Jim Rickards: Money Printing Leading To Deflation?

The pop you heard was the head of Gold bugs all over the world. Jim Rickards, noted gold bug and proverbial bull, levied a major one on all his followers.

Tell me if you heard this before: all the money printing is going to lead to hyperinflation.

Welcome to the world of Keynesian economics.

Nevertheless, as I have stated on a number of occasions, it is not inflation that is the problem. Get real, if the Fed and other central banks were getting inflation, they would not be printing so hard. The reason they churned the presses up is because of deflation.

This is what Rickaards had to say:

“Let’s say I go out to dinner and I tip the waitress. The waitress takes a taxi home, and she tips the taxi driver. The taxi driver takes the tip money and puts gas in his car. In that example, my $1 tip had a velocity of three: the waitress tip, the taxi tip and the gasoline. So, my $1 produces a velocity of three. My $1 produces $3 of goods and services. That’s velocity, but what if I stay home, don’t go out and don’t spend any money? In that case, my money has a velocity of zero. $7 trillion times zero is zero. If you don’t have velocity, you don’t have an economy. The $7 trillion is the base money supply, and that could be $8 trillion or $9 trillion . . . and that by itself does not produce inflation. What you need is turnover, and we are not getting that.”

What Rickards fails to mention is that this is nothing new. All those years touting inflation, what happened.

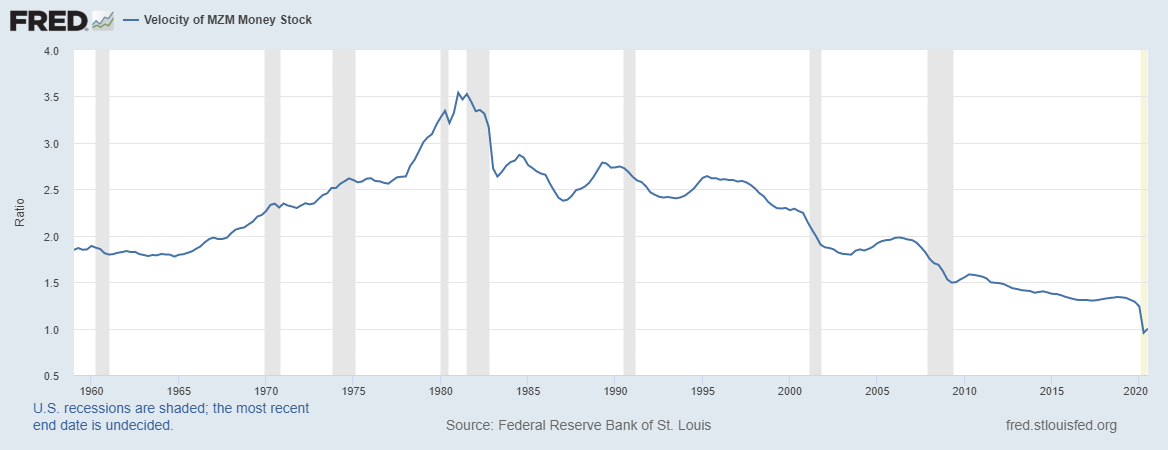

Here is the velocity of money for the last 40 years.

The velocity of money is now at 1 for the United States. To make matters worse, the U.S. is better than all the other major currencies who are below 1.

He goes onto to say:

Rickards says, “Initially, the problem right now is deflation and not inflation, but deflation. There is too much debt. Growth is too slow, and the psychology is wrong because people are saving and not spending.”

Imagine that will you? How could that be possible? We are told money printing leads to hyper-inflation. Yet here is one of the most noted Gold advocates saying there is deflation.

At least he got something right.

Sadly, he then gets unhinged. Here is his forecast.

Gold is going to $15,000 per ounce, and by the way, that is my forecast.

Does he understand what he is saying? He just admitted that we are in a period of deflation and yet he says Gold is going to $15,000 an ounce? Gold has an incredible correlation to inflation, ringing in at 98% historically.

Thus, how can we be in a deflationary period and Gold take off? Is he now proclaiming it is a hedge against deflation?

Of course, let us not forget this tidbit where he believed things would be in 2018.

Source

January 2021 Gold Price: $1,920.

CNBC had a discussion about it.

https://www.cnbc.com/2016/06/10/is-10000-gold-on-the-horizon-one-commodities-expert-says-yes.html

Then we get this lovely piece from him:

Rickards says this will be a process that will take almost two decades, and the U.S. will need 4% inflation to do it.

Two decades at 4% inflation? What is he smoking?

