Why I think the stock market can still run on. At least for a while more...

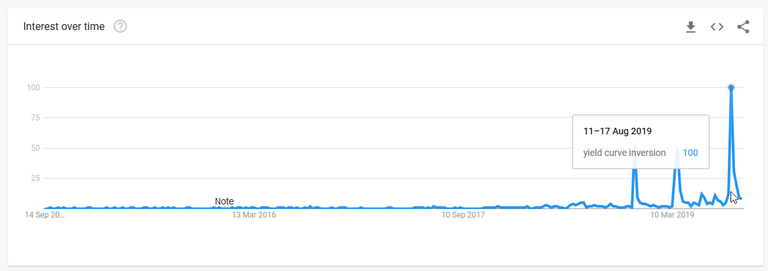

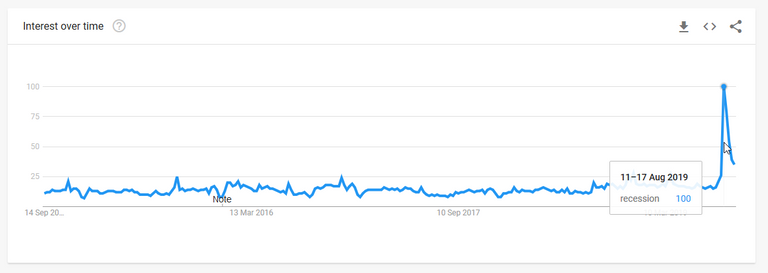

About 1 month ago, the mainstream media were all talking about a possible recession. The yield curve inversion was a hot topic. The search terms "yield curve inversion" and "recession" surge to multi-year high on Google Trends.

Source

If you are not one who follows the stock market closely, you probably still have the impression that it might be taking a hit. Yes, the S&P 500 index did take a hit in August and dipped almost 7%. However, things have changed recently and the market rallied strongly in the past 2 weeks. What is going on? Despite all these chatters on a possible recession, I think we still have one last run left in the stock market. Here is why...

Source

Yield curve inversion? Yes, but there is always a lag time

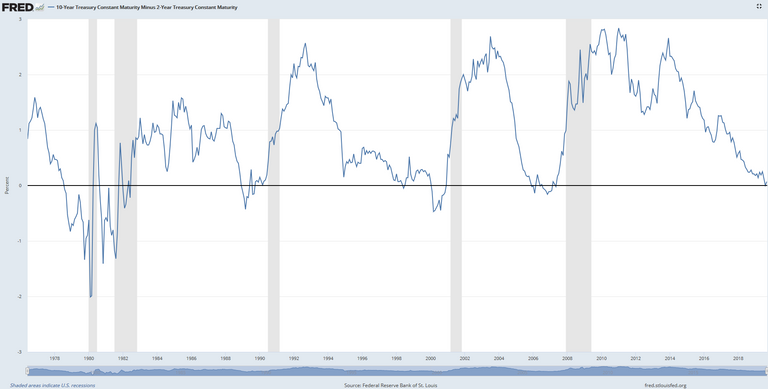

The inversions of the 10 year yield curve and the 2 year yield curve have been pretty accurate predictors of recessions. An inversion can mean that investors see more risk in the short run than the long run. Therefore, it is usually a sign of near term weakness and eventual slowdown to a recession. However, it is important to note that there are usually a 6 months to 2 years gap between each inversion and recession.

Source

In addition, from the graph above, the yield curve has barely inverted this time round. All previous recessions are preceded by a clear yield curve inversion. Hence, the mainstream media are kind of overplaying the event. For what reason? Hmm... I might have a possible explanation which I will cover later, so please read on.

There is still room for Feds to lower interest rates

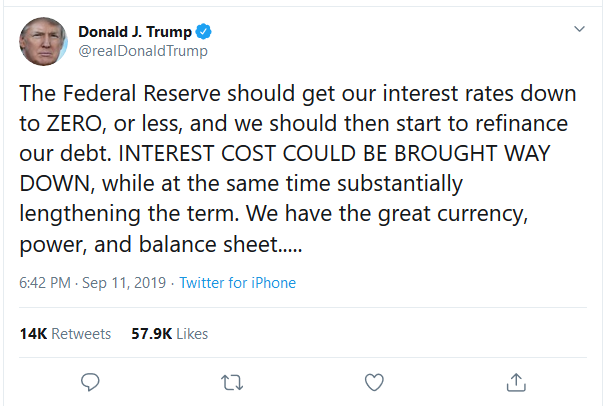

The US Federal Reserve interest rate is currently standing at 2.25%. It is still near historical low but there is still room to go lower. And as long as it can still go lower, the Feds will be pressured to do it. Even though lowering rates may not necessarily avoid a recession, why would they take the risk of not lowering rates and get blamed later if there is one? In fact, US President Trump recently tweeted and suggested that the Feds should introduce negative interest rates

The stock market will take the lowering of interest rates as a buoyant news and rally on it. The fact that there is still much room to 0% interest rate, I think the stock market will continue to be pushed up by the lowering of interest rates.

Trade war is all within Trump's game plan

If you are in Trump's shoes, what will be your primary concern? Will it be the US economy? Will it be the increasing wealth gap? Will it be the affordability of basic healthcare and education? Probably not. I think what is on the top of Trump's mind is the 2020 Presidential Elections.

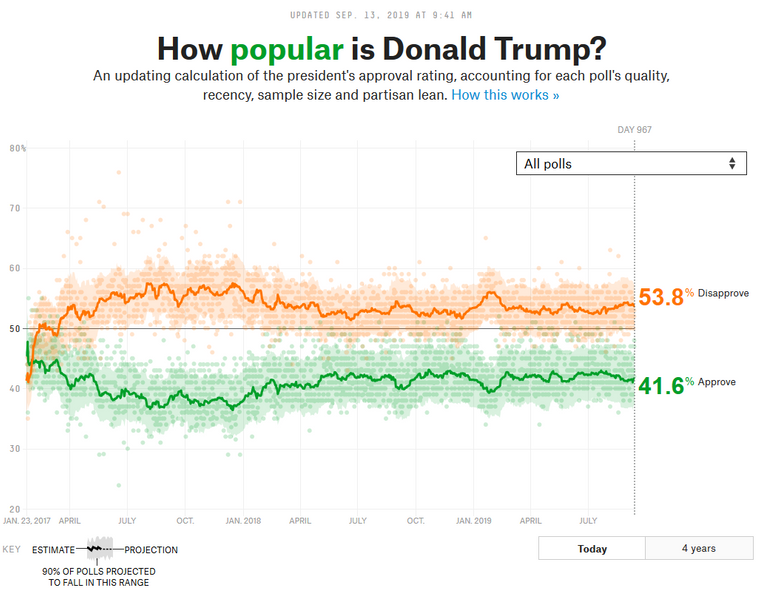

Trump's approval rating is not great and he knows it. From the aggregated poll on FiveThirtyEight.com (screenshot below), it is clear that he is not that popular. The worse thing that can happen right now is a recession which may dampen his chance of getting his second term.

Source

However, Trump is a shrewd businessman and he knows what he can and cannot do. He knows the cards he can play to at least kick the can down the road so that the recession doesn't hit him before his second term is secured. We know that he cannot directly order the Federal Reserve to lower interest rates. However, he can at least show his displeasure on Twitter and add on some pressure. Besides that, he can also play the game of trade war to create a sense of danger. A threat that might cause the US economy to slowdown leading to a recession. With this potential threat, he gives the Feds all the reason to lower interest rates.

Hence, I think the trade war is all in Trump's game plan. Not only does it create the sense of danger which aids Trump to manipulate the Feds, it also serves as a diversion from media attention of his lack of accomplishment in his first term. If all these go according to plan, I think the stock market will continue to scale higher until the end of 2020, giving Trump a boost for his bid to be re-elected.

Smart money are moving in

I remember seeing a quote circulated online which says,

"Don’t listen to what people say, watch what they do"

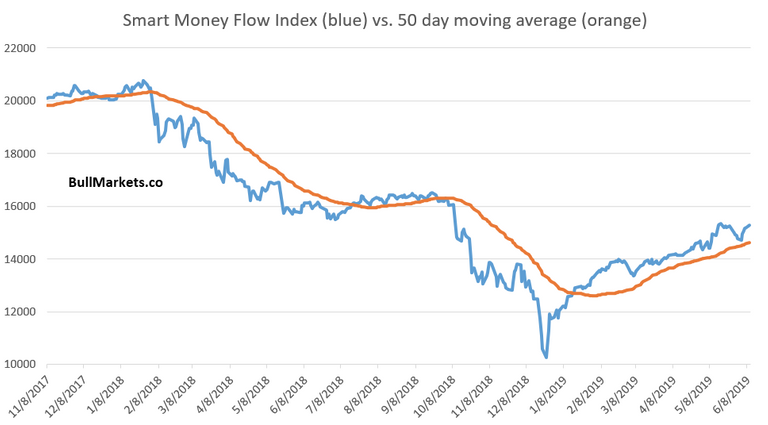

It is from an unknown source, but it makes a lot of sense. When there were a flurry of negative news in the middle of August, the stock market, despite being volatile, did not suffer a huge drop. This indicates a dissonance between news and the market action. Why? I have a conspiracy theory. I think the mainstream media were deliberately led to focus on negative news so that smart money (large financial institutions) can move in to buy stocks at a bargain.

Based on this article, we are seeing the smart money flow index rising since the start of 2019. This coincide with the correction in late 2018. Always remember that the smart money have more information that common folks like us. Hence, it is always wise to focus on what the market is doing than what is reported on the news.

In addition, according to Alessio Rastani (an technical analyst on Youtube that I am following), the smart money is heavily shorting gold. Gold is usually the default safe haven asset when the stock market is not doing well. If the smart money is shorting gold, that means they are expecting gold price to drop which naturally implies that stock is likely going to rally. Below is the video where Alessio discussed about this.

