Getting Bullish on MOGO - Canada's version of Square's Cash App

Mogo Inc. (MOGO) is a Canadian application developer that offers a finance app which helps consumers gain control of their own financial wellness. The application includes free credit score monitoring, identify fraud protection, a digital mortgage experience, digital spending via a prepaid Visa card, and even crypto buying/selling. The very small-cap company trades at a mere $58 million market capitalization based on its current price of $2.14, and appears to mainly be offered only in Canada as even US customers are not yet able to access the application.

First off, I'm bullish on fintech solutions that have begun to incorporate crypto into their offerings, and MOGO is one such shining example of such. It's application offers no fee bitcoin trading, which is already a positive in my book.

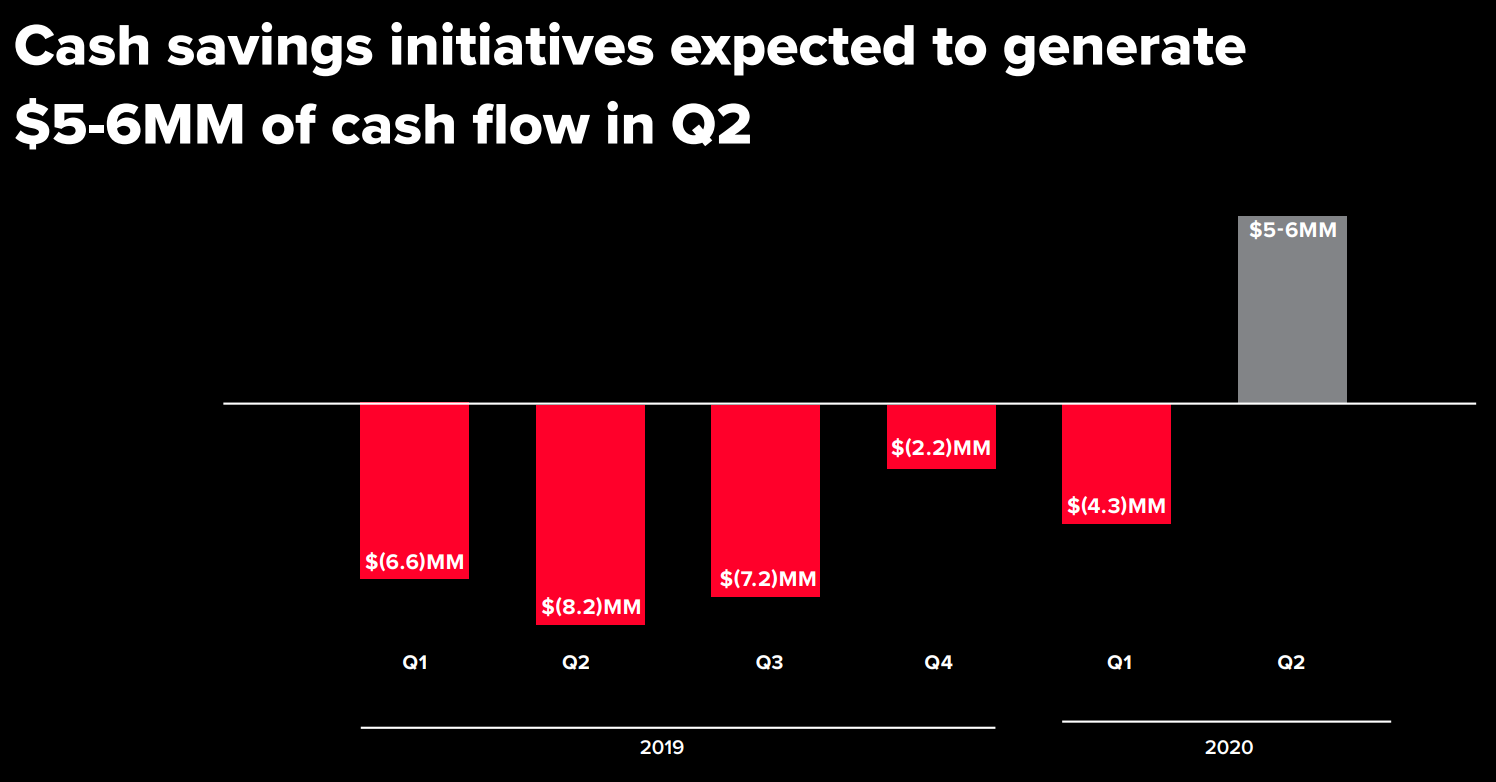

What intriguing to me is that the company is now beginning to increase its cash flow starting in the upcoming earnings quarter. In a preliminary pre-announcement (https://investors.mogo.ca/press-releases/mogo-announces-preliminary-second-quarter-2020-financial-results), the company noted that now expects to generate net cash from operating and investing activities of $6.5 to $7 million, up from its previous guidance of $5 to 6 million. This is a meaningful upgrade considering the small size of the company. Some of this was already anticipated as the company transitions towards a leaner more efficient business model.

https://investors.mogo.ca/presentations/

Revenue is expected to come in around $10.3 million to $10.5 million, which adjusted EBITDA of $4.5 million to $5 million. Again, this is quite meaningful considering the small size of the company. The company is now looking to begin ramping up the monetization of its 1 million member base, and could be poised for some incoming growth given the overall market conditions. After all, taking control of one's finances is becoming an increasingly important aspect in the current crisis.

The company is also beginning to trend favorably on RobinTrack, which of late has been one of the best retail-investor sentiment trackers. After, those crazy YOLO frat boy Millenial traders are the one really driving this stock market at this point, are they not?

The bulls appear to be control of the company's stock based on current momentum and the fact that the company trades above meaningful weighted average prices of entry. I expect that this company can continue to drift higher based on the favorable conditions now underway.

Posted Using LeoFinance