Bond Analysis Report - 30-Year Treasury Bond Hits All Time Lows

Interest rates and bond prices move in opposite directions. When interest rates fall, bond prices rise and when market interest rates rise, bonds fall (which is known as interest rate risk).

Lets say a treasury bond offers a 5% coupon rate, and one year later, interest rates fall to 4%. The bond will still pay a 5% coupon rate, making it more valuable than new bonds paying just a 4% coupon rate. If you sell the 5% bond before it matures, that bond will be in demand, so that bond will sell at a higher price. But what if interest rates rise from 5% to 6% If you sell the 5% bond, it will be competing with new treasury bonds that offer a 6% coupon rate. That 5% bond will be in less demand and will sell at a lower price.

U.S. Treasury yields extended their weeklong slump on Friday as investors worried that the economic impact of COVID-19 may not be contained to China, and is spilling over into neighboring regions.

The 10-year Treasury note yield TMUBMUSD10Y, +0.00% fell 5.4 basis points to a more than five-month low of 1.470%, contributing to a weeklong decline of around 12 basis points.

The 2-year note rate TMUBMUSD02Y, +0.00% slipped 4.5 basis points to a three-week low of 1.348%, extending a 7.6 basis point drop this week. The 30-year bond yield TMUBMUSD30Y, +0.00% tumbled 5.4 basis points to 1.917%, sliding below its previous all-time low of 1.95%. The long bond’s yield fell 12.6 basis point this week.

Historically stocks have outperformed bonds because there is a higher risk in owning stocks. Thus, bonds are safer than stocks and also are inversely correlated to stocks. As a result, when stocks go up in value, bonds go down…typically in a risk-off environment. However, when the economy slows, consumers buy less, corporate profits fall, and stock prices decline and investors rotate their money into bonds.

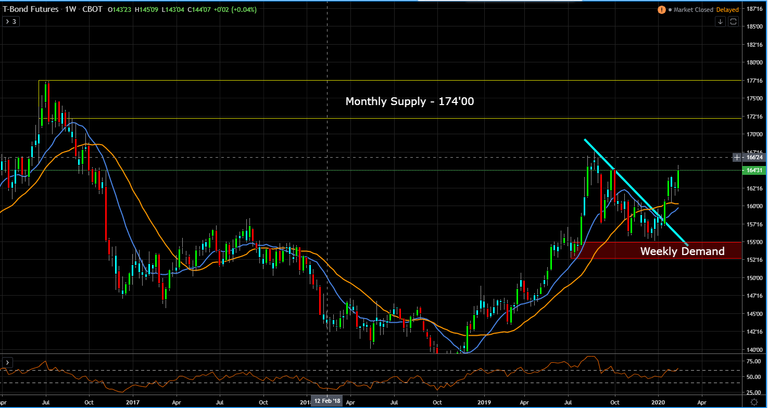

Despite the US equity markets continuing to move higher, that fact that yields are low and certain ones at all-time lows should be a warning sign. Thus, I see yields going much lower…because central banks are going to continue to cut rates to try and keep the party going. And if you remember diagram above, as interest rates fall, bond prices move higher. So fundamentally and technically, look for the 30 year bond to move higher to the monthly supply at 174'00.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

The fact that rates have hit an all time low on the 30 years is very telling.

We truly are in unchartered waters here with the economic environment we are operating within.

I think you are right, the Fed will do whatever it can to keep things pumped up. Look for interest rates to hit zero and the balance sheet to really expand.

Posted via Steemleo