how to grow your trading account: Tips on how to manage a $50-$500 trading account(Part 1)

Enough of the motivational talk, in this post I will be writing on tips on how to manage a 50 to 500 dollar account. Shall we?

Trading with a big account can be very nice. You have the freedom to try some things and have some massive profits. However, not everyone can own a big trading account. Therefore, if you fall into the category of people who do not have a big account, you can follow these tips and successfully grow your account.

Tip 1: Execute only high probability trade setups.

As a trader, when making your strategy one thing you should do is to learn how to identify and classify your trading opportunities. You could classify them into high, medium, and low probability trades or just simply high and low probability trades. If you were trading with a big account you could take medium and high probability trades but since you are trading a small account, your focus should be on only high probability trades. What is a high probability trade setup? A high probability trade setup is a setup that gives a profit of over 90% of the time when you were backtesting.

Tip 2: Learn a bit about compound interest(Don't withdraw your profits too early).

A lot of people make this mistake and even when you tell them they still don't get the concept you are talking about. I know a few persons that trade and withdraw their profits claiming they want to first take their capital out. This is good, however, this stalls your progress as a trader. There are different benefits that come with trading with large equity. This brings me to my first advice for a trader who is just starting out live trading. The advice is still the old classic advice "invest what you can afford to lose". Once you do this, the next thing you do is to pledge to grow that account to a big account where you can start withdrawing profits without it significantly affecting your equity.

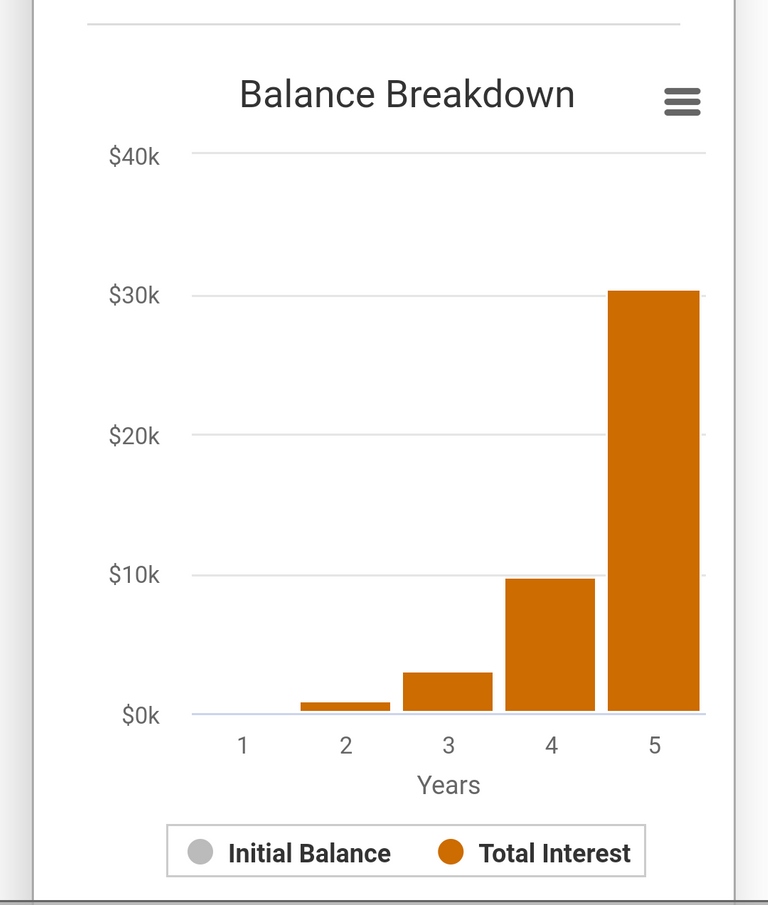

The fastest way to growing your account is by compounding your profits. So let's say you started your live trading account with 100 dollars and you make a profit of ten percent monthly and you compounded monthly. Your account will be worth 984dolllars at the end of two years. At the end of 5 years without withdrawing a dime, your account will be worth over thirty thousand dollars. Isn't that massive? At this point, if you withdraw it will be much appreciated and less significant to your equity.

In summary, start thinking long term!!

This is a graph showing the 5-year outcome of a 100 dollar account after earning and compounding 10% every month

This is a graph showing the 5-year outcome of a 100 dollar account after earning and compounding 10% every month This is a screenshot of the breakdown of the 100 dollar account that was compounded over 5 years

This is a screenshot of the breakdown of the 100 dollar account that was compounded over 5 yearsYou would notice the rate of increase in capital was faster with higher equity.In essence, have the discipline to build your account.

Tip 3: Always trade with STOP LOSS!!!

It's as simple as it sounds. Don't trade without stops if you are using a small account(even a big account). This, therefore, means that you must know how to implement a stop loss on every trade you execute. I know we said that the trade must be a high probability trade nonetheless, this doesn't mean that the trade can go south. If you must succeed as a trader, your trading strategy must contain a strategy for placing stop loss.

Never widen your STOPS!!!

I didn't talk about risk management and discipline as this will be a full post. I must say that risk management is the key to keeping your account and discipline is what you need to grow your account. In my next post, I will be talking about risk management for a trader who uses a small account.

Thank you for reading my blog.

!BEER

View or trade

BEER.Hey @bhoa, here is a little bit of

BEERfrom @gamsam for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Congratulations @bhoa! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPgood article, one of the things that helps more is to have a good risk management because it helps us to plan correctly the accounts gains and losses.

Thanks for your input. I will be writing on risk management in my next post.

Nice post, thanks for taking the time to write it. You should consider coming over to the LeoFinance community and sharing your original work from our front-end.

It's good to see other forex traders talking about consistently building an account using compounding and proper risk management. You've shown the power of both clearly in this post.

Posted Using LeoFinance Beta

Your level lowered and you are now a Red Fish!

Do not miss the last post from @hivebuzz: