Binance Trading Methods #3 | What is Margin Trading and how does it work

Cover created in Canva

Again I have returned after some time to continue with the section called "Binance Trading Methods", I am sorry I could not bring it before, however, I have been covering several branches of technical analysis, with the sole purpose of being able to educate the whole community in a correct order of publications, under a tracking number so that they can more calmly see the different parts that compose it.

In another order of ideas, in the previous publication of this section, we saw what was the first method of trading most recommended for those starting in this world of speculation and investment through the financial markets. You can check it out by clicking HERE, so to continue without delay we will see what is the Margin Trading method.

I must point out that Margin Trading has many details to highlight so in this publication I will only cover theoretical aspects of it, in the next one we will see some practice and how to create an account.

Margin Trading

As is customary, I will begin with a brief definition of this term.

Margin trading, is a method of trading in which to trade or enter the market, you can use funds that come from a third party, ie another person or entity. To be clearer in this definition, simply a loan is granted, in order to trade with someone else's funds, it should be noted that like all LOANS, daily interest on these funds must be paid and this will depend on each currency with which you want to trade or rather enter the market. Now, as I commented on the loans, in this sense, it is good to know where these funds come from with which traders can increase their positions (leverage), to have either higher profits or significant losses.

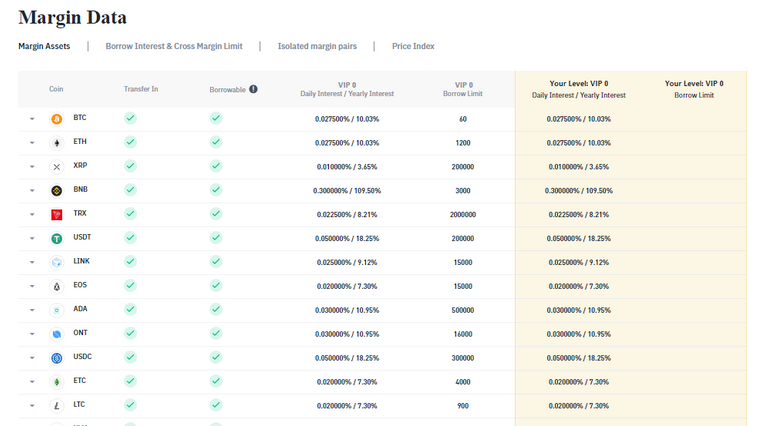

Here is a picture provided from the Binance platform, so you can see the "daily interest" on some assets that can be borrowed. You can also see which pairs you can trade "Leveraged" with.

Image of Binance

Image of Binance

The funds of the Binance Margin platform come from the initiative called "Binance Savings", where many users deposit their funds there in order to obtain a percentage of return interest based on the balance they place in what is called "Standard Savings". In conclusion, it is from here that the funds are obtained so that the operators can enter the market both in Long (Purchases) and Short (Sales) and thus increase their possibilities of earning even more money or as I already mentioned, incur much greater losses.

How does margin trading work at Binance?

Now that I have explained where these funds come from, I must explain how trading with money provided by a third party actually works.

Many will wonder why trading with this method is called margin, because the initial investment made by the user is called "Margin", that is, in order to enter the market with funds from a third party, we must place a certain amount of money that will serve as collateral, in order to access the loan. All this is closely related to the concept of "Leverage" and it is very important that you pay attention to what I will comment next, since each concept is important to handle in order to know this method in depth.

Important

Leverage describes the proportion of the funds that we will be able to access (loan), with respect to the margin (initial investment of the user), in a few words, if for example we seek to enter the market with $50. 000, that is to say, to open for example a transaction in BTC/USDT investing this amount, we as traders will need to have as guarantee $5.000, this will be the money that we must place so that they lend us the $50.000, here it is where the concept of leverage enters, since generally it is expressed in the following way:

According to the previous example, to access that amount of money we would be leveraging 5:1 or what is equal to say, 5x. To understand this in a simple way, 5:1 or 5x means that your initial capital, that is, your margin will be multiplied by 5 when you enter the market. Knowing this we have that: "5,000 x 5 = 50,000", this is how we will know how much is the maximum amount we can access depending on the capital we have. Likewise, this is an example and of course we should NEVER leverage all our total capital.

Remember to always risk no more than 5% of your capital, to correctly control your risk.

Conclusions

In order not to keep doing this long post, I'll leave it here, I don't want to make such a tedious reading for all of you, I'll be thinking of some more feasible way to explain these trading methods. Now, keep an eye on the next part of this section because I will be showing you how to open a margin account in Binance and also show you some examples of how to apply for a loan.

Link to the Erarium community in HIVE

Other posts of educational interest for the community:

The importance of Technical Analysis in Trading | Horizontal Supports and Resistances

The importance of Technical Analysis in Trading #2 | Mathematical Support and Resistance

How trading works and how we should read the market | Introduction Part 1

How trading works and how we should read the market | Bid/Ask Law Part #2

I am Co-founder of the @erarium project, in this community we offer training processes in trading, finance and economic management. Consider joining our official Discord by clicking HERE.

If you are new you can join the game under this LINK

Live the BraveBrowser Experience. Browse fast, safe while earning BAT tokens.

Please download the browser using my Referral Link.

Communities I support and promote

Join the discord of @project.hope

Join the official Discord community

Go to the Discord server community officer in Spanish

@tipu curate

Upvoted 👌 (Mana: 24/32)