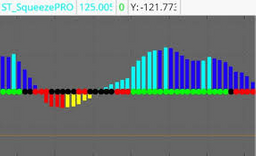

TTM Squeeze 1/23/20…Trade Set-Up #4: VanEck Vectors Semiconductor ETF, SMH

The Markets consolidate within a range the majority of the time and only trend about 20% of the time. John F. Carter, the son of Morgan Stanley stockbroker and a full time trader since 1996 built an indicator, TTM Squeeze Oscillator to systematize his trading around this market phenomenon.

The TTM Squeeze Oscillator measures the strength of the market and its momentum and uses the Bollinger Bands and the Keltner Channel as its basis. When the Markets are consolidating, the Bollinger Bands are inside the Keltner Bands and the Markets are set to be in a squeezing, building up energy. However, when volatility increases, the Bollinger Bands widen and engulf the Keltner channel, it is this switch when the Markets transitions from consolidation, to a break out, to a trending Market. The TTM Squeeze indicator attempts to alert you this event happens.

I’m a Supply and Demand trader, where I wait for price to get to my price levels/zones, but why not take advantage of these price moves to these levels / zones.

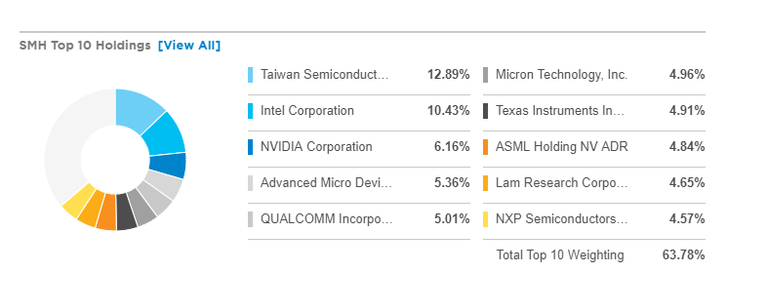

VanEck Vectors Semiconductor ETF, SMH is a concentrated, predominantly US-based ETF of mega-cap semiconductors companies. The top 10 holdings include,

and some of them recently have been getting upgrades.

Intel Corp. was upgraded on Tuesday by Jefferies analyst Mark Lipacis after he turned bullish on the stock, upgrading it to hold from underperform while raising his price target to $64 from $40.

Meanwhile, Cowen & Co. analyst Matthew Ramsay boosted his price target on Advanced Micro Devices Inc. shares to $60 from $47 on Tuesday as well.

Texas Instruments reported their earnings on Wednesday, beat Wall Street's targets for the fourth quarter and guided modestly higher.

Apple Inc. has asked chipmaking partner Taiwan Semiconductor Manufacturing Co. to increase its output of A-series processors this quarter in order to satisfy higher-than-anticipated iPhone demand, people familiar with the company’s plans said.

Along with the popularity of existing models, Apple’s business with TSMC is also set for a boost from an imminent iPhone SE successor, a low-cost model that will begin mass production in February ahead of an official unveiling as soon as March, Bloomberg News reported. It will be built around the same processor as the iPhone 11 generation.

The Taiwanese chipmaker recently reported earnings above most analysts’ expectations and it forecast another good quarter ahead. Though it faces potential headwinds from the threat of tightening U.S. sanctions on key customer Huawei Technologies Co., analysts believe additional demand from Apple and Advanced Micro Devices Inc. will replace any potential Huawei drop-off.

VanEck Vectors Semiconductor ETF, SMH made an all-time intraday high,

so I bought a call option that expires in May with a strike price at $165.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo