Which Is Your Best Source of Money? Investing, Saving or Earning?

Summary

- Which Is Your Best Source of Money? Not always what you think.

- You should maximize your income and minimize your expenses first.

- Maybe you should invest in yourself.

- Investing is an important stage – later.

What Do I Make with My 1,000 Dollars?

One of the most common questions of people – like small investors, savers, employees – used to be: “How should I invest my 500, or 1,000, 10,000, etc. dollars?” But I think the more adequate question for many of you is different. How can I increase my incomes, and decrease my expenses? That can be your best source of money.

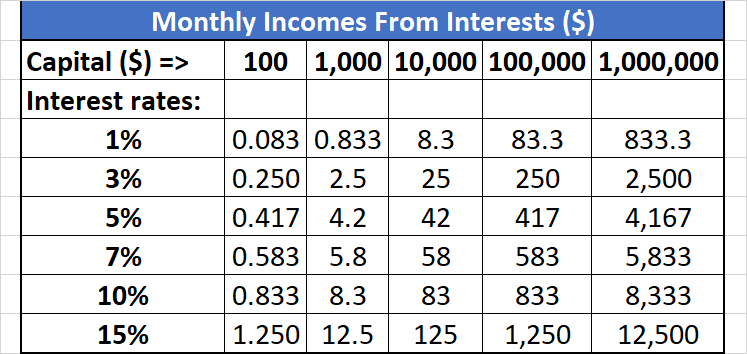

Why? Look at the table below. If you have, for example, 1,000 dollars, you can’t have a decent monthly amount of interests that matter for you. With three percent interest annually, which is a relatively good value nowadays, in 2020, you get $30 a year. That means $2.5 a month. In most countries, that can buy almost nothing. A coffee or a beer in some cities.

(Of course, different in every country. You can substitute dollars with your national currency, and prices with typical ones in your region. Jut make your calculation.)

Saving Money Is Great

That doesn’t mean you don’t have to invest your 500, or 1,000, or 10,000 dollars. In many years, and with the power of compound interests (interests on interests), these amounts can also be very useful for you. What I’m telling you is that you better don’t bother very much about the interest rates and don’t take too many risks. (Unless you want to retrain yourself as a financial expert.)

In your situation, it is better to learn how to earn more and how to spend less. It is much more effective for you if you concentrate first on your incomes and expenses. An example. Let’s suppose you can save those $2.5 – every day. You drink every day a coffee or a beer less. Or, you drink it in your kitchen instead of the bar, coffee shop, fast-food chain, etc. If you can save $2.5 every day, you save approximately $75 a month.

30,000 Dollars Versus 1,000

Guess what… This saving is the same amount as if you had $30,000 in the bank, bearing interests of three percent annualized, instead of 1,000! Saving is much more important at this initial level than choosing the right investing vehicle. (With 2.5 USD a day, you save 900 dollars a year, + interests.)

But I said, “earn more and spend less”. How to earn more? Maybe you can build some “passive income”, as many financial blogs are claiming. But maybe not. Because building passive income is mostly some sort of hard entrepreneurship, and maybe this is not for you. Not everyone has the necessary skills, or the willingness to do that. Making your own business is hard and risky, as I explained it here.

Which Is My Interest, to Invest, Save or Earn Money?

The best tactic could be to combine the three methods, investing, saving and earning.

Continuing, read More on Agelessfinance.com

(Photo: Pixabay.com)

According to the Bible, Is it sin against God if a law enforcer is forced to take someone's life in the line of duty?

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://beta.steemit.com/trending/hive-182074

It is important to always cut expense and earn more, great advice.

It is important

To always cut expense and

Earn more, great advice.

- chesatochi

I'm a bot. I detect haiku.

Thanks for reading and commenting.

Very good point!

thanks

Hi @deathcross

Invest more safely.

No, you must spend more than you can earn.

Save 10% of what you earn to invest in assets.

This would be a good way too, what do you think

How? Taking loans, making debt? Dangerous. Only if you are sure your investments return more than the debt burden. Banks are also tricky, a loan with 6 percent interest can mean in reality 8 or 12 percent

Hi @deathcross

Please excuse me for my late reply.

I think you didn't see the sentence well

...

Greetings friend.

I believe so much in

With this formular, am able to have more money to even invest.

If (hyper) inflation doesn't eat your savings. My next post will be about inflation.

After reading this fine article of yours, I am tempted to revive my piggy bank. I could see how little savings can grow into something very big in the long run. Cheers!

Good luck!