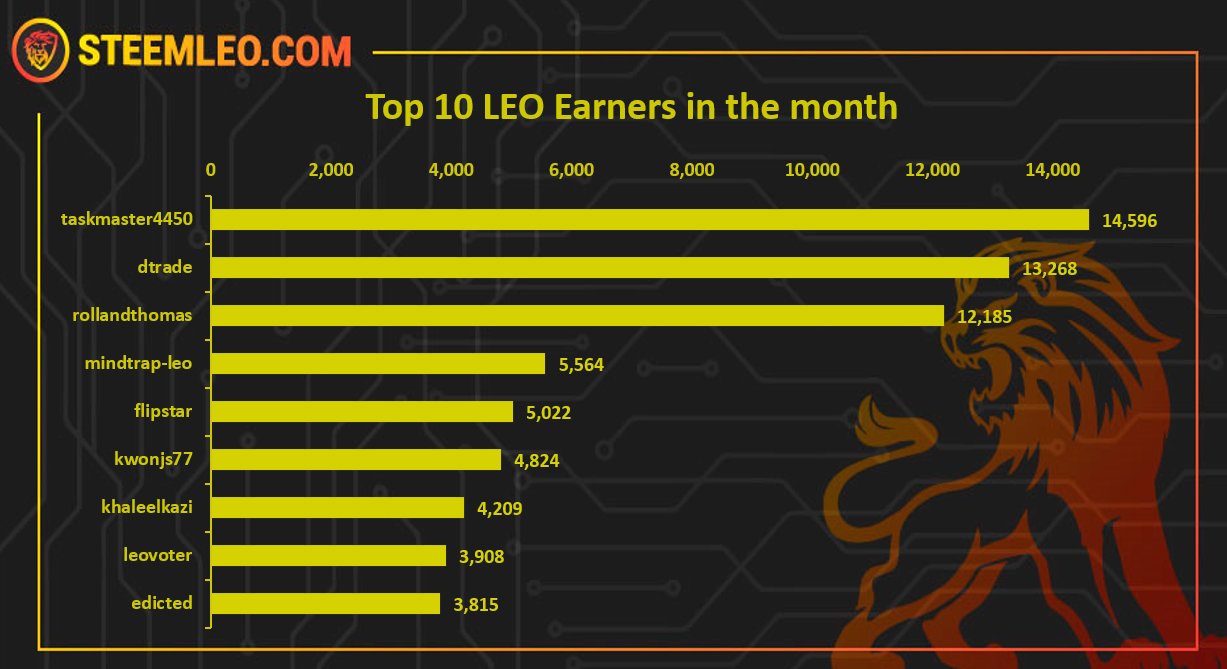

Below is the chart of the top 10 LEO earners in the month.

@taskmaster4450 is on the first place followed by @dtrade and @rollandthomas on the third place.

Note: The @leo.bounties account is excluded from the list above. Bellow, is a separated data on the tokens transferred from @leo.bounties to the delegators. A total of 21000 LEO tokens were issued to the @leo.bounties account in the last month.

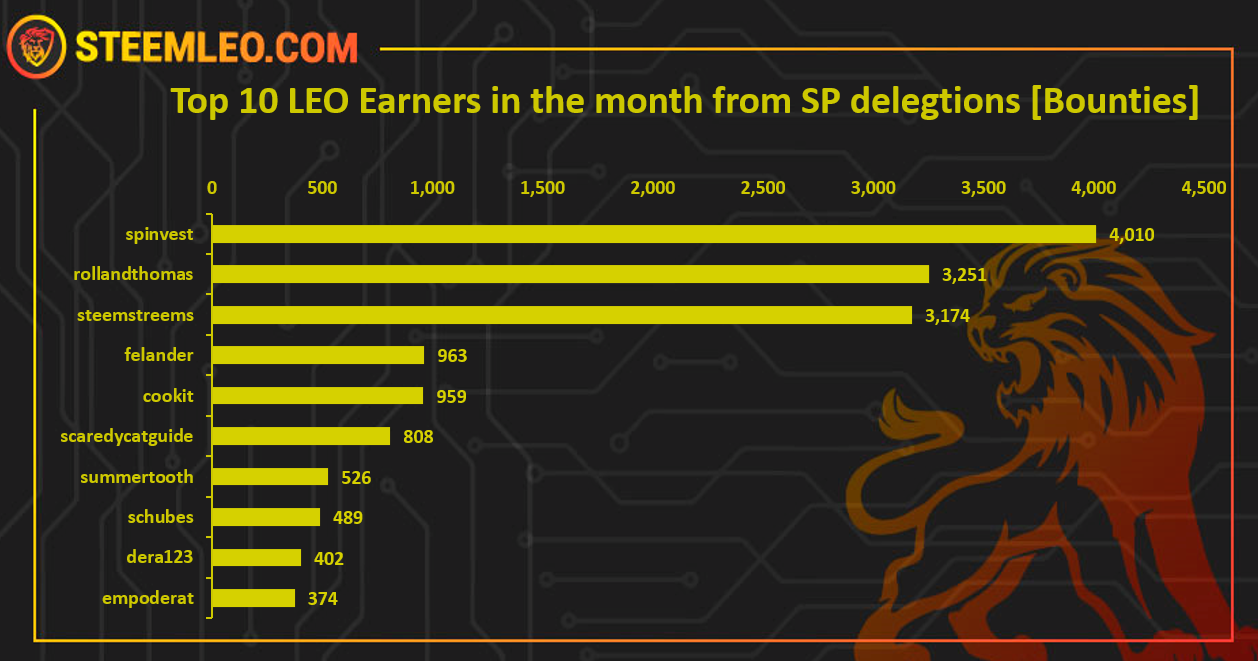

Reward to SP delegators [Bounties]

The LEO platform has a reward mechanism for SP delegators to the @leo.voter account. Users who delegate their SP to the @leo.voter receive daily LEO tokens. The amount of LEO tokens depends on the LEO price.

Having more SP to the @leo.voter account provides incentive to users to use the platform and grow the userbase.

The account @spinvest is on the top of the list, next is @rollandthomas followed by @steemstreems.

Staking LEO

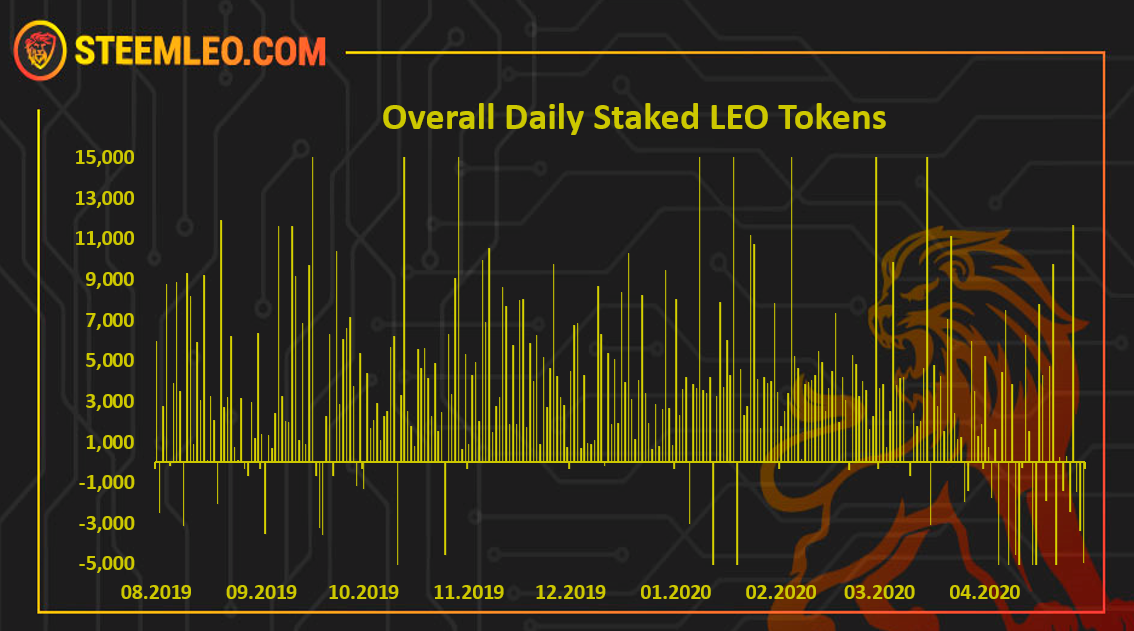

Below is a chart that represents the daily movement of staking/unstaking of the LEO token.

July 2019 is excluded from the chart for better visibility. Those are the first days and there are a lot of tokens staked.

Let’s take a closer look to the last month.

The chart for the last month looks like this.

The leo staking stats were great in the previous period, but because of the HardFork a lot of users were exiting all the SE tokens in general and were trying to get more STEEM to be eligible for the HIVE airdrop. This caused more unstaking to appear. A period of volatility.

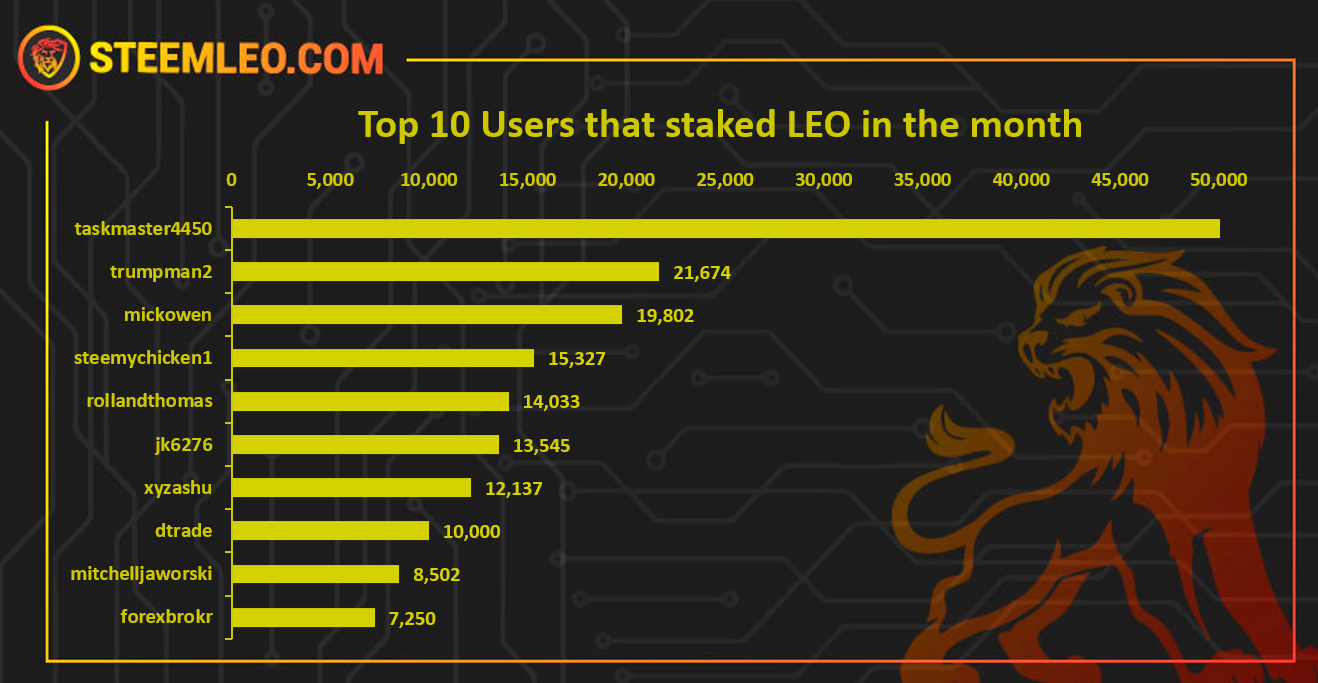

Below is the chart of the top 10 users that staked last month.

