Dollar Cost Averaging, CTP and Lifestyles

Katipalala katipa! > Ifaranga ku meza.

That's a famous, and one of the rare easy to remember riddles in my native tongue. It translates to;

Katipalala katipa! > Money(coin) on the table.

Always have some liquid steem ready, just in case there's a dip.

Dollar Cost Averaging:

Over the last few weeks, one term I kept seeing pop up was "dollar cost averaging." Too much was too much, I got intrigued and looked into it. Paraphrasing from memory, from the random website I read it on, dollar cost averaging is;

Setting up a specific amount of money that will be used to buy a particular bond/stock/crypto repeatedly after a specific period of time, preferably monthly. Buy high, or low. Overtime, the costs should offset themselves, and moon will inevitably come if it's a good project. No one can time the market.

What I gathered from crypto peeps;

If you can afford to lose your principle, buy whenever there is a dip. Small or big doesn't matter, if the project is a good one token should eventually moon. No one can time the market.

I went with the latter.

I loved the concept, like a lot! As much crypto/trading content I've consumed over the last year and a half, I still get bored and confused relatively fast whenever ETAs, inverted curves, and whatnots start becoming prevalent. So DCA did seem more in line with the passive income lifestyle I'm pursuing.

I decided to try it out as opposed to buying in relative bulks all the time, what I had been doing so far. So I did, and so far I'm loving the results. I've done it for a couple of tokens already but for the sake of brievety, I'll only discuss 2 of them here.

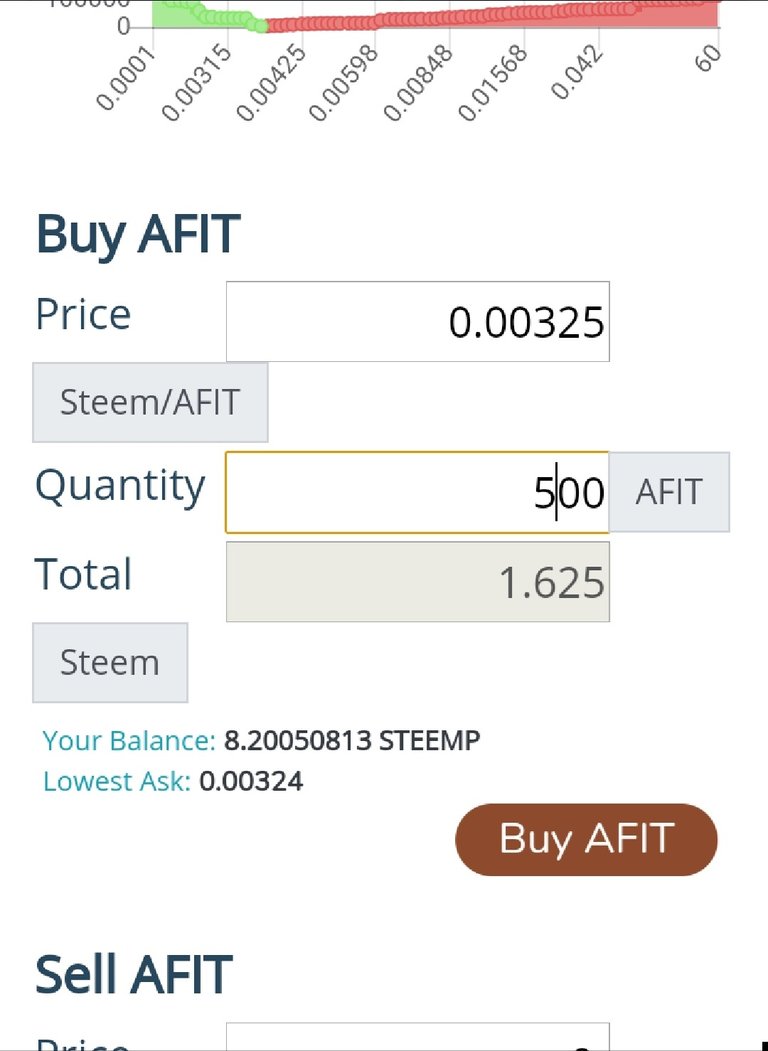

AFIT:

When actifit put their afit token on steem-engine, I knew i had to get some ASAP. So I immediately 2k of them and luckily, it was before a lot of people caught on to it so on that purchase alone, I made some great returns.

But then, as if by fate, the price dropped 20-50% around the same time I'd just read up on DCA. So, I bought 500 AFITs, the price dropped a bit again a few days later, I bought 500 more.

Short term, it seems to be bullish again, nice! Long term, it's one of the steem projects I'm most on bullish on. If it does some crazy x increase I might take some profits, and if it does some crazy x decrease I'll definitely buy more.

