HOW TO USE DeFiBOX!!!

Hello Readers!!!

After the explanation of DeFiBOX.

Now let's get to real business.

Using DeFiBOX might not be so difficult, for everyone used to decentralized way of trading and have used one or two decentralized exchanges before most especially the Newdex Swap.

DeFiBOX should be very easy to use but for the whole new thing relating to DeFi and token swaps, there might be some differences. Before I proceed on how to use DeFiBOX. It is important to let users know that DeFiBox has become one of the biggest liquidity market for EOS. Has more than $20,000,000 locked in USD Value.

Now we proceed

How to use DeFiBOX

Starting to use DeFiBOX, you definitely have to visit the DeFiBOX official website.

DeFiBOX has a very friendly user-interface and on this first page. You will find the followings

- Swaps

- Liquidity

- Market

- USN

- Mine BOX

- Dividend

- Security

- Whitepaper

- Sign In (Where your username will appear after signing in with either a desktop or mobile wallet)

- Exit and Language

- Last Records(Of swaps)

For the benefit of this article and my readers interest. I will be taking us through the most important ones.

SWAPS

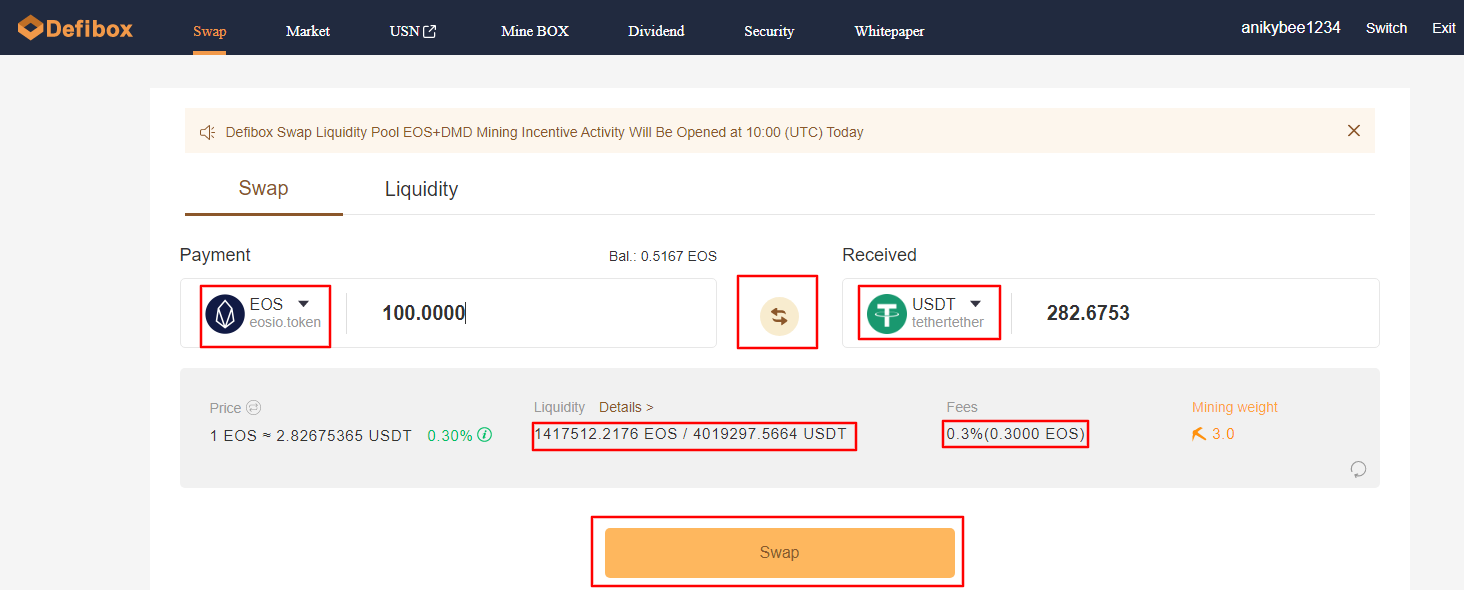

Swaps as explained earlier is simply converting from one token to the other. On this page, users can select which token to send and which to receive. Also it is possible to switch this two token, the receiving one can become the paying and vice versa if you change, using the sign in-between the payment and received boxes

The screenshot above shows the token being paid/the one to be received, shows the price of one EOS, the liquidity pool of EOS/USDT, the fees for swapping, the mining weight and then finally the SWAP button to complete the transaction.

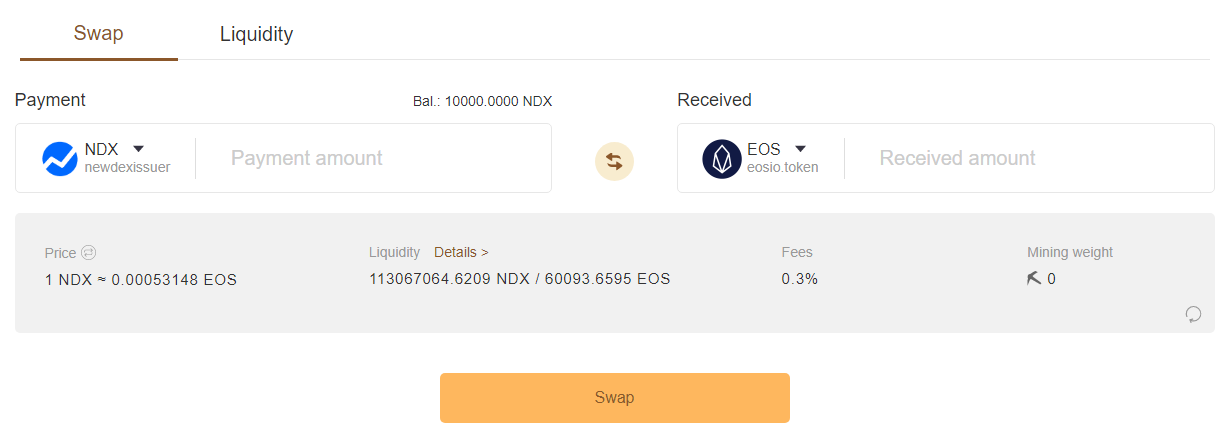

You can always select any other pair for swap. Below is another example of NDX/EOS