In this situation, my hunch is telling me the smart money are accumulating since January 2019 all the way till last month. The last month dip was just created for the smart money to accumulate further. Potentially, this might be the final stage of smart money accumulation. The next phase will be for mainstream media to start focusing on some positive news and slowly let the FOMO seeps in. When the FOMO is at the highest, that is when the smart money will sell.

Conclusion

With all these being said, I am not saying that the global economy is rosy and well. I think stocks are still very much overvalued and I stand by the analysis I made last year. A slowing economy does not always immediately lead to a stock market crash and that is what I think is happening. However, as the can is kicked further down the road and the bubble gets bigger, I expect the next crash to be as bad or even worse than 2007/08. Even though I think the stock market can still run up for a while, I am also being cautious not to chase it too much as any black swan event can suddenly result in a drastic move in the market.

By the way, this is not a financial advice and I am not a qualified financial adviser so please take this article with a pinch of salt. I will love to hear what are your thoughts on this.

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

thank you for sharing interesting information

Thanks for reading! Glad it is useful

Hi @culgin!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.037 which ranks you at #3884 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 109 contributions, your post is ranked at #56.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Sounds like a reasonable analysis. 😊

Hi @culgin

The yield curve inversion is indeed becoming very hot topic lately. There isn't a day I would hear about upcoming recession and I'm also strong believer that we're ahead of difficult times.

However as "we" I mean regural joes. Not asset owners and wall street guys. Thanks to QE and all those money printent and pumped into ecconomies, I would still expect stock martkets to grow stronger (that's where large chunk of those newly printed money end up right now).

Simply because lowering those rates is our "last weapon" to fight with recession and even FED is against lowering them right now. So am I.

Very true. So he is pushing recession in time. If he will win those elections, then we will actually be in real trouble (next president will have a real difficult time to clean current mess)

ps.

I've heard lately that switzerland already introduced negative interest rates. I wonder if more countries will follow. Any idea how that could impact world economy? Negative interests rates and it's consequences are very hard to grasp.

Upvoted already. Enjoy your weekend buddy,

Piotr

The long term impact of negative interest rates have not been tested in history yet. Theoretically, it is supposed to encourage more spending and more credit because one is technically being paid to borrow and paying a fee to save. It didn't quite work in Japan, probably it is an Asian culture to save money so that wealth can be passed down to future generations.

Another problem I see from negative interest rates is that without capital controls, the people there will have the tendency to keep their money in foreign currencies and banks. This might mean less savings in local currencies yet at the same time more credit in the market. Depending on how the balance is right now, it may not be a good thing

Appreciate your valuable feedback @culgin

I seriously wonder what would be long term impact of negative interest rates. Strange times we're living in. Current banking/financial system is spine of entire world economy and they are it feels like we all people are part of another global experiment.

I can also hardly imagine negative interest rates working fine without turning into cashless society. Don't you think that cash will be the biggest enemy for this sort of solution?

Yours

Piotr

I think cash isn't the problem. Cash is just a vessel to represent point-in-time value. I think the problems were easy credit and inefficient distribution of wealth for the past few decades. Unfortunately, now we are facing the consequences

Interesting... the markets I watch are really not that dependent on US then... nice to know though.

Which market are you watching?

Property markets... and large assets (like cargo ships, space rockets, etc).

@culgin, Yes, in this year there are talks about the Market Crash and time to do Preps but in my opinion until it happens it's not happened. It's vital to stay realistic sometimes and thoughts and speculations will not crash markets, until Economy falls down.

Posted using Partiko Android

Hi @culgin.

What we have here is a masterful explanation of the behavior of the market for investment, however I focus my attention on Trump's behavior, every politician, even an entrepreneur, has his sights set on popularity and the possibility of reelection and is willing to Do whatever it takes to achieve it, now, with experience as a Trump businessman, try to make every movement in the economy favor your choice or allow you to gain time to achieve it.

@fucho80

hey @culgin, i noticed you didnt stake your 1000 CCC (which was airdropped some two months ago). Also, if your post has some creative content, you can use the #creativecoin tag to earn CCC tokens ... just saying...

Thanks for the heads up. I rarely post any creative content but it still makes sense to just power up the CCC tokens or sell them away :)

Agreeing with you. A lot of what goes on is planned, i.e. the Euro. Also, transition from Western to Eastern cultural influence of Hing Kong.

Jackie Chan described the situation well in saying that Americans have no idea what its like to manage/account for billions of people.

I ain't saying the powers that be are good people. Many show quite the contrary. What I am saying is that the powers that care have a much grander task at hand than most anyone realizes.

I can't comment whether the situation in HK is staged. However, I won't be surprised if there are foreign influence. I think China is going to handle it well here as they are usually the one playing the long game

Yeah China will remain with a substantial influence at the very least. I wonder though, with impeachment talks and the life term of Xi, if the world will come out more decentralized in the coming years. HK remaining an influence for independent money would be magnified in a more dWorld.