Future of cryptocurrency: war of utility tokens. How can Steem win the war which has lost current battles (i.e. low ranking).

If you look into the top coins in the coinmarketcap, you will find that BTC, BCH, LTC, BSV, IOTA, DOGE, BTG, Nano, Mona, privacy coins DASH, XMR, BCN, ZCash, all they are vying for store of value. They are not good as transnational currency due to speed, fees and volatility. Stable coins are taking their place.

For example, I can buy USDC from coinbase with not cost, sell it for BTC in @binance to buy Steem. I don't bother to buy BTC or LTC to buy Steem or other things if I can buy Steem directly with USDC. I only buy Steem at 0.2% cost at Binance with USDC if they had a pair.

Current status-quo

There will be few coins such as BTC, BCH and LTC can serve as store of value. The question is that which brand will survive in the long run. My bet would be on BTC, LTC and BCH. I don't see any future for the rest of the pack: BSV, IOTA, DOGE, BTG, Nano, Mona. To keep their brand, they have to keep branding.

PoW coins have very little things to develop. All these scalability is patch up for the wounds (built-in slow speed) nothing innovative.

For privacy coin: ZCash, XMR, DASH will linger due to niche demand in the dark market. However, BCN has lowest fee but bad reputation.

In the very long run, we will have few store of value based coins (BTC, BCH, LTC), few privacy coins (DASH, ), few transactional currencies (mostly stable coins), rest of the coins will be utility coins such as ETH, EOS or Steem.

Battle of utility coins

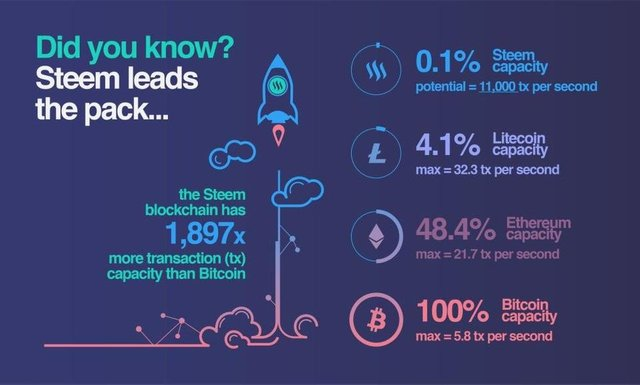

The real war will be in the field of utility coins, since developments and innovation are literally endless. Steem already had 22 HF aka improvements. Utilities coins are already scalable thousand times better than legacy coins such as BTC or LTC. PoW coins BTC or LTC does not provide utility other than store of value. They have failed tremendously as transactional currency.

The war is that which utility coin can provide the highest scalability such as millions of transactions in a second with low cost. Steem almost provide such utility without fee. However, for that to happen one has to invest a little amount of money (e.g. 50 Steem= $8.5) only once. Hundreds of utilities can be implemented, only limit is the bound of imagination and complexity of the implementation.

Steem already has advantages of low cost infrastructure thanks to MIRA and one of the highest scalability solution in the industry. It has tens of thousands active audience aka community, no other utility coin can provide. Lunch a handsome DApp, one can instantly reach to 10Ks of users who are DApp savvy. Imagine that when Steem can have 100 million accounts or few million active users. Devs and entrepreneurs will jump ship from other hyped coins and BUDIL on Steem. Steem has already building the infrastructure. The builders will arrive sooner than later.

Short-term solutions

One of the weak point of Steem is its current price point, hard to acquire (e.g. few exchanges and fiat pairs) and relatively higher inflation. One of the solutions (which may be implemented in future: see comment section of the blog) to improve Steem's price is to restrict Steem's inflation for worker proposals, witnesses (50-100 instead of 20), and PoS stake. APR for hodling SP can be increased to 4% from current 2%. and decease inflation for reward pool altogether.

Rewarding contents should be done with SMTs/Scots other than Steem. STINC or @busy, @steempeak can launch their own token. Then the success of the token will be depend the the company or founders behind. DApp founders can play with their own algorithms for reward pool, burning policy, buyback with Ad profit or whatever they think it will be appropriate.

Steem will be only required for transactions (RC), RC requirements for onboarding new users and speculation.

Even current inflation will be sustainable if Steem can onboard 10 or 100 million users through its plethora of DApps. Active users will need SP to transact. They may not earn Steem but other DApp tokens.

Though Steem has lost the battle to hyped coins such as TRON, Cardano or EOS, it can win the war in the long run since it has certain advantages of low cost infrastructure, scalability (10Ks of transaction in second) and 1.3M accounts. To win the war, Steem has to onboard 10s of millions of new users which is quite possible.

