What Is Oil Telling Us About The Economy?

The Eurozone is dependent upon Christine Legarde. As the head of the European Central Bank, she is responsible for trying to keep the continent afloat. Thus far, in spite of easing for more than a decade, the results are rather poor.

We are watching the European banking system closely since their debt is still in place from before the last financial collapse. At the same time, we are seeing the EU economy tanking even more than the rest of the world. While China and the U.S. show some signs of life, the Eurozone looks like a dead fish.

Oil is tanking over the last week. Why is this? Is this a foreshadow to what is taking place?

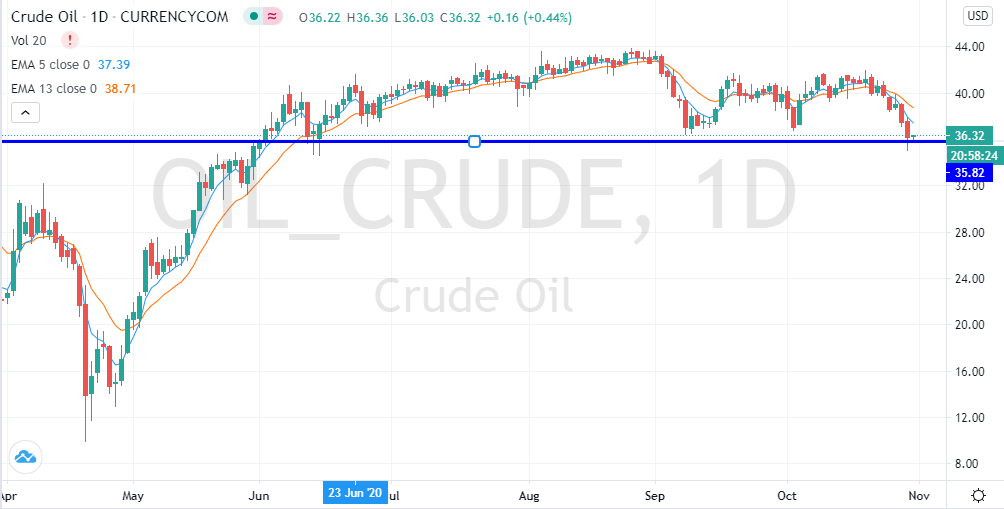

Here is the latest chart:

Over the last few months, oil is basically range bound. At present, it is at the lower end. We will have to see what happens over the next few days. Continued downward pressure on prices will force it through a support zone. This means a drop into the low 30s could be on tap.

How is this happening with rig counts reduced a great deal since the drop in March. There is a glut of oil which was further pressured as the global economy came to a standstill.

Lagard is not very optimistic about the Eurozone. Of course, a great deal of this could be debated was the fault of the actions of the ECB. Leaving that aside, here is what she had to say:

"Incoming information signals that the euro area economic recovery is losing momentum more rapidly than expected, after a strong, yet partial and uneven, rebound in economic activity over the summer months," Lagarde said in her introductory statement during the post decision press conference.

Which then led to the decision that the bank will make in December.

"We think the most likely outcome of the December meeting is still an increase of asset purchases, via both the PSPP but also the PEPP programme, by some 500 billion euro and more, possibly even more tailor-made support for banks and bank lending," ING economist Carsten Brzeski said.

It is clear, Lagard is going to try and print her way out of this mess. The asset buying will continue.

Unfortunately, when confidence is lost by the international community, there is little that a central bank can do. Traders know that the Eurozone is not trustworthy and thus are shunning it. In fact, capital outflows are being recorded each month out of the EU. Many speculate that we will see capital controls instilled here the same as China already has in place.

Regardless of what is taking place, oil is not painting a rosy picture. The last week saw a lot of red in this market. Since it is still such a fundamental part of the global economy, may feel it is a bellweather indicator.

If we see the price of oil dropping into the low 30s, it signal the end of any hope of global economy recovery, at least in the short term.

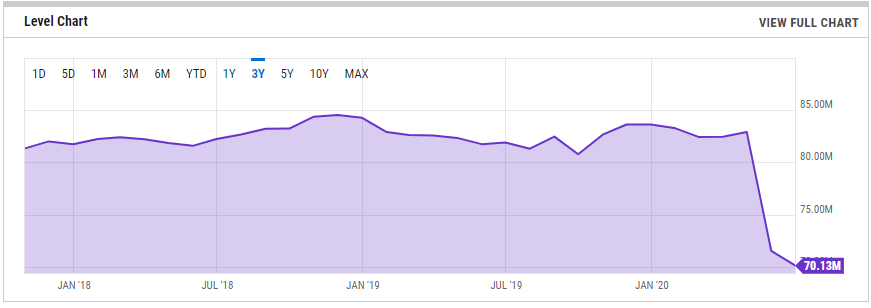

Here is the three year chart of global oil production. We will have to see what the 3rd quarter when the report is released. However, the trend since the main impact of COVID-19, is not looking very good.

With another threat of lockdowns across the EU, coupled with Legard's comments about the economy, we can conclude that things are going to be rough for a while. Energy is what drives the global economy and oil is showing we are using less of it.

That does not equate into an expansion of GDP.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Looks like everything seems to be adding up to a disastrous Q1 for 2021.

Shorting the market and/or loading up on USD may be in the cards on the short term.

Posted Using LeoFinance Beta

If the stock market plunged, do you think BTC could still go to new ATH in December?

Posted Using LeoFinance Beta

I noticed the red charts this week across the board, except for bitcoin and the dollar curiously. I presume the leaders should simply open up the economy once more and end lockdown if they want to pump the market so it flows again. They can't have their cake and eat it. It's either lockdown and crash or open and thrive.

Is this a piece of total horseshit?

The article says that half of the ICU beds in the Netherlands are taken by Covid-19 patients at the moment. Patients are being sent to Germany that has a very good ICU capacity per capita.

https://www.reuters.com/article/us-health-coronavirus-netherlands-tally/stretched-dutch-hospitals-to-send-covid-patients-to-germany-within-days-idUSKBN2771SS

If the epidemic is allowed to run its course with no restrictions by keeping everything open, Europe could be in for a shortage of ICU beds again like in Northern Italy in March.

Posted Using LeoFinance Beta

I hear you.

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: