Forex $1 MM Challenge - Trade #24 (1-22-20) Sold USD/CAD

Two months ago, the Bank of Canada held its overnight rate at 1.75% and cited signs the global economy was stabilizing, helping send the Canadian dollar to a two-week high as prospects for a rate cut faded. The decision to keep rates on hold was due to unexpectedly strong growth and consumer spending expanded moderately while housing investment was also strong in the third quarter.

Today, the Bank of Canada met once gain to discuss their interests rates. Although the put their overnight rate on hold again, the cited a weaker outlook on the economy.

“Data for Canada indicate that growth in the near term will be weaker,” officials said in a new policy statement. The slump could “signal that global economic conditions have been affecting Canada’s economy to a greater extent than was predicted,” the statement said. “Moreover, during the past year Canadians have been saving a larger share for their incomes, which could signal increased consumer caution.”

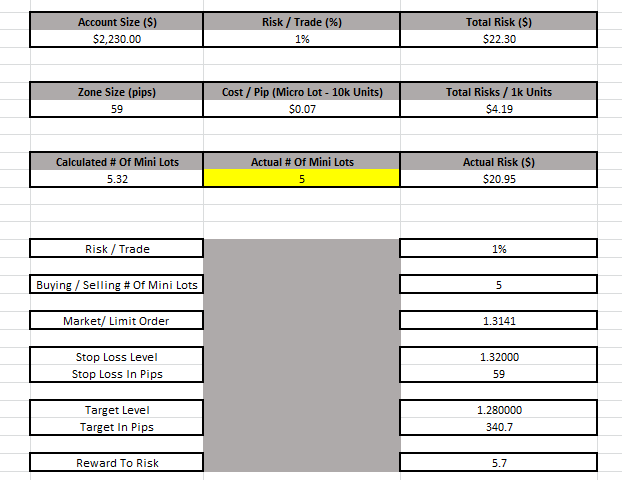

On the news the Canadian dollar sold off against the US dollar. Nevertheless, I went short USD/CAD.

Monthly Chart (Curve Time Frame) - the monthly supply is 1.36500 and the monthly demand is 1.24000.

Weekly Chart (Trend Time Frame) – the trend is sideways with downside bias.

Daily Chart (Entry Time Frame) – thus the chart suggested to short price at the daily supply at 1.31700.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.