Baidu (BIDU) Falls On A Double Whammy

Baidu continues its multi-year stall today as it reported its Q2 earnings. Poor revenue performance haunted the company which saw ad-revenue shrink by 8% in the quarter. The company has been undergoing a recovery that has yet to fully materialize. Despite the poor topline growth, the company has seen significantly recovered earnings as diluted EPS came in at $1.46/ADS.

https://finance.yahoo.com/news/baidu-announces-second-quarter-2020-203000187.html

The acronym for investing in China used to be B-A-T which stood for Baidu, Alibaba, Tencent. These days, it is becoming harder to tell if that 'B' should begin to stand for ByteDance, the parent company of TikTok, Douyin, and Toutiao instead.

Investors have long kept in mind that Baidu will continue to bear the title of being the "Google of China," serving as the dominant internet search platform for mainland China. After all, China's Great Firewall has prevented any true competition from the outside world for their homegrown tech giants. And yet for American audiences, we often forget that the world isn't the same experience to how we perceive it domestically.

For China, the concept of searching the Internet via a computer isn't as prevalent to a tech-driven generation that largely bypassed home ownership of a personal computer. Most Chinese citizens leapfrogged past computers early on and landed into the more practical age of mobile phones which has driven a prevalent use of essential apps like Tencent's QQ and Weixin (the original WeChat).

Robin Li , Co-founder and CEO of Baidu attempted to assuage the path forward for the company as it attempted to become a more mobile-centric company. He noted the following:

"With COVID-19 becoming more manageable in China , Baidu's business is steadily rebounding. We are pleased that in-app revenue grew in the second quarter, despite a challenging macro environment, further validating our strategy to make Baidu App a super app through AI-powered building blocks and marketing cloud platform."

Yet further compounding the relatively tepid top-line performance of the company was the near-simultaneous announcement that one of its key investments found in 56%-owned iQIYI was undergoing an SEC investigation. The company's video unit has long been viewed as a major player in the emerging long-form video streaming market in China. The news of the investigation only further rattled investors as the company shares fell over 7% in the after hours session.

We will have to see where the company's stock lands tomorrow.

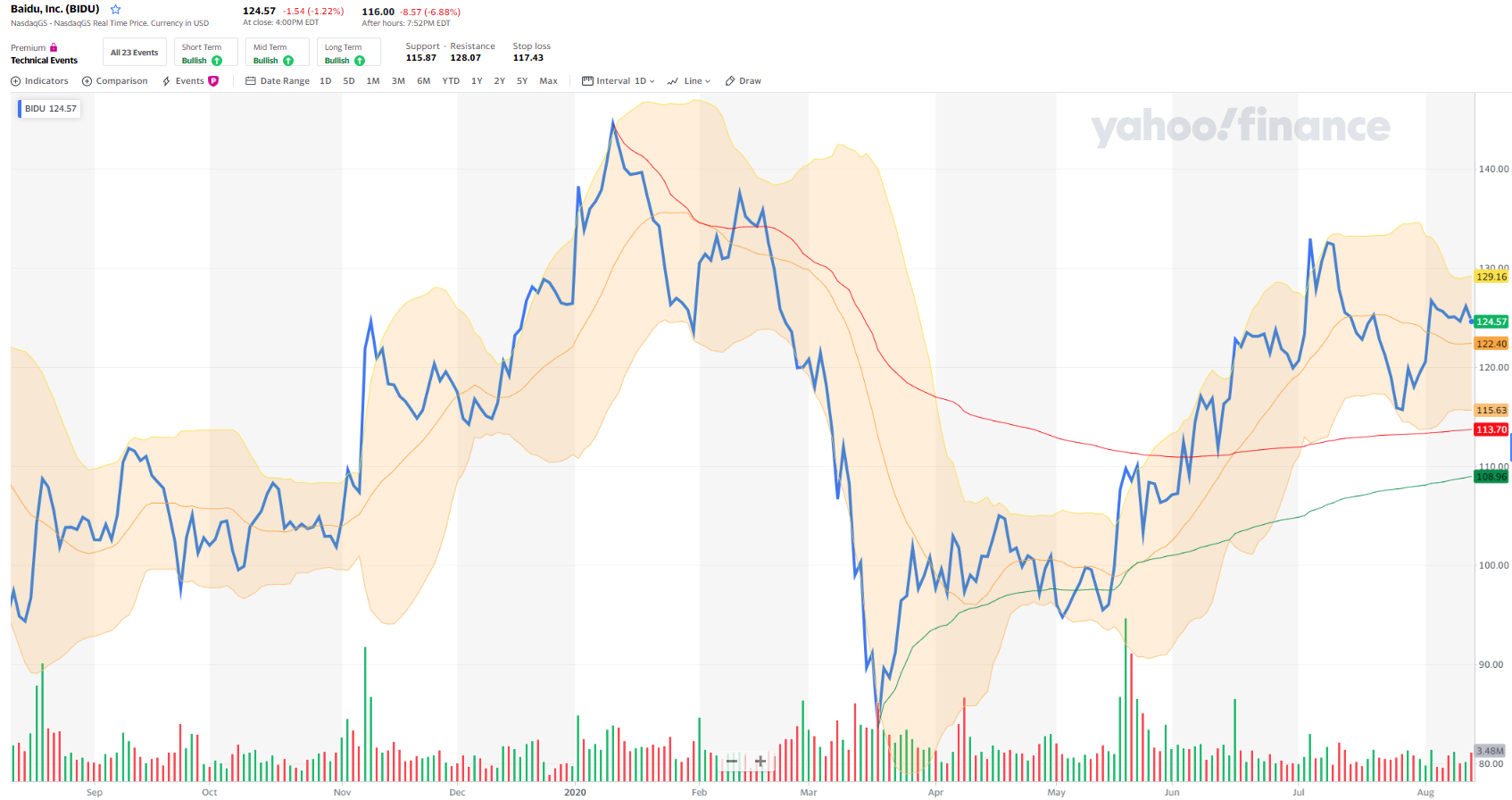

Prior to this decline, Baidu's stock traded at a market capitalization of $42.94 billion based on the closing price of $124.57 as of August 13, 2020. The company trades at a price-to-sales ratio of 2.85 and a price-to-book ratio of 1.83 while carrying an enterprise value of $32.90 billion.

While of late the company's shares had been advancing, this double whammy may prove significant enough to provide more lasting technical damage to the company's stock. Personally, I would be concerned if the company trades below the $113 region, an area that would largely mark a meaningful reversal in which bears will have gained control of the price action.

Posted Using LeoFinance