Tokenization: $400 Trillion Worth Of Assets Out There

In the cryptocurrency industry, there is a lot of talk about the establishing of a new financial system. The present system has excelled in growth yet did a poor job at distribution.

There is little doubt we are seeing a global asset base that is exploding. Numbers use to be discussed in denominations of billions. Today, we talk about trillions.

As this progresses, the world is debating who will become the "first trillion dollar man".

Of course, all this is taking place at a time when billions in the world are living on what amounts to a few dollars a day (if that much). Here we see where cryptocurrency is starting to fill the void.

That said, how much potential is out there? This is a question that many attempt to answer and simply looking at the existing financial system might help.

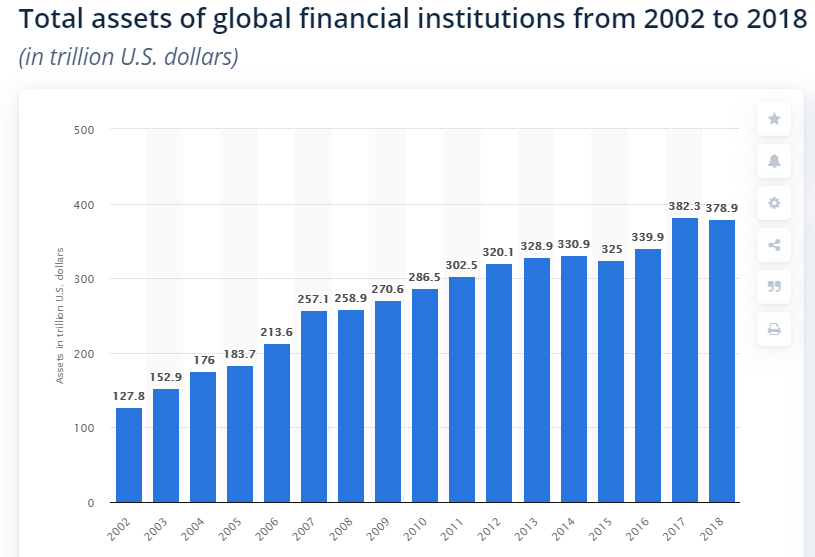

According to Statista, as of 2018, the assets held by all global financial institutions was near $400 trillion.

Source

That is an astounding number. What is even more impressive is the growth rate over the time of this chart. Their holdings started at $127.8 trillion before tripling in a decade and a half.

Simply put, here is the crux of your wealth inequality. Those who are closest to the central banks are the ones who benefited the most.

To realize how big a number this is, there was a study in 2016 that determined the total value of global real estate was $217 trillion. Certainly, it grew since then but the point is clear: these financial institutions are sitting upon a lot of wealth in terms of the assets they hold.

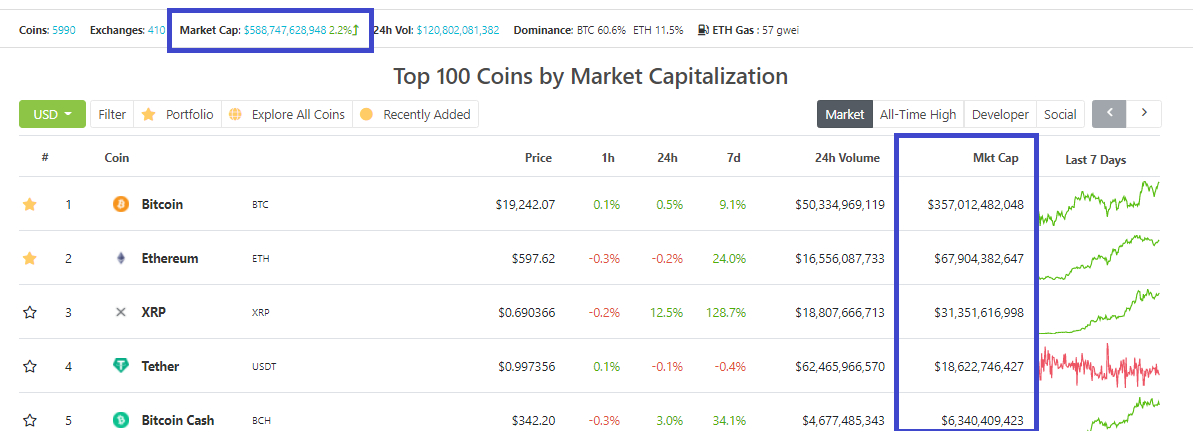

Even after the strong run up in cryptocurrency, the total market cap of all that is listed on Coingecko is still under $600 billion. This means the assets held by the global system is about 645 times larger than the total cryptocurrency market cap. Of course, this is probably skewed since we are all aware that the financial entities are starting to get involved in cryptocurrency.

