All good things must come to an end

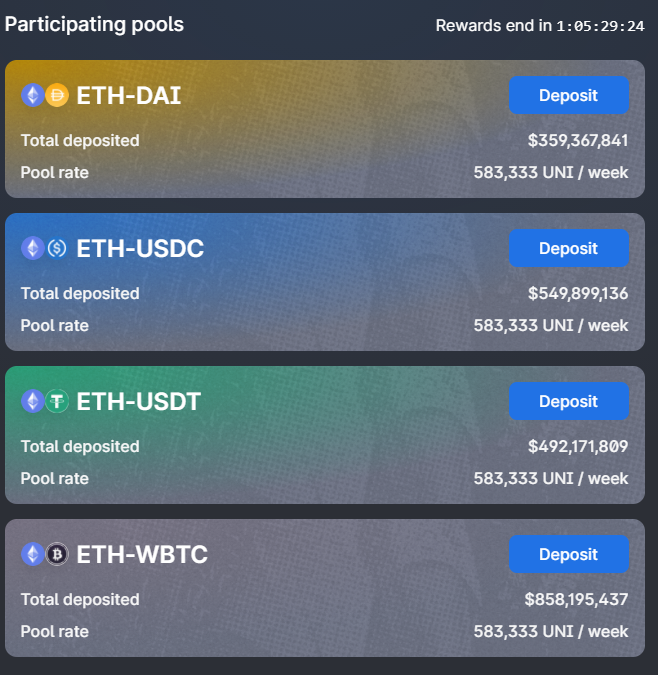

On September 17th, 2020 UniSwap added rewards for four UniSwap pools. Each of these pools had a weekly 583,333 UNI token incentive. These incentives were promised for 60 days.

These pools accounted for over 2.2 Billion USD worth of crypto being staked with a peak around 2.4 Billion USD. In a little over 24 hours the UNI incentive is removed and we will likely see a lot of Ethereum unstaked.

As I participated in these pools, I watched the UNI token vary in price dramatically, in fact it was mostly on a downward spiral. On September 17th it was around $2.58 and peaked around $7.06 a few days later.

Most of these 60 days the price was in a steady decline reaching as low as $1.85 as far as I remember. A lot of talks about UNI have questioned if there was any value behind the token. I initially sold the 400 UNI I received in the air drop at around $5, it wasn't the peak but it wasn't as low as many sold it for.

In the last few weeks (likely the result of the BTC pump) the price of UNI has been steadily rising back up. It is currently at $3.88 and looks like it isn't done yet.

Many users on Reddit were predicting a $1 UNI or less as the price is unsustainable as there isn't a lot of utility to the token. I felt the price was going to drop but felt it would return in the near future, especially as we get closer to the UniSwap V3 launch. Because of this, I decided to participate in the UniSwap pools to farm a good amount of UNI tokens for the launch.

UNI is currently ranked #29 on CoinGecko based on Market Cap.

All and all, I feel I did pretty good. I ended up with around 17% growth based on market movement with an additional 3% or so paid out in UNI token. This is roughly a 120% APY or 18% APY just factoring in UNI tokens alone.

It was no SushiSwap level returns, but it was extrmely low risk.

Will there be any more UNI incentive pools?

Right now, the answer is no. Holders of UNI can vote a proposal in to incentivize pools again. I don't see this happening as many believe the 2,333,332 UNI/week times was the main reason the price of UNI dropped so rapidly. I tend to agree with that, there needs to be more utility behind the UNI token for it to hold a strong value.

I am currently hodling all my UNI until the V3 announcement hits, and then I will decide based on the reaction if I want to continue to hodl or sell. Unless of course we see a big spike in price, I may take some profits and buy in when (if) it drops again. I can easily buy back my 400 UNI tokens from the airdrop at a lower price right now.

There is a risk the price of UNI will drop if a lot of liquidity providers sell off their UNI if they remove their stake from the pool. I have considered this and have been thinking about doing that as well and see if I can get in lower.

There are no sure bets in crypto.

This is not investment advice, I am not a professional and only sharing my personal experiences. As always, talk to your mom before investing.

