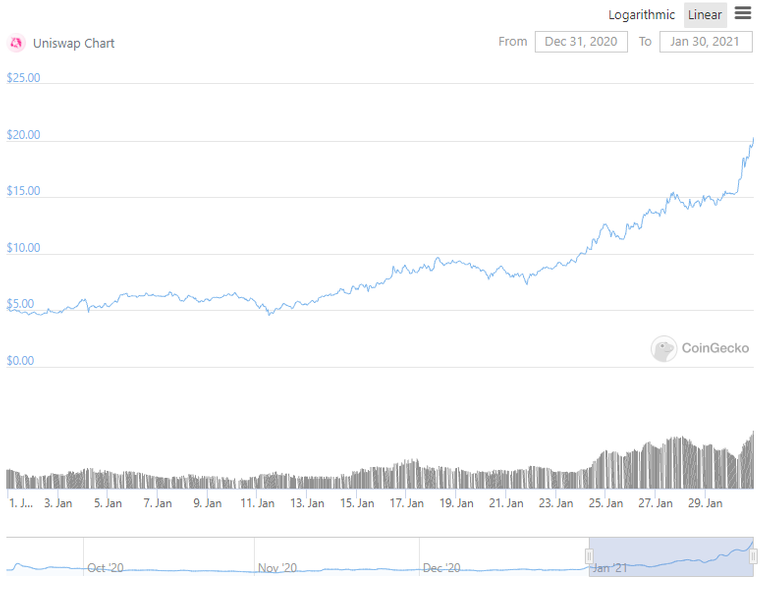

UNI token breaks $20

16 days ago I wrote a post posing the question "Where is the UNI token going?"

At the time, UNI was selling for around $7 USD, today UNI broke $20.

Back in September 2020, UniSwap airdropped everyone who used UniSwap prior to September 1st 400 tokens, at the time worth around $1,200. While many people sold immediately, the bulk sold their UNI tokens immediate around $3.

If you held your UNI airdrop until today, that $1,200 airdrop is now worth $8,000. In comparison, the $1,200 US stimulus would be worth $5,999 if you purchased Bitcoin right away.

Is Uni going to make gains?

Who knows to be honest, but I personally have been waiting until the release of v3 to even consider selling any UNI. I did sell the initial 400 airdrop around $5 but have since been collecting it by participating in the incentivized liquidity pools.

With the recent events like $GME, UniSwap is getting a lot of attention as people look to decentralized solutions. I've been monitoring Reddit lately and have seen an increased interest in UniSwap as an alternative to stocks.

It looks like my prediction of $30 UNI isn't far off and might actually be on the low side. If UniSwap makes good with their promises in V3, we could see even more interest in Defi.

Right now there is almost 3.5 billion USD held in UniSwap contracts with almost 750 million in daily volume.

If you thought Defi was a fad, well it surely doesn't look that way.

This is not financial advice and you should always check with your mom before spending more than your lunch money.

Why you should vote me as witness

Posted Using LeoFinance Beta

Dudeeeee! You're going to make it break and hit $1000! I wanted to buy a few more before you did that 🤣

Posted Using LeoFinance Beta

Check with your mom... 😂😂😂😂😂🤣🤣🤣

Wow 😳 good job friend...

Hey, guess what? I was one of the lucky ones that used uni early and received them. I also did dump mine on the 4 dollar spike, however rolled into ZIL about a penny, so am up about the same! I am shocked tho, i don’t like uniswap anyway. The gas prices are ridiculous, eth sucks compaired to hive! So whatever damp eeet! haha

Maybe one day they will make it easier to swap without eth?

The transaction fees suck but outside of holding BTC, ETH is a gold mine of opportunities. Maybe ETH 2 will mitigate some of the issues, not likely to completely solve them.

The fees just make it a whales only game.

Posted Using LeoFinance Beta

Vitalik has been pretty open that layer 1 will never solve fees. It will simply allow scaling until demand is recapped by fee amount.

What I'm really hoping is that v3 is going to have a layer 2 solution. Given that uniswap is the main thing clogging the network, it'd be a boon for everyone.

The DeFi market is only just beginning. I think we will soon see much higher prices.

Greetings Michael

!invest_vote

!jeenger

@mima2606 denkt du hast ein Vote durch @investinthefutur verdient!

@mima2606 thinks you have earned a vote of @investinthefutur !

Your contribution was curated manually by @mima2606

Keep up the good work!

I’m really late to the defi game, it seems to be a really broad term...I can imagine a bunch of use cases as far as lending and interchain stuff goes but I still don’t understand why all these food coins were going crazy or what yield farming is. Thanks for the reminder that I need to go learn.

At least I bought Uniswap at $6 though, even if I don’t understand it

Posted Using LeoFinance Beta

Crypto is an unregulated market, so whenever something becomes popular, you see a bunch of knock offs, scams, and a couple new legitimate projects. For meme reasons they went through a phase of chosing food based names.

Yield farming is the act of moving your crypto around chasing the highest interest rates, or coin distributions being given to liquidity providers, etc. It's the high risk, high reward, short term approach to defi.

While these two terms dominate the news, most of defi is just people investing in cryptos they like and parking it in protocols they like that earns a little interest. I have never owned a food coin and my yields are small.

That’s really helpful. Hope you post more @rodent. You rock

I'm proud owner of some UNI bought at around $10. Not planning on selling till $1,000. UNI has high chances to replicate ETH's performance from 2017.

Posted Using LeoFinance Beta

I sold mine for under $3 and bought HIVE. So instead of having $8k, I have 1k worth of HIVE.

:(

Ouch.

Posted Using LeoFinance Beta

LOL

Posted Using LeoFinance Beta

Thanks for information

Wow

At the time of airdrop, ETH was less than $400 and I sold a part of it at about $7.50.

Now considering ETH at 3.5x, UNI at $20 is still not equal to $7.5 that day ;)

You should hodl it for over $100.

Its to wipe your face. Youll need it soon enough.

Huh?

😘

You seem salty.

If salty means irritated by your future actions i admit wholeheartedly to it. Im just saying, keep that towel dry. 😉

Oh I thought it was because I said no when you hounded me about your proposal.

No one hounded you about Hives proposal. I was very peppy, accepting and joyful. SOme would even call it elfish.

I was interested in objective feedback. What i got was REEEEEEEEEEEE, from Bernies twin.

But no matter. Im just worried about your personal hygiene. Thats why i brought you this towel.

If you say so