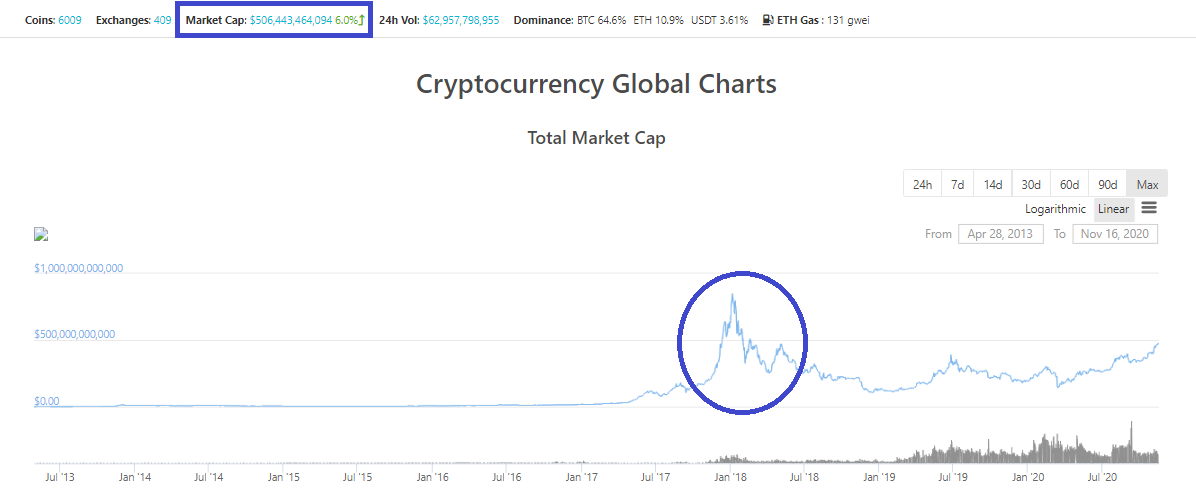

Crypto Market Cap Crosses $500 Billion

According to Coingecko, today was a milestone not hit in recent memory.

With Bitcoin leading the way, followed by a nice push from Ethereum, the entire market cap of cryptocurrency crossed $500 billion. Yes, folks, that is 1/2 a trillion dollars.

Here is a chart as it looked earlier.

The box at the top shows the level hit $506 billion (as of this writing, it is now $510 billion). I also denoted how the level was not reached since January 2018.

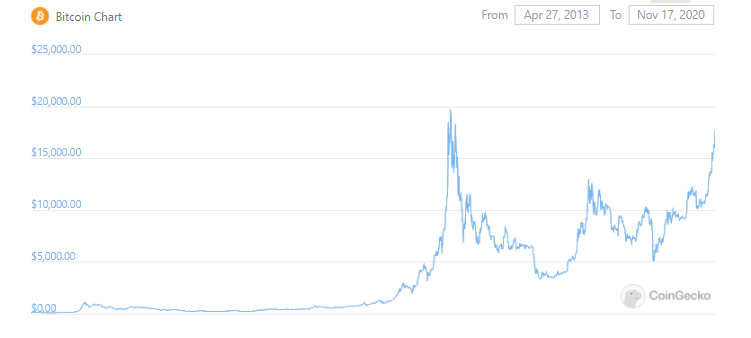

Obviously, Bitcoin is making up a large part of the total move. Since the alt-coins are not keeping pace, we see Bitcoin making up a large portion of the total market cap.

It presently makes up about 65% of the total.

The all time high was just shy of $20,000. With Bitcoin closing in on 18,000, it is a little more than 10% from that level.

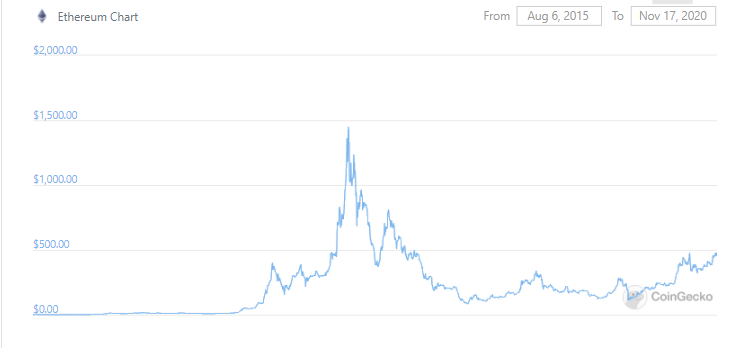

We do not see the same with Ethereum. Even though it made a nice run, it is a long way from the all time high set in the same time period as everything else.

