The Stages Of The Death Of The Mall

Few things die overnight. In the world of business, there is usually a process.

For the shopping mall, this was occurring for sometime. Since the rise of online shopping, malls started to get his as more of their tenants were faced with declining sales, many ending up in bankruptcy.

This has caused a spillover to the mall owners. As flagship stores went under, many smaller tenants were able to exercise clauses which allowed them to leave. Those that remained saw the foot traffic decline, placing further stress on those companies.

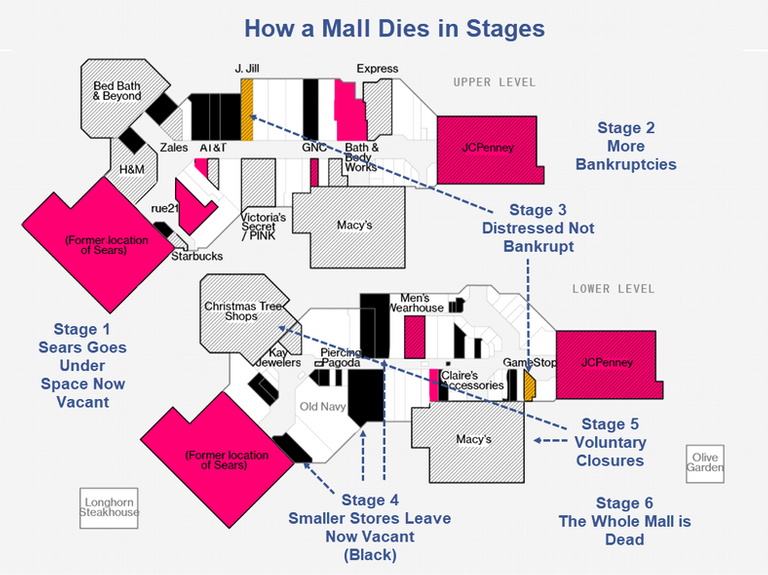

Here is the process that the B malls go through.

Source

Few would point to the troubles of Sears as the onset of the decline of these malls but, as we see, it sets off a chain of events that mean these entities are unlikely to recover.

Once Sears goes, others follow by dealing with their issues via bankruptcy. Payless is an example of the Stage 2. Even if a company enters reorganization, it is likely to close down a large number of stores across the country. Thus, those that are not performing as well end up shuttered.

The distressed stores face the same issue as management starts to reorganize. They too close down stores that are laggards.

All of this, of course, keeps having an impact upon traffic.

As we descend down the scale, smaller stores vacate realizing there is no reason to pay a premium to be an location (the mall) that is no longer premium.

Finally, things are so bad that even those companies that are "hanging in there" end up throwing in the towel. As they look at their own businesses, the idea of sticking with a declining mall makes management's decision easy.

Ultimately, the mall ends up dead.

How long does this take? That depends upon the area and what stores are in there. However, we know this is approaching the end of its first decade so the process is far along. We are going to see more malls going under.

Many are estimating that there will be 25,000 stores closed in the United States this year, far outpacing the 9,000 in 2019.

This process is being played out over hundreds of second tier malls across the country. It is a situation that affects things on many levels. Obviously, tax revenues are hit as less commerce takes place. Employment is destroyed as many entry level jobs are eliminated. Finally, malls fall into disarray which causes a blight on the community.

The next 5 years will see a clearing out of a lot of retail space. Fortunately, much of it can be repurposed although that is in question with the "work from home" movement. Commercial real estate is under pressure from all sides at the moment.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

I think in Nigeria, malls keeps getting even more lucrative for the owners this is because shopping online and the tech behind it is very expensive and the third party fee is enormous to an extent. Well I guess it's quite precarious in the US, so how will this impact these mall owners?

The mall owners are taking it on the lip. They are finding their cash flow severely interrupted. All the paper that is backing the malls is edging towards default.