@taskmaster4450 on the top with a massive 55k LEO staked, followed by @trumpman with 21k and @rollandthomas.

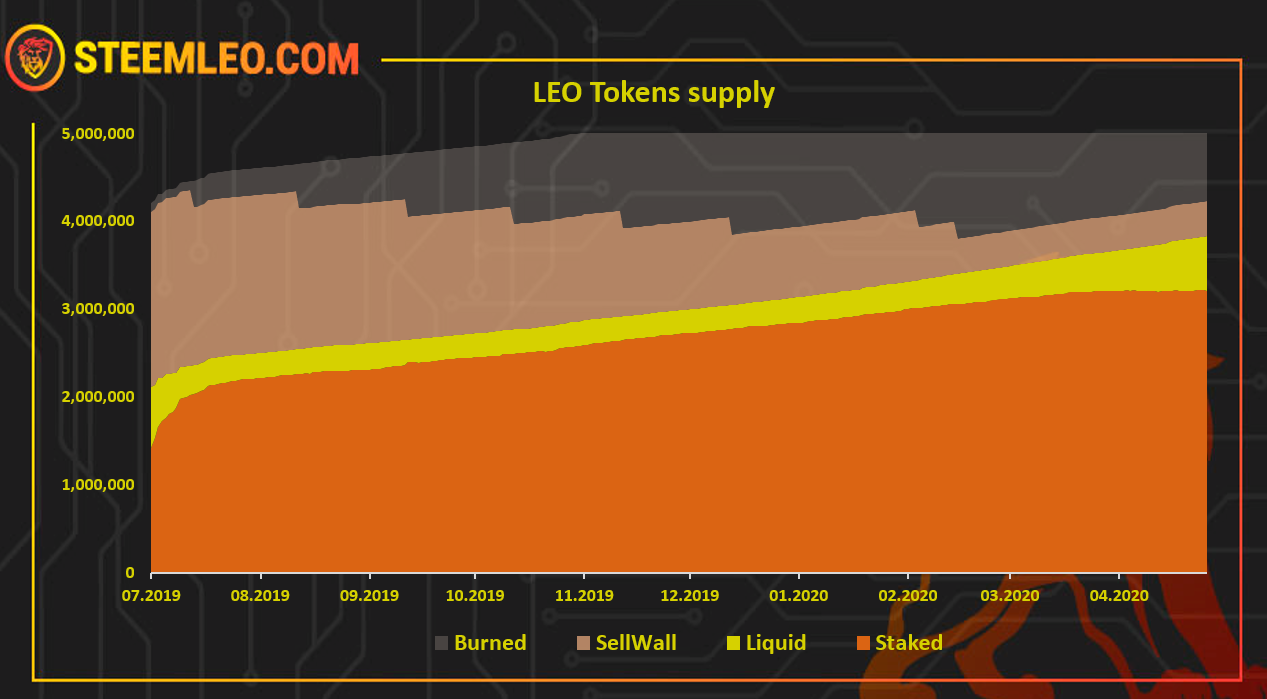

Here is the overall chart on LEO tokens supply.

We can see that in the last period the liquid supply (in yellow) has increased.

