Looking for a Good Investment Return? Use the Magic Triangle!

![]()

Summary

- The return of an investment is only one side of a coin. Not enough to make good decisions.

- You have to study also the risk and the liquidity.

- Most people only ask for the return and don’t understand the risks.

- High return, low risk, and good liquidity? You can choose only two, at most.

- Holding secure investments can also be risky in case of negative interest rates.

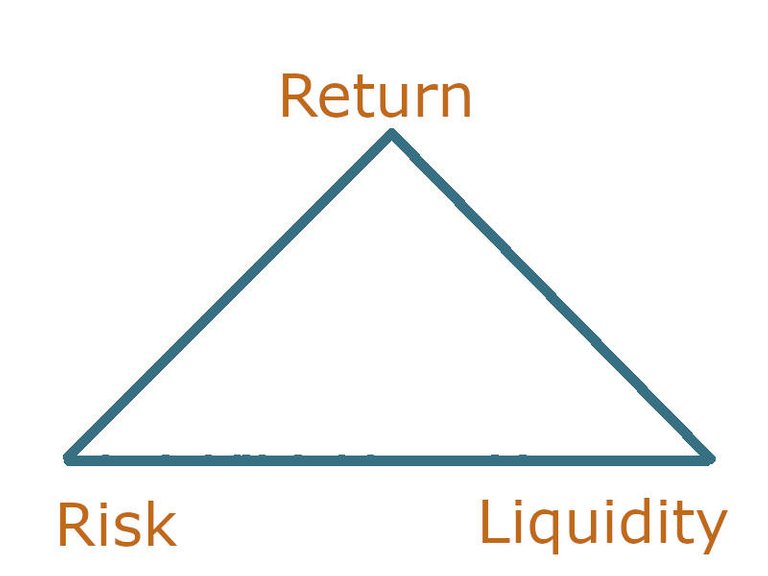

What Is the Magic Triangle?

Magic triangle, sometimes also called investing triangle or investing trinity is the “grandfather of all investments.” It gives you a general recipe for the evaluation of your present or future assets. Although it is not a wonder potion or an all-powerful tool. It has some similarities with the following quote. I have heard that as a child already, about health care, car repair, and other services:

clients can have good, fast, or cheap. Pick two, but then the third will be whatever it has to be based on the other two choices. You can have good and fast if you’re willing to spend a lot of money. You can have fast and cheap, but the quality will be poor. You might even be able to get good and cheap if you’re willing to wait a long time. (Source)