Posted Using LeoFinance Beta

My, having that particular cashflow interrupted is bad for business. Thanks for expatiating further on that

With the e-commerce booming it is hard for mall to keep on going, but after the pandemic passes those might come back to life. I believe that outlet villages are one thing that might expand as they could bring everything in the same place, while being exponentially. If the outlet village is just a mall I think that might survive as people experience clothing shopping in a more pleasant way.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.What should have occurred in 2008 is now occurring in 2020-2021. But at least the bankers were made whole. :(

Posted Using LeoFinance Beta

Yeah well the US has way too much mall space.

Posted Using LeoFinance Beta

Maybe when the dust settles they will be turned into living spaces. And turn them into miniature smart areas to live, eat, work, and play. Because the old model is obsolete.

Posted Using LeoFinance Beta

Around me, much of the retail space was picked up by the medical industry and turned into offices. The hospital chain leased out a great deal of the vacant space since it is growing so rapidly.

Welcome to the world of an aging population.

Posted Using LeoFinance Beta

I guess it's all part of the response to a meta-trend: The US has been greatly "over-retailed" for several decades. Consider that even now there's about 23.5 sq. feet of retail space per capita in the US of A, compared to maybe 3-4 Sq. feet per capita in most of Western Europe. We simply don't NEED as much stuff as is being offered.

I watched one of the very early mall closings happen; the oldest mall in Austin, TX. What's interesting — and I have heard this from a number of observer/commenters — is that the original catalyst for the gradual decline of malls was video games, not online shopping. "Way back when," teenagers and college students considered hanging out at the mall a core activity, but with gaming... and then online gaming... traffic to food courts and "small impulse sales" declined, taking away from the "crowded and thriving" atmosphere that drives mall atmosphere.

Now Covid and movement restrictions is just accelerating an inevitable process. Here in the Seattle area, we're watching mall operators adapt by reducing retail space and adding things like extended stay business suites, educational facilities and cooperative office-sharing facilities.

=^..^=

Posted Using LeoFinance Beta

It would make sense that video games had an impact. There was a time that I remember, before in home gaming, that people had to head to the arcade. Many malls had them and were draws for lots of teens.

Posted Using LeoFinance Beta

Technology appears to be a threat to some business. Malls are good as such, won't be utterly sidelined but online shopping will definitely take the lead in the coming days. A lot of persons would probably prefer to sit at home, make some orders online and have it shipped to their doorsteps.

Posted Using LeoFinance Beta

The numbers reflect that sentiment. Amazon and Walmart are both crushing it in the US with their online sales.

Others are trying to follow behind.

Posted Using LeoFinance Beta

Online shopping would do to malls what email did to postal offices

Posted Using LeoFinance Beta

I think that Corona came like a helping hand for this process and it seems directed by far. It's somehow more convenient to order from home and get your stuff delivered at the door, you can send back what you don't like and get your money back so it's way easier to shop online nowadays than it used to be. It's not for our benefit though, it takes the walking away, it takes trying on some shoes or pants, it definitely takes the socializing process away and it disconnects us a lot. Luckily in my part of the world, Romania, malls are not yet affected this way as we're not shopping online that much and the ones hit by Corona the most were restaurants.

Posted Using LeoFinance Beta

Yeah I think it only sped up what was already taking place.

The decline of the mall is nothing new, this was going on in the US for a decade. Corona only accelerated the pace a bit as it did with a number of technological trends.

Posted Using LeoFinance Beta

I guess they should start looking for alternative uses because I suspect that foot traffic is going to increase now.

Posted Using LeoFinance Beta

Age old story. Enclosed malls rose up and killed downtown retailers, now they are dying to be replaced by small strip malls where individual retailers are the destination rather than the whole mall. I’m sure the lockdowns are helping to destroy the malls already reeling from online sales.

As an aside. What really killed Sears was buying up an already bankrupt Kmart. They couldn’t handle the massive debt.

That is true although Sears was on the path to destruction anyway. The company had no online presence whatsoever and the offerings, outside Craftsman, was not very exciting. Even the appliance business was being eaten into.

The combination with KMart took two entities that were in a nosedive and paired them up. Not exactly a winning move.

Posted Using LeoFinance Beta