TTM Squeeze 1/22/20…Trade Set-Up #3: Activision Blizzard

The Markets consolidate within a range the majority of the time and only trend about 20% of the time. John F. Carter, the son of Morgan Stanley stockbroker and a full time trader since 1996 built an indicator, TTM Squeeze Oscillator to systematize his trading around this market phenomenon.

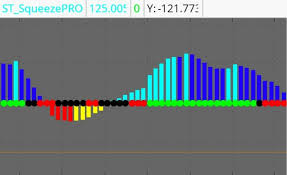

The TTM Squeeze Oscillator measures the strength of the market and its momentum and uses the Bollinger Bands and the Keltner Channel as its basis. When the Markets are consolidating, the Bollinger Bands are inside the Keltner Bands and the Markets are set to be in a squeezing, building up energy. However, when volatility increases, the Bollinger Bands widen and engulf the Keltner channel, it is this switch when the Markets transitions from consolidation, to a break out, to a trending Market. The TTM Squeeze indicator attempts to alert you this event happens.

I’m a Supply and Demand trader, where I wait for price to get to my price levels/zones, but why not take advantage of these price moves to these levels / zones.

Activision Blizzard, Inc. develops and distributes content and services on video game consoles, personal computers (PC), and mobile devices. The company also maintains a proprietary online gaming service, Battle.net that facilitates the creation of user generated content, digital distribution, and online social connectivity in its games.

Last Game Super Cycle for games was in 2013. In 2013, PlayStation 4 and Microsoft’s Xbox One were launched. The launches acted as a cornerstone for the entire industry. When the consoles were bought, they also bought video games. That year, shares of Activision Blizzard ATVI and Electronic Arts EA rose 69% and 58%, respectively.

The video game market is due for a big year. You have the introduction of new consoles for the first time since 2013. Those new consoles will be the first generation of video game consoles with cloud gaming capabilities. At the same time, the 2020 video game line-up is very robust. You also have the mainstream rollout of commercial 5G, which will provide an upward lift to gaming capabilities, and the launch of multiple new eSports leagues.

Against this favorable backdrop, Activision is optimally positioned to reap the rewards of big growth throughout the market. That is thanks to the company’s strong content line-up in 2020, behind a new Call of Duty game and important expansions in its World of Warcraft series. At the same time, shares remain relatively discounted at just 24-times forward earnings.

This convergence of improving fundamentals on a discounted valuation should spark meaningful outperformance in ATVI stock over the next 12 months.

A little over a year ago, Activision had a massive sell off.

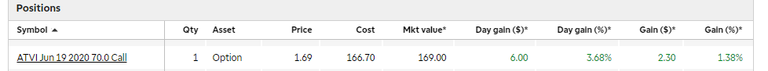

However, the momentum has now reversed and trending up, so I bought a call option that expires in June with a strike price at $70, just above the daily supply at $69.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Best investment you will make.

Results will be very good thanks to CoD Mobile, Wow Classic and the news CoD MW.

Bought some at 48 USD a few months ago (on fundamental basis)

Good stuff @vlemon, once price moves up a bit, I may start to sell calls against my open position.

Good luck. Seems like a smart position to me.

We shall see, I never risk more than 1-5% of my portfolio, so just playing the numbers game with what I hope are low risk, high reward probability set-ups. In essence, looking for my winners to drastically outperform my losses, but will also convert my winners into credit calendar spreads.

Posted via Steemleo