Disclaimer: This opinion is not a financial advice, it my personal perspective and opinion. Please seek professionals for financial decisions.

Thanks for reading.

@dtrade

Cryptominer since 2013, occasional trader and tech blogger

Congratulations @dtrade! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

The biggest challenge currently (in my opinion) is that Steem has implemented all of these great improvements, but.. Binance, Bittrex, OpenLedger have been slow to upgrade their wallets/nodes so that traders can withdraw Steem after purchase.

I think this is severely holding the price down. Buyers become impatient and dump what they are unable to withdraw. We had a small rally the other day that has since been lost as traders are stuck unable to withdraw. Steem's current price is a STEAL. But, you have to be able to use it. :-/

I wrote a bit about it on my blog. I will post ETAs if I am able to determine any. If you have any insight on this, please let me know. Thank you.

https://steemit.com/steemit/@minerthreat/the-answer-to-the-steem-price-mystery-could-be-exchanges-with-wallets-in-maintenance-mode

Basically, exchanges have lower priority to upgrade their Steem exchange nodes. Two things- trading volume is low for Steem and therefore they don't give a priority to Steem and are performing other maintenance. Or, Steem node upgrading is a difficult for them, they are procrastinating and contacting STINC (who are slow to response).

Hitbtc, Kraken, Bithumb, all these top exchanges have disabled transfers for months some years. Steem has known big problems with exchanges. Exchanges like OKex and Bitfinex do not have Steem pair yet.

Steemit corporation has been negligent about exchanges. Usually, more active foundations from lower ranked coins have listed their coins in many more exchanges.

One of the big listings for coins is that most are ICOs and ERC20 (ethereurm) based token. Most exchanges has infrastructure for ERC20 token, therefore, they can easily list another small coin.

But setting up and maintaining Steem node could be hard both technically and financially. STINC has not actively think about this problem. However, their priority is SMT and they lack people & funding.

EOS with similar difficulty was able to be added in many exchanges. They have bigger funding, more developers and aggressive attitude for listing.

Hmmm. I really don't know anything about this at all, but seems like this could be a good opportunity for someone adept at node running could make an arrangement with an exchange and help get STEEM on there.

Say someone like @anyx. They could approach an exchange and offer to setup and run a node for them at little cost or a percentage of trade profits if they would agree to list STEEM. Or maybe Steemit themselves could do this.

I don't know @anyx in any way and from what I've read, that doesn't seem like something they would do. Any one of the really skilled node running developers could do this, make a little profit, and possibly help shoehorn STEEM in on a major exchange.

Could be a win-win for somebody. They would be a STEEM hero :-)

Crazy to see Cardano and its market capitalization with little to no working product. If valuation was based on potential or promise, imagine the price of Steem with our community and Dapps!

Posted using Partiko iOS

They have a great marketing guru as CEO, Charles Hoskinson, former ethereum developer and eloquent speaker of blockchain. Moreover, ICOs lunched in the last bull market has certain advantages of collecting larger funds that they can use for marketing or even buying back coins to create a support level. Moreover, being an ERC20 token and marketed to moon, Cardano is a pipe dream for frequent crypto-traders in large number of exchanges.

I understand why everyone is so focused on the price as being a top 100 or even a top 10 coin on CoinMarketCap is huge free advertising for projects.

I'd be more focused on how to use Steem to create value. The projects that create the most value are the ones that will succeed in the long run.

It's true but price attract users, entrepreneurs and developments. The projects that create the most value also depends on the funding. The more price falls, the greater the sell pressure from STINC (they have to sell more to pay their employees) and other DApps. Developments can decease and it can death spiral to bottom. Many bright and promising projects died due to out of cash or lack of cash flow. STINC already fired 70% of employees due to lack of funds.

Yeah, I get it.

Just hoping that eventually, people will see what a great buying opportunity this is and then we will all be sitting pretty.

I have the seeds for a couple of projects floating in my brain. I’m a systems engineer and not a developer but I understand the power of a mature development environment when building a non-trivial system. How good are tools (which includes documentation) for building DApps in the steem ecosystem?

A great DApp (in my mind) would be one that has intrinsic value apart from steem such that its users would be unaware of what infrastructure it was running on. In that scenario the price of steem would have no impact on the project. Its own tokens would be what people would invest with, and that would have a value with respect to steem (and other currencies, of course). That’s where the devs and investors would get their reward.