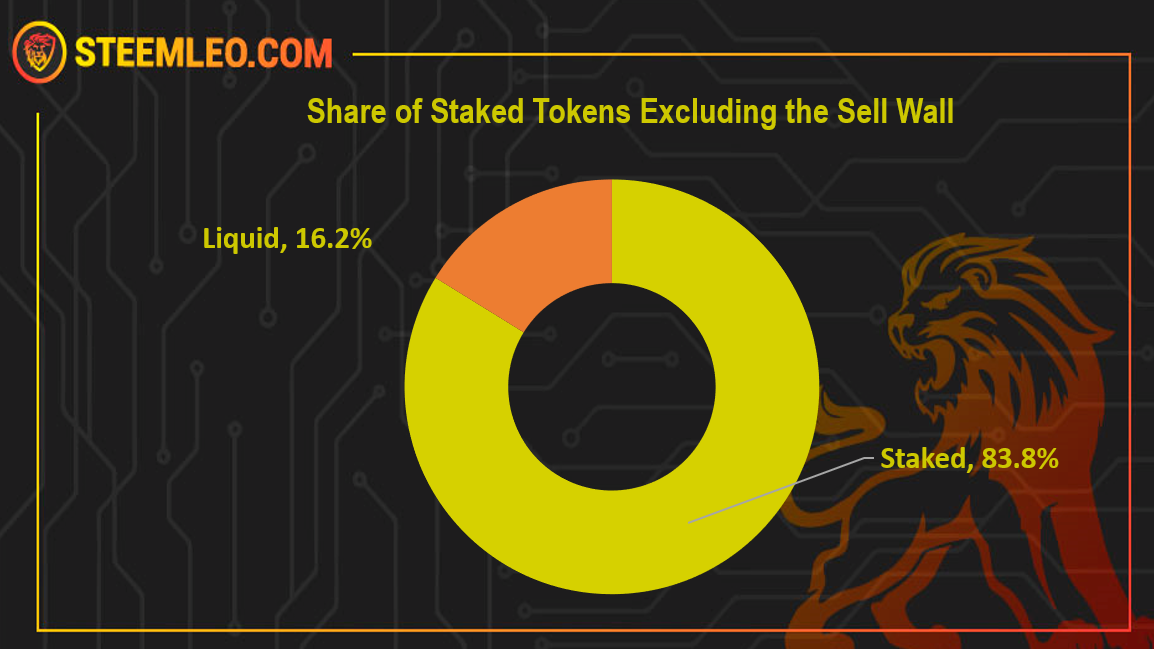

Below is a chart of the ratio staked/unstaked tokens, excluding the tokens reserved for burning (sell wall), at the moment with around 0.4 M tokens.

The share of the staked LEO is around 84%, and with the recent events it has dropped from the 88% in the previous month.

Out of the current supply 4.2 M tokens, 3.2 M are staked, 0.4 M are set to burn and 0,62 M are liquid.

LeoFinance Users

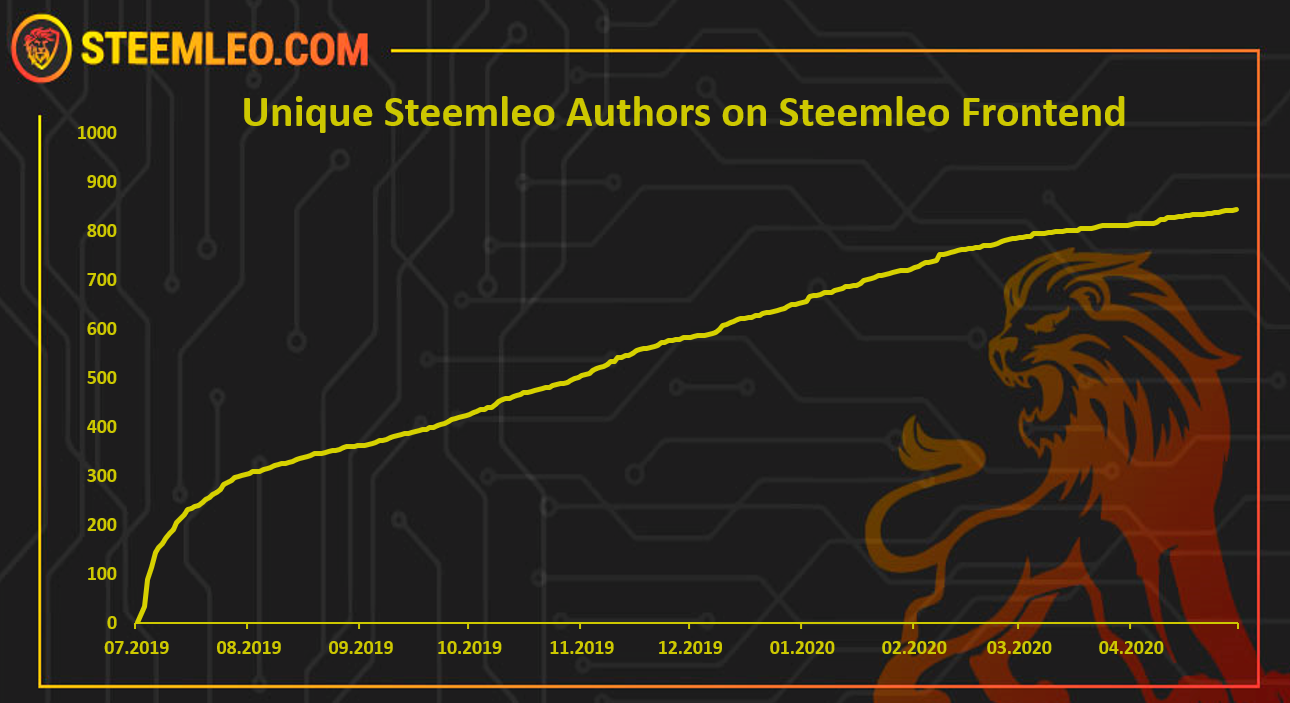

Below is a chart with the number of unique users that posted on LeoFinance frontend.

A total of 844 unique user have posted from the Steemleo frontend.

In the last month there is slight increase in the number of new users.

