TTM Squeeze 1/21/20…Trade Set-Up #1 & #2: XLU and XLV

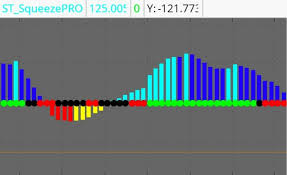

The Markets consolidate within a range the majority of the time and only trend about 20% of the time. John F. Carter, the son of Morgan Stanley stockbroker and a full time trader since 1996 built an indicator, TTM Squeeze Oscillator to systematize his trading around this market phenomenon

The TTM Squeeze Oscillator measures the strength of the market and its momentum and uses the Bollinger Bands and the Keltner Channel as its basis. When the Markets are consolidating, the Bollinger Bands are inside the Keltner Bands and the Markets are set to be in a squeezing, building up energy. However, when volatility increases, the Bollinger Bands widen and engulf the Keltner channel, it is this switch when the Markets transitions from consolidation, to a break out, to a trending Market. The TTM Squeeze indicator attempts to alert you this event happens.

I’m a Supply and Demand trader, where I wait for price to get to my price levels/zones, but why not take advantage of these price moves to these levels / zones.

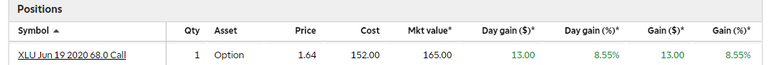

Utilities Select Sector SPDR Fund (XLU) is an ETF that seeks to provide investment results based on to the performance of publicly traded equity securities of companies in the Utilities Select Sector Index.

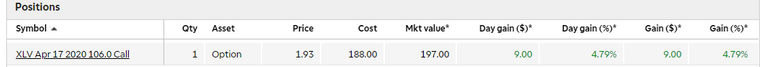

Health Care Select Sector SPDR Fund (XLV) is an ETF that seeks to provide investments results based on the performance of publicly traded equity securities of companies in the Health Care Select Sector Index.

Sector rotation is the action of shifting investment assets from one sector to another to take advantage of cyclical trends in the overall economy in an attempt to beat the market. Sector rotation seeks to capitalize on the theory that not all sectors of the economy perform well at the same time because sectors of the stock market perform differently during the phases of the economic and market cycle.

With the US equity markets at all-time highs and in overbought territory, the Markets are due for pull back. Thus, during the inevitable pull back, I’m expecting the money to pour into the Health Care and Utilities as defensive plays.

Utilities Select Sector SPDR Fund (XLU) is at all time highs

So, I bought 1 call option that expires in June with a strike price of $68.

Health Care Select Sector SPDR Fund (XLV) also at all-time highs.

So, I bought 1 call option that expires in April with a strike price of $106.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.