Liquidity

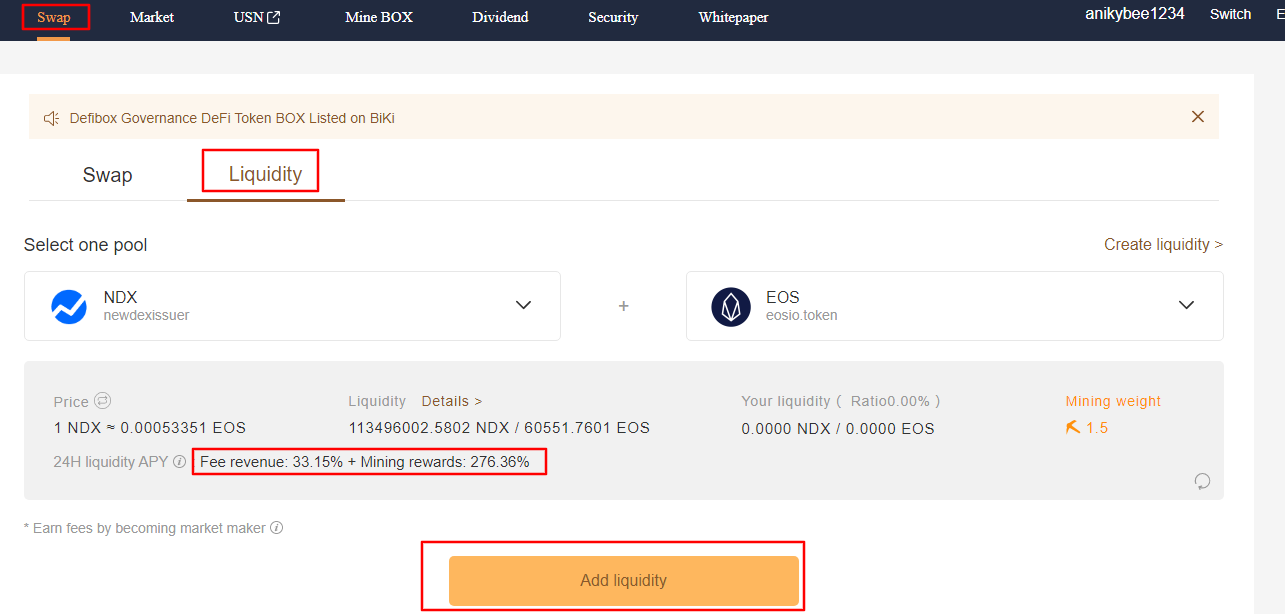

There's a liquidity for every pair and everyone who has contributed to the liquidity pool is known as a market-maker and are automatically eligible to fees paid by users while transacting but this is strictly based on their liquidity ratio.

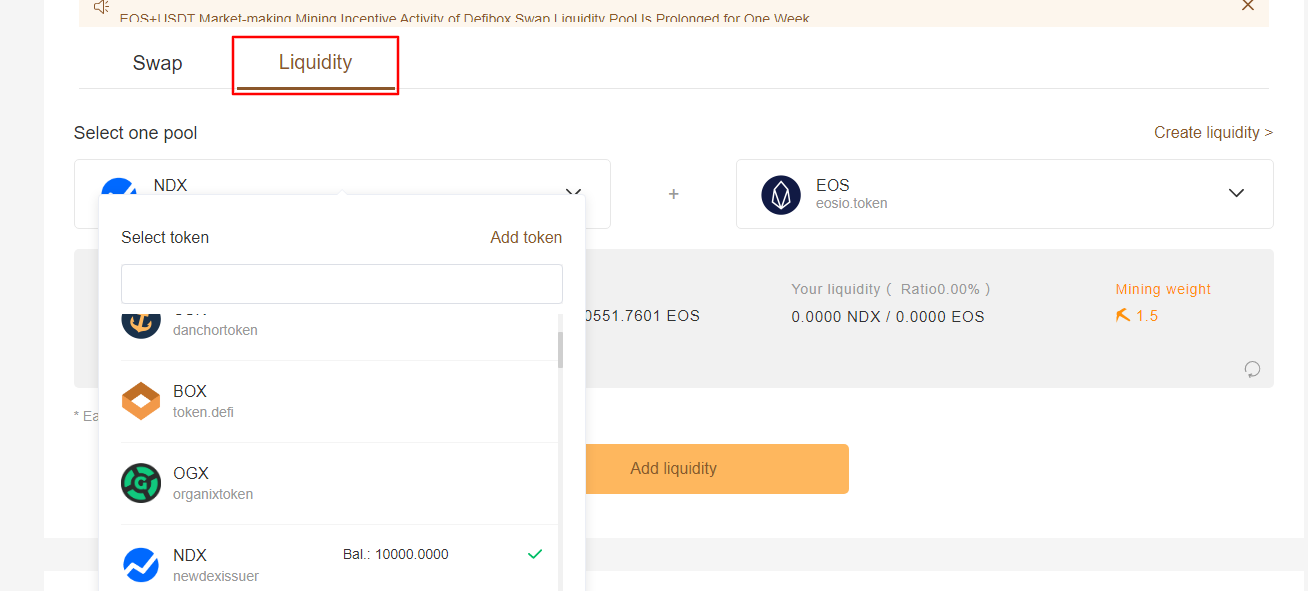

You can add liquidity by clicking the liquidity tab and selecting which pool you want to provide liquidity for.

