Crypto Index - UBCI Index

Stock market has longer history than Cryptocurrency.

To no surprise, stock market has many indexes that have been used and validated in long application cases. So, many professional investors, portfolio managers and private investors could use to analyze market, specific stock and future trends.

But crypto markets generally do not have that sort of official indexes so many. Maybe some of stock professionals could utilize raw data to read the meaning and forecast upcoming trends.

I recently found that one of Crypto Exchage Upbit provide these indexes and try to look at the meaning of those.

Upbit started to provide these indexes since 2017 having long-term plan and goal that expecting its indexes would be utilized in Crypto market as a standard criteria and ETF products could be released based on these indexes. But I guess that these indexes usage has been not so much as it was expected first 2017.

I look at some of the indexes and try to catch some meaning of it.

Indexes

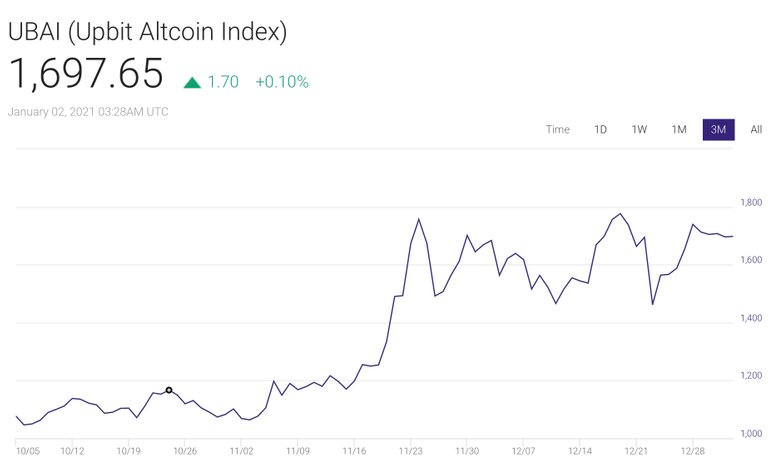

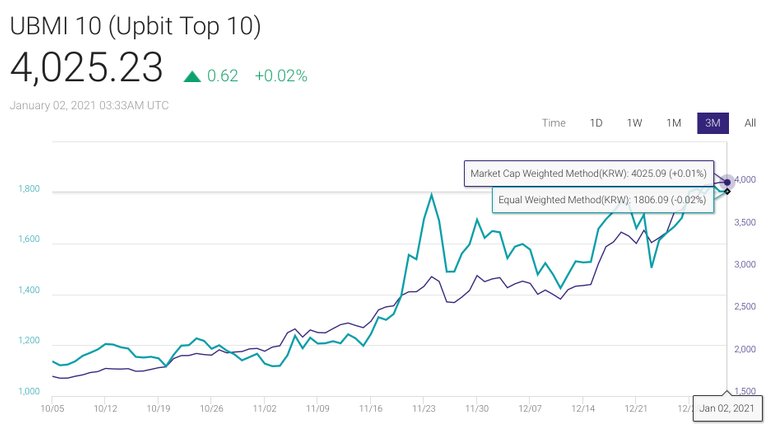

Source: Upbit, 3 months Indexes

Market cap weighted method applied for all indexes.

UBMI 10 offer equal weighted method in addition to market cap weighted.

This all index stared at index 1,000 in 2017. Now UBMI shows 4,357 that means 4 times of its original average price. UBAI is 1,697 that means 1,7 times average price increase since 2017.

Regarding 3 months fluctuations, UBMI increase almost more than doubles and UBAU increase is less than double.

If the index includes Bitcoin, the index shows more than 4,000.

Performance (Regarding past 3 months daily return)

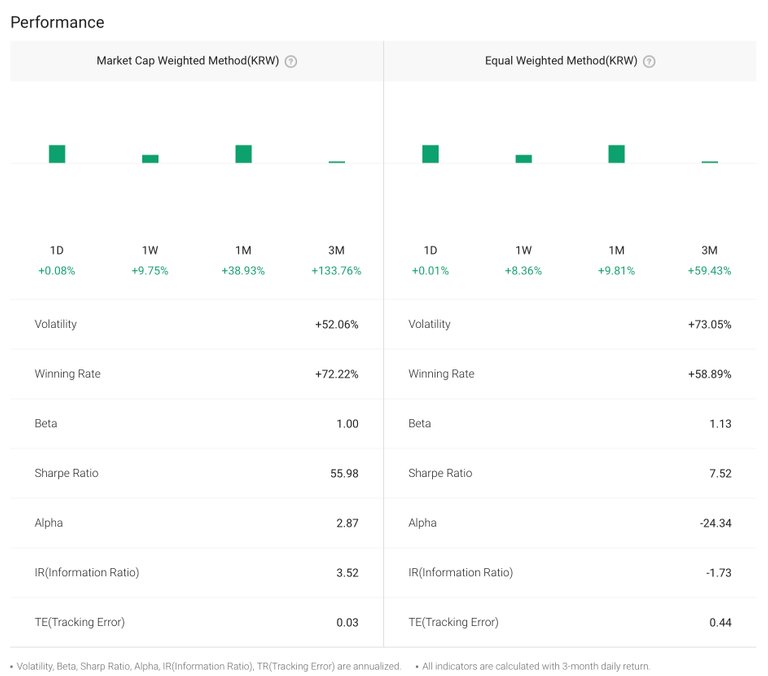

I just review UBMI 10.

It shows top 10 highest market cap coins average index.

Volatility

Top 10 coins have 73% volatility as of Equal Weighted Method basis.

Compared with stock market, the volatility is so huge. The volatility of Market Cap Weighted is 52% with much weight from Bitcoin stability.Winning rate

More than 50% chances of deal not to lose money as of Equal Weighted.

Regarding weighted method that having more weight on Bitcoin the chances not to lose money increase by 14%.Beta

Without Bitcoin stability, the volatility may increase 13%.

UPMI seems to be a benchmark index.Sharpe ratio

Market cap weighted that weight much on Bitcoin has more score that means Bitcoin has give more benefit covering the risk.

The performance is just based on past 3 months data collection.

So this analysis may not fit to reliable future forecast regarding so volatile and uncertain crypto market.

Posted Using LeoFinance Beta