Briggs & Stratton Corporation: Not Buying The Bounce by Wealth Insights

Summary

- Briggs & Stratton Corporation has had a tough year, but investors got some positive news on November 1st when a strong quarter drove earnings higher.

- The short-term picture has improved, but there is still too much to worry about over the long term.

- The current risk-reward isn't favorable. Long-term investors should wait this out to see what the future holds for Briggs & Stratton.

Shares of engine manufacturer Briggs & Stratton Corporation (BGG) received a jolt of optimism when the company reported a pleasantly surprising first quarter for its 2020 fiscal year. While the company has made strides to stabilize itself in the short term, a number of potential headwinds remain when looking further out. The company has kicked its debt further down the road, and being this far into an economic up-cycle leaves us cautious about a recession, and what that could mean for Briggs & Stratton as it strives to turn itself around. With the stock now significantly off of its late-summer lows, we don't feel that there is much safety left for long-term investors.

Strong Quarter Provides Short-Term Momentum

The past year has been a pretty miserable experience for shareholders of Briggs & Stratton. Operational struggles and margin pressures from tariffs have pushed the stock increasingly lower, and the slide was punctuated by a huge earnings miss and dividend cut in August. That represented a true low-point as investors had lost approximately 75% of their investment with shares hovering near $4 per share.

source: Ycharts

However since then, shares have begun to rebound. This recovery was highlighted by a surprisingly strong FY2020 Q1 on November 1st that sent the stock 15% higher. The report had some positive developments:

- EPS of -$0.67 and Revenue of $314 million were both better than analyst estimates.

- Net sales grew 12.4% year over year, driven by growth both in engines and the company's product segments.

- The company saw margin improvement on its engines, but still saw overall margins compress (was expected by management).

- The company's operational losses of $34.23 million for the quarter were a year-over-year improvement.

- Management successfully refinanced its revolving credit facility, effectively providing access to more capital and getting the company out from under looming debts that were due in December 2020.

It's not a surprise to see the stock make such a strong move higher, the dividend cut had essentially pushed the stock into a "worst case" scenario in regards to market sentiment, and double-digit revenue growth (as well as newfound financial flexibility) is certainly a sign that the company should operate on a stable platform for the near-term future.

Things Are A Bit More Uncertain Looking Further Out

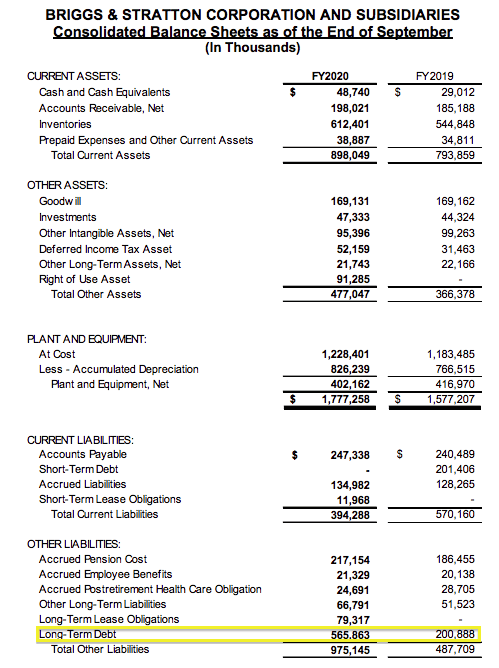

We take a long-range view on any potential investment, and while Briggs & Stratton is definitely making strides, there are some potential headwinds that leave us very cautious when looking ahead from here. The first being the company's balance sheet.

source: Briggs & Stratton Corporation

It's good for the short-term benefit of the company that it was able to refinance upcoming maturities and increase its cash balance to $48 million for the first quarter. They really didn't have a choice. However, the company is placing a risky bet that the business will perform well - further into the future. The company's gross long-term debt has now increased significantly from $200 million in FY2019, to $565 million. This isn't to say that Briggs & Stratton will be going belly-up, rather its balance sheet will be a long-term anchor on the company's cash flows and bottom line. Interest expenses alone for 2020 are estimated at $38 million. Even if we assume the business rebounds to 2018 levels where EBITDA was $97 million, leverage is still a whopping 5.82X. There is simply substantial balance sheet risk present.

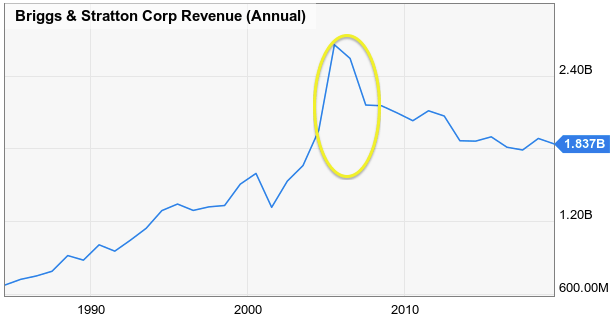

This is amplified by the company's sensitivity to economic factors. In other words, Briggs & Stratton's business is directly impacted by recessionary events. Notice the large drop off when the recession hit a decade ago. Considering that the company is simply striving for positive FCF for FY2020 rather than burning more cash, the company is ill prepared to experience a drop in revenues like this.

source: Ycharts

An unexpected hit to revenues would devastate already shaky margins that remain under pressure from tariffs. Fortunately, Briggs & Stratton does have the ability to continue to draw from its new revolver (78% utilized as of end of Q1), and inventory is currently built up for "peak season", so the company is poised to continue positive progress as it draws inventory down (hence management's forecast for increasingly positive operational results in 2020). In the event of a recession, though, things could get a bit more dicey.

Read the full post on Seeking Alpha

Author Bio:

This article was written by Wealth Insights. A well-known investment author on Seeking Alpha with over 6,000 followers.

Steem Account: @wealth-insights

Profile on Seeking Alpha

Steem Account Status: Unclaimed

Are you Wealth Insights? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Yeah, I'm in agreement, this company is a no touch until price can close above $10 on the monthly chart.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.