With a high of near $1,500, the price of about $500 is only 1/3 that of the all time high.

Could this lead to another alt-coin run just like in 2017? Bitcoin led the way yet lifted "all boats".

Thus far, while some of the alts got a kick, they have no exploded like before.

One thing we can be certain of is that there is a lot of money starting to flow into the cryptocurrency market. Bitcoin is eating up the large majority of it yet some is obviously finding its way to Ethereum and perhaps a few others.

All of this ties into resiliency. The larger the cryptocurrency market is, the greater the ability to withstand outside "attacks". Crossing half a trillions dollars is a big milestone, if it holds of course.

Hopefully we are on the way to a trillion dollar market cap. Standing between where we are now and there is the $850 billion level. Based upon basic technical analysis, there is not a lot of resistance standing in the way of a run to $850 billion.

To get there, naturally, will require the participation of the alt-coins. It is unlikely that Bitcoin can sustain a run on its own to pull the entire market cap up that much.

One thing that does bode well for the alt-coins is that when Bitcoin hits the 65% range in terms of dominance, it tends to move the other way. This can happen either by Bitcoin dropping or alt-coins moving up by a greater percentage.

With the momentum that Bitcoin has, it is unlikely that it is going to take a big step backwards. Institutions are just getting started and we can expect more to join the party. It does not appear this is a push coming from retail investors.

It is possible that Bitcoin does move towards 70% dominance but that would be out of character.

We will have to see how this all pans out.

What are your thoughts? Let us know in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

IF bitcoin stands to be the digital gold

everything else will be silver for a while.

After all said and done, altcoins could see a rise

If bitcoin sustain its high price few will sell it.

we could see defi explodes again and there altcoins

could make a move.

Trust is what holding altcoins to move up.

So far it is better to see how high btc will go before

any alts will make a move and if investors are pushing the

price we can just sit and wait.

Posted Using LeoFinance Beta

I do believe that Bitcoin is digital gold so anything short of gold's market cap is on the table for me.

That said, the history is that Bitcoin reaches a point of dominance where it cant suck any more out of the market. That doesn't mean that it can't keep going higher, it certainly can. My point is simply that Alt-Coins will have to pick it up.

The advantage of the Alt-Coins right now is the fact that it doesn't take a lot of money, relative to Bitcoin, to make them move.

Posted Using LeoFinance Beta

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I think we can say Bitcoin has surpassed Gold so, why peg it to Gold?

Posted Using LeoFinance Beta

I am not sure w6assed gold. After all, the gold market cap is like 16 times that of Bitcoin.

And how is it pegged to gold?

Posted Using LeoFinance Beta

as in Bitcoin is gold and alts are silver or copper or what ever.

What I mean is BTC is worth X more than Gold. Sure Gold is also older but once mass adoption hits BTC btc maybe be 17 times that of gold.

I see this a lot but dont buy it. Yes the price of BTC is higher than Gold but there is also more ounces of gold in the world than number of bitcoin. It is like when people say LEO is worth more than Hive, ignoring the difference in tokens available.

I do believe there will be a point when Bitcoin's total value (market cap) exceeds that of gold. Will it be a multiple? Possibly. How many multiples? That is where the fun comes in.

Posted Using LeoFinance Beta

For other coins to challenge BTC in terms of market value, they should bring forward the strong use case. It seems, BTC is slowly considered a store value asset that competes with other limited quantity value assets like gold. ETH is still trying to prove its efficiency in terms of DeFi and other smart contract based financial solutions. May be there will be a new coin or a group of coins that will change the narrative of a social/technical problem ( don't know what that is - video?) which will ultimately trigger the mass adoption of crypto on a large scale.

Posted Using LeoFinance Beta

Hard to say what that will be. If we had a crystal ball that was clear, it would be a different story.

That said you are correct; the big winners in the future will be those coins that have use cases. This is why I always point to development. Hype and speculation only carries on for so long. After a while, something needs to show up or investors will move on.

It is one of the reasons why I am high on Hive...we see actual development. Over time, that will benefit the entire ecosystem.

Bitcoin is taking the mantle of store of value, something that it will not give up. You are right, there is little room in there for anything else. I agree it will eventually harm the gold world but for now, it is only in the digital.

