OIH: Get Ready For The Big Comeback by Michael A. Gayed

Summary

- A strong bearish trend in OIH kept investors away for over five years.

- Oil services industry is projected to grow 3.6% CAGR in the next six years.

- A move above $20 may just be the proof of life bulls desperately need.

- This idea was discussed in more depth with members of my private investing community, The Lead-Lag Report. Get started today »](https://seekingalpha.com/checkout?service_id=mp_1302)

"Growth in U.S. real imports slowed to about 3% in 2006, in part reflecting a drop in real terms in imports of crude oil and petroleum products." – Ben Bernanke

In the meantime, the United States became a net oil exporter. After Congress lifted curbs on crude oil exports, September was the first full month of a positive oil trade balance since 1940.

The oil price (WTIC) consolidates close to the $60 level in a triangular pattern that can break both ways. With the world focused on the Organization of Petroleum Exporting Countries (OPEC) meeting in Vienna, Austria, this coming Thursday, some producers see the current oil price as comfortable moving forward.

Plenty of things are on top of the OPEC agenda – a deal on 2020 production cuts, Saudi Aramco (ARMCO) IPO, or supply pressure from outside OPEC - and each one is able to swing the price of oil in any direction. But regardless what the price of oil has done lately, there's one industry suffering the most – oil services.

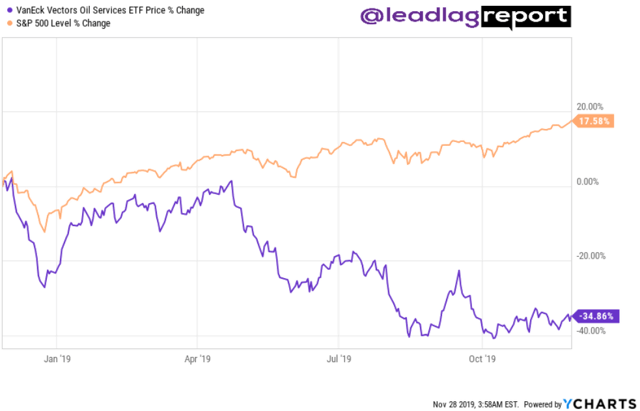

One of the latest Lead-Lag Reports I wrote mentioned that the oil services sector has been a huge underperformer this year. Is it time to go bottom fishing in it selectively or via buying the VanEck Vectors Oil Services ETF (NYSEARCA:OIH)?

A close look at the OIH price evolution in the last few years shows some very depressed prices. From close to $50 five years ago, the current $11 valuation makes it difficult to build a bullish case out of it.

Yet, this is precisely what this article is about. The fundamental perspective alone is enough to attract interest to the sector.

The oilfield services market is supposed to grow to over $170 billion in 2025 when compared with $138.9 billion in 2019 – a healthy 3.6% CAGR. Increasing demand for oil across the globe, technological advancements, and increasing use of internal sources of funding are only a few factors fueling this growth, with Asia-Pacific the fastest growing regional market.

The discovery trend of new oil resources is set to continue. Only in the first half of 2018 alone 4.8 billion barrels of equivalent was discovered in the United States, Norway, Oman, or Cyprus and ongoing exploration likely provides lucrative opportunities for the services industry.

Moreover, the fastest growth in the oilfield services market in the next five years is the well completion services, such as post-drilling operations. OIH exposure to oil-related services and equipment and oil and gas drilling makes it an interesting bet for a magical turnaround of the bearish trend.

With such a positive fundamental perspective, investors need a “proof of life” from a technical perspective too. As long as OIH remains below the bearish trendline, going long is a no go.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Oh, that’s interesting. I didn’t realize the US could export now.

Posted using Partiko iOS

The Smart Money is starting to buy up oil assets and there is negative divergence on the weekly chart. However, price will have to at least breach the first weekly supply at $16 to make me a believer.