Coca-Cola Continues To Head In The Right Direction by Wealth Insights

Summary

- The dust is starting to settle since Coca-Cola finished re-franchising its bottling operations and acquired Costa Coffee for $4.9 billion.

- Coca-Cola's margins and balance sheet are improving rapidly, which bodes well for the future. The company's cash streams should continue to grow.

- The stock has become modestly overvalued, and we recommend a 10% discount from current levels. Valuation is key, but Coca-Cola still has that famous wealth-generating ability.

Famed Warren Buffett favorite and beverage giant The Coca-Cola Company (KO) has been around for ages. The company was founded in the late 1800s, and has paid a quarterly dividend since 1920 - the most recent 57 years featuring an increase to that payout. However, it has spent much of the past decade reshaping itself. The company has spent years re-franchising its bottling operations to become less capital-intensive, while spending in a big way to land British coffee shop chain Costa Coffee. These actions simultaneously compressed revenues and further levered the balance sheet. Now that the dust is starting to settle, we can see that several key metrics of Coca-Cola are establishing trends heading in the right direction. While the stock isn't cheap by any means, we feel that the future at Coca-Cola is as bright as ever.

Returning To Growth

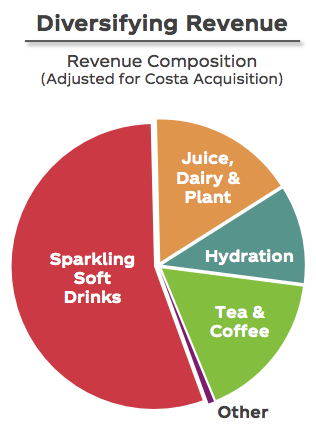

One of the hangups on Coca-Cola a few years ago was the question that the company faced regarding its legacy sparkling soda products. The millennial demographic just wasn't taking to soda as much as previous generations, and Coca-Cola began to see its total growth slow down because sparkling beverages represented such a large portion of its total business. Even as recently as 2017, 70% of the company's overall case volumes were sparkling soft drinks. Since then, Coca-Cola has made strides to diversify its revenues by scaling water, juice, and other non-sparkling brands. It has also invested heavily in bringing Costa Coffee onboard, as well as rebranded its Diet Coke brands and reduced sugar in its non-diet offerings.

(Source: The Coca-Cola Company)

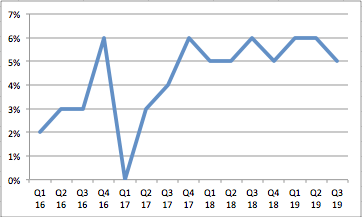

These efforts have paid off, and organic growth (chart below) has returned to a consistent 5-6% clip that has been sustained for the past two years and counting.

(Source: Chart created by Wealth Insights via data from Coca-Cola)

While society will continue to strive for healthier eating and drinking habits, Coca-Cola appears to be pacing the changes we are seeing. It has built such a large footprint that much of the money that leaves sparkling soft drinks will simply transfer over to the company's owned non-carbonated brands. With two years of consistent growth now, our confidence is pretty high at this point in Coca-Cola's ability to maintain it. The company is also launching a caffeinated seltzer brand, which could provide another spark should it catch on with the market.

Operational Results Are Improving

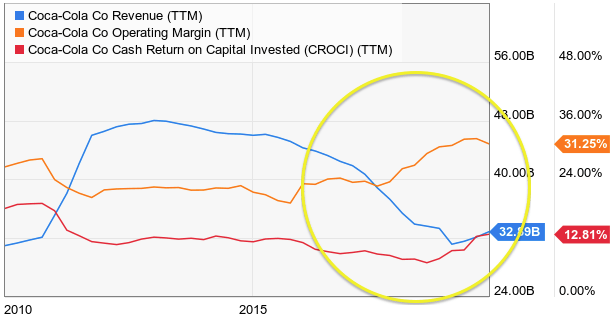

The re-franchising of Coca-Cola's bottling operations were quite traumatizing to the company's top line. The bottling operations were high-dollar, lower-margin assets that Coca-Cola removed from its plate in order to make the company a more profitable, less-capital intensive branding machine. It completed this process in late 2017, and we are now seeing the business turn higher across the board.

(Source: YCharts)

After dropping from $48 billion to $31 billion at re-franchising completion, revenues are heading higher thanks to consistent revenue growth. Operating margins have surged from a low of 19.7% in 2015 to 31.25% today. Coca-Cola is now converting roughly 20% of its revenue into free cash flow. The company's rate of return on invested capital has also rebounded. Investors should continue to look for these to improve, as Coca-Cola's large $4.9 billion Costa acquisition will take some time for the company to absorb and maximize synergies.

The Balance Sheet Is Strengthening

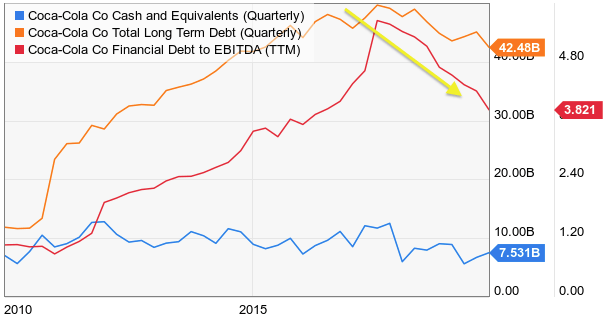

Our largest worry as Coca-Cola was going through this process was the company's increasingly levered balance sheet. Management has done a good job of beginning to steer the balance sheet in the right direction as well.

(Source: YCharts)

Coca-Cola maintains a solid cash hoard of $7.5 billion, which puts its debt-to-cash ratio at 5.6 to 1. While the company's current leverage ratio of 3.8X EBITDA is still above the cautionary threshold of 2.5X that we benchmark at, it has come down dramatically in just a couple of years. Coca-Cola currently holds an "A" credit rating with Fitch with a stable outlook. Management has a long-term goal of 2.0X-2.5X (on a net basis), so the balance sheet should continue to improve as the company improves margins and diverts cash towards paying down debt.

Checking On The Dividend

Most investors take up stock in Coca-Cola because of that legendary dividend that has now been increased each of the past 57 years. The dividend totals an annual sum to shareholders of $1.60 and yields 3.09%. Over the past 10 years, the dividend has grown at an average rate of 7.5%.

....Read the full post on seeking alpha

Author Bio:

This article was written by Wealth Insights. A well-known investment author on Seeking Alpha with over 6,000 followers.

Steem Account: @wealth-insights

Profile on Seeking Alpha

Steem Account Status: Unclaimed

Are you Wealth Insights? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

@tipu curate

Upvoted 👌 (Mana: 5/20 - need recharge?)

I didn't realize over the past 10 years, the dividend has grown at an average rate of 7.5%. I wonder how Pepsi's dividend pay compares to Coca-Cola...maybe I will do a post about it?