Reasons why Ethereum looks poised to skyrocket soon!!

Another crypto after Bitcoin that’s listed in the top 100 biggest assets of the World

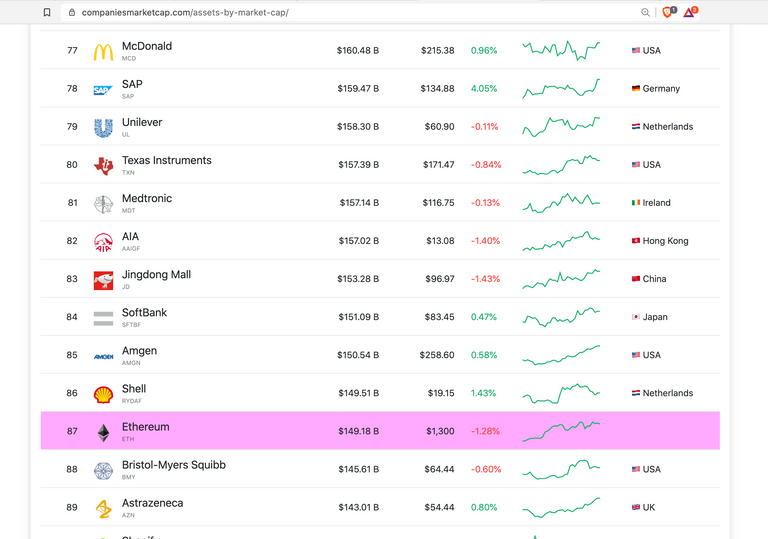

Ethereum, is another cryptocurrency that has made it into the list of the top 100 largest assets of the world in terms of its market capitalisation, with it currently ranked as the 87th largest asset by analytics website companiesmarketcap that monitors market capitalization of various asset classes - company stocks, precious metals, exchange-traded funds. Ethereum is becoming a major crypto asset with a market capitalisation of $149.18 B.

The crypto currency’s increased market cap is mainly due to its appreciation in price, which has already touched it’s previous ATH of $1417 on Jan 19 this year, however now ETH is struggling to cross that price level with resistance at 1400$.

Ethereum's Price Chart from tradingview

Ethereum is ripe for attracting investments from institutional investors

We are aware that institutional investors took into investing in Bitcoin, which was a major reason for the price of Bitcoin to touch as high as 40,000$. Now, they will start investing in Ethereum too. Ethereum platform, despite its scalability issues, has a head start compared to other emerging scalable and interporable layer 1 blockchain projects that are emerging as competitors to the Ethereum platform.

Advantage of Ethereum having been cleared as a cryptocurrency by the SEC

One must remember that Bitcoin and Ethereum are certified by the US Securities Exchange and Commission(SEC) as cryptocurrencies and not securities. Therefore US institutional investors would not hesitate to invest in these asset classes, as they can be sure that its accepted as a legitimate crypto asset class by the US regularly authorities.

Ethereum Futures’ launch by CME is coming up soon!!

One of the most prominent exchanges for Bitcoin Futures, Chicago Mercantile Exchange (CME) has announced that Ethereum Futures will be initiated on the platform in February this year, which will also be settled in cash just like Bitcoin futures in the platform are settled. Perhaps this will have more institutions pour into Ethereum now.

I heard that a major catalyst for Bitcoin’s price to pick up to bubble heights in 2017 was the launch of Bitcoin Futures by Chicago Mercantile Exchange (CME), maybe that same phenomenon will happen with Ethereum, to drive its price to high levels like perhaps 10,000$.

ETH price can shoot also due to supply shortage now

Meanwhile, there is a shortage in the supply of Ethereum, because lots of ETH are locked in the Beacon chain for staking. Therefore if high demand for Ethereum happens, considering institutional appetite for investing is generally far higher than that of us tiny retail crypto investors, then the price of a Ethereum coin could shoot up.

Layer 2 solutions are getting implemented to scale the Ethereum Blockchain

There is news of layer 2 solutions in the implementation stage by Dexs like Synthetix and Uniswap, which would increase the scalability and reduce fees of transacting in these dexs that are using the Ethereum Blockchain. So, exciting things are happening for the further development of the Ethereum Blockchain, which sets good fundamentals for the Ethereum price to skyrocket and soar

Please note this article is not investment advise and I am no financial expert, please do your research before investing and take responsibility for your investment decisions.

Hi @mintymile

Ethereum is surely going to rise, you have given important point to highlight in this whole crypto world. And if we rely on fundamental analysis all this impacts very positively on the price of this crypto particularly, and no doubt that it will also benefit the other cryptos.

Yeah... I too feel ETH is going to skyrocket like BTC did in 2017, that time I was not following the crypto world and now I am quite deeply in it only(: