Option Trades: managing the iron condor.

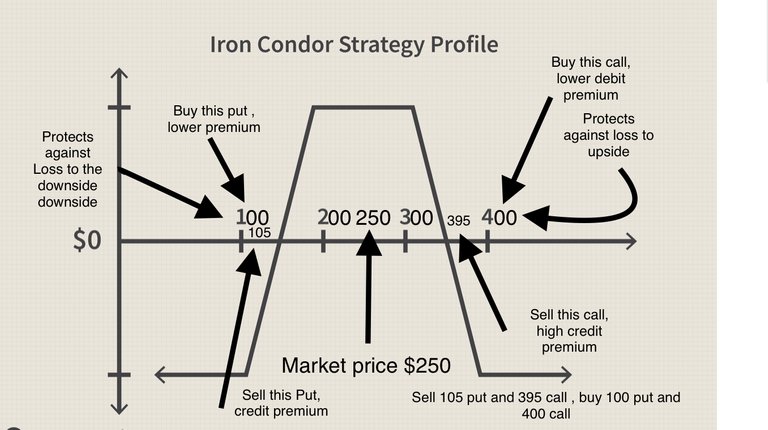

The iron condor is a options trade made up of four positions, two calls, two outs all on the same underlying stock company and all with the same expiration date. This allows us to earn premium on two vertical spreads, but only taking risk for one spread because it’s guaranteed that one of the sides will be successful , as the stock can’t close both below our put spread and above our call spread.

I like to place my strikes out in the 80-95 percentile range, the farthest out I can go and collect a premium 1/3 the width of the difference between the strikes. and our maximum profit is the net credit. The maximum loss is the difference between those two positions in dollars or cents times one hundred which is the multiplier because each contract is for 100 shares.

Example;

I sell a call spread on Apple.

Apple current price 200$.

I sell the 230 call for five dollars.

I buy the 235 for 3.5 dollars.

Both are multiplied by 100 shares per contract.

I buy the 235 price for $3.5times 100 = $350

I sell the 230 price for $5.00 = $500.

My net credit is 5.00 - 3.5 or 1.5 times 100 = $150, this my max profit or net credit.

My risk on the trade is 235-230= 5$ times 100=$500- minus my max profit or 500-150=$350.00.

I am risking $350 to make $150 and I have a 85% probability of success.

Now if I sell a Put spread on the other end of the scale at the 85 percentile.

I sell a Put 170. For $5.00

I buy a Put at 175 for $3.5

My max profit is 500-350 or $150 or net credit.

My max loss is the distance between the two puts $5 multiplied by 100, $500 minus my max profit $150, = $350.0.

Now I get both the Put spread net credit $150.0 and the call spread net credit $150.0, but since the stock can only close above my calls or below my puts, I don’t risk two $350 dollar max losses, only one. So in essence one spread is riskless, so my brokedoesn’t require me to tie up $350 times two or $700, only $350.

Management

I use the same management principle of watching my strike percentile position.

I start in the 80-95 percentile. I go out as far I can go and get premium equal to 1/3 the strike width.

I have two sides, put side and call side. If the stock moves toward the call side and broaches the 70th percentile, I roll the call side the away from the market price back out to the 85th by unwinding by buying back the position I sold, sell the position I bought and then recreate the spread further out. The software I bought does all the work. Then on the opposites side the put side I look to see if I can roll towards the market price, make a bigger premium and stay in the 85 percentile. For this move I need to be aware of cost of the move, it must not exceed the increased premium.

Thus if I lose a little premium moving the call side, I make it up by rolling the outside. If it was a big move I will consider doubling the number of positions on the put side.

✍️ Written by Shortsegments

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

I didn’t understand everything, but some things. Thank you

Posted using Partiko iOS