Liquidity Lesson

Today, on another day where Bitcoin traded completely flat, we see that Steem has a lot of volatility.

From 14 cents to 23 cents and now currently sitting at 20.7 after dipping to 17.5, Steem is really all over the place.

Most people welcome this trend as it nets a positive gain, but personally it is a constant reminder that Steem has pretty horrible liquidity issues. Also, it's times like these where even seasoned veterans of the space show their ignorance of the markets.

For example, today some might have seen the market cap of Steem rise from $45M to $65M and thought: wow, $20 million dollars was added to the market. But was it really?

Nope.

Market cap is an extremely flawed measurement of value. It essentially assumes that you'd be able to sell every single coin of a network at the current face value. This is ridiculous. It means nothing. It is an extremely flimsy piece of auxiliary information that most people treat as the ultimate most important aspect concerning the value of a network.

Liquidity.

A crypto could have a billion dollar market cap valuation, but if it doesn't have the liquidity to back it up, you wouldn't even be able to sell 1% of the networks coins before the price flash crashed into the dirt. Liquidity is a much better measurement of value. How much money can you pump in one direction or the other without significantly sloshing the price around? Many consider this the true killer app of Bitcoin. No other project even comes close at the moment.

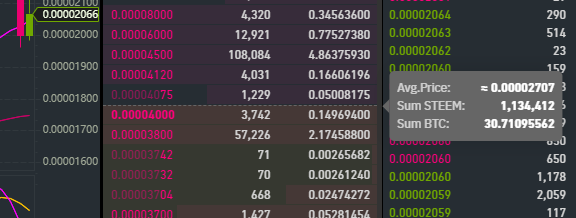

If we take a look at Steem on Binance, we see that it would only take 30 Bitcoin to currently double the price of a coin. That's right. Less than $300,000 would add $64M to the perceived market cap. It is in this way that we see how flawed the market cap metric really is.

Of course this is also an exaggeration, because we know that the STEEM/BTC pairing on Binance isn't the only market people are trading on. Even on Binance, there are STEEM/ETH pairings and STEEM/BNB parings. It would take 360 ETH ($63,000) to double Steem's price, and 3000 BNB ($54,000). If someone was aggressively only buying Steem with BTC on Binance this would create arbitrage opportunities and bots would start liquidating BNB and ETH and adding it to the BTC market.

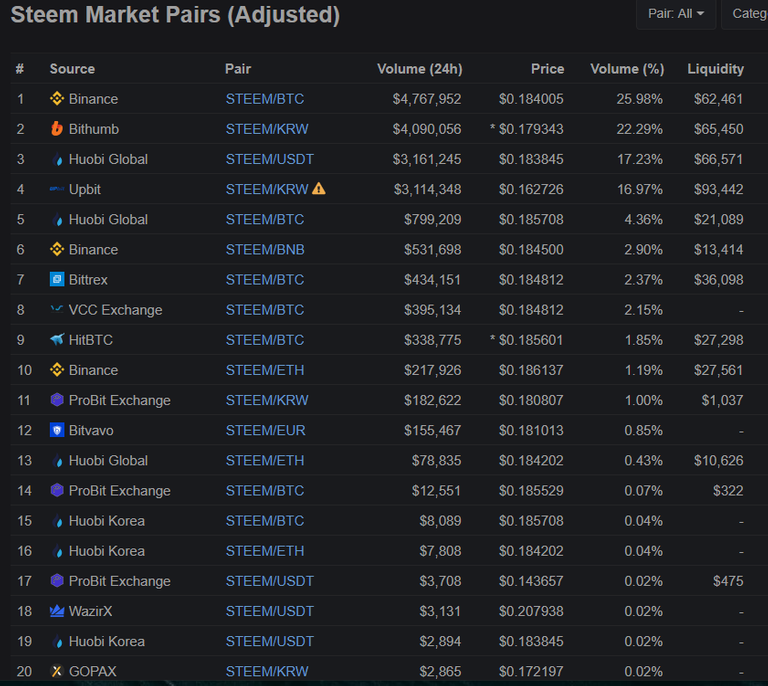

There are also other exchanges that trade Steem like Bittrex.

https://bittrex.com/market/index?marketname=btc-steem

However, looking at liquidity there, we see it would only take 9 Bitcoin to double the price on that market (and only 5 to be cut in half). Therefore, you get the gist of it. It takes relatively very little capital to move mountains when it comes to perceived market cap value.

Fake liquidity.

We also have to consider that bots dominate this space. Sell walls can fall away and reappear in less than a second using bots connected to the exchange's API. Wash trading happens all the time to make exchanges look more relevant. I do not trust the Korean exchanges volume or liquidity. Bithumb has almost the same volume/liquidity as Binance? Yeah right. I call bull shit. You have to be a Korean citizen to even use those exchanges.

Although I will say I certainly do appreciate how much Korea is goo-goo for crypto and think that they might end up being one of the richest countries in the world because of it over the next few decades.

Steem is worse than the rest.

We have so many mechanics that take coins off the exchange's liquidity books and lock it away. Powering up is the most obvious one, but even the SteemEngine STEEM-PEG token is locking away liquid coins in order to allow trading for all those other markets. SMTs will do the same.

Conclusion

Oh, look at that, Steem has dipped another 3 cents in the time it took me to write this. The volatility is insane, and it's not a good thing. It deters investors, and I'm much closer to understanding that mindset as I've been completely boxed in to the palnet and steemleo markets from a lack of liquidity. Let it ride! Many others are not willing to take that risk on a larger scale, and for good reason.

Essentially the only remedy for this is to keep chugging along and building more value for the network. The higher our market cap gets, the more liquidity (in terms of dollars) we will generate. Perhaps it's possible to create a DAO that helps estimate and regulate the price of Steem, but such an endeavor would likely be highly good-Samaritan based with little reward for adding liquidity to the markets (due to the ease at which to game the system with wash-trading). I guess it's something to think about.

For investors, liquidity is the killer app.

Users must be able to enter and exit the system at will if they desire.

And now Bitcoin breaks above $9k to $9.15k... this is getting nuts.

Oh snap! Didn't even realize about BTC! LET"S GO!

Also @theycallmedan brought up the whole liquidity issue earlier, but spun it in a positive direction!

Either way, we are due for some crazy volatility on the way up, but as the price of Steem lags behind, we'll get large pumps b/c of it in the bull market.

Yeah his buy walls very may well have contributed to the seller side getting blown out.

It's crazy to think that one person can manipulate these markets so much, and it's all totally unregulated and "legal".

That's actually a great point (yikes)!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

I really appreciate you posting things like this. I'm learning a lot!!!!! It takes me a while to get it but I'm determined. It's crazy, I've been here 2.5 years but don't really understand these types things. Have a !BEER on me!

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @cflclosers for you. Enjoy it!Learn how to earn FREE BEER each day by staking.

Have you tried to rank steem by trading volume on a monthly level?

I tried with CMC data ...and it ended in the top 20 .... I guess CMC data is a bit of ... but it may indicate that the coins between 20 to 80 ... have even less trading volume than steem ...

That wouldn't surprise me. There is so much garbage in front of us on the market cap.

Here is the post if you are interested

https://steemit.com/hive-167922/@dalz/ranking-the-top-cryptocurrencies-by-trading-volume-or-where-does-steem-stands

Interesting read and thanks for sharing. Definitely something I've noticed on LEO and PAL coins as well as it's much smaller amount and didn't realize how much Steem would be affected as well by such small amounts.