Market

Market simply shows all important information relating to each token. Anyone visiting DeFiBOX website can have a clue of what each token pairs is like and how they've been performing. Market of all token pairs have the following:

- Price

- Liquidity

- 24 hours Liquidity APY (Fee Revenue and Mining Reward %)

- 24 hours Swap

The above listed are self explanatory

USN

USN explained earlier as a sub-project of DeFiBOX. This is a project of Danchor and USN is a decentralized staking stable coin on EOS Blockchain. EOS can be staked to generate USN. To know more about USN, go Here

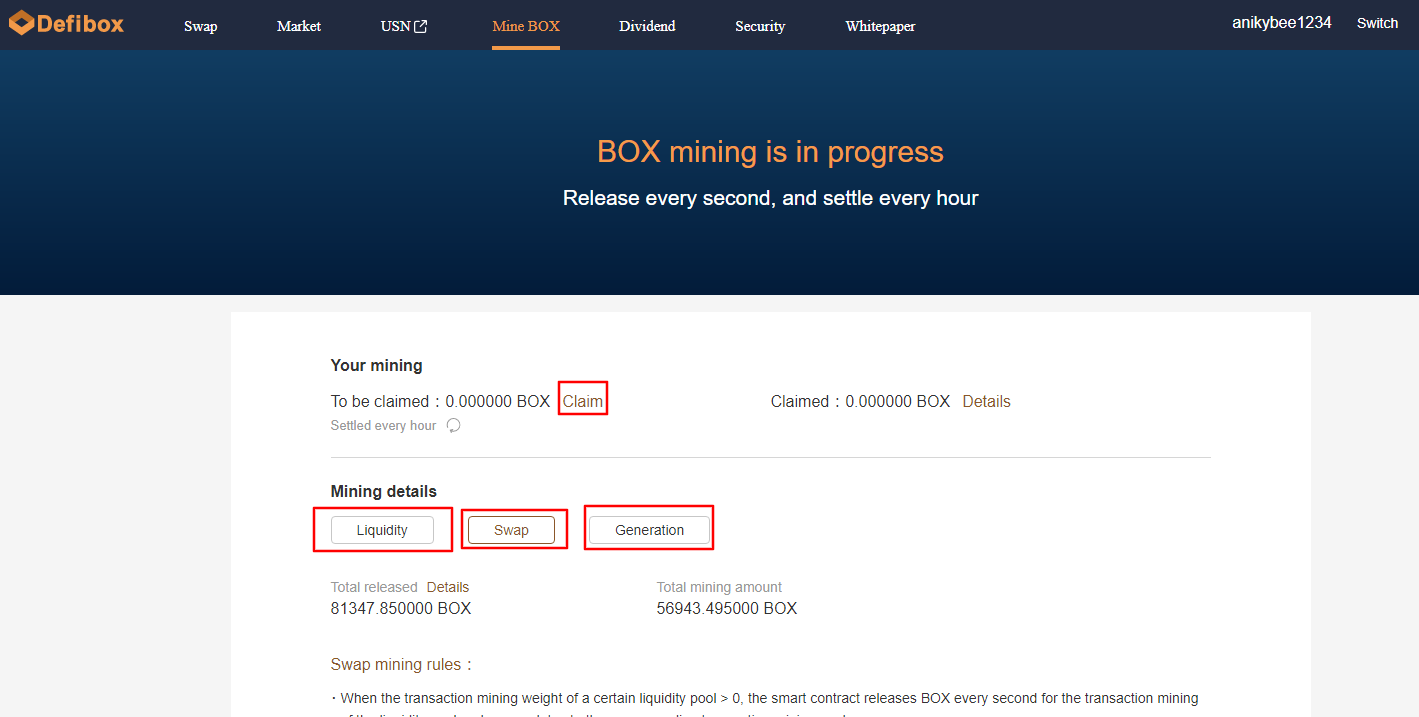

Mine BOX

