On Corporate Entrepreneurship in the Modern Era

The tale of Xerox’s Palo Alto Research Center (PARC) lies at the very heart of our current Big Tech bull market. That's because without PARC, there would be no Silicon Valley. Xerox, which gained prominence after World War II as its wartime products were successfully commercialized, founded PARC in 1970. Its location, on land leased from notoriously forward-thinking Stanford University and, perhaps more importantly, three thousand miles away from corporate headquarters in Stamford, Connecticut, was strategic. With a parade of intelligent, multidisciplinary researchers and without the restrictive oversight from the leadership of its traditional profit centers back in Stamford and Rochester, New York (where business leadership very clearly focused on xerography or what we call today photocopying), Xerox PARC created many of the innovations that form the backbone of the internet as we know it today.

Computer networking, bitmap graphics editing, object-oriented programming, the WYSIWYG text editor, graphical user interfaces (GUI), and the mouse all have their roots in PARC research. Yet, by 1982, Xerox stock had reached all-time lows ($4.56 per share split-adjusted for today’s share count) and even today the company is worth a comparatively paltry $8.8 billion. And that's even after adding on the value of Conduent (CNDT), the business services division that Xerox spun off in 2017. That's a far cry from the twin $1.4 trillion companies (Apple and Microsoft) that started their firms with ideas "borrowed" straight from PARC.

Back in the day, Xerox was the leader of the Nifty Fifty, a collection of high-growth tech-oriented firms from the early 1970s. They even became one of the select few companies in the history of the world to have earned themselves a place in the English dictionary as a verb. So how is it that Xerox has managed a sub-2% compound annual growth rate (CAGR) in the nearly 40 years since those 1982 lows? What lessons can we take from PARC? How can we not only promote such staggering innovation within our own companies but, unlike Xerox, actually capitalize upon its creation?

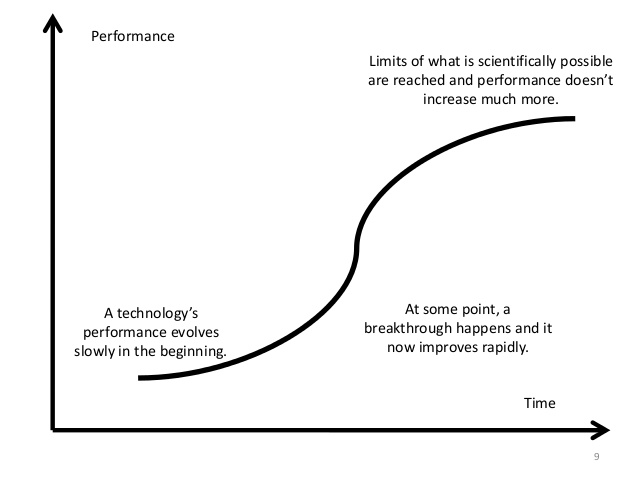

Part of the answer lies in properly managing S-curves. There are two types of S-curves: technological and market. The technology S-curve is simpler to describe. Years of research and investment may yield only slight improvements upon an original design, until one year, a confluence of accumulated tacit knowledge and technical breakthroughs creates a tipping point, after which tremendous growth can be expected for a time. Due to physical limitations of technology, at some point, this growth must level out, after which incremental investments cease yielding extraordinary gains.

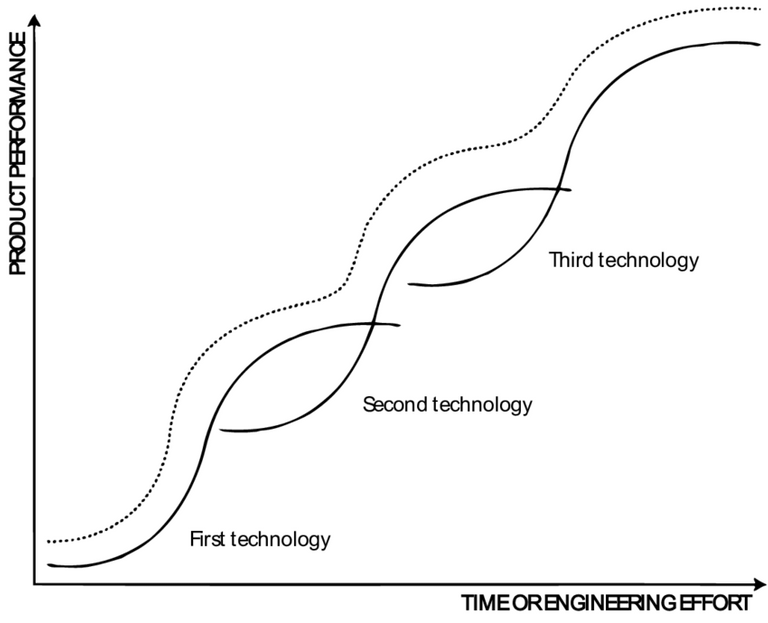

This technical description of the technology S-curve is not nearly as interesting as the interaction one S-curve has with other S-curves of either type. The lifecycle of an industry, or perhaps even the entirety of business itself, can be described as a series of chained S-curves. Companies that fail to see the oncoming S-curve risk falling into obsolescence. Think Netflix versus Blockbuster or iTunes versus the music industry. As the pace of technology increases in the twenty-first century, the ability to properly react to and forecast these cascading S-curves gets more important with each passing day.