Activities on Steemleo

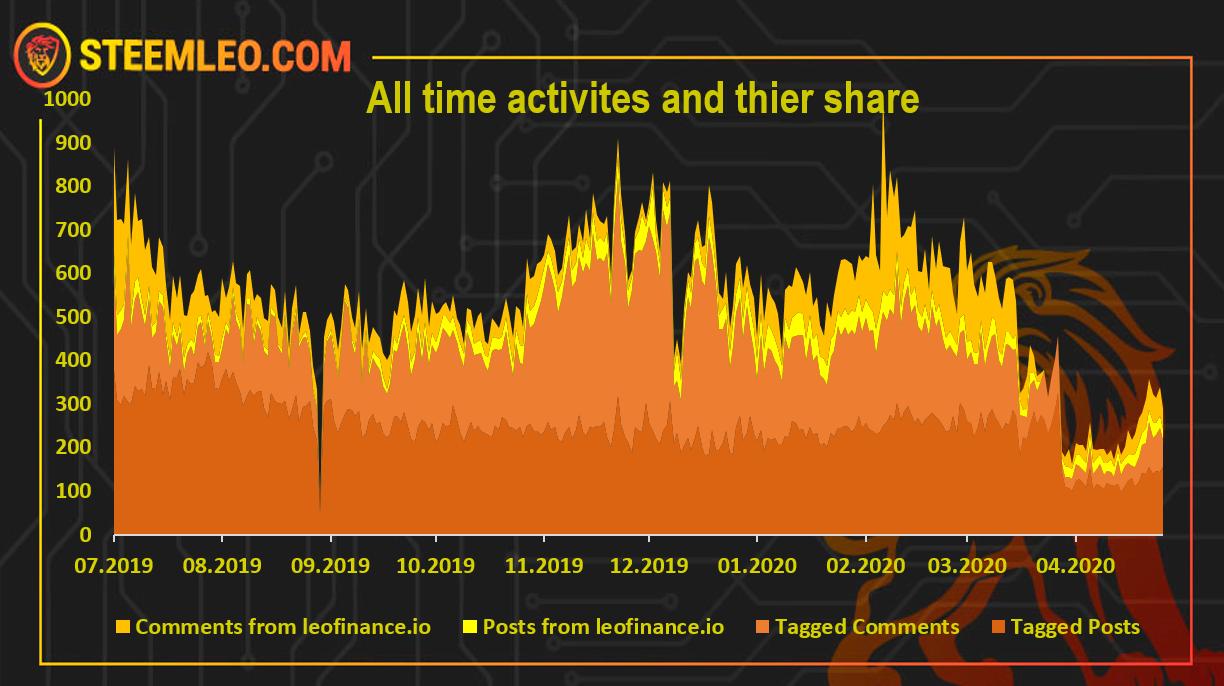

Below is a chart of the LeoFinance activities, including posting and commenting from the Steemleo interface and posting and commenting with the leofinance tag.

Beocuse of the HardFork the frontend was down for a certain period of time and we can notice that there is drop in the activities, but they are already peacking up and at the end of the month are going strong.

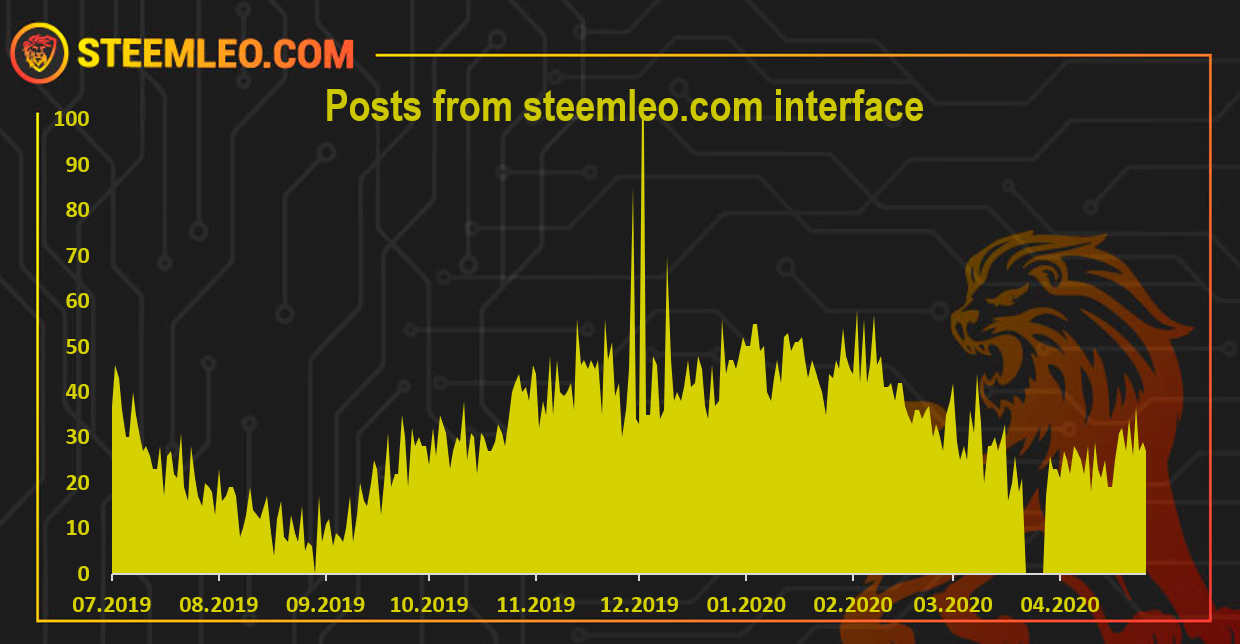

Here is the chart only for posts from leofinance.io interface.

The stated above can be noticed on this chart as well.

Price

All time LEO price

It is interesting to look at the LEO token price, having in mind the crazy ride that HIVE had in the previous month.

Here is the price chart in dollar value with proper daily candles.