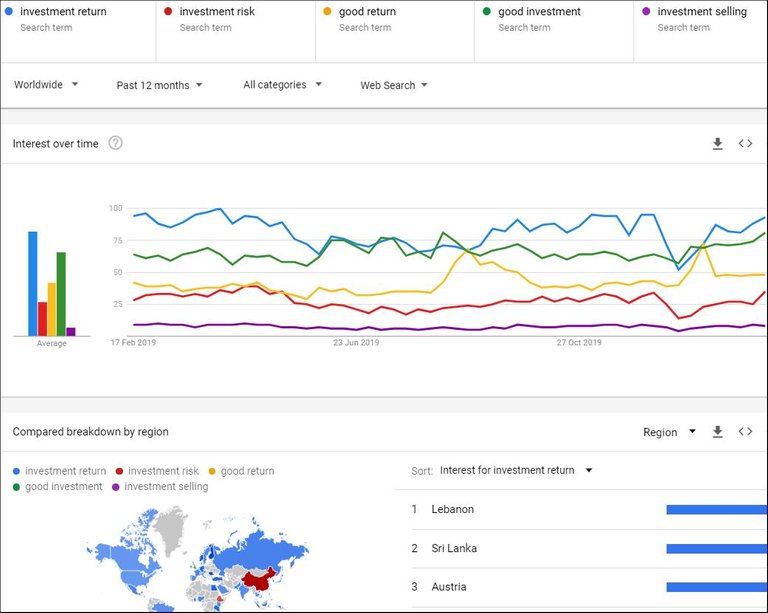

The magic triangle of investments works similarly. It has three edges: The return, the risk, and the liquidity of the investments. (Or, profitability, security, and liquidity.) People are searching in the first line only for a good, high investment return. But they forget the risks and the liquidity. (Most people don’t even know what liquidity is.) I can prove that with the chart of Google Trends. Many more people are searching for investment returns or good investments (blue and green, also yellow lines) than for risks (red line). Liquidity is unknown to them. (It was below the purple line on the chart.)

Chart: Global basic investment searches on Google Trends. (Remark: “investment liquidity” had fewer searches than “investment selling”.)

Don’t Overestimate the Return

Studying only the yield of an investment, searching for a good return is one side of the coin. It’s just like you care about how much you will earn, but not at what efforts, what risks. For example, you might get a high-wage job but one year later you may die. Or, of a disease caused by your work or, getting killed in duty.

Risk is “exposure to the chance of injury or loss” in the dictionary. In finances, it means the possibility of total or partial loss of your investment. This risk is never zero. That’s why studying investment return is not good enough. But what is liquidity?

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market at a price reflecting its intrinsic value. In other words: the ease of converting it to cash. (Investopedia)

Why Is Cash So Often the King

Cash is always considered the most liquid asset. That’s because people sometimes say “cash is king”. Real (tangible) assets – like real estate, art pieces, jewelry, oldtimer cars, etc. – are very illiquid. Shares in companies and other working businesses can have different liquidity. Stocks, bonds, other assets on stock exchanges are liquid. Can be sold, “cashed-out” mostly in a couple of days. Other assets, like limited partnership units, shares in private companies are much more difficult to sell. Continues on Agelessfinance.com

Picture: The magic triangle of investments

Continue Reading on Agelessfinance.com

More Important Readings for You About Your Money

- 6 Effective and Proven Ways to Lose Your Money

- How Works Compound Interest? Learn the Secrets of the Dark Side

- Eight Ways How Inflation Threatens Your Income and 13 Ways to Fight It

- Which Is Your Best Source of Money? Investing, Saving or Earning?

- Is It A Myth? – The Genuine Truth About Passive Income

- Why Do You Need Ageless Finance? Priceless Lessons of Our Ancestors

(Cover photo: Pixabay.com, eurocents, “stux”, slightly altered)

Disclaimer

I’m not a certified financial advisor nor a certified financial analyst, accountant nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research, or consult your advisors before making any investment or financial or legal decisions.

According to the Bible, Bro. Eliseo Soriano: Should I join the true Church of God?

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://beta.steemit.com/trending/hive-182074

Golden ratio! :)

Perfect info!

That choosing only two options out of three good things brought me several memories, it is a rule in other things and fields in which I have worked.

Thanks for the post, you have information that you didn't know and present it in a very clear and direct way.

Thank you for reading and commenting.

This is the first time I will be reading about the investment triangle, and your post made it easy to understand, thanks for sharing.

Dear @deathcros

I finally managed to find some time to read your publication. Sorry for such a late comment (quite busy few days).

Thanks for sharing your valuable experience about investing. I never heard about "magic triangle" and I must admit that this name sounds amusing to me :)

Very bloody good point. It is also my impression that majority of investors are greedy and they follow every single FOMO, without paying attention to risks involved.

Solid read, Upvoted already,

Yours, Piotr

Quite a lot of traffic in the Hive ultimatelly... I can't comment every post, neither the half of them.

It's me again @deathcross

I would need to ask you for little favour. Recently I've decided to join small contest called "Community of the week" and I desribed our project.hope hive/community. Would you mind helping me out and RESTEEM this post - just to get some extra exposure? Your valuable comment would be also appreciated.

Link to my post: on steemit or on steempeak

Thanks :)

Yours, Piotr

Done.