Let's go back and time and imagine a PARC in the late 70s and early 80s. Back then, when the East Coast Xerox managers visited PARC to check on the status of their eclectic innovation team, the PARC employees derisively called them “toner heads.” These executives had made their way up the corporate ladder because they were good at selling copiers. As a result, the only thing they saw when they visited PARC were those projects directly linked to the copier industry. These Stamford-based MBA types were excited about the opportunity in laser printers! Yes, laser copiers would eventually make Xerox a ton of money, but they failed to recognize the hundreds of billions of dollars latent in the litany of other diverse technology being nurtured at PARC. They did not accurately forecast, or simply did not see, the market opportunities in these cascading technology S-curves for the future of Xerox’s business. In contrast, when college dropouts and avowed techies Bill Gates and Steve Jobs visited PARC, they immediately grasped the potential of these technologies.

PARC employee Larry Tesler:

After an hour looking at demos, they understood our technology and what it meant, more than any Xerox executive understood after years of showing it to them.

Adele Goldberg, a PARC researcher, refused to allow the future tech moguls in to see the works-in-progress without a direct order from above. She warned her superiors that they were “giving away the kitchen sink.” Leadership has to be able to make the hard decisions. Xerox could not. They were addicted to their “cash cow.” As Richard Foster states in his seminal essay, "Working The S-Curve: Assessing Technological Threats," when it comes to managing the technology S-curve, “sometimes it is necessary to cut off your arm.”

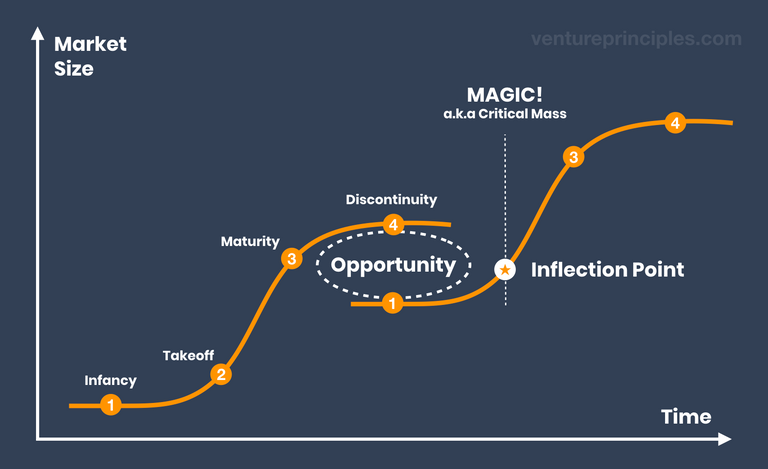

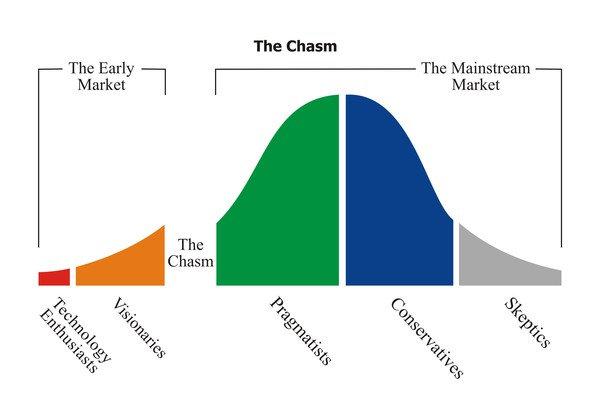

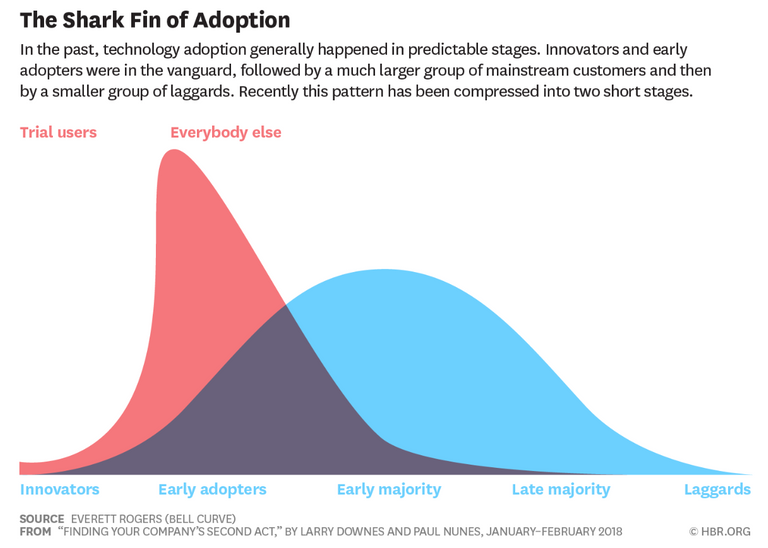

The market S-curve is somewhat different. New products compete for innovators and early adopters, hoping that these target segments will eventually lead other customer populations to use their product. Geoffrey Moore terms this transition from hipsters to the majority, “crossing the chasm.”