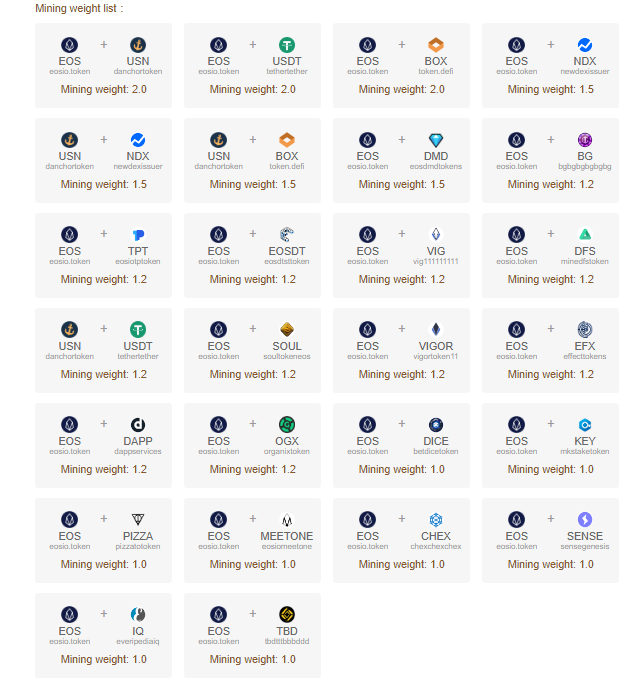

For everyone who has added an amount to any of the liquidity pool, there's always a mining weight for each pair of token. This mining weight determines how much BOX in mining will be allocated to the market-makers.

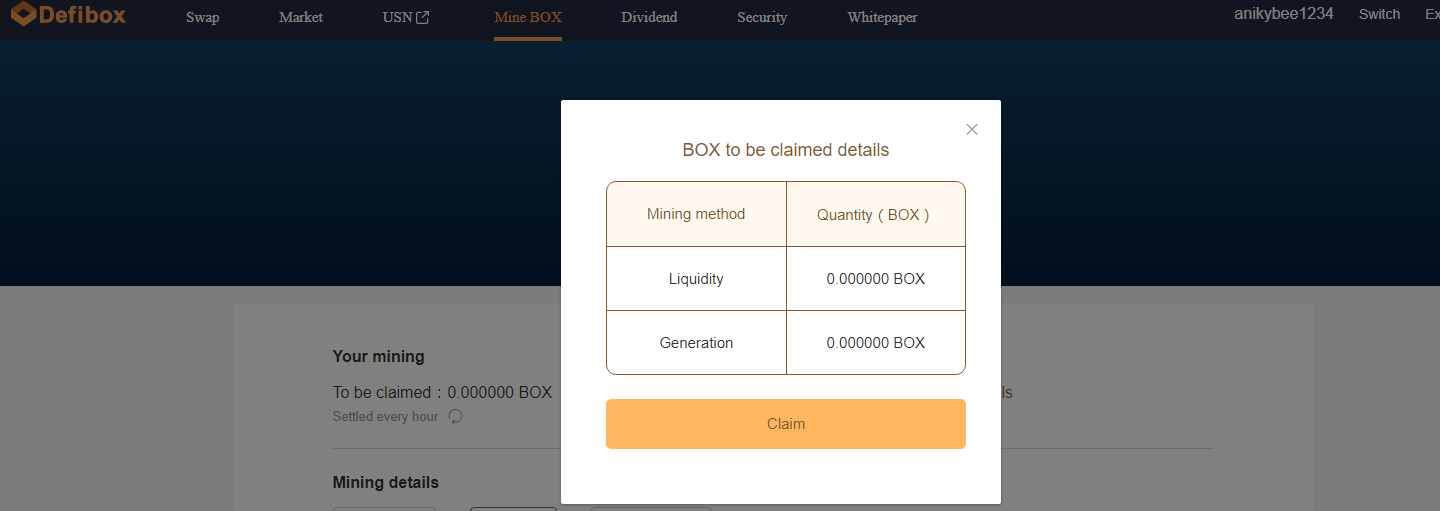

Therefore, BOX mining is always in progress as it is released every seconds and settled every hour. There's a BOX mining allocation for Liquidity, Swap and Generation but not all liquidity pool receives BOX mining. Some won't receive BOX mining because their mining weights are not greater than zero. BOX from this mining can be claimed if you visit the Mine BOX tab.