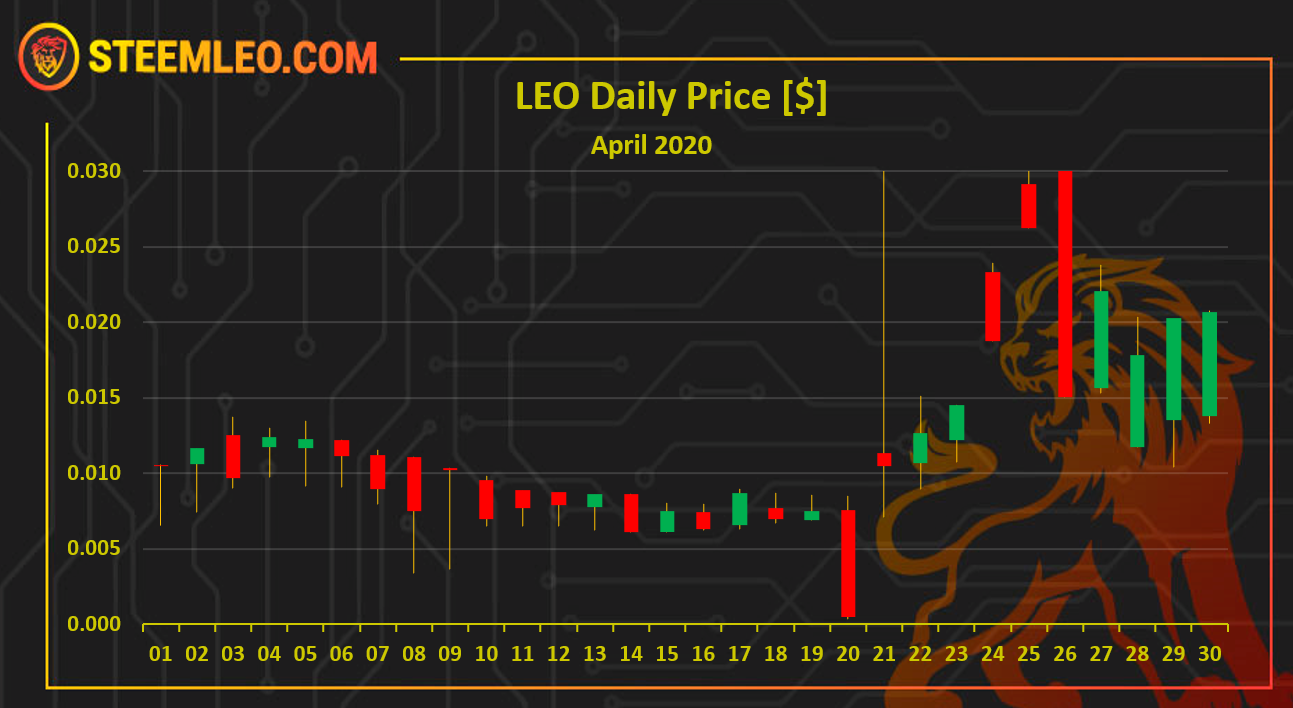

Last 30 days LEO price

Here is the price in the last 30 days also in dollar value.

Since LEO is traded against HIVE on the Hive Engine, we can see the volatility in price. Especially after the token move to HIVE on April 20.

Looking forward for a new chapter for LeoFinance and HIVE!

#steemleo - A Next-Generation Community for Investors

Report by @dalz

Posted Using LeoFinance

Were the SP delegations earned from steemleo or leofiance?

Posted Using LeoFinance

Delegating to the @leo.voter account ... I think :)

Posted Using LeoFinance

Delegate Hive Power to @leo.voter (on the Hive Blockchain) ;)

Posted Using LeoFinance

Taskmaster is a beast and very consistent...nice job.

Posted Using LeoFinance

Yes taskmaster has been killing it the last month :)

Posted Using LeoFinance

When in steemit, every comment using steemleo received a small upvote in LEO. That is not happening here on hive. Do you intend to renew these upvotes here on hive?