ROR: Road of Rich;

If there's one thing crypto enthusiasts will never fail to mention, is how gaming will be among the first industries to be disrupted by blockhains and cryptos.

I don't mind, though I don't game as often as I used to, I still get the hang of the rules and gameplays fast and I like money. Win win. Plus there will also be some mechanism(s) to hodl and earn, a life savior if you don't play, or the tribes you are already involved in are overwhelming a bit. I.e Now.

About Road of Rich, I first started buying it around the same time they came around, I used DCA before I knew what DCA was though admittedly, it was mostly because I didn't have enough liquid steem. I have read up on the project through their several updates but due to lapse of time, and since most were read through Google translator, I can't really explain much about it off the top of my head. But how I can summarize it is;

World building, scarcity, marletplaces, hold and earn, South Korean, actual companies behind it, daily upvotes, mercenaries etc. Long story short, huge potential.

Sorry not sorry, go do your due diligence. You're welcome.

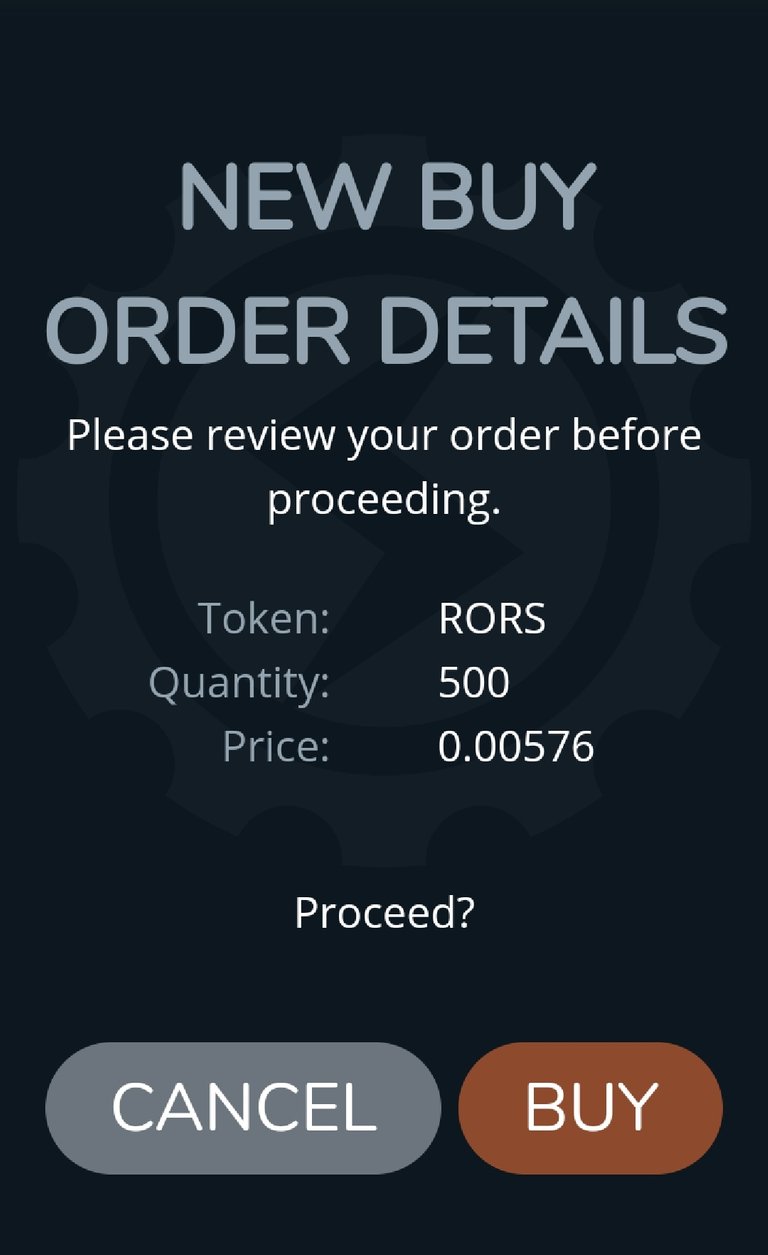

But back to DCA, I got my initial 7050 RORS in several sets, sometimes buying 300 tokens, other times 1k, and sometimes somewhere in between.

I sat on them for some weeks until last weekend when the token price had lost 50-70% of it's ATH value. Since DCA was the craze, I hastly purchased some 500 more tokens, and another 500 on Wednesday or Thursday.

X2

X2

As of now, the price has regained significant portion of if ATH and it seems stable for now, so, feeling good right now!

My plan with the token is to keep stacking when opportunities present themselves, observe what happens with the game/tokenomics for the first few weeks after it's official release, and then accordingly decide my next move.