Screenshot below contains list of token pairs with which their liquidity pool receives BOX mining

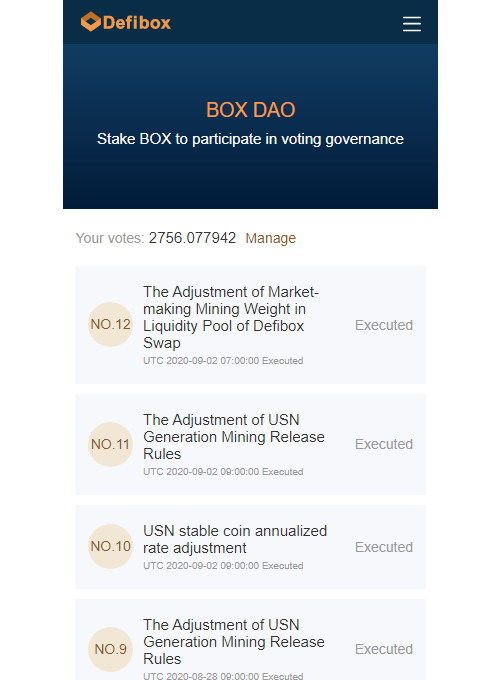

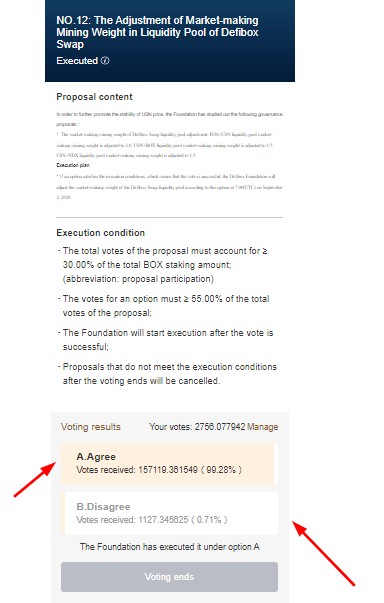

For DeFiBOX governance

Only users that stake their BOX are able to vote on governance proposals and as at the time of writing this article, there's no tab or page for governance on the DeFiBOX PC version. BOX DAO can only be accessed from any EOS mobile wallet that supports DeFiBOX or visit Here to access the proposal page.

All you have to do is click on the proposal and either agree or disagree then vote.