Posted Using LeoFinance Beta

Agreed. From now on, while buying coins I will focus on use cases and what structure and vision they have behind the project. That way, you are investing in a vision and not only focused on a coin.

Posted Using LeoFinance Beta

I am going to keep my buys rather tight in scope. It is getting to the point where I do not need to spread the buying across dozens of projects. Too much to follow and there are opportunities within the realm we are operating in.

Posted Using LeoFinance Beta

Half a Trillion is a huge amount that can run many states in my country for a full year. The value of cryptos are picking up. I wish pride and selfishness in economic leaders would allow them to help the masses key into this tech revolution in finance.

Posted Using LeoFinance Beta

I dont think, globally, it is governments or leaders who are keeping people from adopting cryptocurrency. Few are willing to put in the time to get involved. We see it on the comments here: people mention talking to friends or family about it only to get the "its a scam" or "it isnt real" stuff.

As I wrote years ago, everyone will end up in crypto, sooner or later. The masses will end up choosing later.

Posted Using LeoFinance Beta

And in a way this is a good thing. It would be a lot less exciting if everybody was doing it.

Posted Using LeoFinance Beta

Very true. The early days are a bit of the Wild West which is always interesting. When markets mature, the novelty and wild innovations tend to subside.

Of course, with mass adoption comes its own form of excitement.

Posted Using LeoFinance Beta

No doubt about that :<)

Posted Using LeoFinance Beta

It seems soon, l other altcoins are going to follow bitcoin rising pattern. Perhaps bitcoin will help them

@taskmaster4450le, In my opinion after the Pandemic Situation many doubted Centralised Monetary System, specially because of ongoing discussions regarding Global Reset and etc,which inturn lead to new vision of new era. Cryptocurrency space is new era. Stay blessed.

Looking at the charts I wonder if going into the WLEO pools with so much money as I did was a stupid move or now. The pool started right before the latest BTC rally, while LEO and ETH did not move much. On the other hand, it is much more fun to own utility tokens than digital gold. We will see how things pan out. Either way, it is exciting to see things go up again after such a long time. Maybe my time of working for a minimum wage is slowly coming to an end.

Posted Using LeoFinance Beta

I actually believe there will be bigger returns in some of the utility tokens than in Bitcoin. That said, Bitcoin is a much less risky proposition in my opinion at this point.

For example, Bitcoin at $400K is a little more than a 20x. A great return, something few would contest.

However, a 20X in something like Hive puts it at $2.30, still a long way from the all time high.

From where we are now, we need about an 80x to get to the all time high, a much larger return that Bitcoin at $400K.

Now the question is which is more likely? That is where I think Bitcoin carries a bit more certainty than other coins like Hive.

Posted Using LeoFinance Beta

You mean the ath of Steem?

After 3.5 years in the crypto and crypto blogging scene it becomes morea and more clear to me that Bitcoin is indeed not much of a risk. And the little risk that it has is totally worth it imo :<)

Posted Using LeoFinance Beta

Yes because Hive has its legacy with Steem.

It wasnt around the last time the crypto had a major bull run.

Posted Using LeoFinance Beta

I remember hitting the jackpot on one Steemit post, in December 2018 and trying to sell on an exchange ( Bittrex ) for the first time. By the time my account was finally up and running, SBD had already gone down a lot. It feels like ages ago but it was my first bull run experience after about half a year in crypto.

I like to think that I'm a lot wiser now.

Posted Using LeoFinance Beta

That is true although we tend to get dumber when emotions are involved.

And when bull runs hit, our emotions get turned all upside down. That is why it is a continual lesson in emotional control.

Posted Using LeoFinance Beta

True that. Our reptile minds can be in our way at times :<)

Posted Using LeoFinance Beta

I noticed the 500 billion - half a trillion does indeed sound even more impressive - plus marketcap too. Exciting times indeed. As we did indeed reach 800 billion three years ago, there's no doubt that we will go way over the 1 trillion in this bullrun. The only question is when?

Exciting times!

Posted Using LeoFinance Beta

I think we will hit the trillion mark next year. BTC will be king and some cryptos will ride also this power train. I think LEO has a chance to 10x at least. :)

Posted Using LeoFinance Beta

At the moment over half of the market cap is made up of Bitcoin with a still high dominance of 66.3%

Bitcoin is currently the queen of the markets and we are confident that the liquidity entered through BTC will be equally distributed on the altcoins 😎

Posted Using LeoFinance Beta