So yeah, l that's been my story with dollar cost

Back to Instincts:

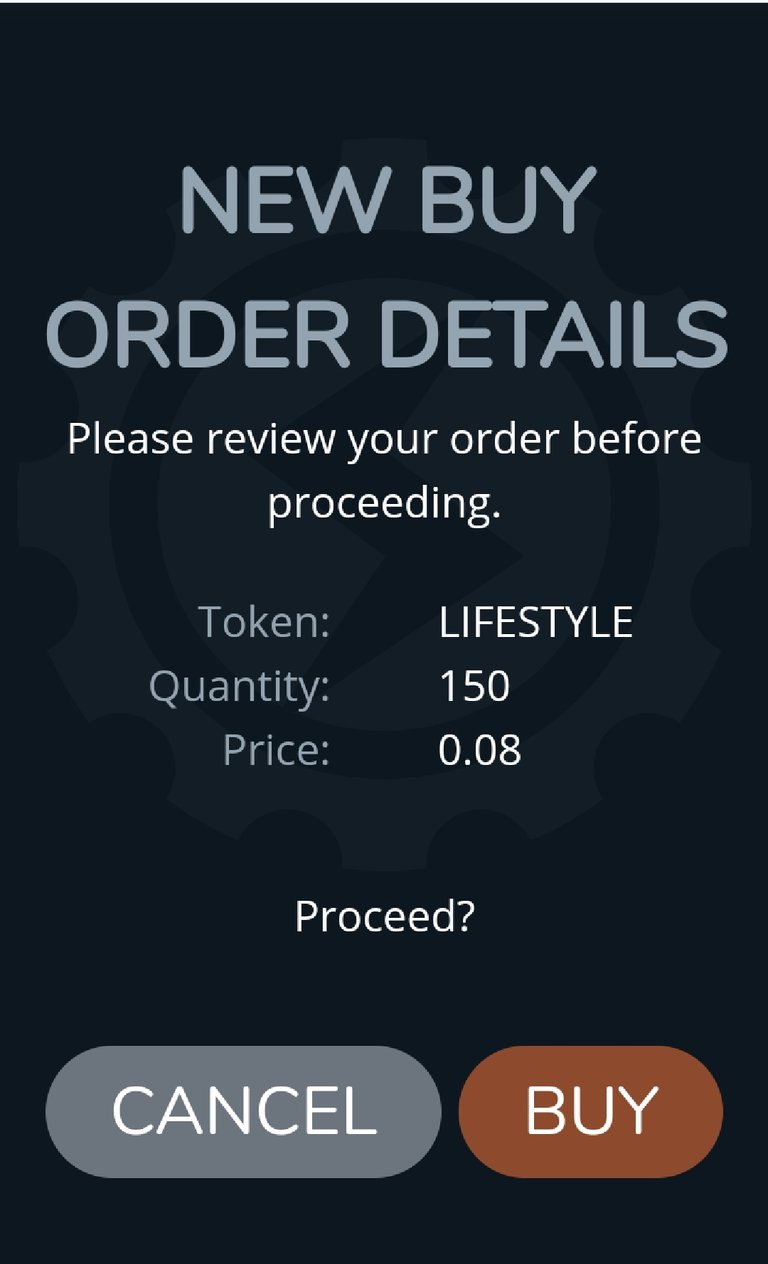

DCA being the new go to formula doesn't mean that if I spot an opportunity early on I won't splurge on it. I.e: Yesterday I saw the lifestyle tribe's announcement barely an hour after it had been posted. I quickly read into it, checked who was supporting it, and who would potentially support it. Quick DD done, I was in! Last night, I went and purchased 167(plus a buy order of 5 that eventually came through) at 0.08 $teemps per token, and another 150 this morning at the same price.

In ±24 hours, I've already made a 50% gains. Obviously this is cryptoland and it could go down 200% within the next 2 hours, none would be shocked. But, I'm a stay positive and bet a few more x gains are on the way.

Doubt I'll make the same kind of ROI as with CTP though. With the latter, I've already recouped my principle even though I still have 71 liquid CTPs and another 1k staked, and all that in less than a month I believe. Yup, I doubt, but who knows.

As I was finishing editing, I realized I'm starting to get cocky due to the recent gainzz, gotta keep that in check keep it in check...,

So yeah, that's been been my story with dollar cost averaging so far. Would love to hear your inputs, corrections related to my assessments, tips, you know the drill.

I do have most of the screenshots of the aforementioned buys and sells but what the hell.

Shoutout to CTP for financing at least a third of these recent lifestyles of mine, katipalala katipa:

Thank you for your continued support towards JJM. For each 1000 JJM you are holding, you can get an additional 1% of upvote. 10,000JJM would give you a 11% daily voting from the 700K SP virus707 account.