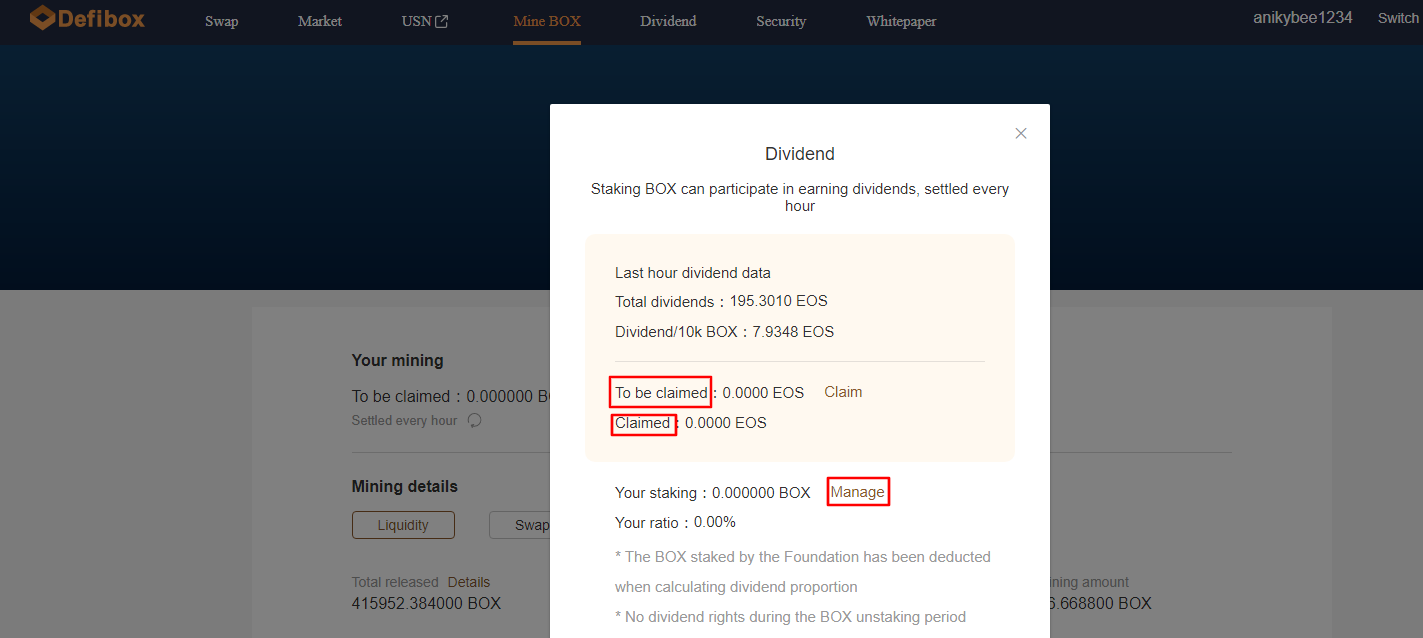

Staking Dividends

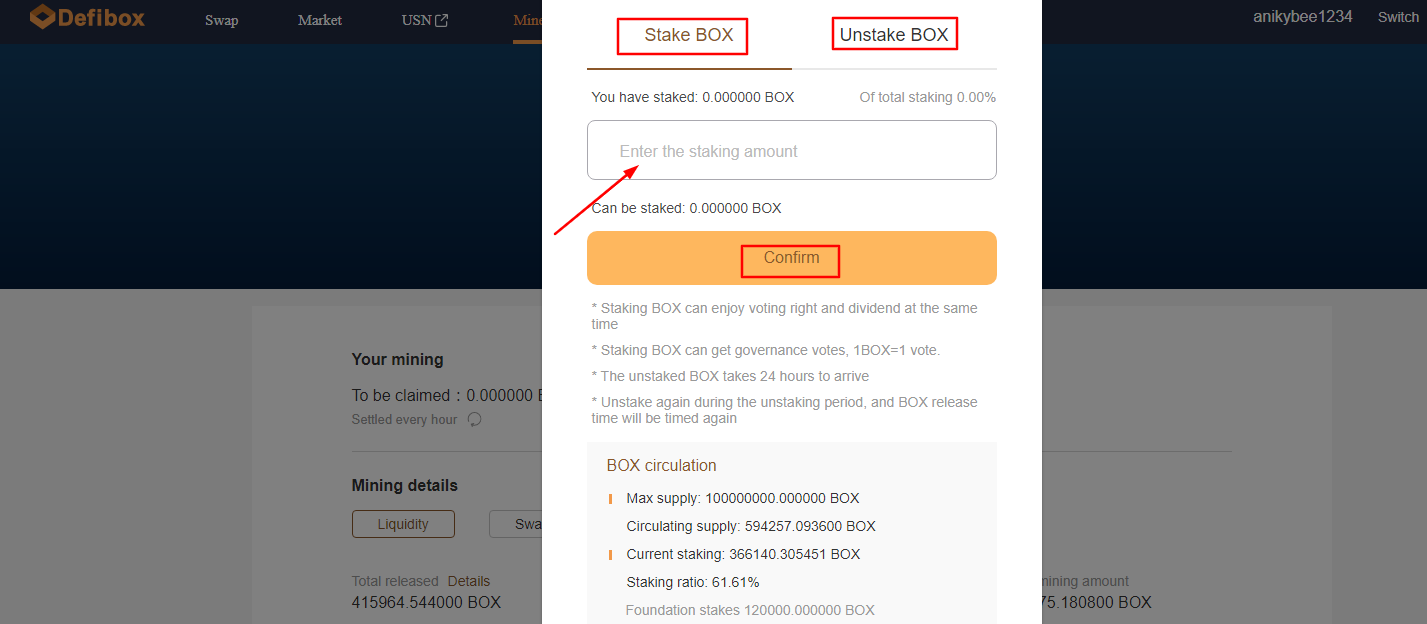

If you visit the staking dividend tab, you will be able to stake your BOX token which can earn you dividend in EOS every hour and don't forget that staking BOX also gives you the power to vote on Governance proposal.

On this same page, Users can see the number of EOS to be claimed and the amount already claimed.

Also, If you click on Manage, you'd be able to stake more BOX and unstake any amount you want.

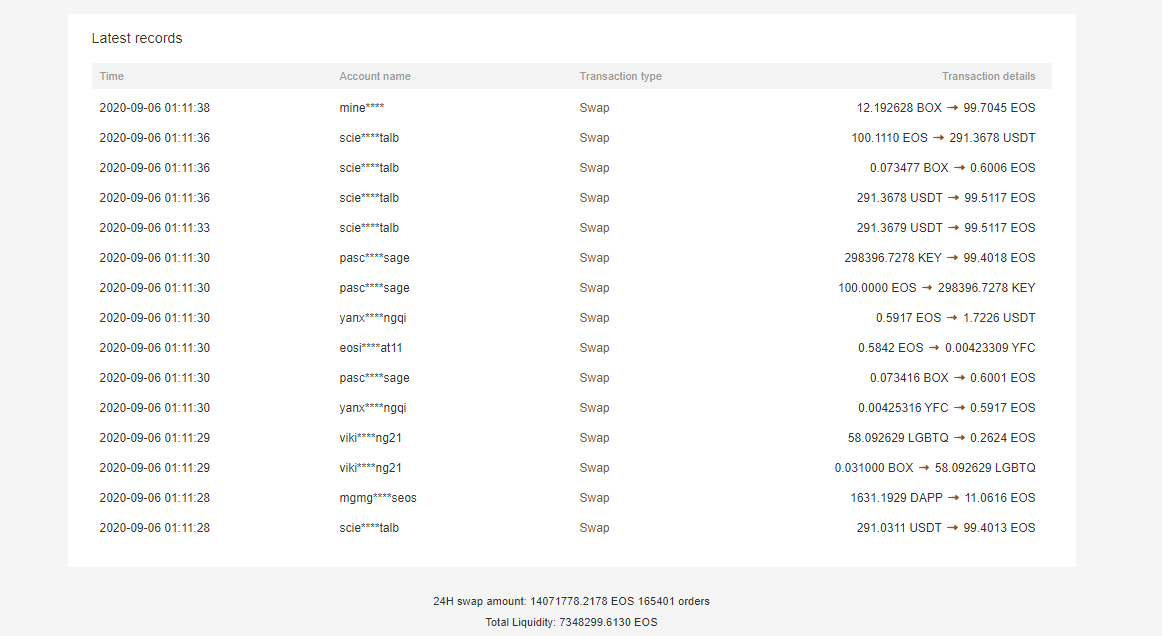

You can see the latest record of swaps that happened on DeFiBOX if you scroll down the swap page.

CONCLUSION

DeFiBOX has made DeFi much more interesting being on the EOS Blockchain. A fully decentralized one-stop DeFi platform giving users the chance to experience full decentralization and having a say on their funds and investments.

I really can't tell how happy I am for this great initiative on the EOS Blockchain. No transaction issue or slow block confirmation. Every of your transaction can be found on EOS Blocks Cafe which is Bloks.io

If you have any issues, you can always refer back to this article or see official website for more information.

THANKS FOR READING

I am Bee 🐝 in the City of Neoxian

Posted via neoxian.city | The City of Neoxian

https://twitter.com/eosdac/status/1362414905341734919