Weekly Sample Portfolio Update - Week 31

Dear trading community,

here is a look at my weekly sample portfolio update for Friday, August 2nd 2019.

Closing QQQ July Long Call Butterfly

This is a free butterfly with a locked in profit of 54 cents ($54 per one lot).

On Friday, August 2nd 2019, I closed this trade for a credit of 29 cents, so my overall profit on this position is 83 cents ($83 per one lot).

Defending IWM September 30 Delta Strangle

On this position I got whipsawed this week.

On Wednesday, July 31st 2019, I had to roll up my put into a straddle for a credit of $2.35, since my short call got hit. Because of the following sell off I had to defend the position again by rolling down my call for a credit of $2.86 and go inverted.

My overall credit for this position is now $8.92.

My profit target for this position hasn't changed, it is still $1.70, so I'm going to close this position when it trades for $2.01 or at 21 DTE.

At the moment this position is down $2.78 ($278 per one lot).

Rolling TLT September Short Strangle into a straddle

On Friday, July 26th 2019, I sold this position for a credit of $1.91.

On Thursday, August 1st 2019, I had to roll up my put into a straddle for a credit of $1.22, because my deltas got too short.

My overall credit for this position is now $3.13.

My profit target for this position hasn't changed, it is still 85 cents, so I'm going to close this position when it trades for $1.06 or at 21 DTE.

At the moment this position is down $1.53 ($153 per one lot).

QQQ July Covered Put

My basis of this position is $165.65.

At the moment I'm down $25.17 ($2,517 per one lot).

So I have still a lot of puts to sell against this position, until I'm back to even.

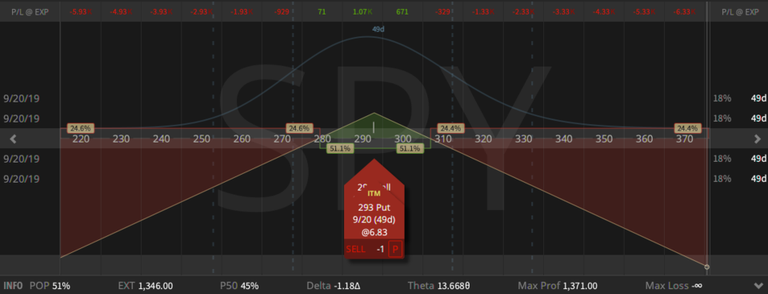

SPY September Straddle

Since IV really popped this week and the price of SPY went down to around 293, I added an additional SPY September 293 straddle to this position for a credit of $14.03, so my overall credit for this position is now $10.56.

Since I'm in full defense mode on this position, I'm looking for a scratch in this position.

At the moment this position is down $3.15 ($315 per one lot).

Closing SPY Classic Put Diagonal

I bought this position for a debit of $2.07 on On Monday, July 15th 2019.

On Thursday, August 1st 2019, I closed it for a profit of 43 cents ($43 per one lot).

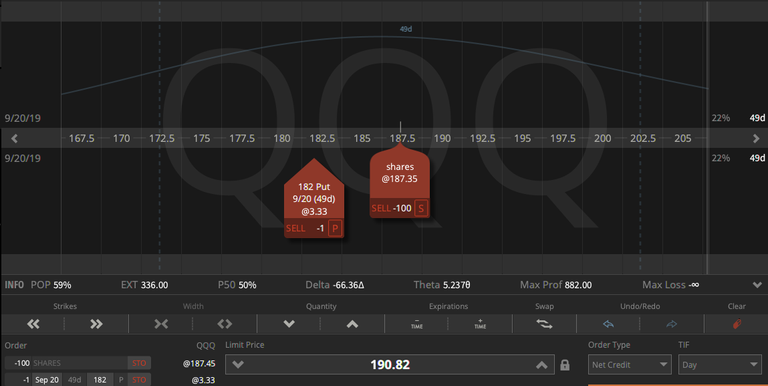

QQQ September Short Straddle

The overall credit on this position is $4.62.

Since I'm in full defense mode on this position, I'm looking for a scratch in this position.

At the moment this position is down $7.19 ($719 per one lot).

Closing GLD September Short Strangle

On Wednesday, July 17th 2019, I sold this position for a credit of $2.41.

On Thursday, August 1st 2019, I closed it for a profit of $1.26 ($126 per one lot).

