The Incoming Run In Commodities

We are entering a great period for those who invest in commodities. This sector is going to see a multi-year run that will push the prices higher, and likely to a large degree.

What did you read that correctly? Did I say we are going to have bouts of inflation?

Yes I did.

Here is the problem that most people have. When looking at things with markets, we need to look at time period and causes. They often tell a much different story than the present narrative.

In the medium-term, the next few years, we are likely to see inflation. And, no this is not due to the money printing the Fed is doing. That is just trying to make up for the loss that took place due to the lockdowns and collapsing of the global economy. The money printed pales in comparison to the wealth destroyed.

What is causing this is shortages. We are back to looking at the basic supply-demand equation. Just like all the talk was the glut in oil, which sent prices collapsing, that deflationary was going to turn once the supply issue was resolved.

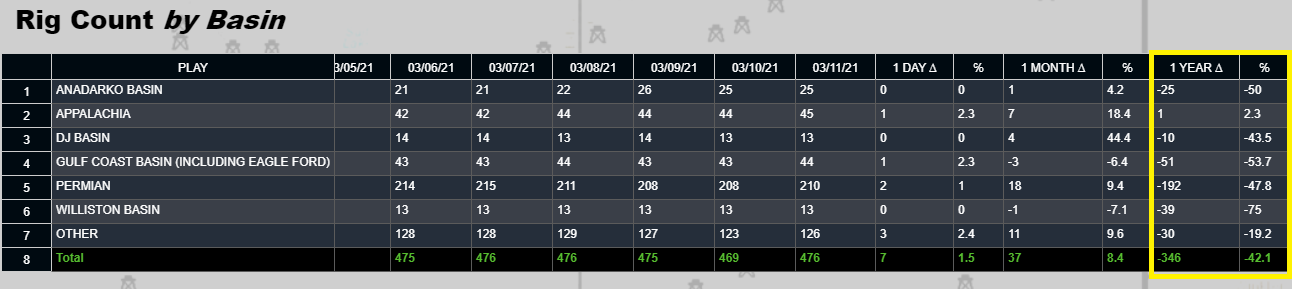

Here is a table of the rig count in the United States. The last two columns deal with the last 12 months. As we can see, the rig count is down 42%.

Source

This too should come as no surprise. More than half of 2020 saw the oil companies plugging ever hole they could. The rig count dropped by near half. That means we are seeing a lot less crude coming out of the ground. Even though demand is still down from where it was, the supply is down more. This evens out the supply-demand equation, pushing prices higher as we all see.

Let us look at the one year chart in crude from Marketwatch.

Notice how it went from $28 a barrel right around the time the pandemic was starting to hit to the present price of $65. This is sending gas prices higher.

Of course, we were told this wasn't support to happen. The end of oil was near with the introduction of EVs. Utility plants were switching to green energy, making oil obsolete. In fact funds were not investing in the fossil fuel based energy sector.

This was the narrative anyway.

Of course, it we look at the XLE, we see a different story.

It seems there was plenty of money flowing into this sector as evidenced by the doubling of price since the lows in April.

Then there is food.

We know there was a lot of turmoil caused by the lockdowns. One of them was the fact that workers could not get out to get the crops in time. Many farmers had to plow over crops as they went bad. At the same time, meat packing houses were shut down, meaning ranchers could not get their herds to market.

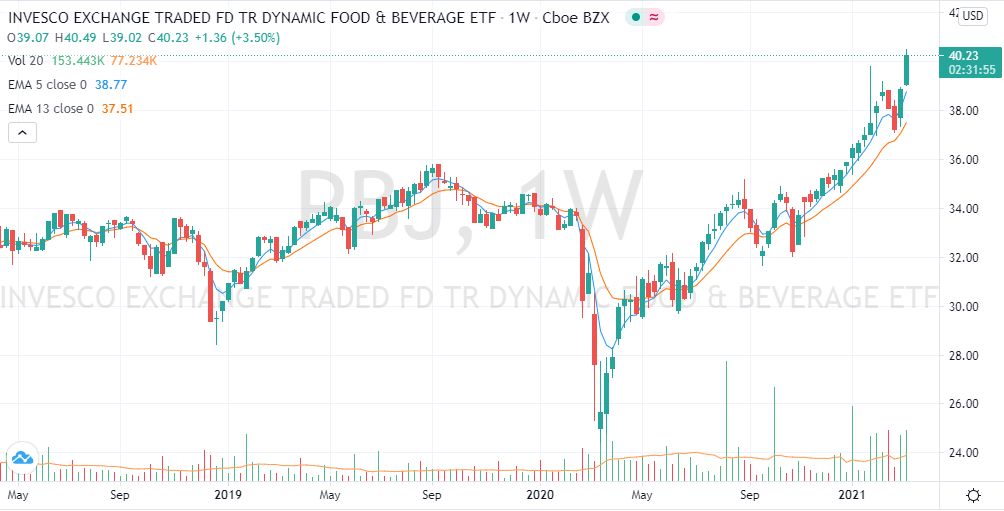

All this is starting a food crisis. It is something that is being overlooked in the mainstream media yet the markets are well aware of it. Let us look at the Food and Beverage ETF.

Similar situation to oil.

When the supply is decreased, this tends to send prices higher.

Did you hear about the semiconductor shortage? This is affecting everything from computers to cars to appliances.

Once again, we see a similar story.

Supply chains across the globe were completely disrupted during the pandemic. This means that it is going to take a number of year to correct. The markets are already telling us these sectors are about to soar. Of course, with a contracting global economy, this tells us the demand side is not expanding.

Just like the oil glut took about 3 years to reverse, we will see a similar situation again. As we get closer to the flipping, we will experience a multi-year run where there is simply not enough oil. The same will hold true with food since growing seasons cannot be sped up. This will spread to the rest of the commodity segments, providing a nice multi-year bull run.

Of course, 3 years is a long time in a technological era and companies are not just going to sit back and do nothing. Many will innovate and adapt, meaning the implementation of technology to counterbalance an increase in prices.

Thus, right about the time it will peak, the technological impact could hit around the middle of the decade, sending prices plummeting again.

Watching the supply-demand equation can be very informative. With commodities, it tells a great deal of the story.

Those who are positioned in them will likely do very well over the next few years.

Posted Using LeoFinance Beta

food crisis is looming and it looks like many people are just pretending like nothing is happening,something urgent must be done to fix the crisis or else the world will be in serious trouble...@taskmaster4450le

Posted Using LeoFinance Beta

I thought the high gas prices were Biden's fault. :) This is a very interesting analysis. I like how you point out that inflation will likely be tied to something else besides the constant printing of money. While I am sure that doesn't help, it seems to be the singular focus on the inflation narrative right now. By those who don't take the time to look at the facts and research of course!

Nice post!

Posted Using LeoFinance Beta

No people often overlook the simplest of economic concepts. Of course, the bigger problem is trying to look at anything economic as a singular activity. Markets are holistic in nature, with many variables. Also, Americans tend to only look at themselves, not realizing there is an entire world outside their borders. Few take the time to consider the impact upon the global situation.

Biden certainly had an impact upon oil since the shutting down of pipelines affects the supply of gasoline hitting the market. At some point that is really going to affect prices.

Posted Using LeoFinance Beta

Living in Michigan I don't have too much of a problem with the pipelines being shut down. Given our dependence on tourism, I can't think of anything worse than an oil leak in the straits. There has to be a better way that doesn't impact the marine ecosystem.

How true you are with this as I have started to see this in my industry already. Next month sellotape goes up 32 % and my raw materials get an additional 13% hike out of nowhere. This then gets passed onto the next person and eventually the consumer pays more as their logistics prices have increased. This is the first of many increases over the coming months and can see things going up 25% easily which is unfair as salaries don't match inflation. We are all going to be poorer unless we have alternative revenue steams.

Posted Using LeoFinance Beta

The demand shock in oil was so bad that for a short while last year oil became such an unwanted commodity that suppliers were paying for someone to take it off their hands. It is quite natural that we will see that same in reverse. We've already learned about the price of timber going up.

You're predicting a multi-year bull run in commodities. Which commodities will be most affected by this?

Posted Using LeoFinance Beta

The supply and demand issue is evident. It is easy to shut down production facilities but its not as easy to get them back up running. When they shut down production, they tell everyone to stop and they just stop ordering. However when they start up a facility, they require a steady supply of materials, people and buyers. This is why a lockdown was so destructive to our economy.

Posted Using LeoFinance Beta

3 years seems like a very long time for a bull market, anyway I'm curious when the crypto bull market will end so I can hopefully make some profits to reinvest in the bear market

Posted Using LeoFinance Beta

Lol, that was for me and Peter Shiff!

Posted Using LeoFinance Beta