Is There A Change In The Air?

Bitcoin is the dominant coin in the world of cryptocurrency. There is still no dispute there.

However, there is a growing chorus of people who believe tat we could see a flippening with Ethereum eventually overtaking Bitcoin as the largest cryptocurrency by market cap. Of course, we will not know this until it happens.

Could we be seeing a change in the air nevertheless?

Change is often progressive. It often takes place in stages. One of the first steps might be to eat into Bitcoin's total dominance.

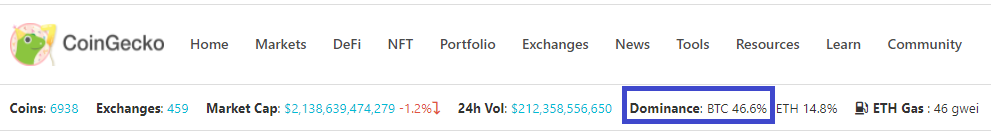

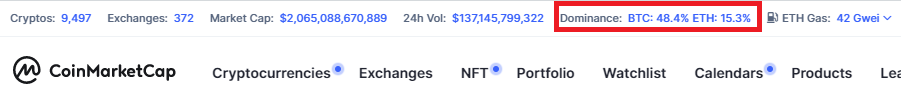

This is happening right now. For the firs time since 2018, Bitcoin dropped below 50% of the overall market cap.

This is show on both Coingecko and Coinmarketcap.

It is obvious what is taking place. What is interesting, however, is the fact that we are seeing it happening so quickly. The "Alt-Coin" season is on it seems.

Part of the change is fueled by the DeFi platforms. Both Ethereum and Binance Smart Chain are seeing explosive growth and that is being shown in the markets. Both of these chains are now worth a combined $400 billion. The fact that they both account for more than 40% of the market cap of Bitcoin shows how quickly they are closing the gap.

Many major influencers have gotten on the bandwagon of Ethereum. This is helping to push that blockchain into the forefront. People like Marc Cuban are all over the NFT craze while others are jumping on the DeFi craze.

Both these are major on Ethereum.

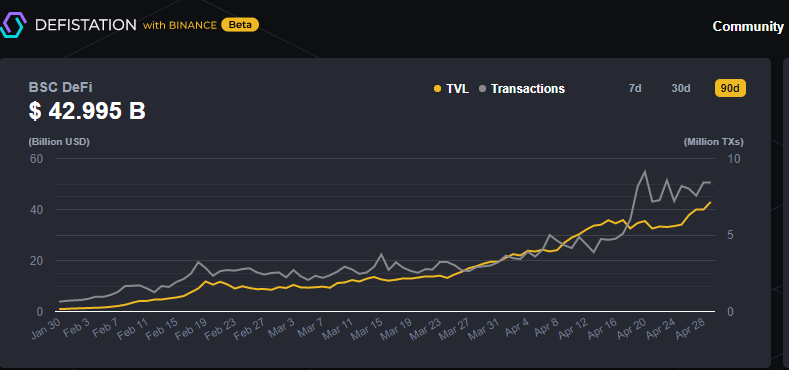

Of course, we cannot overlook BSC. This is starting to eat a lot into Bitcoin's dominance. This chain, while not decentralized, it is starting to pick up a lot of interest from smaller investors who cannot afford the fees on Ethereum.

Defistation has the tvl on this chain moving towards the $43 billion level.

This is, overall, a positive sign for the crypto-sphere. The fact that things are spreading is a step in the right direction. It makes the entire industry more resilient since there are less areas of attack.

For years, Bitcoin was the target for much of the FUD. It weathered the storm, holding strong while other projects grew out of the limelight.

Now we are starting to the results with Ethereum. Some are speculating that it is a coin that could push the $30K level at some point.

There is another piece to this story however. We are going to see this situation repeated a number of times throughout the next couple years. There are a number of projects that are capable of making a lot of noise.

As things mature, we are going to see more solutions provided. We still see a lot of speculation up and down the crypto industry. However, there will come a point where this takes a back seat to what is actually going on.

Activity is going to tell the story. One does not get the Network Effect simply by talking about potential. Eventually, we need to see where the people are going and what they are utilizing.

