How @spinvest makes money and how much!

Hello everyone, as we get closer to the 10,000th SPI token being issued and things have been heating up with token sales mooning in the past few days and only under 500 are left until you can never got SPI tokens for 1 STEEM again. Today i will be mostly talking about what i am doing with the 9,500 STEEM POWER that @spinvest already has and how we are making money

Steem powered investments @spinvest has been set up to offer an investment fund based on funding from STEEM POWER. Investments are funded through extracting value out of STEEM POWER and taking advantage of STEEM's high inflation rate. The aim is not to get rich quick; the aim is to build a safe portfolio of investments that will stand the test of time while insuring all investors starting capital is not at risk. Full details can be found here

How SteemPower Investments is making money

SPI is set up to make it's primary money from leasing out STEEM POWER. Other things way include vote selling, curations trails and passive incomes. The project is still under a month old but has oalmost 9000 STEEM POWER leased that is getting paid for, an active steem-engine wallet that collects steemleo and palnets tokens and we already have our first off platform investment in the form of bitcoin. Things are only started and this is the best time to get involved, lets have a look at how investor's money is being used and what the returns are.

Leasing STEEM POWER

We can start with off market leases. These are lease's that i filled by myself and are normally for a monthly payment. Currently we have a 5,000SP off market lease with @steemcryptosicko which is long term lease with no end date in sight. It pays us 20 STEEM every Sunday which works to be 20.8% with no fees. Bigger lease's (5k+) will be done off market as i find they last longer with less cool down waiting periods and of course no fees can work for both parties advantage. I personally have a hand in a few upvoting bots and would have no problem locking up 30,000 STEEM POWER today and but there is potential for me to use my contacts to fill delegation requests for a few hundred thousand STEEM POWER so im not worried about running out of off market leases until we are at around the 300,000 mark which might take a while and gives plenty of time to plan. Planning now is pointless as crypto moves so quickly and im always learning new stuff, meeting new people and we cant predict 1-2 years away in crypto land.

Secondly we have on market leases, @spinvest is using @dlease for this. These lease's are plentiful and mostly under 5,000. Currently @spinvest has filled lease requests for 8 users totaling 3795.15 STEEM POWER. With a target of 20% we are doing well with an avg of 22.4% and i find if i check the site a few times a day i can get 20+% but they come and go quickly. The way delease works is they divide the total lease payment by the number of days the request is for and they send that amount to your STEEM wallet everyday. We currently receive a daily payment from dlease for all lease's of 2.56 STEEM per day. On market lease's will provide us with consistent liquid STEEM if ever required.

Vote selling

Im gonna really honest here, is this the thing i have not looked into that much at all. When i looked into it in the beginning it looked like here were 2 safe options, minnowbooster and smartsteem. I want with smartsteem basically cause the website interface and the information provided looks better with both earning around the same. Vote selling is set to sell votes to whitelisted members when voting power is over 90%. I have it set to pay weekly and it makes us around 3-4 STEEM per week plus a tiny bit of curation. Voting selling will not be a big earner as the plan is to have as much STEEM POWER leased out as possible and vote selling is more to make sure that unleased STEEM POWER is not being wasted and still earning something for us. As @spinvest grows, this could be something to look into as curation rewards are set to go up after HF21 and we might beable to take advantage some how but for now, it's just to make sure we are not wasting STEEM POWER in the @spinvest wallet.

STEEM POWER Inflation

This is something i never speak about but the STEEM POWER in your wallet increases over time. There are a lot of posts that show different percentages of what is paid out but i checked some stuff myself on steemworld and it works out to be around 2%. That means the 5000 STEEM POWER lease we are filling for @steemcryptosicko will be roughly 5100 after a year. It might be a good idea for me to manually redelegate off market leases every 3 are 6 months so this does not build that much, we dont wonna giving away STEEM POWER when it could earning.

Steem-engine wallet

Our steem-engine wallet is turning out to be a surprise in terms of earnings. Forgetting about worthless airdrops and focusing on ENG, Steemleo and palnet could pay very well and im undecided as to what to do with Leo and Pal tokens. Most airdrops will be sold within a week of being received and exchanged for ENG tokens for HODLing. @spinvest does not do any manual upvotes so do not see the point in staking Leo are Pal tokens at the minute. If the price of one jumps 50% in a day which can happen, we are not able to take advantage. When we have more of both i will look further into their delegating systems.

Within the week are so i will release a post pushing the idea of creating a curation trail so that we can earn more of these tokens, get bigger post payouts, get higher in trending and of course earn more money for SteemPower Investments. Here is the steem-engine wallet as it stands.

Geek, meep, god, future, meme and maybe the mot tokens will at some point buy exchanged for ENG. I dont see them being worth anything in 2-3 years time so why keep them on a gamble? I would compare buying these tokens to betting on a 3 legged blind horse that runs like a crab. Get rid of them and HODL ENG instead.

Post Payments

This is another thing we dont talk about but all post payouts for powered up so it is worth it if you are an investor to upvote, leave a comment and resteem my posts as your helping yourself. I spend hours writing this posts and it would be fantastic to see more support from investors. I will be using #spinvest, #steemleo and #palnet for every single post ever with the other 2 being more post content related. I have been posting once a day at about 9am GMT and will continue to do so. Like i said in last paragraph a curation trail will be started soon to help boost post outs. I currently have @steemcryptosicko upvoting at 50% on posts so there is curation there for others. This is something that will build overtime as i notice users auto upvote alot and rarely maintain there settings.

How much has @spinvest made to date?

Today SteemPower Investments is 4 weeks old and with 9500 STEEM POWER we should be making 146.15 STEEM every 4 weeks. Of course we have not have 9500 STEEM POWER for 4 weeks already but to keep everything simple. This is what we should earn based on making 20% per year from filled lease requests forgetting about everything else.

9500(SP) x20%(est earnings per year) = 1900 STEEM / 13 (13x4=52 weeks) = 146.15 every 4 weeks

I am holding back on on releasing the true SPI token value until the 10,000th token has been issued which should be within a day are 2. I can say that we have already made over 200 STEEM thanks mainly to post payouts and the steem-engine wallet. Im very happy with results so far and i believe its only gonna get better. When enough time has passed and SteemPower Investments has gained trust on the some level as for example SBI, there will be stopping us.

Under 500 SPI tokens left before token price goes up?

There are currently just over 9500 SPI tokens issued with under 500 left before the token is repriced and i host a 200 SPI giveaway for hitting out first target of having 10,000 tokens issued.

You can send any amount of STEEM you like to @spinvest and you will receive the same amount in SPI shares up to 2 decimals. All SPI tokens (shares) will be transferred to investor’s steem-engine accounts within 24 hours of sale completion .

Convert other steem-engine tokens to SPI tokens

Most of us by now earn a few different tokens through other steem front ends are have been airdropped tokens during launch ect. I have wrote a step by step post that shows anyone how to convert other steem-engine tokens into SPI tokens. You can learn how by clicking here

Resteeming is a wonderful way to spread the word and get as many eyes as possible on this. Let's get a buzz going

Discord Invite - Click Here -

I go by silverstackeruk#3236 if you would like to DM me

And the cherry on the cake

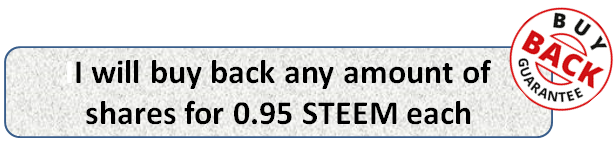

What do you have to lose? What token has a operator with so much faith they offer a 95% buy back

Few tips from me :)

That's just my 3 cents ;)

I'll check out both those tokens, steem monsters will be around for a long time.

As im saving up STEEM POWER, it is vote sold to earn some STEEM but i dont think i would ever be over1,000 STEM POWER. Would you have a rough number for a yearly percentage on delegating STEEM POWER as i like the reinvest option and i like tipu, i have been using it daily for my personal account and upvote bot account for almost a year.

For annual return please check https://www.steemprofit.info

For @tipu, if you set the reinvest to tokens and sell them on the market, the APR is pretty much x 1.6 (around 32% :).

32% !!!!!!!!! Thanks for writing back btw, most people dont.

Ok, taskmaster dropped me a DM telling me some stuff so im gonna give it try. To be honest i just like the tipu service, it's honest, it works and i can see your contactable easy enough which ticks all my boxes.

I'll drop 500-1000 SP later this evening and track it for a week. If the return pays out more than filling lease requests, you have a investor and i have another egg in the basket my friend.

to the future :)

Just remember to set the reinvest to 100% and in tokens :) at https://tipu.online

went for 800SP 👍 😎

All looks good, just set the Reinvest In: tokens ;)

Im glad i check for replies :) Thanks man, that's me all set and ready to pigpy back some of tip-u earnings to SPI

I just read this post, you have my attention @silverstackeruk

so you can exchange Steem for SPI one for one........Can you also delegate to SPI or is this strictly buying into the token???

Hey man,

At the minute, STEEM to SPI is 1-1 but im gonna be revaluing the token when i sell another another 400ish tokens. It's strictly buying only buddy, i have no use for delegated SP.

Please dont buy any, i have a power down coming tomorrow and i wonna get some at 1 STEEM for me. lmao.

You can buy directly from me at token cost and i'll transfer you your newly issued tokens are they sell on the SE exchange for 1.02 STEEM each if your converting worthless airdrops are other tokens you have earned, the extra 2 cent pays the withdraw fee.

I have Steem deposit clearing in a week and I like where you are going with spinvest and steemcryptosicko!

So .... if I invest Steem to SPI how are dividends paid out?

Or it it only token price ???

Is there a benefit to staking and or using #spinvest in my tags

Thanks for all you do..

So many questions Lol!👍

Posted using Partiko iOS

Thanks man for the nice comment.

SPI will pay dividends during certain parts of the coin distribution plan but the main focus is growth and paying regular dividends take away from the overall account value and reduce the value of each token. As the SPI token's price goes up, the market on SE will open up for investors to sell for a profit. No staking cause each token has to be backed by at least 1 SP. I dont understand how staking works for normal tokens that have no frontend are reward distribution. Using the #spinvest tag is really only for psts that contain content about SPI and the same way as SBI uses there tag. If your are writing any posts that have SPI content, it helps to get more eyes on the project which increase's token sales which makes all tokens holders more money.

Any other questions, fire away

Thanks @silverstackeruk, we definitely need to spread our investment around.....

I’ll consider this, I have a week before my Steem deposit clears.....

Cheers 👍😊

Posted using Partiko iOS

no worries

Congratulations @spinvest! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

There are no sell orders on steemengine, I have a buy order for another 100 waiting to be filled.

Yeah, nobody wants to sell them :)

I bought 9 of the tokens

awesome :) Good to have you aboard again

Thanks I appreciate the welcome