Cardano ada: Choosing a stake pool and delegating your ada

As Shelley era started in Cardano blockchain, finally delegation and staking launched together.

ADA holders could earn benefit delegating or staking ada running own staking pools.

But still it seems to be hard for beginners to find the best or not bad quality delegation pools.

There are some relationship between stake pool fees, staking rewards, and pool saturation. And you may have the trade-offs between delegating to one or multiple pools simultaneously.

Cardano Slot Leader Elections: More like a lottery having more chance for the pools who have large amount of ada

In a proof of work (PoW) blockchain miners use hashing power to validate blocks.

Therefore, the higher the hashing power a miner has, the greater the likelihood that they will be chosen to validate a new block.

In PoS systems, and more specifically Cardano, slot leader elections function more like a lottery.

We can envisage each ada token as a ‘ticket’, and anyone participating in staking can ‘win’ the chance of becoming a slot leader — reaping block rewards paid in ada.

Stake pools that have a greater amount of ada delegated to them have a statistically higher chance of being elected as a slot leader and producing the next block, and therefore have a higher likelihood of reaping greater block rewards.

Naturally, this will usually result in more regular rewards for delegates, and potentially earn those delegating their stake to large pools more ada rewards. However, this is not all to affect to delegation rewards.

Other parameters beside the amount of ada delegated

There are many trade-offs to be made throughout the staking process.

Each stake pool determines its fees, and it can be difficult to choose between a small stake pool which charges low pool fees, or a larger pool that charges greater fees.

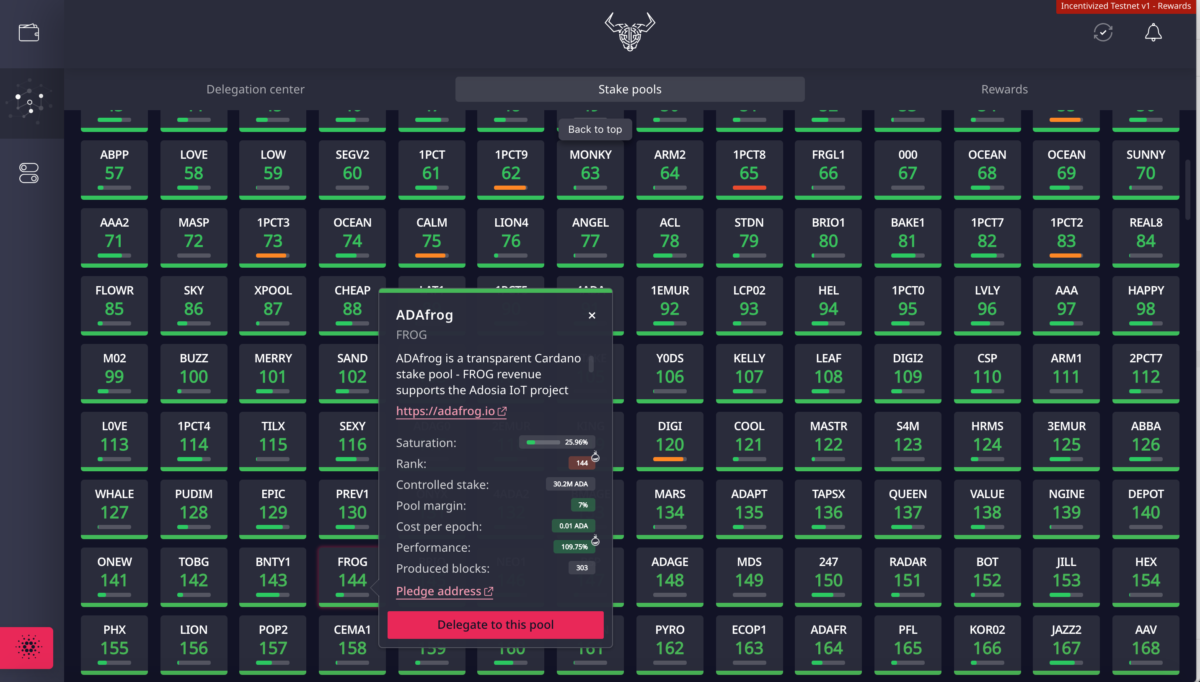

Stake pools that become too large may encounter pool saturation, which is defined as the ‘K’ value, or saturation parameter. Pool saturation offers diminishing rewards to delegators once a pool has a sufficiently high amount of staked ada, preventing a small number of pools from exerting disproportionate influence over the protocol.

Pool saturation is designed to encourage delegators to explore different stake pools, rather than simply choosing the most popular pools.

Exploring different stake pools will not only potentially yield maximum rewards, but it also helps keep the network sufficiently decentralized.

Pool Desirability: A Combination of parameters

As there is a long list of available stake pools, pools are ranked according to how likely they are to produce more user rewards.

Desirability is decided by a combination of reliability, pool costs, profit margin, saturation, and the pledge amount.

Reliability — Stake pools need to maintain 24/7 up-time to validate new blocks if it is chosen as a slot leader. Pools with the greatest up-time have the highest reliability.

Pool costs — Naturally, although much lower than PoW systems, stake pool operators have some costs associated with running a pool. These costs are declared in ada for each epoch.

Profit margin — As well as pool costs, which cover the stake pool operators outgoings and don’t necessarily represent profit, they may also charge a profit margin — an incentive pool operators take for maintaining and running the pool.

Pledge — The pledge represents the stake of the pool operator. While there is no minimum pledge, larger stake pool operator pledges result in greater rewards for every delegate in that pool. As a result, you should consider the pledge amount when choosing a pool.

As we can see, pool costs, the initial pledge, and profit margins, which are set entirely by stake pool operators, affect your rewards from delegation.

If a stake pool changes its fees, they will take effect in the next epoch, and you will be notified of this change through your wallet.

It is worth noting that even though stake pool operators set pool fees, they are not responsible for paying out staking rewards. Instead, this is handled automatically by the protocol, so the stake pool operator themselves cannot disrupt reward distribution.

Source: Medium.com, Cardano Forum, Cardano Foundation

Posted Using LeoFinance

what a jungle to start in dude...djeeez..which one to choose?

if you are not familiar with this selection, just start with popular one but not saturated.

Source

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.