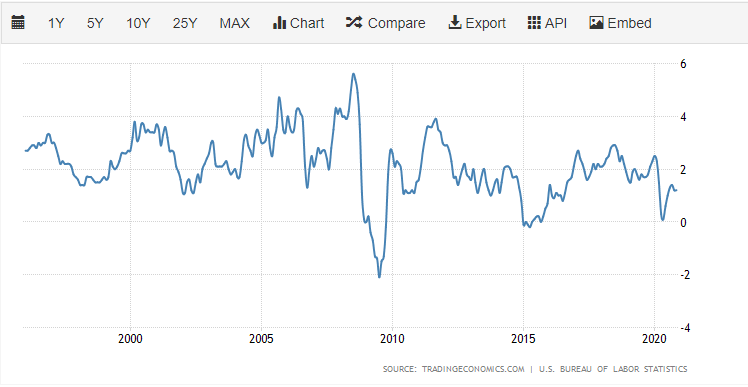

Here is a chart showing the last 25 years of inflation in the United States.

Source

Notice how it has only touched 4% once in the last 12 years. Even before that, it was over 4% a couple times yet could not sustain it.

The NGDP of the US is under 4% now and likely heading to 2%. How in the world does anyone think we are going to have 4% sustained inflation over 2 decades in an accelerating deflationary environment?

Could the price of Gold head higher? Certainly although I think the fact that it stalled out is a warning sign. Things are in chaos yet Gold pegged the $1,900 range after reaching it all time high. It easily could move passed it although my guess, if it does, it will not be for long.

When people figure out that the recession/depression that is coming is deflationary, not inflationary, then I see Gold taking a hit. Watch the 2015 low on your chart. If that does not hold, expect it to push down towards the $1,000.

As a side note, that is my guess as to when to buy Gold. We will see a commodities run starting in a couple years, perhaps 2023, which should benefit Gold. But the 30 years cycle is about to hit later this decade which could carry it much higher.

But $15,000? I wouldn't bet on it.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1346991051404320771

Isn't gold supposed to be around $2k currently? 15k? That's totally unlikely, the way he analysed deflation gave me really different perspectives but that was obviously bogus.

Posted Using LeoFinance Beta

If I have to choose between BTC and gold I choose BTC just look at BTC now

Tell BTC there is deflation. Kind of interesting how things are playing out right now. Not ruling out deflation coming but if indeed it is around the corner or close and BTC is still rising in price I can only imagine when its inflation how much higher BTC will rise.

Nothing says that BTC is tied to inflation. People expect it to operate similar to gold but that might not be the case.

BTC is such a new asset, relatively speaking, that nobody can be sure what environments it will operate in.

Posted Using LeoFinance Beta

Hasn’t he predicted $50,000 gold many, many times? I guess his predictions are suffering from deflation.

Posted Using LeoFinance Beta

LOL I never saw $50K but I have seen $5K. Hell he wrote a book a number of years ago about that.

Forecasting is hard of course but, at some point, give up the ideology. Gold might run higher, in fact I would expect over the next couple decades it will. However, the continuous calls for huge numbers kind of blows the belief out of the water.

Posted Using LeoFinance Beta

Gold looks fine, but BTC looks awesome right now!

Posted Using LeoFinance Beta

everyone waiting for

Is that money or cocaine?

I guess people will take both.

Posted Using LeoFinance Beta

they would prob rather take the wheelbarrow than the fiat at that point

There is a major asset inflation going on. The stock market is in definite bubble territory. Wall Street is up while Main Street is in the gutter.

So, no CPI inflation but the asset inflation is undeniable.

Posted Using LeoFinance Beta

A bubbles pop.

Most times those dont affect the average person plus asset is wealth.

When someone sells stock and makes a profit, do they say damn I wouldnt have made anything without inflation.

Posted Using LeoFinance Beta

That is a pretty crazy number thrown for Gold, but there are more crazy ones for Bitcoin. With that in mind and considering the scarcity of both assets I think that in the future we might see them reach those "outrageous" prices.

Posted Using LeoFinance Beta

There are some outrageous claims for Bitcoin, no doubt about it.

We do see a difference between the two. Bitcoin is just starting to attract institutions while Gold already had them. When we watch the flow of capital, if it is comparing the two, the flow is more towards BTC right now.

Posted Using LeoFinance Beta

Once the pandemic ends I think the avid consumerism will be back in full force and the banks will feel much happier so people can get into even more debt for things they don't need.

Posted Using LeoFinance Beta

Deflation is already here and all the money printing is trying to fill the deep dark abyss. How many commercial real estate loans would be in default right now if it were not for the ability of the printing press. There is a massive shift of assets which are deemed "safe" i.e. not in a financial institution with counter party risk. Crypto is certainly gaining from this as well as silver and gold. So could gold be $15000 per ounce? Not likely, IMO, but could it reach $5000 sure. I think we get a real taste of the deflation at the end of the first quarter this year and everything takes a hit. But after that the shift away from the Stock Market and Banks will begin in earnest with crypto, gold and silver leading the way.

Posted Using LeoFinance Beta