FED to print close to $500 billion by year end - why Bitcoin matters

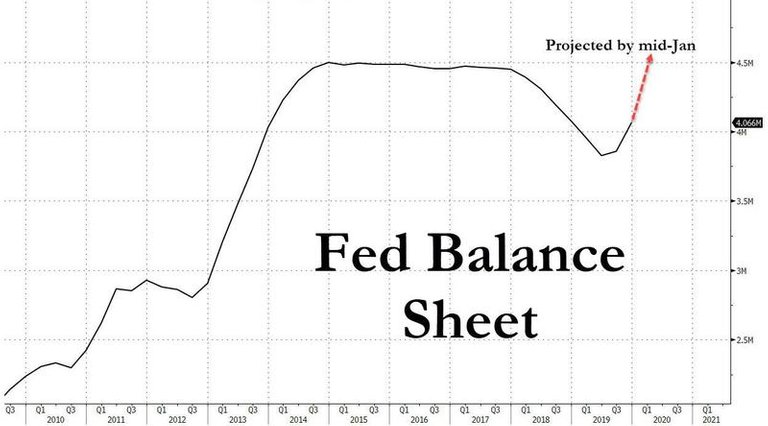

FED Balance Sheet will hold more than $4.5 trillion by mid-January which is the highest level ever

The FED balance sheet will be bigger than it ever has before.

Yes, even before the height of the financial bailouts and QE.

After the REPO market injections are done this month, the FED balance sheet is expected to go over $4.5 trillion for the first time in a while, and reach the highest levels ever.

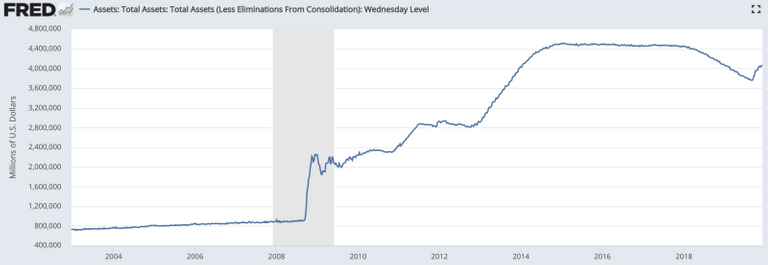

This is what the balance sheet has looked like since 2008:

It's mostly been straight up since QE and the financial crisis starting in 2008.

Though, there was a brief unwind of some of those purchases in 2018.

What intervening in the REPO markets looks like

Now that the FED has announced they will be flooding the REPO markets with liquidity, the balance sheet is suddenly on the rise again.

The reason for this is to keep rates within the target interest rate range, more of which can be seen here:

Either way, the activity will boost the FED's balance sheet for the first time in over a year.

In fact, as mentioned above, it will boost the total assets held on the balance sheet to the highest levels ever:

Though, be sure to not call this QE, it's technically not, even though the balance sheet is still expanding.

If it quacks like a duck, walks like a duck, looks like a duck, it's not QE.

This is why hard money and Bitcoin matter.

Stay informed my friends.

-Doc

Your post has been manually curated by FreeVoter Team.You can earn liquid steem by delegating SP to @freevoter !! We are now paying 100% daily earnings and 90% curation reward to our delegators !! Join Discord for more information. Thank you !!

Thanks.

Dear @jrcornel

Another interesting publication.

Amount of liquidity FED is pumping into their banking system is enormous. QE and REPO market are burning HOT. I can forsee more and more countries trying to escape usd as a form of international payment for oil and more military conflicts happening across the globe (US won't let it happen easily).

I've learned that printed money need to be backed up by debts. What is backing up money injected to system via QE or REPO? Any idea?

ps.

I've noticed that you've been posting sometimes about crypto, blcokchain and technology. I love those topics as well.

If you would ever publish anything related to technology, economy, marketing, psychology or steemit etc - then send me link in memo. I'm trying to support quality content and I have 2-3 upvotes daily to spare from @project.hope (over 200k SP) i my own account. I will gladly support your publications (as long as they represent solid quality :)

Solid read. Upvoted already.

Cheers, Piotr

Sure, thanks for the heads up. I do mostly crypto posts, with a few steem/steemit ones sprinkled in from time to time as well.

This one might fit?

https://staging.busy.org/@jrcornel/the-biggest-winner-of-the-last-decade-wasn-t-netflix-facebook-or-even-amazon-it-was-bitcoin

or perhaps some of my recent steem ones...

And to answer your question, nothing is backing US dollars except the US federal government (and their army). At some point that will be an issue, especially when other countries decide they no longer want to accept something that can be created out of thin air. Which may already be happening.

the mistake they made in 2009 and still they are continuing with that

Yep.

Great article, mate!

Having quite a large balance sheet can only mean that any financial, or economic crunch to come could have even less cushioning from the government, as I'm seeing a weakening purchasing power, and I doubt the FED could take in more assets on their balance sheet, at least without provoked attention.

That said, such an artificial method of boosting the economy, without first strengthening fundamentals could backfire. So, if anyone ever needs to hedge with cryptocurrencies, now would be the time to do it.

Yep. The invisible hand works until it doesn't. No one is bigger than the market and at some point that fact will be felt in a rather hard way.

Like I've said numerous times before, real value of USD is very close to zero as they print more money just to cover the debts they are piling up on top of each other. Eventually value of USD will be so small that other countries will hit the panic button and that will be the collapse of modern financial system and start of global crisis. It can only be fixed by pegging everything to Japanese Yen as it is tightly controlled.

How long before that happens? I'd guess it will take a while...

I don't know how long it will take exactly, but there is already signs that global crisis is getting closer and closer... It could be months or few years, but definitely less than 5 years.

Where I'm from, the government collapsed and the new government lasted just few days before it was close to collapsing too...

I think the collapse can be pushed back and kicked further down the road than most think... I wouldn't be surprised if people are still talking about the collapse that hasn't happened yet, 10 years from now. Just like they were 10 years ago, and then 10 years before that.

I try to be realistic, so I stick to the prediction that it will happen most likely within next 2 years, definitely within next 5 years. I also try to be optimistic, so I predict it won't happen within next few months.

I just remember everyone saying the exact same things after the 2008 recession... mostly in the years following... like 2010 or so. Well, here we are a decade later and they still haven't been right yet. I would not be surprised if it gets pushed back much later than everyone thinks.

Nothing is certain when it comes to future that isn't only few minutes from present moment... It's like weather, everyone makes predictions based on some model, but it doesn't have anything to do with facts...

All about assumptions and probabilities and past patterns. :)

People are inherently lazy... They don't do anything radical unless there is no other choice... It takes a big effort to change an average person enough to be willing to participate in a revolution. In the end, it's the common people who selected the people in governments.

Si.