US Stocks (03.23.20)

FED Intervention

By 8am the FED had made a dramatic move in summary they were going to start infinite QE and buying back all types of mortgage back loans and corporate debts. They were simply just shy of saying that they would buy stocks. The news burned shorts who held and the ES futures reach up to +80 points into green territory with less than half hour from opening session.

Story Here:

https://www.zerohedge.com/economics/fed-unleashes-unlimited-qe-will-buy-corporates-munis-cmbs

Stock Volitality

As prices started out at highs of the session it would go on in a whip saw between bulls and bears with a slight advantage for bears.

Despite the significant price movement one thing that was significantly different in today's trading has to do with volatility.

With VIX falling while markets falling it seems to give signs that selling is abating. This is because the cost of premium on options are falling. What could been in play is traders see future price swings lessen with the lower VIX.

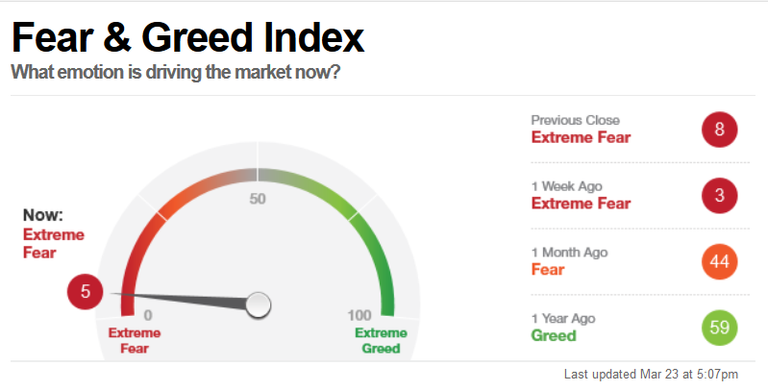

The fear gauge is still near all time lows so seller exhaustion is viable.

The difficulty in trading today is due in part that the price was moving in either direction and nothing really trending with regards to the SPY. The end result was if someone pick the wrong end of the highs or lows they would have incurred a lost. On top if they were trading options the IV decay was also dramatically losing price values.

A Bounce?Currently futures for the SPY is up 2.5% and there are many outside factors that may fundamentally help lift stocks up. Thru the weekend congress was trying to pass a stimulus bill to assist the country's struggle with Coronavirus but it ended in Monday as a no. The Republicans are going back negotiating the bill to get it pass with Democrats but it seems there are struggles to get it done. There are news outlets mentioning that a bill may not pass until Friday leaving a lot that can still happen in stock prices until Friday.

Another note worthy news event coming is this Thursday's anticipated weekly unemployment number. The fear is that the unemployment number will be in several millions leading many investors to believe the economy has not only stalled but falling apart. This news will be worth looking out for as it may factor in on how stocks do.

All in all with outside news and volatility falling it is still a difficult market to trade in. I was in some short puts on SPY from last Friday but after witnessing the morning pre trading session burn shorts

I closed out my puts right near opening of trading session and never put on another trade. There were too many outside news that could basically push stocks higher even though the current trend is to the down side.