How do institutional players guard their crypto assets?

The entry of institutional players in the crypto market in recent months was something that drew attention and contributed a lot to the appreciation of Bitcoin. Large investors, such as pension funds, hedge funds and even insurance companies, got into the game and started to understand that Bitcoin will be part of the macroeconomic context going forward.

The ways these big players use to expose themselves to markets are specific, such as over the counter (OTC), high frequency robots (HFTs) to execute orders and sometimes CME and CBOE futures contracts.

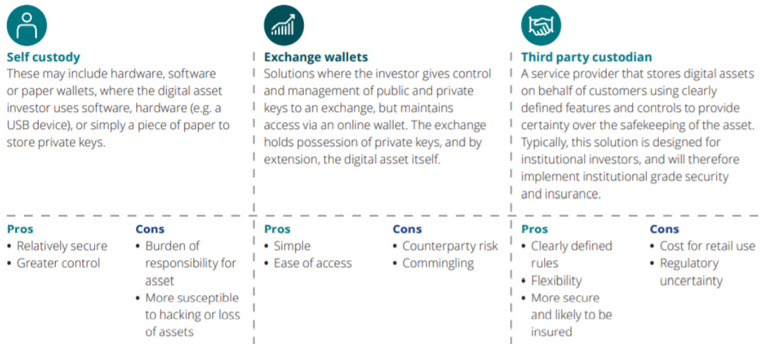

Well, these are some of the ways they use to enter, but when it comes to the custody of the assets they acquire, how do they store the large amounts they can accumulate, since they leave in an exchange or in a simple wallet would it be too dangerous?

This is a very interesting question. Although the concept of disintermediation is very strong when it comes to Bitcoin, in the case of investors who have a huge amount of capital, this requires unconventional forms of custody, as the incentive for malicious hackers to act is very great. If for individuals, the process of securely storing cryptography is often no longer simple, imagine for a whale, which deals and needs to manage millions of dollars.

THE IMPORTANCE OF CUSTODY FOR INSTITUTIONAL INVESTORS

There is a concept in the traditional capital market that says: “whoever operates does not control it”. This means that the correct thing to do is to separate the operational tasks from the custody tasks, due to the risks involved when trying to manage and custody assets at the same time.

In the United States, under Securities and Exchange Commission (SEC) regulations, enacted as part of the Dodd Frank Act, institutional investors who manage assets over $ 150,000 are required to store holdings with a "qualified custodian".

Bringing this reality to the crypto market, this means that, over time, the growth of trusted third party custody solutions will emerge, not only to ensure the security of large investors' crypto, but also to allow regulators and administrators of receive the relevant information.

Imagine that an investment fund wants to invest $ 2 billion of its PL in Bitcoin for a period of 3 years. During that time he would have to make an area available only to take care of the security of private keys, using the most expensive and sophisticated procedures possible, to protect himself from online attacks and even physical threats. Very risky task and extremely high operational complexity. Therefore, it may be more appropriate in this case to outsource custody to a trusted institution that will store and ensure that assets are available for operations in the event of a withdrawal request.

There are already 150 crypto investment funds that together have US $ 1 billion under management (AuM) and 52% of these funds use an independent custodian.

PROCEDURES USED IN THE CUSTODY OF THIRD PARTIES

Although the niche is still in its infancy, competition in the crypto custody sector has been growing, following the trend of traditional investors' interest in Bitcoin. These services use strict security protocols, which mix online and offline storage and include data centers, connectivity and specific facilities.

Some locations used by custody service providers have biometrically controlled bank-level safes, military-level procedures, 24-hour video monitoring, 7 days a week, armed guards and teams prepared for times of incidents, as well as geographic distribution of multi-signatures.

Next, we will get to know some of the companies that provide this service.

BITGO

It is considered the main supplier of custody solutions

for institutional clients.