Why you should vote me as witness

Posted Using LeoFinance Beta

https://twitter.com/Bhattg18/status/1328049788986617856

3 mint and 103 votes the favorite man in crypto blockchain.

Posted Using LeoFinance Beta

Huh?

Mr Marky the legend thnks for you remember me.

i find it difficult holding anything i don't understand. I got my UNISWAP airdrop. Sold all of it and invested in a REAL-LIFE project that has greatly impacted my life. I don't know if i would buy their coin in the nearest future.

Posted Using LeoFinance Beta

Sounds like you shouldn't have any regrets.

Thanks for your analysis of this. UNI is something I dont see written much about. I kept my airdrop so still sitting on 400 tokens.

Now I have some guidelines to look at. Is there an ETA on V3 out there?

Posted Using LeoFinance Beta

I believe around December or Q1.

Okay thanks Marky. I will keep my eyes out for that.

Posted Using LeoFinance Beta

https://twitter.com/itsjustmarky/status/1328052897620365315

nice summary

the price is pumping instead for now at least

This uniswap airdrop has been the most massive airdrop in history.

Posted Using LeoFinance Beta

I think the airdrop was around $600M of free money. When you see a number like that you wonder who is paying the bill.

Lol.. Exactly. That was massive and a lot. I hope another one comes by and I don't miss it.

Mum told me girls and money are bad.

She might be right. In my experience with both I have to disagree.

Your mom is 80% right

in fact, a sharp decline in ONE which also coincided with other DeFi projects such as YFI and Band for example.

A currency of which I have not understood if it can have a usefulness or is just speculation 😅

Posted Using LeoFinance Beta

It is difficult to see uni price rising up above that steady of $3 something except perhaps uniswap comes up with a tempting stuff to push it up

Interesting read. I sold my UNI from the airdrop at about 4.5$ and never looked back. I don't really see the use of UNI so I won't pick it up again either.

Posted Using LeoFinance Beta

It gives governans in the platform.

You seem to have done quite well from all of this so far and what you are saying makes logical sense as well. Waiting for the next phase is smart depending on price of course.

Posted Using LeoFinance Beta

D*arn, I missed all of that. Only learned about Uniswap when the snapshot already happened. And only used Uniswap when KOIN mining was launched. I find what Uniswap offers, the swapping of assets / crypto's fascinating. I would think, this would give at least some recognition / brand value to the Uni token. That said, enough other tokens around with maybe more substantial use cases defined for them.

Posted Using LeoFinance Beta

I give you a ned in the hope you give me one good deepfake back :)

Most unique disclaimer I have ever seen!

🧡 100% for making me laugh! Oh, and a ROAR to get the information out!

Posted Using LeoFinance Beta

The airdrop was great, though!

Posted Using LeoFinance Beta

It really was, but who pays for the $600M USD that was created out of thin air?

Wasn't it made from the high Uni fees?

Not really, it was a token created out of thin air that had no value what so ever and then given away. The free market decided what it is worth.

That's actually quite something!

Posted Using LeoFinance Beta

yea, I got lucky and sold at 6,5 for my UNI and invested in other things (Rune seems like its going on a run now)

But the selling pressure going and V3 coming out are good upward indicators

Posted Using LeoFinance Beta

Yes. UNI and FLM I think are good for invest thinking in next year.

I had almost forgotten I still have the 400 UNIS. I have just HODL, because I sold the RARI airdrop too early and missed out of lots of upside. I am tempted to sell as I am moving more equity into BTC. But UNI is also a short term 5-10 bagger candidate, so dilemma, dilemma, dilemma as always in the cryptosphere.

I think we need to find more uses for many of the coins that are being used today. For example, Hive, if we could get people to use Hive or HBD for everyday things, it would become a strong coin.

I do not see that happening in the near future as many only know BTC, ETH, bigger coins like them. People buy Hive to powerup and try to make their account as big as possible to get influence on the Hive Blockchain or save enough to sell and get ETH or BTC to do the things they want to with them.

I have no ideas there as I am not in business and people look at me funny at the mention of Hive. So many little coins out in the crypto world and they are just used to trade in for ETH and BTC. I guess that is the purpose really of all the little coins out there from what I see. Just my two cents and an honest opinion, hate it or agree with it, that is the way I see it.

Nice info