In the meantime, people are watching the top of the market cap rankings to see what is going on. Ultimately, for the industry to be very strong, the dominance of Bitcoin needs to drop a great deal. This will help to bring other players to the forefront, again encouraging overall decentralization.

We are seeing some major wealth generated through this industry. This is going to help fuel further development, enhancing the offerings that the entire sector has. What is amazing is that we are still awaiting the "Killer Dapp". This is not to say that cryptocurrency itself could not be considered one since it is.

Nevertheless, from a user perspective, the idea of jumping on an application for the sake of what it offers, and not the money, has not really come thus far.

When that happens, we could see a major shift immediately occur.

So we have some change in the air.

Cryptocurrency is growing up.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Ethereum will have to grow to the same margin

with BTC. Right now owning couple of ether and BNB

should be planned.

Ethereum will definitely grow when change to POS.

Abundance is coming.

!BEER

Bitcoin will continue to lose dominance. The only thing it has going for it is the name and when most people think of crypto the first thing that comes to mind is Bitcoin.

However there are FEW use cases for bitcoin anymore, better chains, better alternatives, more platforms use other cryptos and no one really uses bitcoin for anything besides holding it because you don't want to pay $100 to move the dang thing or buy something.

Classic example of if your not developing your coin is dead. It will take a few more years but Ethereum or another crypto will take over dominance.

Bitcoin has already said they wont be changing anything so don't expect anything new out of it. If we have another mega boom alt coin season I feel it will be one that stays this time around and bitcoin wont be able to recover from.

Posted Using LeoFinance Beta

I agree with this although I dont think that is going to happen in Bitcoin's case since it is going to operate as another form of global store of value.

That said, the technology is passe. It might work for large sums of money, catering to bigger players. After all, if you are buying $1.5 billion like Tesla did, then selling $250 million, do you care about a hundred bucks?

The action is on other blockchains, I agree with that.

Posted Using LeoFinance Beta

I think there is a change indeed and Hive could be in a good position if we keep developing and find a way to draw some more traffic

Posted Using LeoFinance Beta

Yes, hypothetical and fringe use cases are a great way to get development started, but true 'entrepreneurship' arises when bold individuals venture forth to satisfy genuine needs -- e.g. freeing people from endless tedium or pent-up pain, angst, and frustration.

Let's see. I'm a part of corporate America who is extremely uncomfortable with crypto to begin with, but I'm being forced to rethink my strategy because my government has decided to make my balance sheet worth 50% less every year going forward. So, what do I do? I've got an idea: let's take our millions of dollars and throw it at a blockchain that keeps inflating it's currency and promises to scale better in the future. In the meantime, the competition on this blockchain keeps getting stiffer and better. Or, we could invest with the one who started it all. Who clearly has the widest network and has been attacked again and again and keeps surviving and thriving. Oh yeah, it also can't be inflated past the number we know and is tradable against basically every currency and cryptocurrency on the planet. Hmmmmm.....

Ethereum will have it's day and, who knows, could end up seeing $10,000 plus. But at the end of the day, it's an ALT-coin. Period. Bitcoin will continue to dominate this space for at least the next 10 years. Returns at times may be better on some alts but the risk doesn't match the rewards, in my opinion. I'm not a maximalist. Ethereum and alts are here to stay. But facts are facts. I KNOW what I'm getting by putting money in bitcoin. I'm HOPING I'm getting a better return with Ethereum.

Posted Using LeoFinance Beta

That sure is an interesting point of view and I think most of what you said is most likely to be the view of veteran bankers/traders. I think other long-term investors will probably in the ETH and Defi space because it generates higher returns despite the risks. In my opinion I am conflicted because I think Bitcoin has a 50% chance of being flipped between its use as a valid store of wealth and will depend on the big investors.

Posted Using LeoFinance Beta

Not sure what makes you think this but okay.

Bitcoin might have the highest market cap. Gold, after all, is a $8 or $9 trillion market cap, far bigger than any single company which comes in about $2 trillion. However, Gold is not bigger than the entire market cap of, say, the technology sector. And there is nothing that says gold, with all that is going on, will not be usurped by a single company.

The problem with your view is you do an analysis from a financial perspective. What you overlook is the technological component. That is walking a dangerous path.

Bitcoin will be fine in price. However, in a decade, it will be a fringe asset like Gold. People (well governments and institutions) will hold it as a store of value.

But for daily use in the Metaverse, Bitcoin isnt keep pace.

Posted Using LeoFinance Beta

I can't wait for the alt season to arrive sooner. Bitcoin has done its work of charting the course and creating the needed ripples that would ring more corporate investors closer to the crypto space.

Posted Using LeoFinance Beta

It already arrived. Where have you been? Look at the prices of most tokens from their lows.

Posted Using LeoFinance Beta

Its also the reason why I think use cases will make the block chain succeed. Because of that, I think BTC is more likely to be a store of wealth and the rest will be based on utility. I don't know where things like Doge will be but coins like ETH, BNB and others will be based on those who believe in their development plus applications. Because of this, I think HIVE will have a higher position among the rankings so long as we continue development and create a robust social media network.

Posted Using LeoFinance Beta

That is where the Network Effect will come from.

Bitcoin will not have 300 million people regularly using it. Other blockchains will.

Posted Using LeoFinance Beta

This would be very interesting and unexpected for me. For years other blockchains have offered far more functionality than bitcoin, but it hasn't been the case that the world shifted towards using the better tech. Now, with new crazes, maybe they serve as a tool to increase the adoption of the better tech. And what about even better tech which in my view Hive offers? I don't know if it will take some existing or new craze to increase its adoption.

Posted Using LeoFinance Beta

Many blockchains offer much better tech than Bitcoin, Hive included. Hive's major disadvantage now is that it does not have a reliable smart contract solution platform that is decentralized and without a honey pot to hit.

Posted Using LeoFinance Beta

Ether is already fine, there has been the most development with smart contracts but this GAS is killer. If they don't change anything soon, the BSC will eat them for lunch.

That might nor might not be true.

Did you see the EIB just put up a couple hundred million in bonds for sale on Ethereum?

To them, a $50 transaction fee is nothing. While BSC might have more users, the big money players will be on Ethereum.

It takes a lot of $500 or $1,000 transactions to equate to $100 million.

Posted Using LeoFinance Beta

I still believe bitcoin will dominate the next 5 years. Ethereum and other currencies are good but it depends upon the massive adoption of crypto. Any big investment of a millionaire can make a difference to ether or btc

Posted Using LeoFinance Beta

The store of value is going to keep rising. However, the Network Effect is going to be interesting to watch. Where do the newer players end up?

Posted Using LeoFinance Beta

I was going to say, it almost looks like BSC is closer to overtaking ETH than ETH is to overtaking BTC. Especially with the recent news about NFTs coming to BSC, we could see a huge boom for that token. BSC certainly seems to be on a tear right now. It will be interesting to see how far away the DPoS actually is for ETH. That could be a huge boost to its momentum too. Assuming it happens sooner rather than later.

Posted Using LeoFinance Beta

BSC does have that you are right. And it could eclipse ETH.

However, ETH is making some moves that might fend of what we are perceiving. Then again, it might not.

BSC is picking up the smaller players and NFTs will make it a lot more viable than ETH.

It is not decentralized though and that could be a problem.

Posted Using LeoFinance Beta

Yes, that is a very good point about not being Decentralized. I always seem to forget that simply because I am so used to dealing with blockchains that are the majority of my time.

Posted Using LeoFinance Beta

More players in the market means more competition. Which will be beneficial to the consumers.

Will this impact the transaction fee in the future ? May be ?

Let’s see.

If the altcoin season is really here I want to see Hive at $1, otherwise it feels like we are the dork in the classroom that nobody pays attention to

Posted Using LeoFinance Beta

Watching Ethereum flip BTC from Hive must be like watching nations take over other nations on earth from heaven. It makes sense I guess, but they don't know what I know.

I don't see it happening for another few years. Bitcoin and Ethereum is quite "old" already, but for sure Bitcoin will continue to lose its market share (by market capitalization) as the months go by, unless there is a major bull run for the coin. There are too many other coins that are just ultimately better than Bitcoin and a lot of new users are learning quickly about alternatives.

I'm sure BTC maximalists may be upset about this, but it's entirely predictable. Either way, this isn't a dig at Bitcoin holders, I think all cryptocurrency users can learn from this shift, and its not inherently a bad thing for the general cryptocurrency community. More competition means more innovation. Bitcoin developers need to really woo the crowd if they want to retain dominance.

Posted Using LeoFinance Beta