In 2018, the company became a financial services provider with the launch of the BitGo Trust Company, the first qualified custodian created for the storage of digital assets. In 2019, it acquired a license from the South Dakota banking division and became a public South Dakota Trust Company.

The assets in custody are insured under a US $ 100 million policy and protected by the security of BitGo's multiple signatures.

BitGo Trust is regularly audited by a regulatory body and must comply with strict capitalization standards, anti-money laundering procedures, confidentiality, auditing, reporting and storage.

Coinbase Custody

Launched in 2018, Coinbase Custody offers customers access to the institutional-level offline storage solution, whose service has been used by the Coinbase brokerage since 2012.

Launched in 2018, Coinbase Custody offers customers access to the institutional-level offline storage solution, whose service has been used by the Coinbase brokerage since 2012.

It is the first custodian to offer staking from offline storage and the minimum balance required to become a customer is US $ 1 million.

In August 2019, Coinbase acquired Xapo's infrastructure for $ 58 million, which doubled its size. It currently has 7,000 institutional clients on its platform and more than 30 billion in custody.

Anchorage

Founded in 2017, it is a company licensed to meet the growing demand for institutional custody.

Headquartered in San Francisco, California, and Sioux Falls, South Dakota, it supports a variety of assets and claims to have one of the most advanced platforms in the world in terms of security.

It also provides trading, staking, governance and financing services, which are offered only to US customers, most of which are crypto investment funds, many of which are company investors. He is one of the founding members of the Libra Foundation.

Kingdom Trust

It is a qualified custodian and regulated by the South Dakota Banking Division, specializing in custody solutions for individual investors, family offices and hedge funds.

The company already has a long experience as custodian of traditional assets and offers custody services for Bitcoin, Ethereum, Ripple and Litecoin and guarantees the deposited assets for greater security for its customers.

Launched in 2010, the company serves more than 100,000 customers and has more than $12 billion in assets in custody.

Gemini Custody

In addition to being a well-known cryptocurrency exchange, the twins' company Winklevoss also offers custody solutions for institutional and individual clients.

The company launched the Captive Insurance Company, licensed by the Bermuda Monetary Authority (BMA) to insure Gemini Custody, which has $ 200 million in coverage, one of the largest in the industry. Storage facilities have management strategies

military-grade security.

The custody company was launched in September 2019 and supports more than 23 different assets. In addition to having a New York State license, it is qualified under the New York Banking Law and is licensed by the NYDFS (NY Department of Financial Services).

Main customers: Polychain capital, Samsung and TradingView.

Fidelity Digital Assets (FDAS)

The investment giant recently acquired the NYDFS license to act as custodian of crypto assets, which is remarkable, since Fidelity already manages much of the American wealth through its products and its investment platforms.

FDAS has a diverse customer base, including hedge funds, familly offices, investment advisers and pension funds.

Bakkt Warehouse

The company was created in late 2019, after the acquisition of Digital Asset Custody Co. and offers custody solution for institutional investors consisting of online and offline storage, in addition to

having a coverage policy of US $ 125 million for the portfolios, which is periodically evaluated based on the best operating practices.

Bakkt is working with one of the largest custody banks in the world, BNY Mellon, as part of its custody process, and has a long history of being an exchange of future digital assets founded by the Intercontinental Exchange (ICE), which was also responsible for the creation of the New York Stock Exchange (NYSE).

Customers include Pantera Capital, Galaxy Digital and Tagomi.

This is altogether a new perspective on the subject of custody of crypto wallet keys by the corporates who started investing in the new asset class of bitcoin

Is tesla using the infrastructure of any of these companies?

I really dont know how Tesla custody their crypto.

It would be really interesting phenomenon to watch out.

I'm trying to dig out the wallet address, and what I really want to see is whether a bunch of the bitcoin going into Tesla's wallet were re-sold after the pump as a means of fund raising.

1.5bn BTC were bought near $35k pumped to $60k levels were resold for gains in a few months, and who knows how many wallets that's been filtered through.