New GLD September Call Ratio Spread

I sold this one for a net credit of $1.26 on Thursday, August 1st 2019.

My profit target is 25% of max profit (90 cents), so I'm going to close this position, when it trades for 71 cents or at 21 DTE.

At the moment this position is up 1 cent ($1 per one lot).

XLE September 25 Delta Short Strangle

On Monday, July 22nd 2019, I sold this position for a credit of $1.40.

My profit target for this position is 70 cents, so I'm going to close this position when it trades for 70 cents or at 21 DTE.

At the moment this position is down 60 cents ($60 per one lot).

FXE September Short Straddle

On Monday, July 22nd 2019, I sold this position for a credit of $1.85.

My profit target for this position is 45 cents, so I'm going to close this position when it trades for $1.40 or at 21 DTE.

At the moment this position is down 15 cents ($15 per one lot).

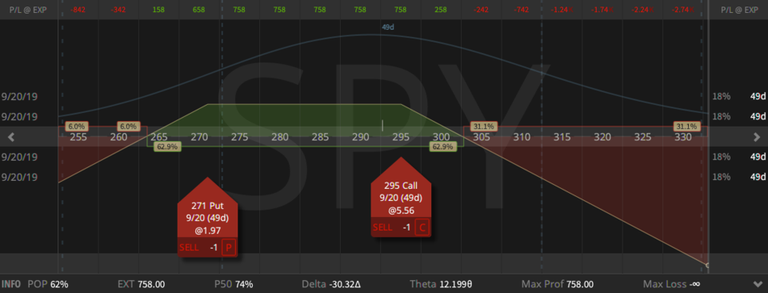

New Aggressive Short Delta Strangle in SPY

On Thursday, August 1st 2019, I sold this position for a credit of $9.12.

My profit target for this position is $3.21, so I'm going to close this position when it trades for $5.91 or at 21 DTE.

At the moment this position is up $1.54 ($154 per one lot).

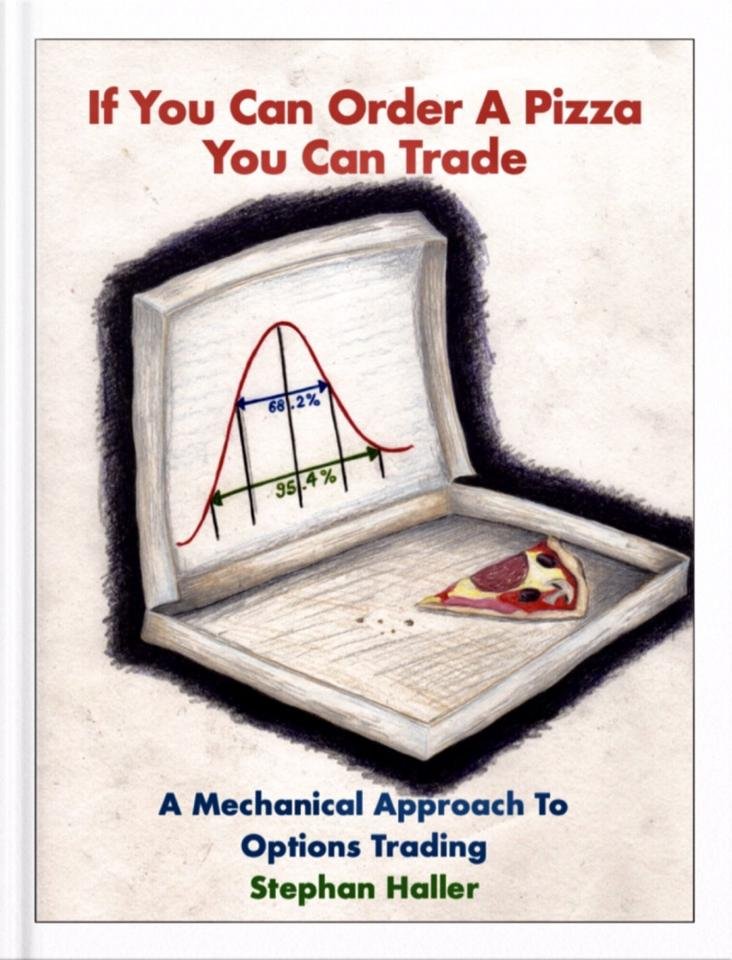

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.