For Xerox, this process unfolded over the course of many years. At one point, it had a 100% market share in photocopiers. Alas, single products, particularly technological ones, have a defined life cycle. Like the tide, they rise and fall, making it paramount to catch the next wave. However, in the dawn of the technological era, this perception was not readily apparent.

The quickening pace of innovation fundamentally alters the shape of both of these curves. As technology entered the global virtual networked space, the physical limitations that had historically restricted growth disappeared. Consequently, a dominant technology S-curve now takes much longer before it flattens out. As knowledge becomes increasingly instantaneously distributed, the market S-curve shortens because there is no information asymmetry for one party to enjoy over another. While Geoffrey Moore initially segmented his model into five distinct populations, Larry Downes and Paul Nunes in their 2013 publication Big Bang Disruption describe it with just two: trial users and the vast majority.

In a recent HBR article titled "Finding Your Company’s Second Act", the "big-bang disrupter" theorists bring some hard truth about “near-perfect market information.”

Buyers are thoroughly informed about your product—including what other buyers like and dislike about it—at launch (and sometimes even before). Everyone who wants the product will adopt it immediately. Rogers’s other segments never arrive: Any holdouts simply wait for a better, cheaper product to be introduced by you or a new entrant.

In other words, when you're introducing new products into an innovative and hyper-growing space, you only get one shot. Get it right and stick the landing, you're on your way to unicorn status. If you bumble and fumble it away, "Yer done, son!"

But even with this shift in vocabulary, the importance of managing S-curves is manifest. How can a firm best manage these fundamentally important S-curves? The answer, as ever, lies in culture. The entrepreneur must set an example as well as provide a platform that sustains the entrepreneurial spirit of his company long enough to nurture it throughout its nascent growth period. The best leaders imbue their companies with that spirit to such a degree that, even once they move on, that spiritual resonance remains.

What if we think of a company as a hurricane? At the eye of the hurricane lies a company’s corporate culture, its essential essence. This center wields a centrifugal force of such magnitude that it continuously swallows up more things around it. Its nature not only governs the company’s relationship to each business element but it is also around this center that the momentum of profits coalesces. Such momentum compels the company to enter new markets and create new products, to push forward through time and through the inevitable change wrought to industry structure.

In almost every industry, corporate culture sets the parameters for a company’s value activities. The retailer extends his footprint. The manufacturer expands his output. The successful media company swallows up ever more tiny and not-as-successful media companies. Whatever the industry, the elements to success are the same. The strength and cohesion of the hurricane’s eye defines both its longevity and intensity. Through the vigilant maintenance of its branding, margin controls, technology, and finance, a company’s corporate culture is the critical link to success in each of these disciplines.

Time passes and the perfect storm rages on. The company’s reward for its attentiveness is increasing market share. At this high performance plane, a feedback loop exists where revenue expansion fuels increasing profits that, when reinvested wisely, fuel growth which contribute to further revenue enhancement leading to greater profits, and on and on...

A hurricane is an apt analogy for the modern enterprise as it moves through time in an uncertain era of perpetual volatility and inevitable technological change. At the center of his growing business is, by definition, the entrepreneur himself and the culture he has created that is, essentially, an extension of himself. Warren Buffett. Walt Disney. Steve Jobs. Bill Gates. Jack Ma. Jack Welch. Their experiences lead us to the same conclusion. Unleash the force of the hurricane… but create a culture strong enough to corral that force and pivot it toward the most profitable direction at a moment’s notice.

Posted via Steemleo

Enjoy a $trendotoken bonus from MAPX!

Please also take a look at @MAPXV and @MAXUV as MAPX tokens are almost sold out.

Thanks for being a member of MAPX.

Congratulations @map10k, you successfuly trended the post shared by @shanghaipreneur!

@shanghaipreneur will receive 4.00785975 TRDO & @map10k will get 2.67190650 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

According to the Bible, Bro. Eliseo Soriano: Should I join the true Church of God?

Watch the Video below to know the Answer...

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://steemit.com/created/hive-182074

A member bonus $trendotoken tip and !trendovoter for @shanghaipreneur from MAXUV!

Also consider our MAPR fund and MAPXV vote bonds too.

MAP Steem Fintech: growing your STEEM without SP.

Also, please take a look at our new Nonsense Writing Contest post with MAPR prizes.

Congratulations @maxuvv, you successfuly trended the post shared by @shanghaipreneur!

@shanghaipreneur will receive 4.04172788 TRDO & @maxuvv will get 2.69448525 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @shanghaipreneur, your post successfully recieved 8.04958763 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site