Therefore, even this vehicle to freedom is being eaten up by the global entities we all know and have come to despise.

Many believe we are going to see the tokenization of everything. This is a crucial point going forward. When assets are tokenized and put on the open market, more people have access to them. This is really helpful if more people are starting to get rewarded in cryptocurrency, thus providing them with some resources to get involved. One of the biggest factors of the present financial system is exclusion. Tokenization is a process of inclusion.

We still have some issues before we can get there. The present system wants to maintain control. Thus, we have to deal with the regulators on subjects pertaining to ICOs and what is a security. One of the reasons the financial system is so wealthy is because they create financial products "out of thin air". This is something that would land the rest of us in jail.

However, with cryptocurrency, anyone can create a token. This can represent anything one wants it to. We see projects that are being developed with the intent of replicating what exists in the present financial system. Therefore, hundreds of millions of people will be given the opportunity to profit in the same way these giant companies have.

Consider for a moment how the wealth and income structure of the world would be if this $400 trillion in assets was spread out over the global population. This is exactly what cryptocurrency and tokenization can do.

Source

The opportunity for outsized returns exists. It is very common in the traditional financial system. The only problem is that we are not the ones who share in it. Instead, it is venture capitalist, large banks, and hedge funds that can get involved in projects that net great windfalls. They also have the opportunity to put their money to work in ways that the rest of us do not.

Thus, we believe that a 7% annual return is amazing. This is a drop in the bucket in many private equity deals.

A great advantage that cryptocurrency presently has is that enormous returns are possible when dealing with smaller markets. For example, the likelihood of the United States Equities market having a 400% gain in a year is slim. The market is simply too large to experience that.

Crypto, on the other hand, could easily see a jump like that. Of course, if that happened, the entire market cap would still trail the silver market.

The network effect is going to be a driving force. As more people get involved, innovation can increase greatly. This will drive value through the roof. Here is where we see the major jumps. While Bitcoin can lead the way, even that isn't going to have a 25x move. A lot of other projects could see this.

That is how we close the gap. Instead of the 3% holding all this wealth, we start to involved tens of millions of people. If those people are experiencing outsized returns as project develop and grow, word will quickly spread. This will start to feed on itself, causing exponential results.

Keep this in mind the next time someone mentioned how it is not possible for tokens to be worth this much. When compared to what the global financial institutions are holding, this is literally a rounding error.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1331591097177485312

Your current Rank (20) in the battle Arena of Holybread has granted you an Upvote of 16%

great post as usual and I agree, the price in many cryptocurrencies will spike up so fast, this bull market is totally different from 2017, google trend search for Bitcoin still at lows meaning retail investor are still sleeping on Bitcoin and with so many institutions buying Bitcoin the liquidity on exchanges is going down, there is only a limited amount of Bitcoin that can be generated daily, price will go up so fast

To me, it doesnt feel like the retail investor is involved. My sense is we are dealing with institutions.

We need to see a network effect throughout the entire industry.

Posted Using LeoFinance Beta

Agree, true power on crypto price is holding and institutions are traders and traders will trade meaning dump when they get scare, not saying its gown back to bear market but yes I gree BTC needs retail

Retail will enter but only after FOMO is kicked off.

Before then, they will sit on the sidelines while the smart money pushes things higher.

Posted Using LeoFinance Beta

a lot of people in the world lives with less than one dolar per day inclueded my country imagine one man who have 5 child and woman, well this is 7 people who lives with around US$300 per month this month needs to take great desitions to maximise his income, well but it is our normaliti here in the country for the not equal distirbution of the money, well this is normal as you say.

well, fortunately for my and a little part of the people that have criptos in their wallet well could hope that inthe future this could convert us in the new man that could help people in the future.

Posted Using LeoFinance Beta

I am very surprised that the concept of crypto has not spread through countries like yours like wildfire.

What you say is truly heartbreaking and crypto can help in so many ways. Look at LEO, price at around 25 cents. Certainly earning a couple hundred a month would make a big difference.

Imagine two or three in a household doing this.

Posted Using LeoFinance Beta

Yes, I know, but people prefer to spend their time on facebook or twitter, to whom I have invited, I have only been spent by paying 6 steem per account created, believe as 7 already and only one publishes once a month,

but hey, we are still on the job, we hope people realize the potential

People want money today I publish, tomorrow I earn tomorrow I spend we are very short-term, I need to support my region but now they have not left, I hope to program a bot to filter jobs in my region and that everyone through a network of discord or what app can access them, and maybe their quality of life will improve but it is just an idea that is there and I hope to realize in the short medium term.

Thanks for your support always.

Posted Using LeoFinance Beta

I imagine that a big problem would also be to exchange cryptos into local fiat currencies. Are there options for this?

We only have a bitcoin ATM but few use it, I would say very, very few, and it is also something technical that many people fear and do not understand or do not want to understand, and also due to the fact that we are very short-term users that we do not like it. long-term sacrifice.

And there is also the educational factor. People heard that btc was for drugs so they say u and that's dangerous and then they don't enter.

but hey we keep swimming against the current what I am completely sure is that it will arrive soon I have full faith of it.

Posted Using LeoFinance Beta

well said i just rehived this post. indeed crypto is the big deal. but i still think most people still have fears of waking up one day and realized the whole thing about crypto is no more, but is that possible?

Posted Using LeoFinance Beta

That is a good question.

I think it is possible that countries do outlaw them and with their jails/guns, this could be effective. However, there is no way that we will see all countries agreeing. So some will have it legal while others could outlaw it.

In the event of outlaw, would that even be effective? The US had pot illegal for a long time but most American adults had tried it.

I feel the best defense is to keep growing things as quickly as we can. The larger the entire industry is, the harder it is to bring down.

Posted Using LeoFinance Beta

absolutely sir, indeed by doing just as you have said will give no way for it to stop. and hopefuly countries start accepting it

Posted Using LeoFinance Beta

After all, it is about a social inequity since the world. All the gods said that this is normal, is it Satoshi Nakamoto's invention to beat the gods?

Posted Using LeoFinance Beta

Maybe Satoshi is divine.

Posted Using LeoFinance Beta

Maybe!

Posted Using LeoFinance Beta

You're right, gains like 400% can only be synonymous to Crypto market and this proves that crypto is never limited by any growth parameter or whatsoever and the more more people gets involved the more lives can change and be influenced through crypto.

Posted Using LeoFinance Beta

That are a lot of tokens that can 4x in a short period of time.

Even Bitcoin can do it from this point in a year.

Others could do it much bigger.

Posted Using LeoFinance Beta

Obviously the level of no limitations to how some token can do those high levels can be sometimes amazing

Posted Using LeoFinance Beta

The only question is whether we are holding the tokens that can take off like we expect.

There are many and it is only a matter of time before it happens.

Posted Using LeoFinance Beta

the crypto market today is really a crumb compared to the money that goes around the world financial exchanges.

There is really a lot of potential for dizzying growth for many crypto projects

Isn't that the truth? It really is nothing compared to the dollar amounts....billions versus hundreds of trillions.

Posted Using LeoFinance Beta

Sure, if capital were to migrate to the crypto market, we could easily see Bitcoin at 1 million dollars

Migration will take time but it is inevitable. The new investment front is called Cryptocurrency

Posted Using LeoFinance Beta

The thing with crypto is it can increase without fiat but people utilizing the applications and kicking off the network effect.

This is really something that is different from many other opportunities.

Posted Using LeoFinance Beta

Tokenization as I see it is one way to distribute wealth and maybe close a little bit the gap between the rich and the poor. Let's take the example of LEO Finance with the LEO token and myself which I onboarded this community few months ago. Through my work I gained at the moment 3,000 LEO which was possible through the way this system it build, its values and the reward system put in place. In real life there are some domains where you simply cannot enter because there are others holding the influence or simply dominate the space.

Posted Using LeoFinance Beta

Many large companies did not look favorably on BTC and the crypto market and nowadays what is most known is that these same companies are coming in strong by injecting their millions of dollars because they have already realized that the future is with the cryptocurrencies that are revolutionizing the financial system.

Posted Using LeoFinance Beta